Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Crude oil not only managed to rally last week, but it also showed significant strength this week – is the final bottom for the crude oil prices already behind us?

Not likely. The medium-term trend still remains down and the only thing that changed is the very short-term trend.

In yesterday’s alert we emphasized that the very short-term outlook changed and that betting on lower crude oil prices was no longer justified as the risk of seeing higher prices shortly was too big, even though the medium-term trend remains down. Yesterday’s session showed exactly what we meant. Crude oil moved visibly higher, even above our initial target for this counter-trend rally.

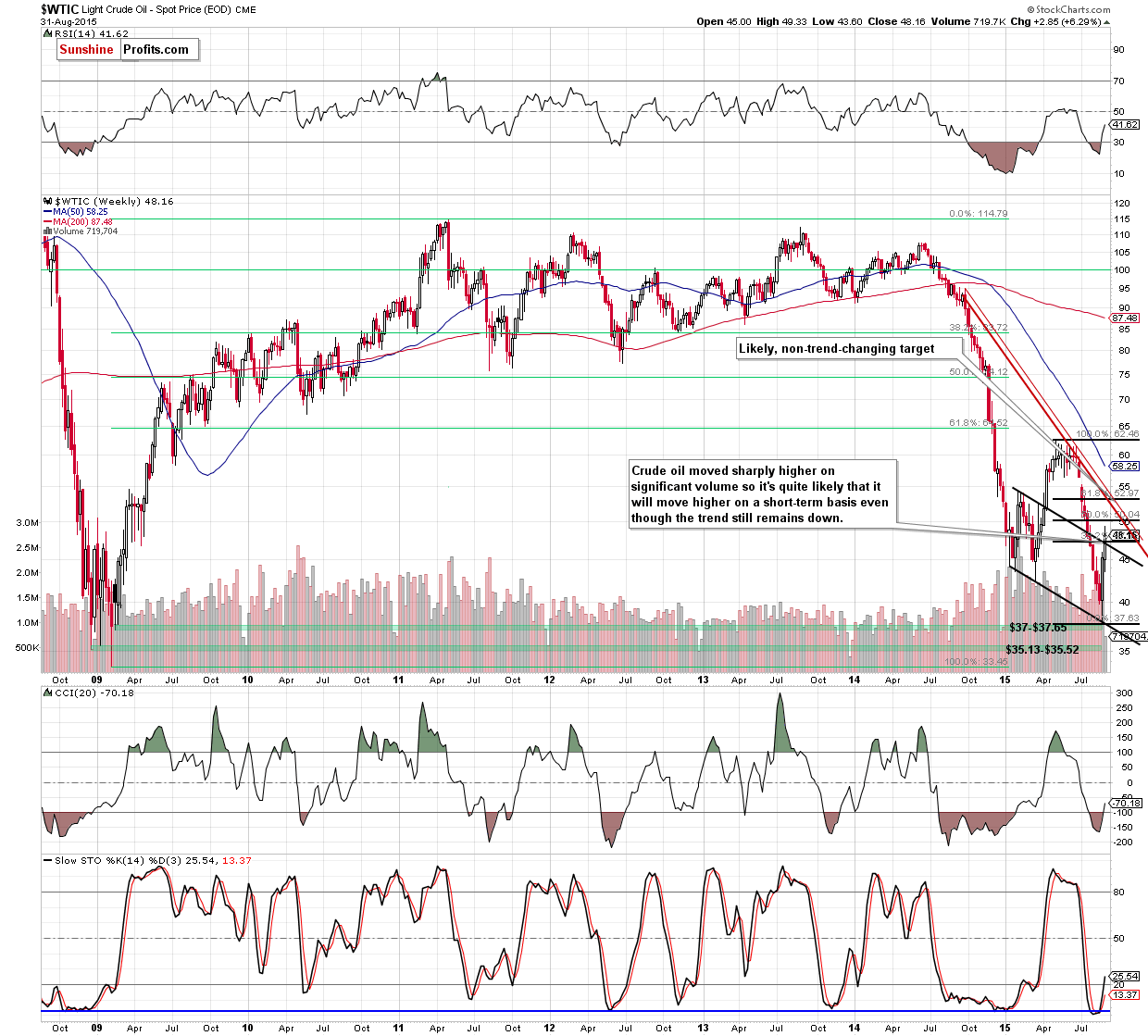

Let’s take a look at the chart (chart courtesy of http://stockcharts.com).

In yesterday’s alert we wrote the following:

The answer is that because of last week’s strength, crude oil is likely to move even higher temporarily (on a short-term basis) before turning south again. The next meaningful resistance level is a few dollars higher (at $47 or so due to the combination of the 38.2% Fibonacci retracement level and the declining resistance line) and since that’s a quite likely target we see no point in holding a short position open – instead, we will focus on the confirmations of the local top and re-entering the short position and more favorable prices.

Confirmations are particularly important because crude oil could easily move even higher – to $52 or so and still remain in a medium-term downtrend and we don’t want to get in the market several dollars too early.

Given the sharpness of the recent rally, it could be the case that the above-mentioned target levels will be reached relatively soon, if we get bearish confirmations shortly as well, we’ll likely re-enter the short positions with even greater profit potential than the previous positions had. As always, we’ll keep you informed.

The confirmations are very important – and we didn’t see any. Conversely, we saw a breakout above the $47 level (38.2% Fibonacci retracement and the declining resistance line), which suggests that crude oil will likely need to move even higher before the trend reverses and before re-entering short positions becomes justified from the risk/reward perspective. Please note that if the medium-term trend is indeed down (which is likely) and we re-enter short positions above $45 (which is likely as well), then the fact that we closed the short positions at $45 will increase the overall profits from the slide as we’ll profit on a bigger move – one starting from higher levels.

Overall, we can summarize today’s alert just like we summarized yesterday’s issue:

Summing up, crude oil rebounded sharply in the final part of last week and the very short-term trend is now bullish. Consequently, we believe that waiting with re-entering short positions for even higher prices is currently the best approach to the crude oil market. Well keep you – our subscribers – informed.

Very short-term outlook: bullish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts