Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

Although crude oil moved lower after the market’s open, the key support zone helped oil bulls to trigger a rebound in the following hours. But did this price action change anything in the short-term picture of the commodity?

Yesterday, Genscape, Inc. showed crude oil inventories at Cushing, declined by 625,000 barrels for the week ending on Sept. 22, which sparked optimism among investors and pushed the commodity to an intraday high of $45.18. But did this price action change anything in the short-term picture of the commodity? Let’s examine the charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote:

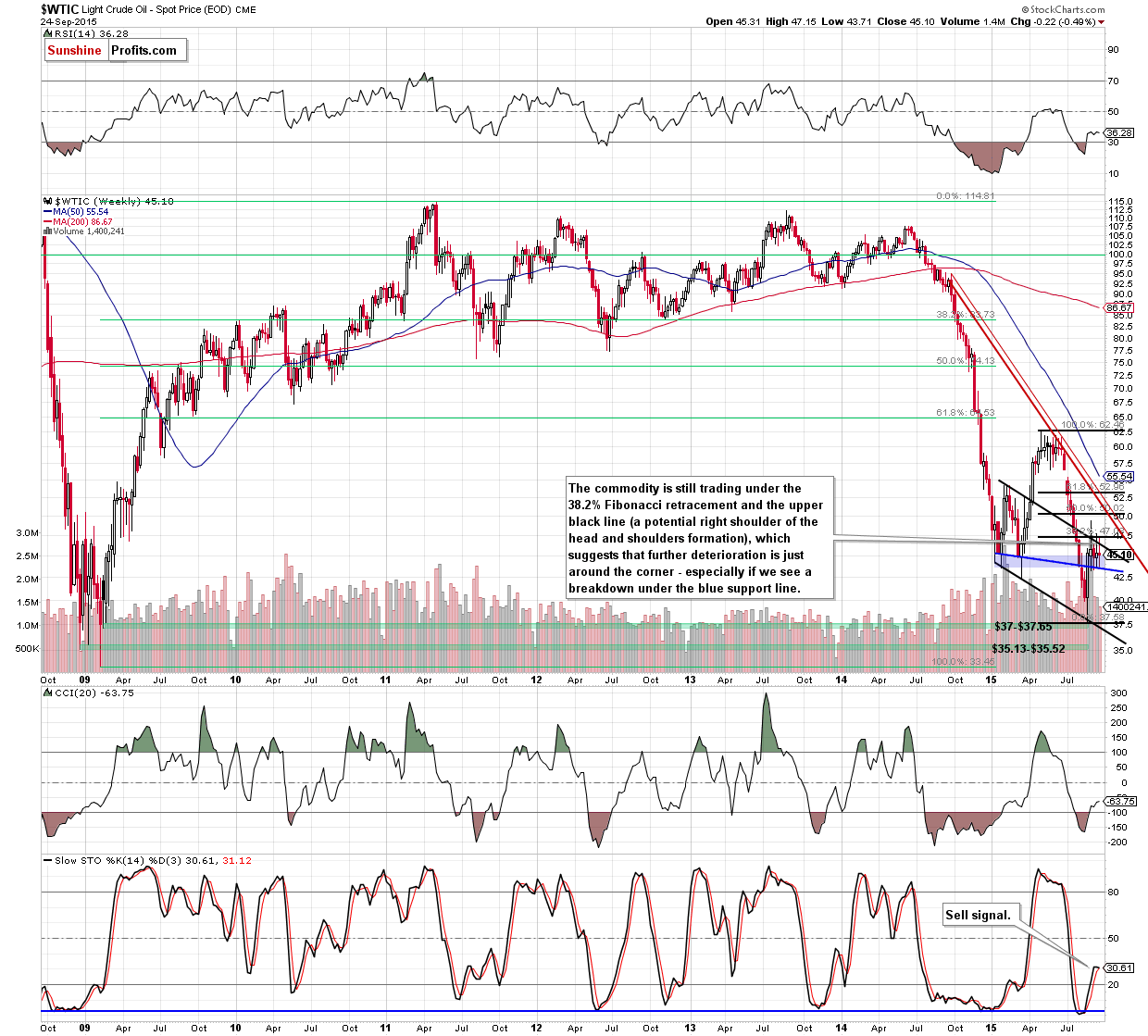

(…) the 38.2% Fibonacci retracement in combination with evening star candlestick formation and sell signals generated by the indicators encouraged oil bears to act, which resulted in a drop under the 50-day moving average. In this way, light crude invalidated earlier breakout, which is a negative signal that suggests further deterioration – especially when we factor in the fact that yesterday’s drop materialized on bigger volume than Monday’s increase.

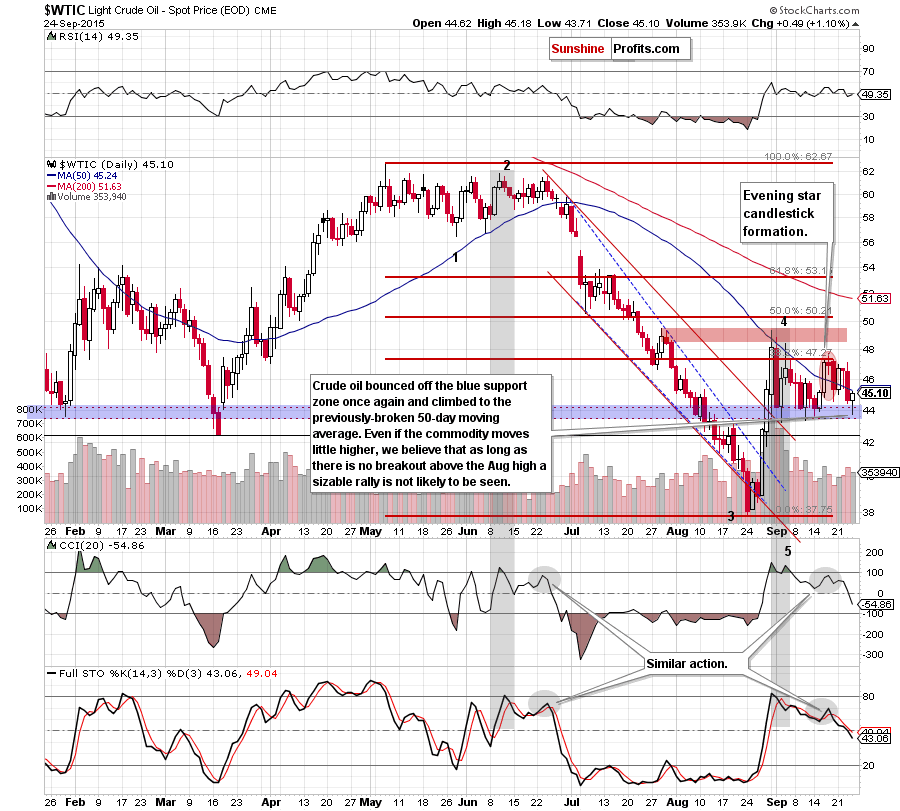

Looking at the daily chart, we see that the situation developed with the above scenario and crude oil declined after the market’s open. With this decline, the commodity re-tested the blue support zone (based on Jan lows) and rebounded once again – similarly to what we saw in previous cases. As you see, oil bulls managed to push light crude to the previously-broken 50-day moving average, but the commodity closed the day below it.

What’s interesting, the size of volume that accompanied yesterday’s rebound was smaller than day before, which raises some doubts over their strength. Nevertheless, taking into account price action that we saw after similar drops to the blue support zone, it seems to us that light crude will likely move little higher in the coming day(s).

However, even if we see such increase, we should keep in mind that as long as there is no daily close above the 38.2% Fibonacci retracement, sizable rally is not likely to be seen and another test of the key support can’t be ruled out.

Finishing today’s alert, please note that, we still believe that an acceleration of declines will be more likely and reliable if we see a breakdown under the blue support zone and the blue support line marked on the weekly chart. Until this time short-lived moves in both directions should not surprise.

Summing up, crude oil declined to the blue support line and rebounded to the 50-day moving average, which means that the overall situation in the short-term (not to mention the medium- or long-term situation) hasn’t changed much and the outlook for crude oil remains bearish. Therefore, we believe that short positions (which are already profitable as we entered them when crude oil was at about $46.68) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 (yes, that far as the medium-term outlook is unlikely to change as long as crude oil stays below the declining medium-term resistance line) and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts