Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

- WTI Crude Oil No new position justified on a risk/reward point of view.

- Brent Crude Oil No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Aggressive monetary tightening policy, the energy crisis in Europe and China's continued zero-COVID policy are all dragging on the oil market.

Geopolitics

The recent events on both pipelines (North Stream 1 & 2) have raised the question of sabotage.

Currently, it is difficult to find out who led such explosive operations (at least three) in the Baltic Sea but that it is not going to help a de-escalation of the Russia-Ukraine war, even though international investigations have begun.

Meanwhile, former U.S. President Donald J. Trump suggested mediating a peace agreement between Russia, Ukraine, and the United States through a few posts on “Social Truth” (his own social media network):

Macroeconomics

On the macroeconomic view, the greenback has kept rallying above its previous swing high.

As I expected in my two previous articles, the quarterly R3 pivot (around $115) became the new target. So, it is where the market stopped after making a new high at $114.778 yesterday.

Therefore, a strong dollar tends to reduce the purchasing power of investors using other currencies.

U.S. Dollar Currency Index (DXY), daily chart

The Weather

The market initially reacted to the evacuation of twelve oil rigs located in the Gulf of Mexico in anticipation of the passage of Hurricane Ian, which swept through Florida on Wednesday.

Fundamental Analysis

Speculation of a production cut by OPEC+, which will meet next Wednesday, is weighing on prices.

Indeed, OPEC+ could decide on a drop in production to galvanize prices – a scenario anticipated by investment banks such as UBS or JPMorgan.

Commercial crude oil reserves fell slightly last week in the United States, according to figures released on Wednesday by the US Energy Information Agency (EIA), as analysts expected a sharp rise in inventories.

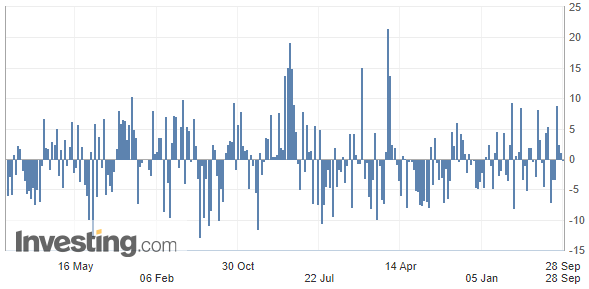

U.S. Crude Oil Inventories

On Wednesday, the Energy Information Administration (EIA) released the weekly change in the count of barrels of commercial crude oil held by US firms.

During the week ended September 23, oil stocks fell by 215,000 barrels, when the consensus, established by Bloomberg, was counting on an increase of two million barrels (so, almost five times as much as the forecasted figure of 443,000 barrels).

(Source: Investing.com)

In the context of the energy crisis in Europe and sanctions hitting Russia, U.S. crude is in high demand.

On average over four weeks, crude oil exports are about 40% higher than they were last year at the same time.

In addition, the drain on U.S. strategic reserves was significantly lower than in previous weeks, at more than four and a half million barrels.

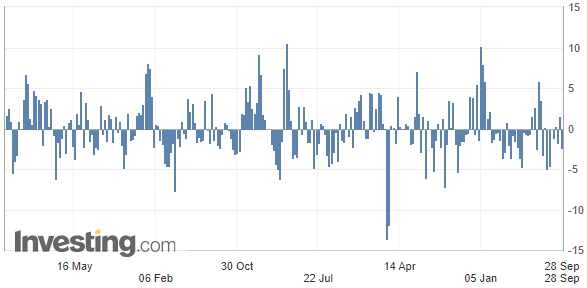

U.S. Gasoline Inventories

As for gasoline reserves, they have shrunk by almost two and a half million barrels, while analysts expected an increase of almost half a million barrels.

(Source: Investing.com)

Technical Analysis

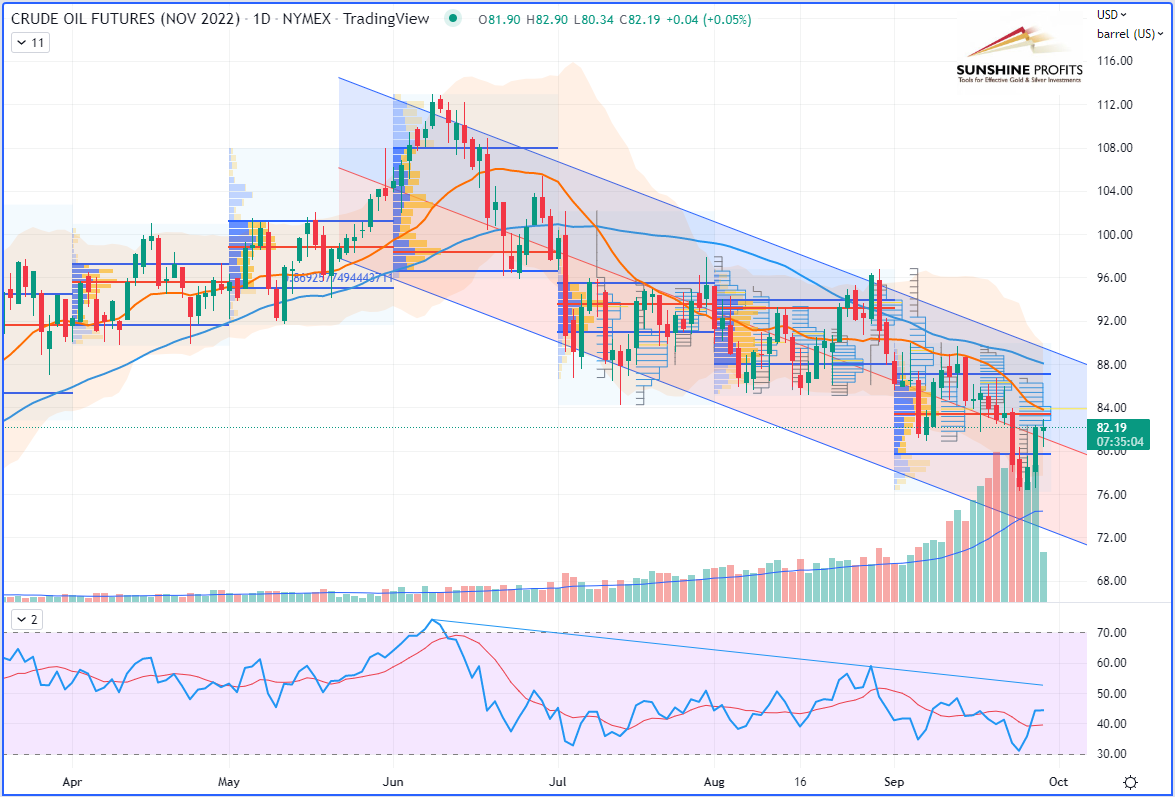

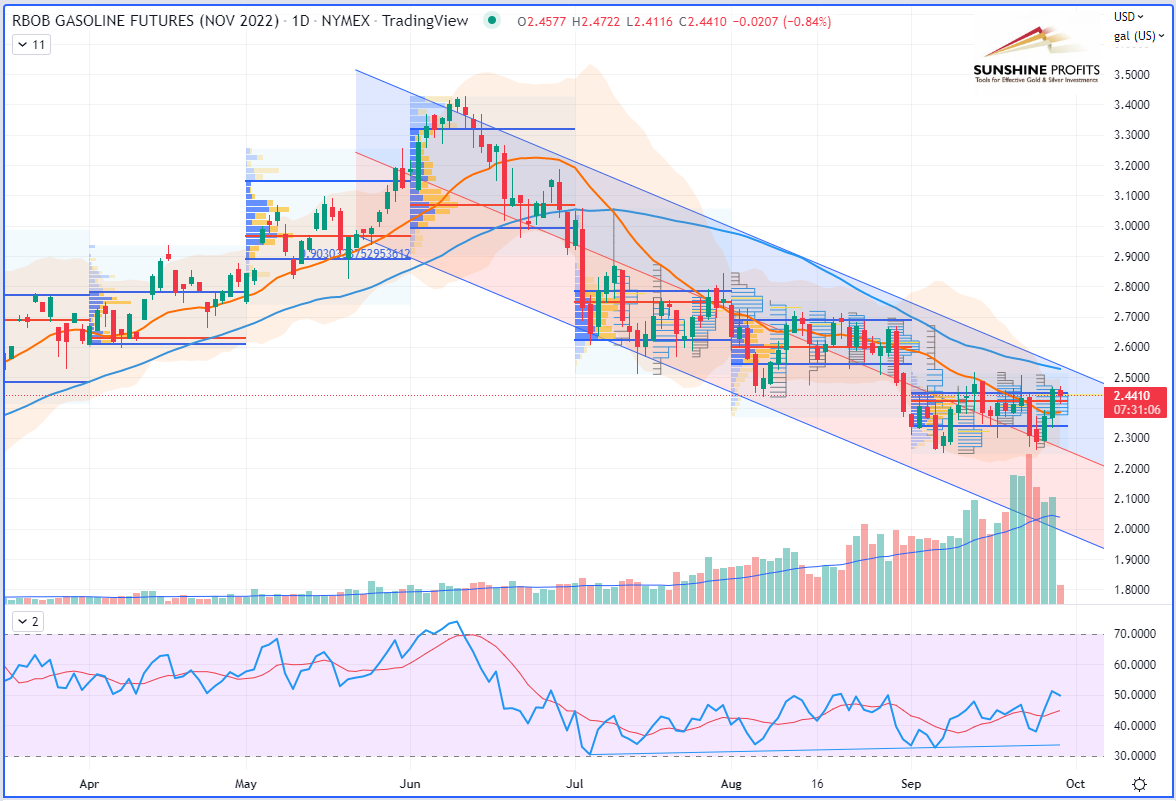

On the daily chart, WTI crude oil (November contract) has been falling again into the lower band before bouncing back above its mean regression line (or median of its regression channel) currently starting from May-20 on the daily chart to get a Pearson’s R (coefficient) near 0.87, with a 4-month long correlation of almost 87% for WTI, 90.3% for RBOB Gasoline, and almost 93% for Brent (see the charts below).

WTI Crude Oil (CLX22) Futures (November contract, daily chart)

RBOB Gasoline (RBX22) Futures (November contract, daily chart)

That’s all, folks, for today. Stay tuned for our next oil trading alert!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist