Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil gained 1.23% as the combination of solid Japanese data, a weaker greenback and another drop in U.S. rig count supported the price. In this way, light crude bounced off the Feb lows and posted the first monthly gain since last June when oil prices began declines. Is this as bullish sign as it seems on the first glance?

On Friday, although Japanese prices, jobs and retail sales data missed expectations, industrial production month-on-month increased by 4.0%, beating forecasts of a 2.7% gain, which fueled hopes over demand growth for the major oil importer (Japan is the third world’s largest oil importer).

Additionally, mixed U.S. data pushed the greenback lower, making crude oil more attractive for buyers holding other currencies. As a reminder, the Bureau of Economic Analysis reported that the U.S. gross domestic product expanded by 2.2% in the fourth quarter of 2014, beating expectations for 2.1%, but below initial estimates for a growth rate of 2.6%. Data also showed that the Chicago PMI declined to five-and-a-half year low of 45.8 in Feb, missing expectations for a drop to 58.0, while the University of Michigan consumer sentiment index rose to 95.4 in Feb, beating expectations for an increase to 94.0.

On top of that, Baker Hughes reported that the count for oil and gas rigs nationwide dropped by 43, while the nationwide right is also down by 502 in comparison with the count from last year at this time. In these circumstances, crude oil bounced off the Feb lows and increased to an intraday high of $49.94. Will we see crude oil above $50 in the coming day(s)? (charts courtesy of http://stockcharts.com).

In our last Oil Trading Alert, we wrote the following:

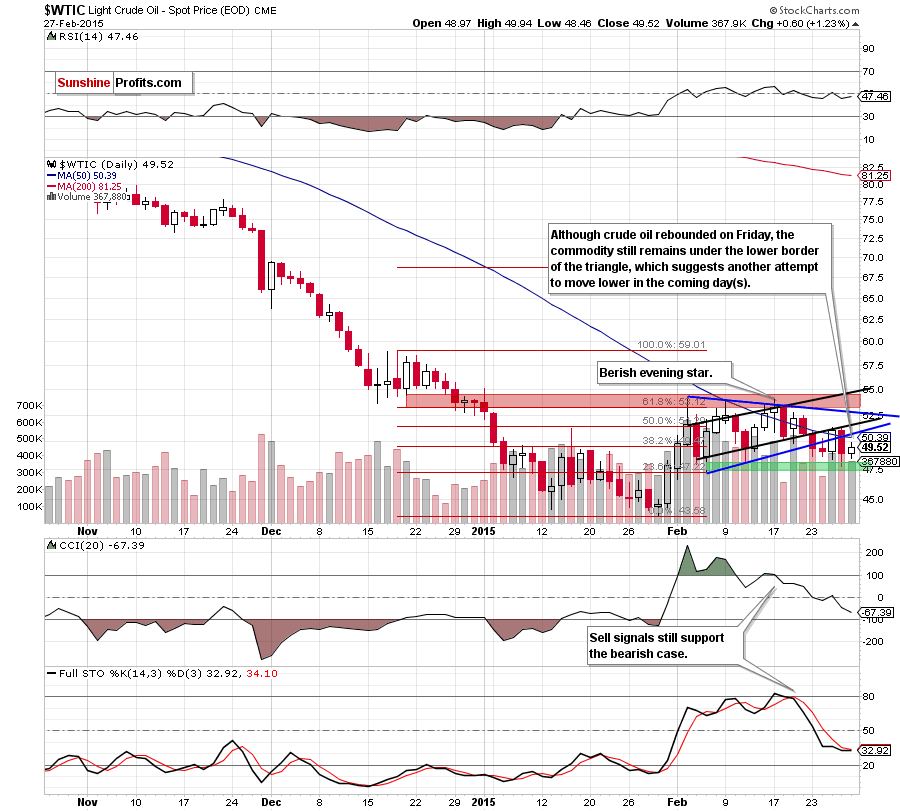

(…) light crude reached the green support zone based on the Feb 5 and Feb 11 lows, which triggered a small rebound in the following hours. Will we see further improvement?

(…) yesterday’s downswing took the commodity to the green support zone based on the Apr 2009 lows, which suggests that we could see a rebound from here in the coming week – similarly to what we saw earlier this month. If this is the case, the initial upside target would be around $50.70-$51.70, where the previously-broken blue and black resistance lines (marked on the daily chart) are.

Looking at the charts, we see that the situation developed in line with the above-mentioned scenario and crude oil rebounded on Friday. Despite this improvement, the very short-term picture hasn’t changed much as the commodity didn’t even reach its key resistance lines (the blue and the black one) and is still trading below them.

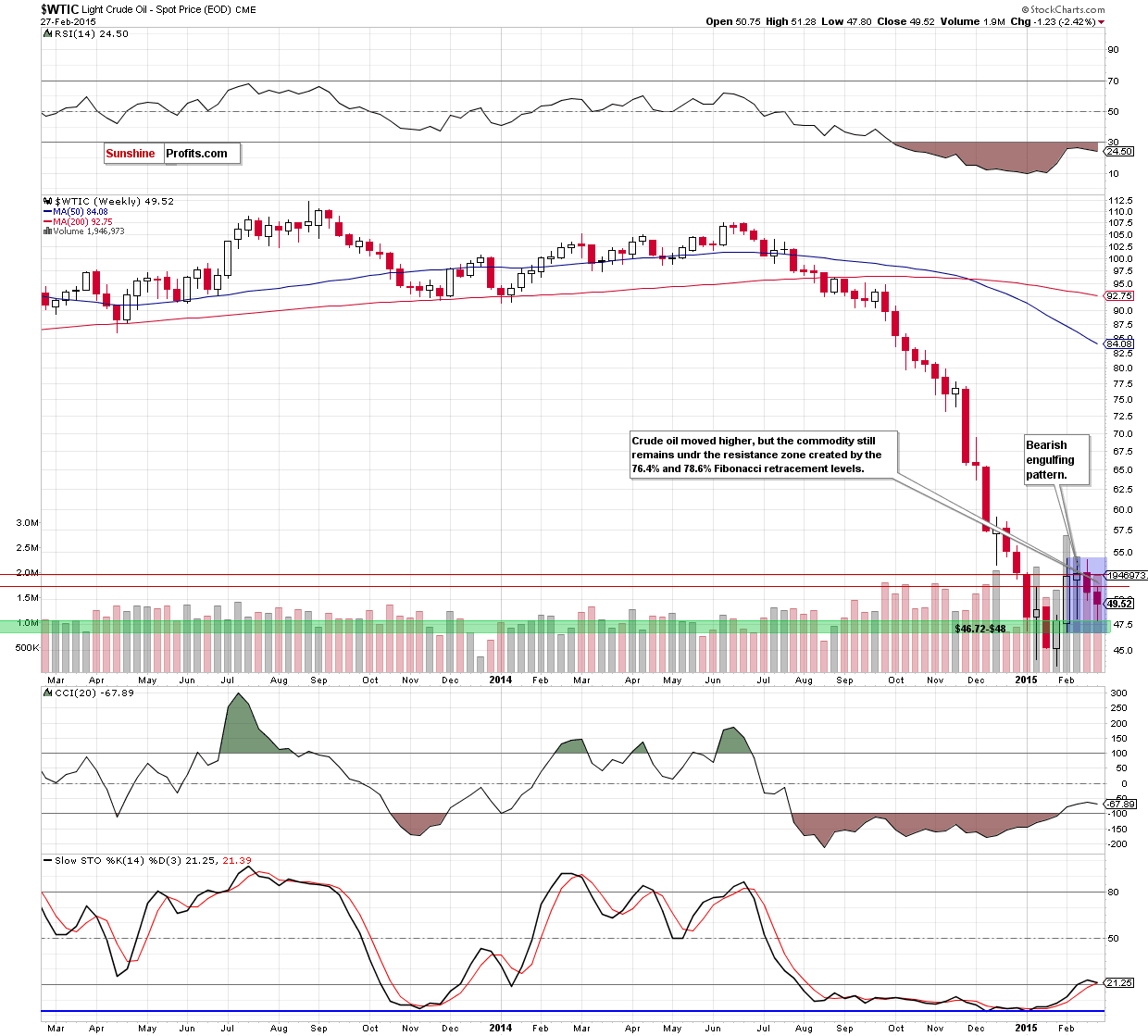

Additionally, crude oil still remains under the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels (marked on the weekly chart) and bearish candlesticks formations (the evening star and bearish engulfing pattern) are still in play, supporting the bearish case.

On top of that, the size of the volume that accompanied Friday’s increase is quite small, which suggests that oil bulls are getting a bit weaker, which could translate to lower values of the commodity in the coming day(s) – especially when we factor in the above-mentioned technical factors. If this s the case, the initial downside target would be around $47.36-$48.05, where the Feb 5 and Feb 11 lows are.

Summing up,although crude oil moved slightly higher on Friday, the commodity still remains under the previously-broken black resistance line, the lower border of the blue triangle and the resistance zone created by the Fibonacci retracement levels (seen on the weekly chart).Taking these facts into account, we think that another attempt to move lower and a test of the green support zone (marked on the daily chart) in the coming day(s) is likely. Therefore, we believe that opening any position is not justified from the risk/reward perspective as the situation remains unclear.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts