Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil moved sharply lower after the market’s open as the USD Index climbed slightly above the barrier of 100. Despite this drop, the commodity reversed in the following hours after Saudi Arabia comments. As a result, light crude gained 1.28%, but did this upswing change anything in the short-term picture of the commodity?

Although yesterday’s data showed that existing home sales dropped by 3.4% to 5.36 million units in Oct (missing analysts’ forecasts for a 2.3% fall), demand for the greenback continued to be supported by expectations that the Fed would raise interest rates next month. Thanks to these circumstances, the USD Index hit an intraday high of 100.06, making crude oil less attractive for buyers holding other currencies. As a result, light crude slipped to an intraday low of $40.41. Despite this drop, the commodity reversed in the following hours after Saudi Arabia said it is ready to cooperate with OPEC and non-OPEC producers in order to stabilize prices. Thanks to this news, light crude rebounded sharply and climbed above $42, but did this upswing change anything in the short-term picture of the commodity? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

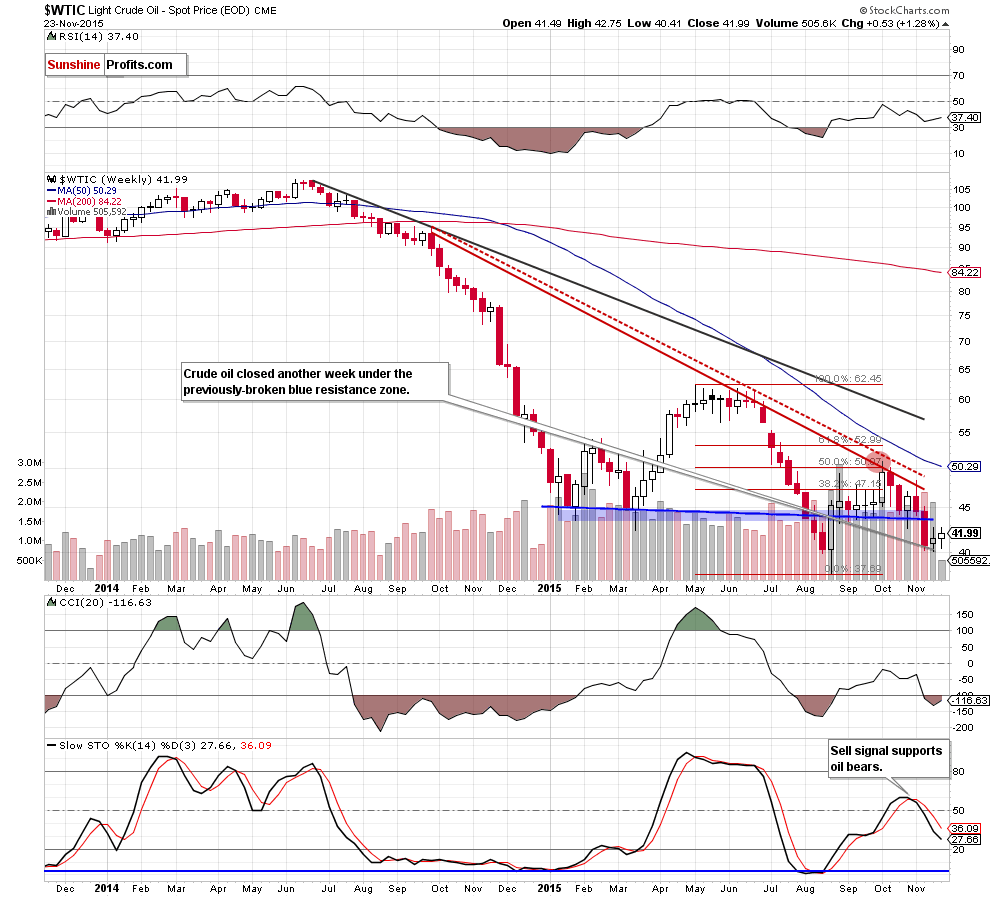

Although crude oil moved little higher, the overall situation in the medium term remains almost unchanged as the commodity is trading under the previously-broken blue zone (reinforced by the blue line), which in combination with a sell signal generated by the Stochastic Oscillator suggests further deterioration in the coming week.

What can we infer from the daily chart? Let’s check.

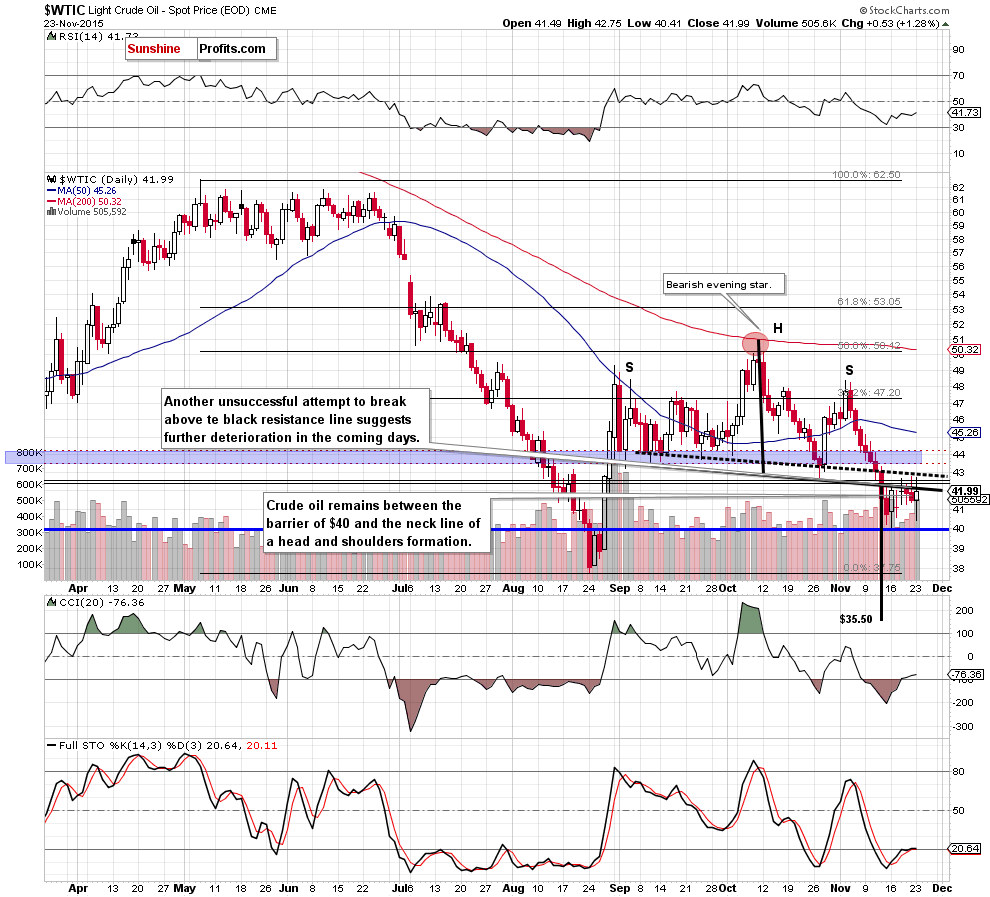

Looking at the daily chart, we can summarize yesterday’s session in one simple sentence: more of the same. Although light crude bounced off session low and climbed above the black resistance line, oil bulls didn’t manage to hold gained levels, which triggered another pullback. With this downswing, crude oil invalidated earlier small breakout above the black resistance line - similarly to what we saw (several times) in the previous week. Taking this fact into account, we think that as long as there is no confirmed breakout above black lines, a bigger upward move is not likely to be seen.

Nevertheless, the current position of the indicators (the CCI and Stochastic Oscillator generated buy signals) suggests that oil bulls will try to push the commodity higher once again and we’ll see another test of the black resistance line in the coming day.

Finishing today’s alert, please keep in mind what we wrote a week ago:

(…) the black resistance line (…) could be the neck line of a potential head and shoulders formation. If this is the case and crude oil declines from here, we’ll see a drop below $40 in the coming days. At this point, it is worth noting that if we see such price action, the current decline will likely accelerate, which will likely translate to a test of the Aug lows.

Nevertheless, taking into account the above-mentioned bearish pattern, we may see a decline even to around $35.50, where the size of the downward move will correspond to the height of the formation.

Summing up, the first resistance line continues to keep gains in check, which increases the probability that the potential head and shoulders formation (marked on the daily chart) is underway. If this is the case, we’ll see further deterioration in the coming weeks (even if light crude re-tests the black lines once again). Therefore, we believe that short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts