Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Monday, crude oil lost 1.06% as a stronger U.S. dollar continued to weigh on the price. Although the commodity didn’t hit a fresh multi-month low, light crude closed the day at its lowest level since Apr 2. Will the barrier of $50 withstand the selling pressure?

Yesterday, the USD Index extended gains and climbed to a fresh multi-month high of 98.31, making crude oil less attractive for investors holding other currencies. Additionally, the United Nations Security Council unanimously approved last week's accord between Iran and a group of Western powers on a comprehensive nuclear deal. In this environment, light crude moved lower and closed the day under the Jul low. What’s next? (charts courtesy of http://stockcharts.com).

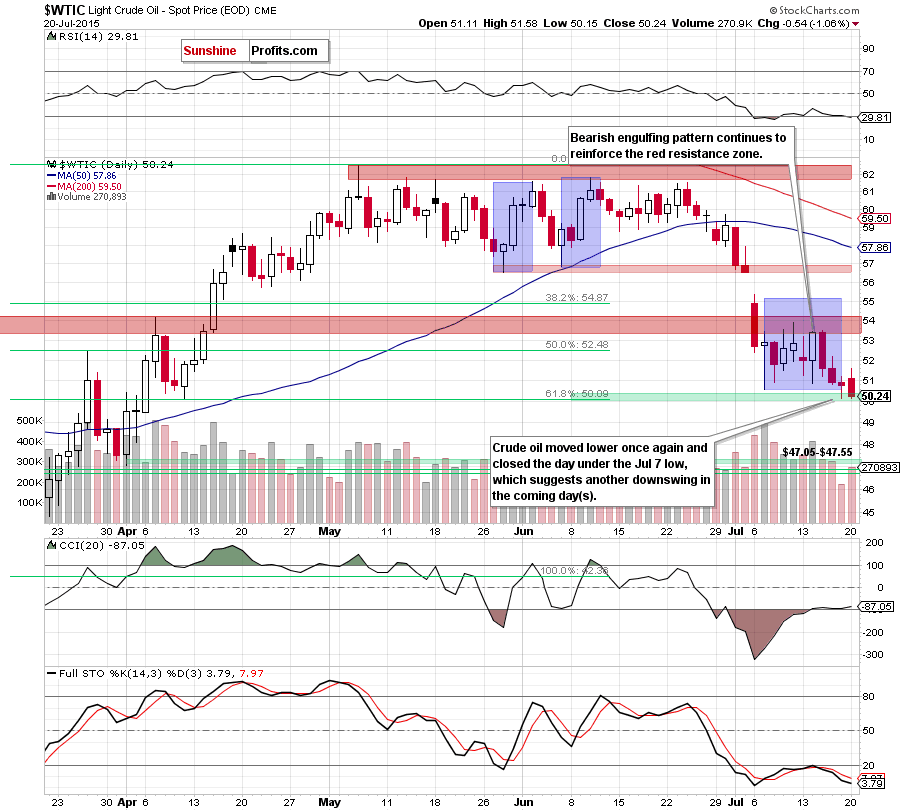

Yesterday, crude oil moved higher after the market’s open, but oil bulls didn’t manage to push light crude above $52. As a result, the commodity reversed and declined sharply, approaching Friday’s low. Although crude oil rebounded slightly, this move is barely visible from this perspective. Additionally, the commodity closed the day not only below the Jul 7 low, but also at its lowest level since the beginning of Apr, which suggests that another attempt to test the barrier of $50 and the 61.8% Fibonacci retracement is more likely than not (especially when we factor in the fact that the short-term downward trend and sell signals generated by the weekly indicators remain in place).

Nevertheless, in our opinion, another acceleration of declines will be more likely if crude oil closes the day under the psychologically important barrier of $50 and the 61.8% Fibonacci retracement.

What could happen if we see such price action? If crude oil declines under the above-mentioned support zone, the next downside target for oil bears would be around $47.05-$47.55, where the Apr 10 low (in terms of an intraday and opening prices) is. If it is broken, crude oil will likely test the lower border of the support zone created by the 76.4% and 78.6% Fibonacci retracement levels (around $46.72-$47.17).

Summing up, short positions in crude oil are justified from the risk/reward perspective as the commodity declined once again and closed the day below the Jul 7 low (the lowest daily close since Apr 2). This confirms that the downtrend remains in place, suggesting lower values of the commodity in the coming days (especially when we factor in sell signals generated by the weekly indicators).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts