Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

In yesterday’s alert we wrote that crude oil may have moved a little ahead of itself and a pause here was likely. Crude oil has indeed corrected yesterday and the question now is if the correction is already over and is it safe to get back into the long positions.

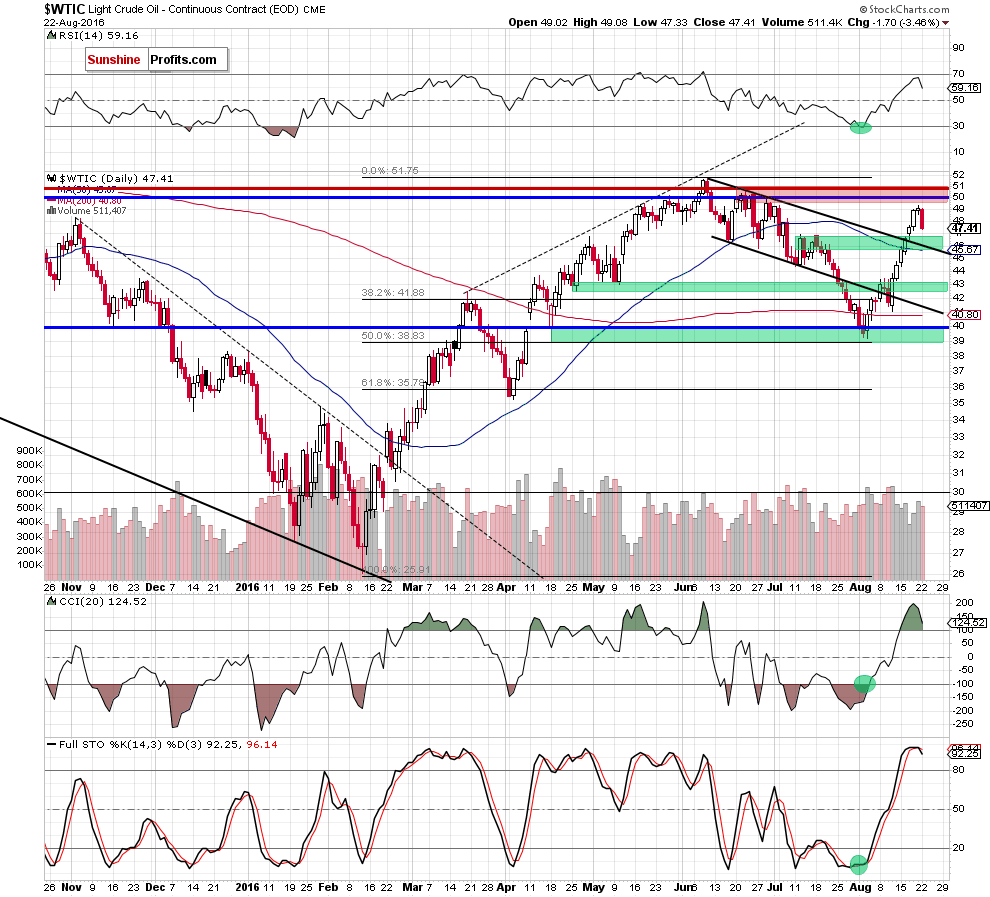

In our opinion, it’s a bit too early to do so. Let’s take a look at the chart for details (charts courtesy of http://stockcharts.com).

In yesterday’s alert, we wrote the following:

On Friday, crude oil moved slightly higher, which approached the commodity to the red resistance zone created by the Jun highs and reinforced by the barrier of $50. Additionally, the RSI approached the level of 70, the CCI moved little lower, while the Stochastic Oscillator is not only significantly overbought, but also very close to generating a sell signal, which increases the probability of a pullback in the coming week.

If this is the case, and light crude declines from current levels, we may see a correction to around $46.84 or even to the previously-broken upper border of the black declining trend channel (currently at $46.24) in the following days.

Based on yesterday’s closing price, the Stochastic indicator has indeed generated the above-mentioned sell signal, so the bearish outlook for the short term appears confirmed.

The volume that accompanied yesterday’s decline was not huge, but it was not very low either, so it doesn’t appear that it has any bullish implications. Will crude oil move higher right away? As discussed yesterday, it seems that the support levels close to the $46 level will need to be reached first. At the moment of writing these words, crude oil is trading at about $47, so we are moving closer to the support levels, but not yet at them.

Summing up, we are seeing the corrective downswing that we discussed yesterday and it seems that even though it’s close to being over – it’s not over just yet. We think that closing long positions and taking profits off the table yesterday was justified from the risk to reward point of view, and yesterday’s decline seems to confirm it. The next trading opportunity seems to be close, but not here just yet.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts