Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Thursday, crude oil shoot up after the market’s open supported by a weaker greenback. Despite the rally, the key resistance zone in combination with the bearish EIA report triggered a sharp decline, which erased all earlier gains. As a result, light crude lost 0.71% and invalidated the breakout. What does it mean for the commodity?

Yesterday, the U.S. Department of Labor showed that the number of initial jobless claims in the week ending September 26 increased by 10,000, missing forecasts for a 3,000 rise, which pushed the USD Index lower, making crude oil more attractive for buyers holding other currencies. In this way, light crude extended gains and hit an intraday high of $47.10. Despite this rally, investors digested the EIA report (which showed that U.S. crude stockpiles increased by 4.0 million barrels for the week ending on Sept. 25, significantly beating expectations for a 0.5 million drop), which in combination with the key resistance zone, weighed on their sentiment and translated to a sharp decline. Thanks to these circumstances, light crude came back to the declining trend channel and verified important breakdowns. What are the implications of this event? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

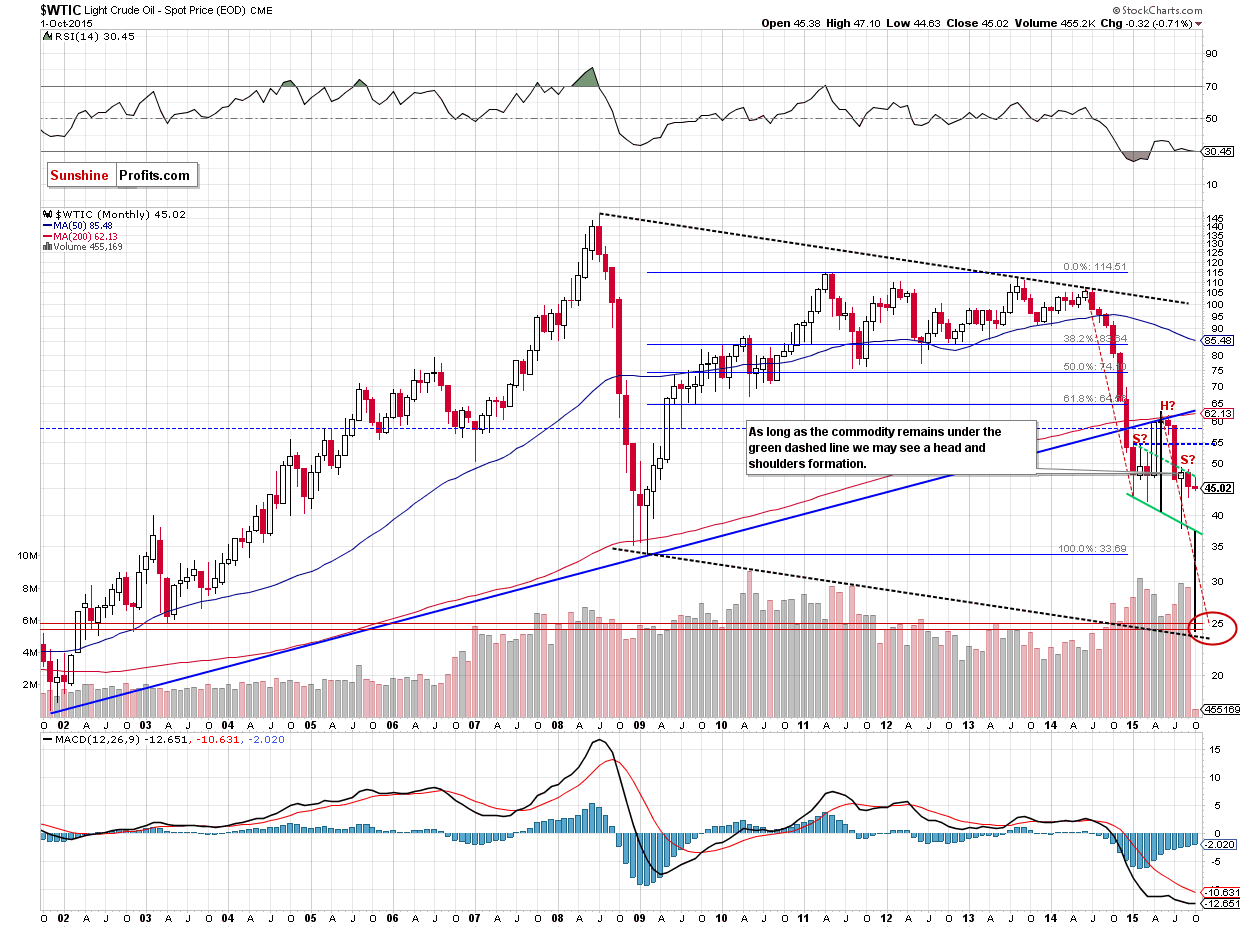

The first thing that catches the eye on the long-term chart is a verification of the breakdown under the green dashed line, which is a bearish signal that suggests further deterioration in the coming weeks.

What impact did this move have on the daily chart? Let’s check.

Yesterday, we wrote the following:

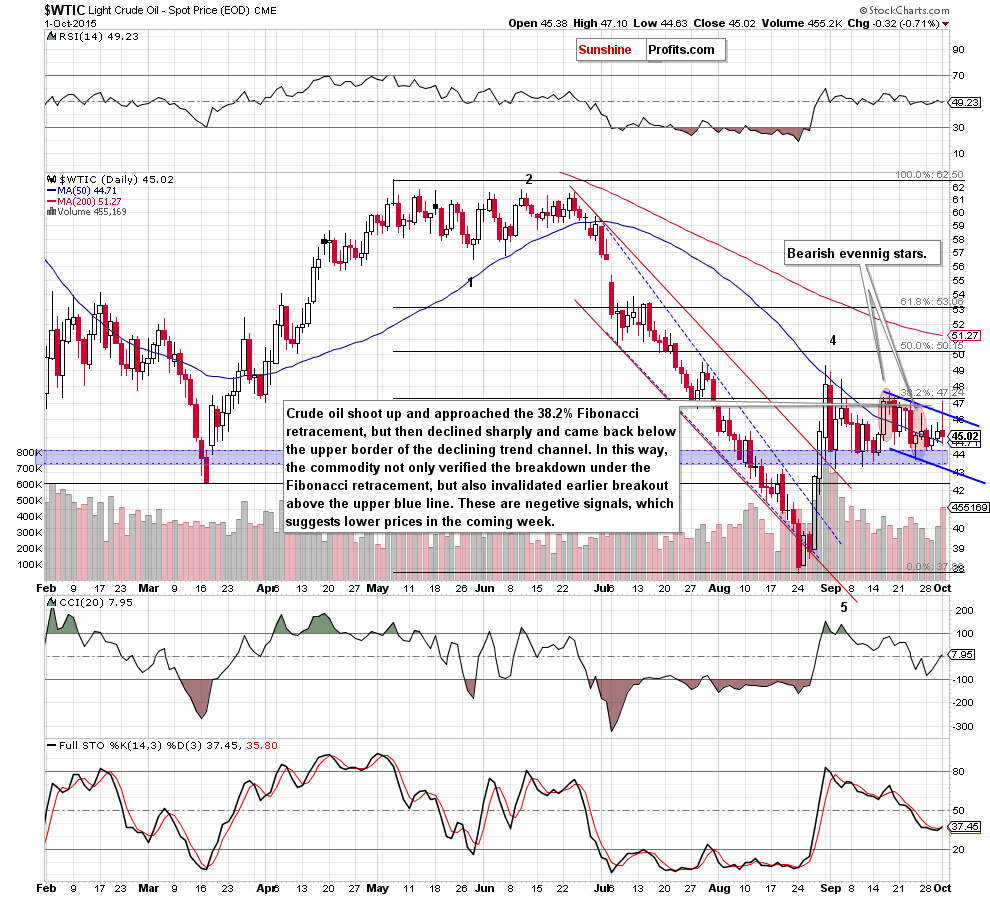

(…) crude oil moved higher once again and closed the day above the 50-day moving average. Additionally, the size of volume was bigger than day before, which suggests that we’ll see a test of the upper border of the declining trend channel (or even the recent highs and the 38.2% Fibonacci retracement) in the coming day(s).

Looking at the daily chart we see that oil bulls managed to push light crude above the upper border of the blue declining trend channel, which triggered further rally and approached the commodity to the recent highs and the 38.2% Fibonacci retracement (as we had expected). Despite this improvement, the key resistance zone was strong enough to stop further improvement, which resulted in a sharp decline. With this downswing, light crude came back below the previously-broken blue support/resistance line, invalidating earlier breakout and slipping to the 50-day moving average. Without a doubt these are bearish signals, which suggest lower values of the commodity in the coming days.

On top of that, yesterday’s downswing materialized on huge volume (compared to what we saw during recent upswings), which confirms oil bears’ strength. Nevertheless, we think that an acceleration of declines will be more likely only if we see a drop under the blue support zone and the lower border of the declining blue trend channel (which is, in our opinion, only a matter of time).

Summing up, crude oil verified breakdown not only below the 38.2% Fibonacci retracement, but also under the medium-term green dashed resistance line, which is a bearish signal that suggests further deterioration in the coming week(s). Therefore, short positions continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts