Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

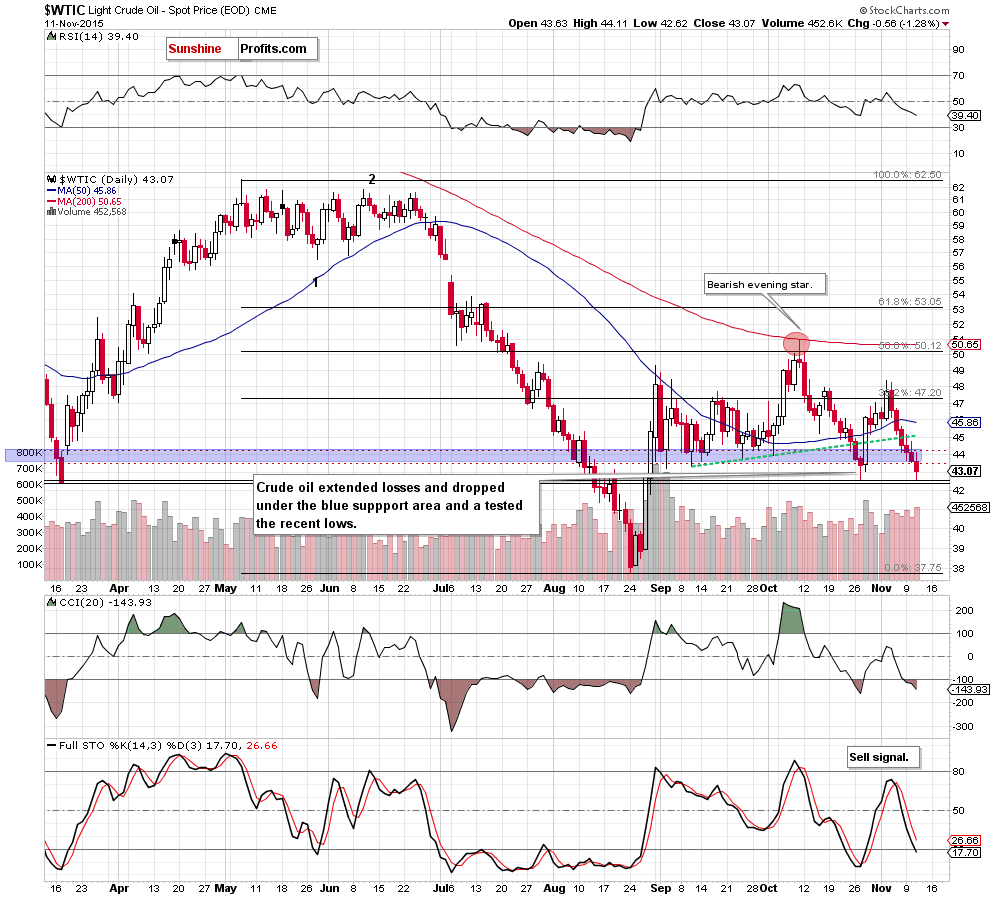

On Wednesday, the commodity lost 1.28% after a bigger-than-expected build in crude oil inventories. Thanks to this news, light crude dropped under the key support area. Will this negative event trigger further deterioration in the coming days?

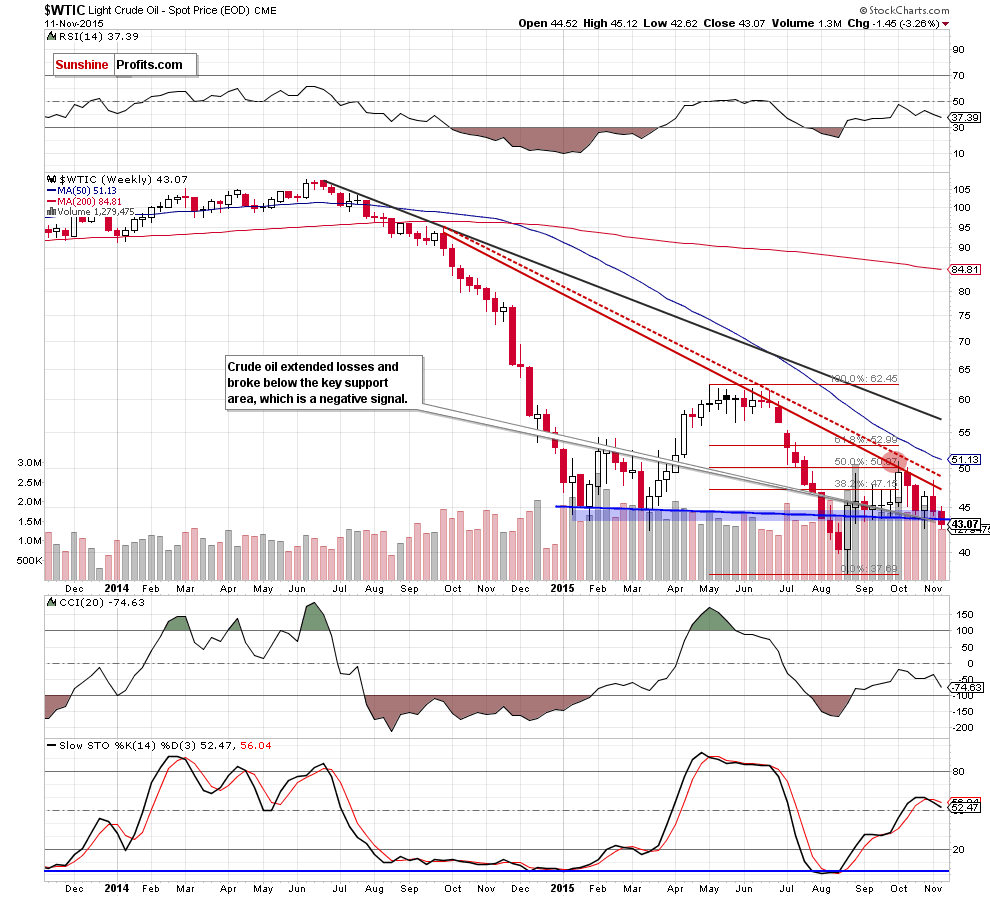

On Tuesday, the American Petroleum Institute showed in its weekly report that U.S. crude inventories surged by 6.3 million barrels for the week ending on Nov. 6. On top of that, crude inventories at the Cushing Oil Hub in Oklahoma rose by 2.5 barrels for the week, which weighed negatively on investors‘ sentiment and pushed the commodity to an intraday low of $42.62. Will we see a breakdown under the Oct low in the coming days? Let’s examine charts and find out what are they saying about future moves (charts courtesy of http://stockcharts.com).

Quoting our Monday’s Oil Trading Alert:

(…) the commodity reached our next downside target [the blue support line]. Although light crude could rebound from here – similarly to what we saw in previous weeks, the current position of the indicators (weekly and daily Stochastic Oscillator generated a sell signal) suggests further deterioration and a test of the recent lows.

Looking at the charts we see that the situation developed in line with the above scenario and crude oil dropped under the key blue support zone (reinforced by the blue support line), approaching the Oct low. What’s next? At the end of the previous month, oil bulls managed to stop their opponents and trigger a rebound from here, which suggests that we may see a similar price action in the coming days.

Nevertheless, this time, the position of the indicators supports oil bears (sell signals remain in place). Additionally, the size of volume that accompanied yesterday’s decline was significant, which confirms the downward trend. This means that what we wrote on Monday is up-to-date also today:

(…) we believe that a successful breakdown under the key support area will accelerate declines and we’ll see a drop to (at least) $40.57-$40.86, where the next support area (created by the 76.4% and 78.6% Fibonacci retracement levels) is.

Finishing today’s alert please note that the bearish scenario will be more reliable if crude oil closes this week under the blue area.

Summing up, crude oil extended losses and dropped under the key blue support zone. This is a bearish signal, which suggests that further deterioration in the coming day(s) is more likely than not and short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts