Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil moved higher once again as a weaker U.S. dollar and news that Russia wants to meet with OPEC and non-OPEC members to find a way to stabilize crude oil prices weighed positively on investors’ sentiment. In these circumstances, light crude approached the key resistance zone, but then gave up some gains and closed the day in a very interesting place (from technical point of view). What’s next?

Although the price of crude oil remains under $50 per barrel, Russian oil production increased to a post-Soviet Union record high near 10.75 million barrels per day in the previous month. In recent months, Russia hasn’t shown a willingness to cut crude output even if it could help bolster global oil prices. As a result, a prolonged downturn in oil market influenced negatively Russian economy, which pushed the ruble lower against the dollar, fuelling worries over a decline to the last December lows, when the Russian currency lost approximately one-third of its value in a span of three weeks. In these circumstances, Russia has expressed a desire to meet with OPEC and non-OPEC members to find a strategy, which could stabilize global oil prices. Oil investors reacted positively to this news, which translated to an increase to an intraday high of $46.94. Despite this move, the commodity reversed and gave up some gains, closing the day on the resistance line. Where will light crude head from here in the coming days? Let’s check the charts and find out (charts courtesy of http://stockcharts.com).

In our previous commentary, we wrote the following:

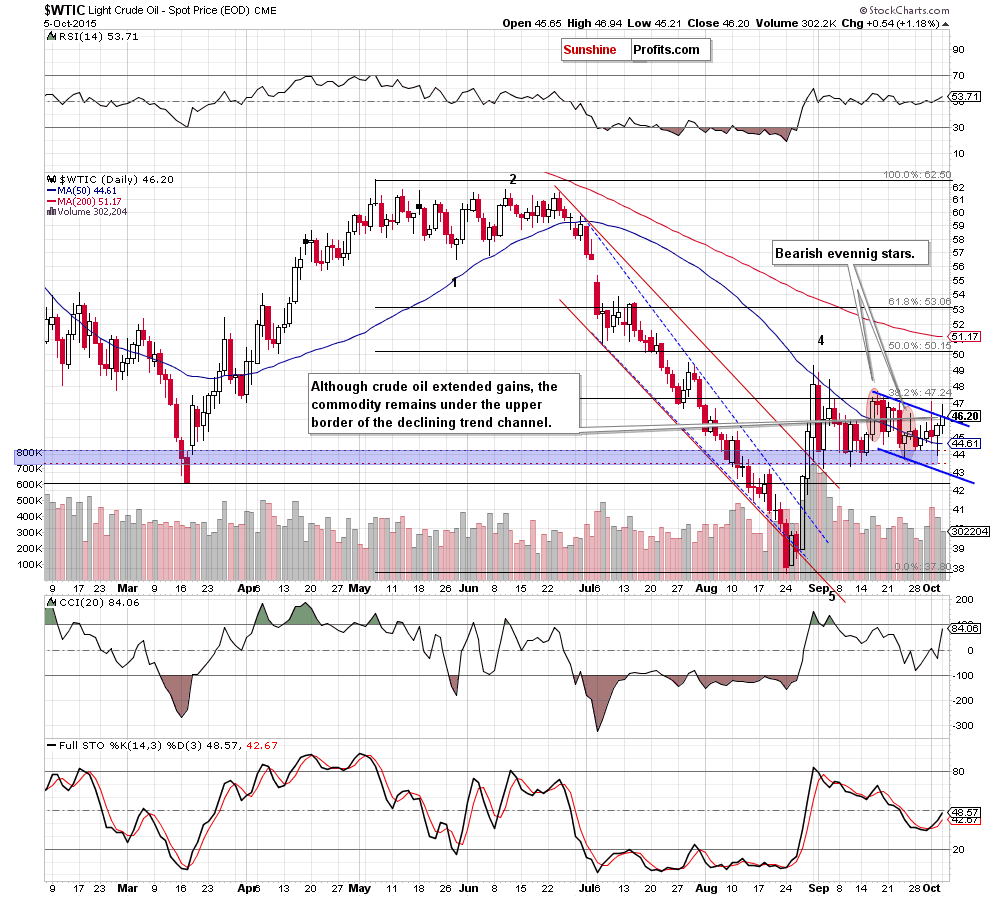

(…) Taking into account the fact that the Stochastic Oscillator generated a buy signal, we think that oil bulls will try to push light crude higher in the coming day(s). In this case, the initial upside target would be around $46.25, where the blue resistance line is.

Looking at the daily chart, we see that oil bulls not only took the commodity to the blue resistance line, but also managed to approach crude oil to the resistance zone created by the 38.2% Fibonacci retracement and the previous highs (and reinforced by the bearish evening star formation). Despite this improvement, the key resistance area was strong enough to stop further improvement and trigger another pullback (similarly to what we saw in previous days). As a result, light crude gave up some gains and closed yesterday’s session on the upper border of the blue declining trend channel.

What’s next? In our opinion, the probability of another downward move from here is quite high. Why? Firstly, another unsuccessful attempt to break above the key resistance zone is a negative signal, which suggests that oil bulls are not strong enough to push the commodity higher. Secondly, yesterday’s increase materialized on visibly smaller volume than Friday’s move, which is an additional sign that suggests oil bulls’ weakness. Thirdly, but the most importantly, light crude remains under the medium-term green resistance line marked on the chart below.

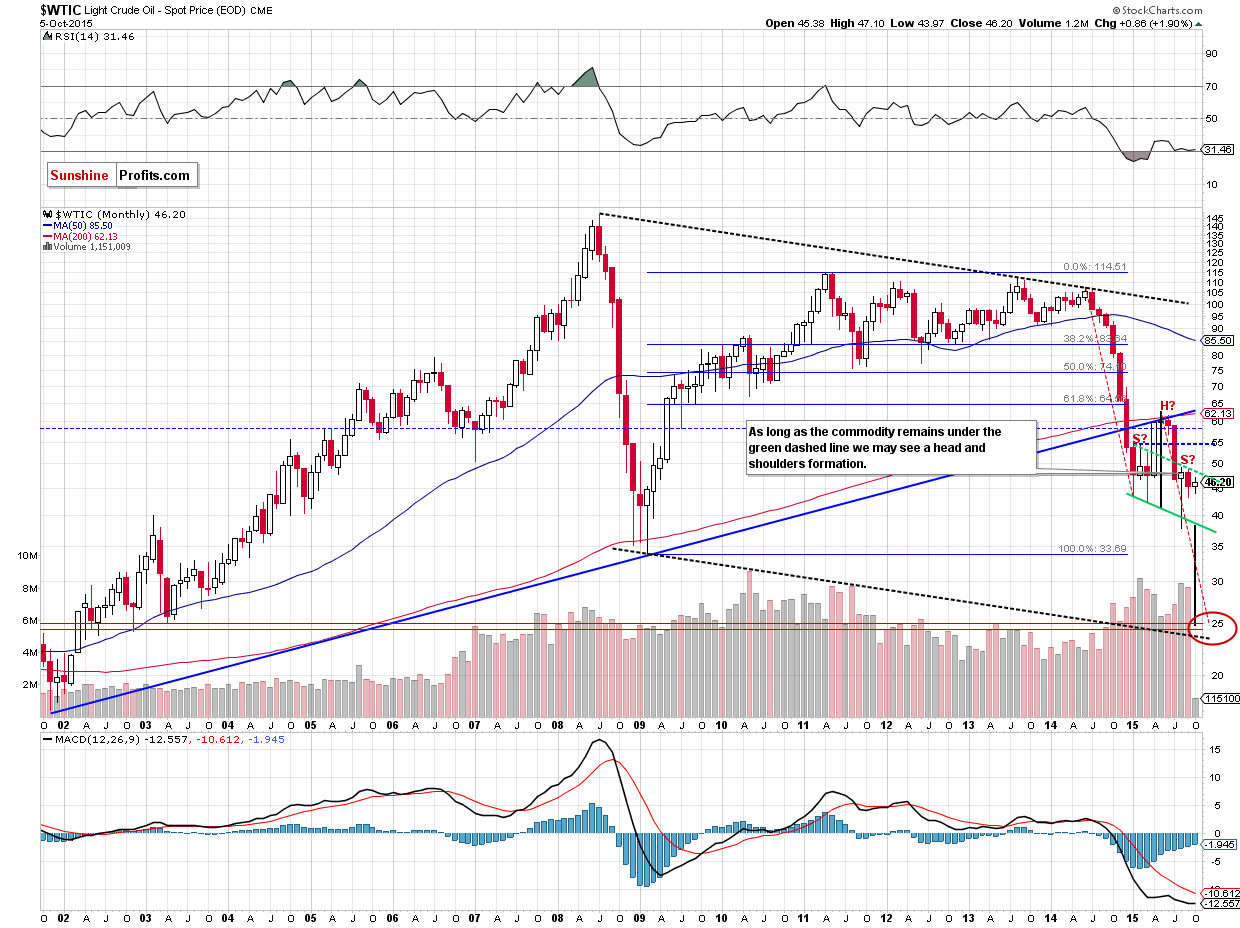

On the monthly chart, we see that although crude oil moved higher earlier this month, the probability of the bearish head and shoulders formation is still very high as the commodity is trading under the above-mentioned medium-term green resistance line (parallel to the support line based on the Jan and Mar lows). In other words, as long as there is no successful breakout above this key resistance line, a sizable rally is not likely to be seen and another downward move is more likely than not.

Summing up, crude oil moved higher once again, but the upper border of the declining trend channel and the medium-term green key resistance line continue to keep gains in check. This means that the outlook for crude oil remains bearish and short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts