Trading position (short-term; our opinion): Long positions (stop loss at $37.23; initial upside target at $46.90) are justified from the risk/reward perspective.

On Monday, crude oil gained 2.92% as speculation of potential late-September freeze from OPEC affected positively investors’ sentiment. In this environment, light crude came back above $43 and invalidated earlier breakdown under short-term support. Will this event encourage oil bulls to act later in the week?

Let’s examine charts below and find out (charts courtesy of http://stockcharts.com).

Quoting our yesterday’s summary:

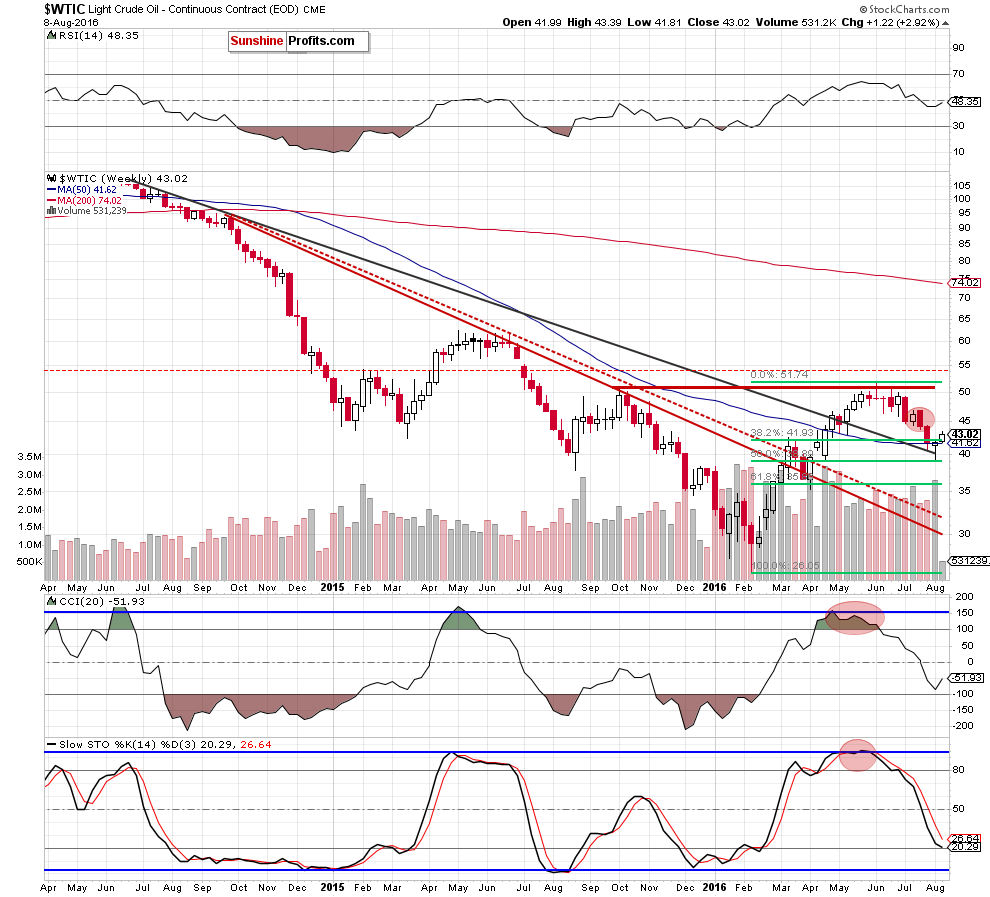

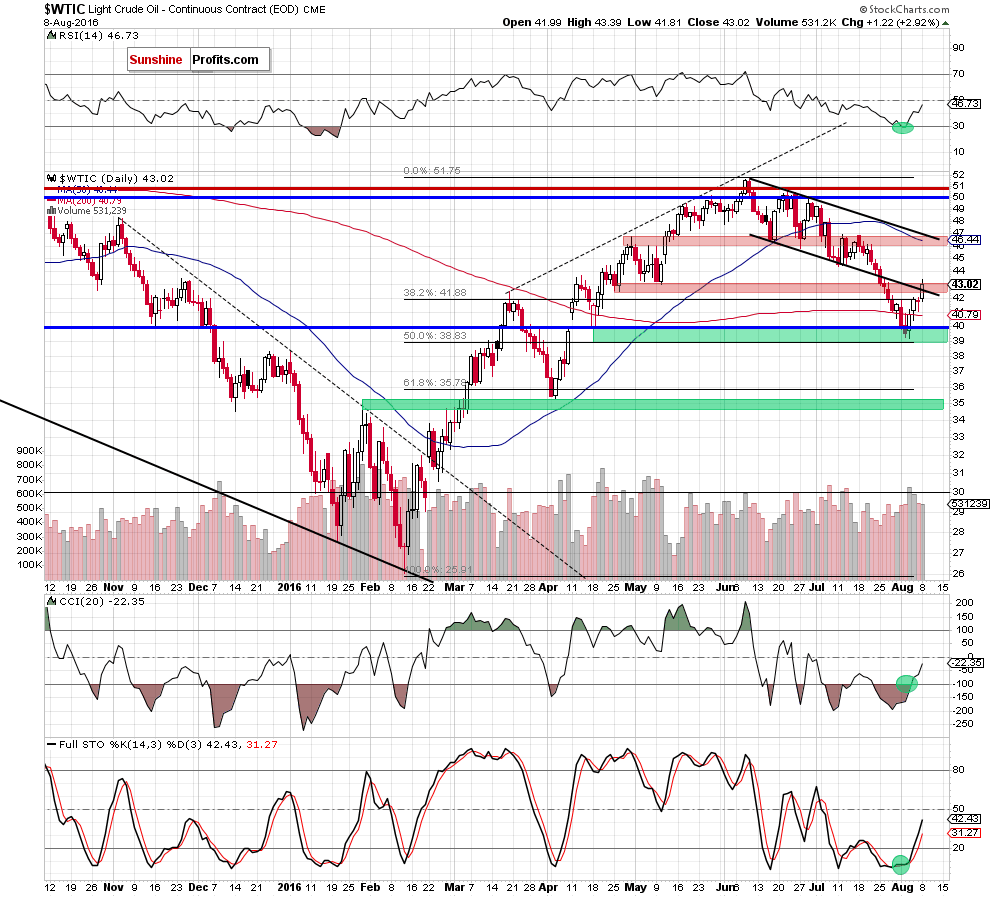

(…) the green support zone encouraged oil bulls to act, which resulted in invalidation of the breakdown under the barrier of $40. Additionally, the commodity invalidated earlier breakdown under the 200-day moving average, which in combination with a weekly closure above the long-term black declining line (marked on the weekly chart) and buy signals generated by the daily indicators suggests further improvement and a test of the previously-broken lower border of the black declining trend channel (currently around $42.70).

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil extended gains yesterday. With Monday’s increase, the commodity not only increased to our upside target, but also climbed higher and closed the day above the lower border of the black declining trend channel. In this way, light crude invalidated earlier breakdown under this short-term support, which in combination with buy signals generated by the daily indicators and invalidation of the breakdown under the 200-day moving average and a weekly closure above the long-term black declining line suggests further improvement in the coming days.

If his is the case, and crude oil moves higher from here, we’ll see an upward move to (at least) the upper border of the black declining trend channel (currently around $46.90) in near future.

Summing up, crude oil invalidated earlier breakdown under this short-term support, which in combination with buy signals generated by the daily indicators and invalidation of the breakdown under the 200-day moving average and a weekly closure above the long-term black declining line suggests a test of the upper border of the black declining trend channel (currently around $46.90) in the coming days. Therefore, we believe that opening long positions is justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop loss order at $37.23 and initial upside target at $46.90) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts