Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open on Friday, the commodity reversed and declined as the key resistance zone encouraged oil bears to act. Where will the commodity head in the coming days?

On Friday, crude oil moved higher as the combination of a weaker greenback and Baker Hughes report supported the price. As a reminder, on Friday, the U.S. currency extended losses and dropped under the level of 95, making crude oil more attractive for investors holding other currencies. Additionally, the Baker Hughes report showed that the number of rigs drilling for oil in the U.S. dropped by 9 in the previous week (to 605), which was the lowest level since July 2010. In this environment, light crude extended gains and hit an intraday high of $50.92. Despite this improvement, the key resistance encouraged oil bears to act. Will we see further deterioration in the coming days? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

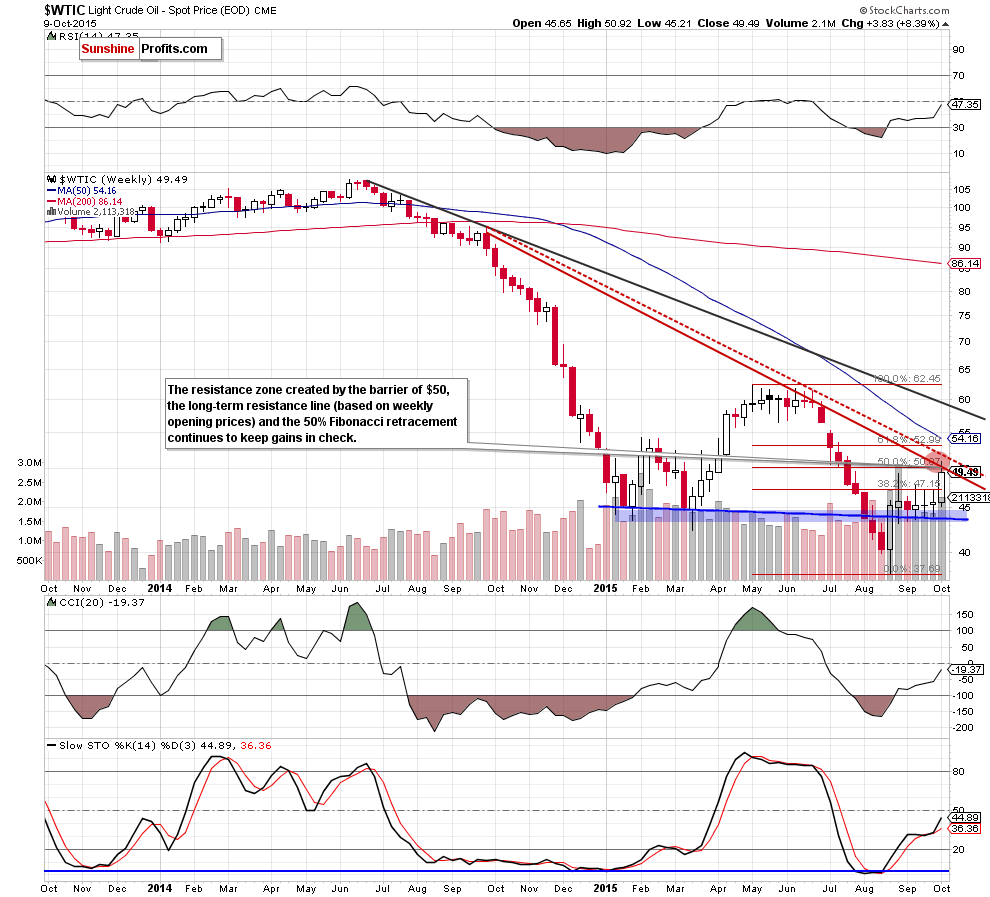

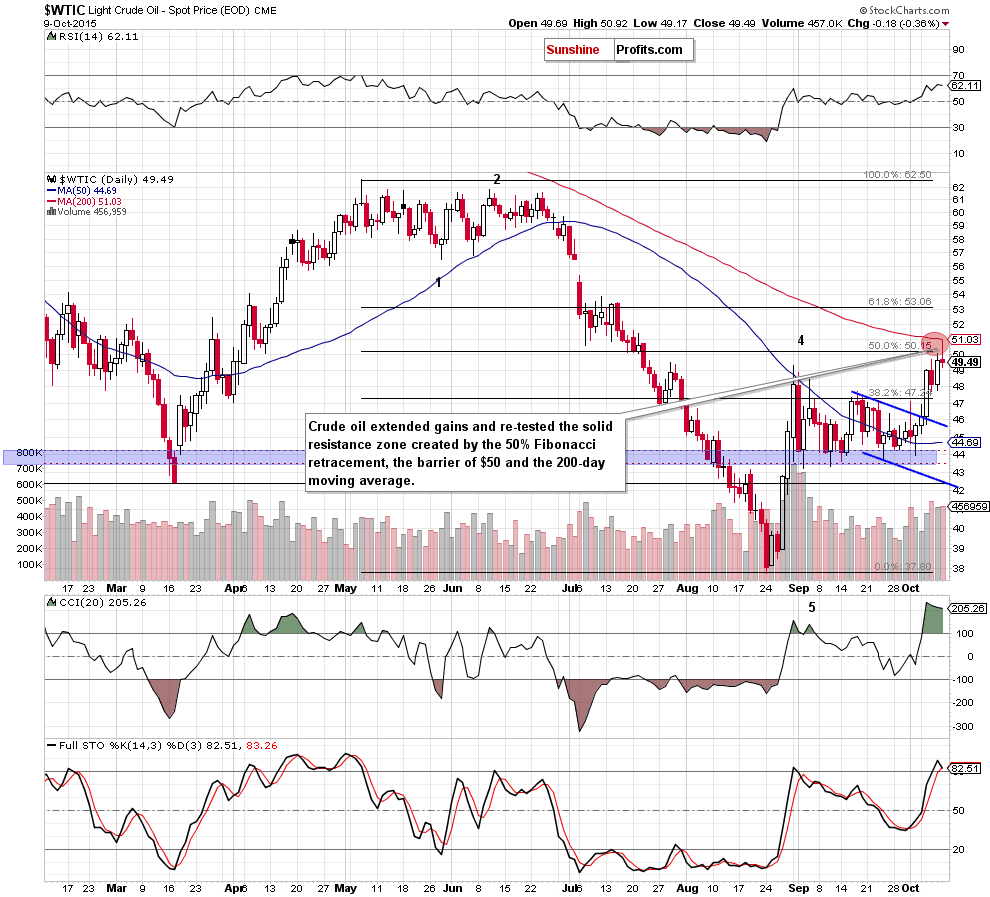

Looking at the charts, we see that crude oil moved higher once again and re-tested the key resistance zone (marked with red circle on both charts) created by the long-term resistance line (based on the weekly opening prices), the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average. Despite this improvement, the commodity reversed and closed Friday’s session under this zone.

Additionally, the Stochastic Oscillator generated a sell signal (while the daily CCI is overbought), which could encourage oil bears to act in the coming days. If this is the case, and light crude declines from here, the initial downside target would be around $45.70, where the previously-broken upper border of the declining blue trend channel currently is.

Finishing today’s Oil Trading Alert, please keep in mind that we still believe that the above-mentioned resistance area (around $50-$51.06) will be strong enough to stop oil bulls in the coming week(s).

Summing up, crude oil re-tested the key resistance zone (created by the long-term red resistance line based on the weekly opening prices, the 50% Fibonacci retracement, the psychologically important barrier of $50 and the 200-day moving average) once again. Despite this move, in our opinion, the space for further gains is limited and we believe that short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts