Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil extended gains after the EIA weekly report showed a bigger-than-expected drop in U.S. crude oil inventories. As a result, light crude gained 2.97% and climbed to the barrier of $50. Will it stop oil bulls once again?

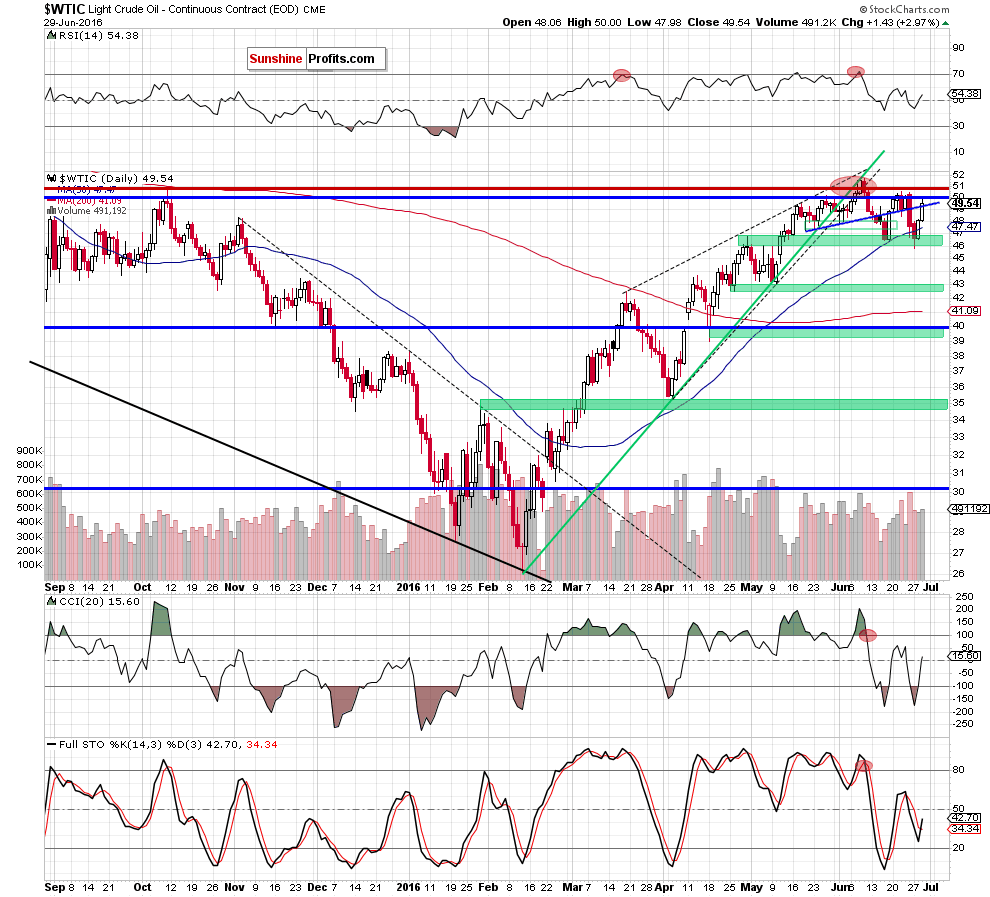

Although, the U.S. Energy Information Administration showed that gasoline inventories increased by 1.4 million barrels (compared to expectations for a gain of 58,000 barrels), the report also showed that crude oil inventories dropped by 4.1 million barrels and distillate stockpiles decrease by 1.8 million barrels in the week ended June 24. Additionally, supplies at Cushing, Oklahoma declined by 951,000 barrels last week. Thanks to these bullish numbers, light crude climbed to the barrier of $50. Will it stop oil bulls once again? Let’s check the chart below and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) we should keep in mind that light crude invalidated earlier breakdown under the 50-day moving average and the CCI generated a buy signal, which suggests further improvement. If this is the case, and the commodity extends increases, we may see a climb even to the previously-broken blue line (currently around $49.22) in the coming days.

Looking at the daily chart, we see that oil bulls pushed the commodity higher as we had expected. With yesterday’s upswing light crude not only reached our upside target, but also climbed to the barrier of $50. As you see on the above chart we had similar situation in the previous week. Back then, crude oil also invalidated earlier breakdown under the blue support/resistance line and climbed above $50. Despite this improvement, oil bulls didn’t manage to hold gained levels, which resulted in a sharp decline on Friday. Taking this fact into account, we think that history will repeat itself once again and we’ll see another attempt to move lower. If this is the case, and light crude declines below the blue support line once again, we’ll see a re-test of the 50-day moving average (currently around $47.50) in the coming day(s).

Summing up, crude oil extended gains and climbed to the barrier of $50 – similarly to what we saw in the previous week, which suggests that we’ll likely see another downswing and a re-test of the strength of the 50-day moving average in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts