Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

Although light crude moved sharply higher after EIA showed that crude oil inventories declined once again in the previous week, the commodity reversed and declined as gasoline and distillate stockpiles increased. As a result, light crude lost 0.47% and closed the day under $60. What’s next?

Yesterday, U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories declined by 2.7 million barrels in the week ended June 12, beating analysts' expectations for a 1.7 million barrels drop. These bullish numbers supported the price of the commodity and pushed it to an intraday high of $61.38. Despite this improvement, light crude gave up the gains and declined sharply as oil investors digested that gasoline inventories rose by 0.5 million barrels, while distillate stockpiles increased by 0.1 million barrels. On top of that, supplies at Cushing, Oklahoma, increased by 112,000 barrels last week, missing forecast for a drop of 850,000 barrels, which together took the commodity to an intraday low of $58.85. Nevertheless, later in the day, a weaker U.S. dollar (which made crude oil more attractive for buyers holding other currencies) supported the price and light crude climbed above the short-term support/resistance line. Where the pair head next? (charts courtesy of http://stockcharts.com).

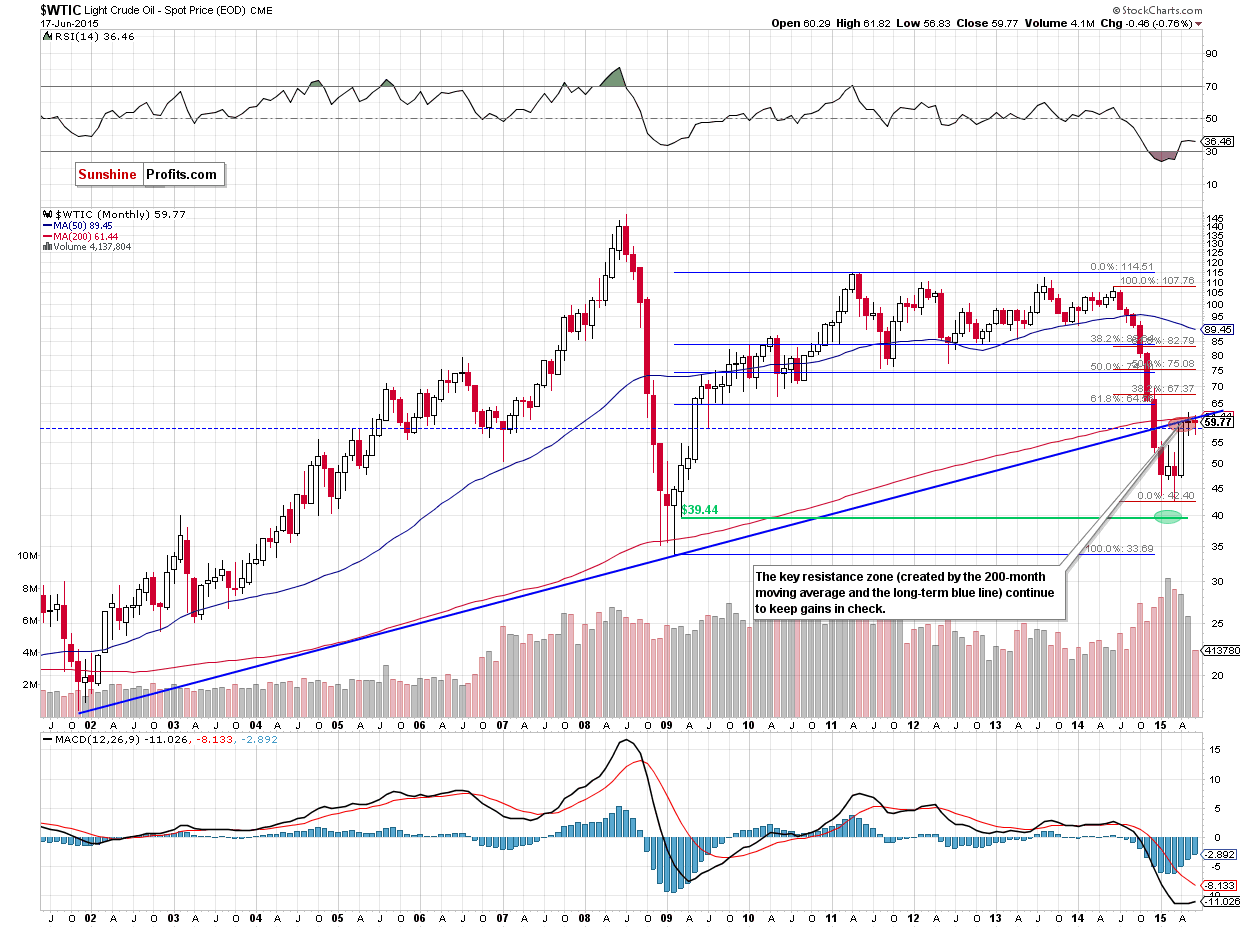

As you see on the long-term chart, although crude oil climbed above $60, the overall situation hasn’t changed much as the key resistance zone (created by the long-term blue resistance line and the 200-month moving average) continues to keep gains in check. Therefore, we believe that as long as there is no successful breakout above this area further improvement is not likely to be seen and another attempt to move lower should not surprise us.

What can we infer from the very short-term picture? Let’s examine the daily chart and look for more clues about future moves.

Quoting our Tuesday’s Oil Trading Alert:

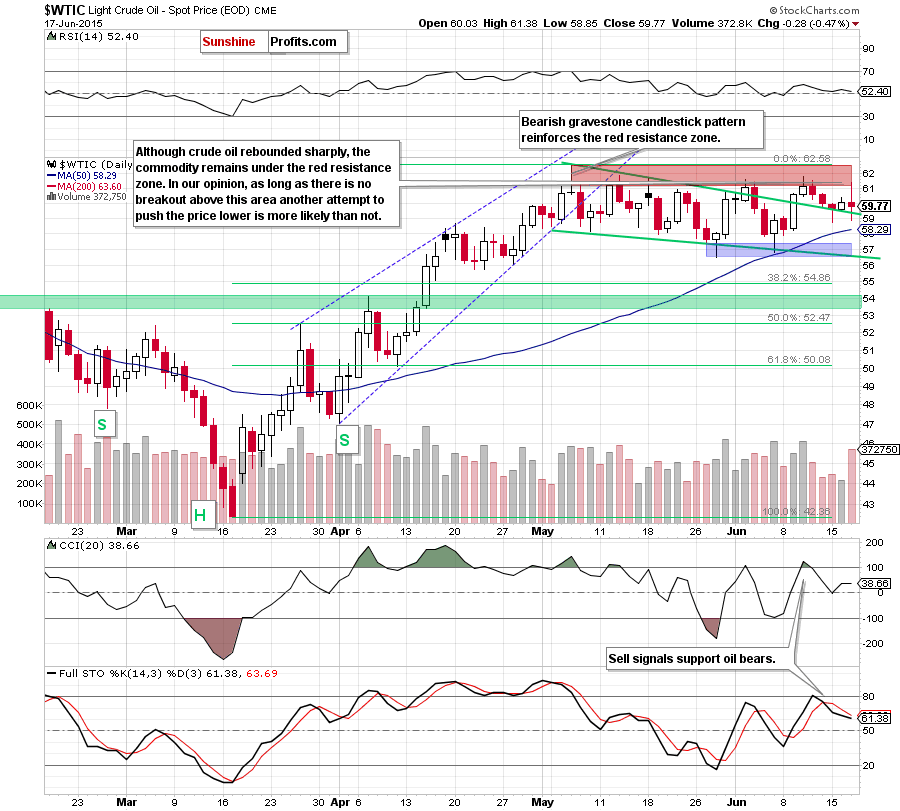

(…) Although light crude could rebound from here (and re-test the red resistance zone once again), we think that the proximity to the key resistance zone in combination with the current position of the indicators (the CCI and Stochastic Oscillator generated sell signals) will trigger further deterioration in the coming days.

Looking at the daily chart, we see that oil bulls pushed crude oil higher as expected. However, the red resistance zone stopped further improvement and triggered a pullback – similarly to what we saw in previous weeks. Taking this fact into account, and combining it with the long-term picture and sell signals generated by the daily indicators, we think that lower values of the commodity are just around the corner (even if we see another test of the major resistance in the coming day(s)).

Nevertheless, in our opinion, further deterioration will be more likely (and reliable) if crude oil closes the day below the green support line and the 50-day moving average (under $58.29). In this case, the last stop before the Feb highs would be the blue support zone ($56.50-$57.60).

Summing up, crude oil re-tested the red zone, but this solid resistance withstood the buying pressure and pushed the commodity lower – similarly to what we saw in previous weeks. This means that as long as this zone (reinforced by the 200-month moving average and the long-term blue line) keeps gains in check further rally is not likely to be seen and another downswing should not surprise us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts