Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): No positions are justified from the risk to reward point of view.

Oil supply has been boosted by the decision of The American Petroleum Institute (API) to draw one million barrels from the inventories last week. This is contrary to the market’s expectation that inventory levels were increasing on a weekly basis due to flat demand and reduced output of refineries due to cold weather. This excess supply has softened the price a bit, although most traders are on the sidelines currently, waiting to see how the market unfolds.

The slight drop in prices is also due to oversupply concerns over Iranian oil finding its way into China's market. Iran, being sanctioned by the U.S. and not bound to follow OPEC+ production cut rules, is selling oil at lower prices. China's large oil purchase from Iran and later possibly India also joining as a buyer, is undoing the decisions of OPEC+ to limit supply. This rearrangement in supply-demand mapping is to be on the lookout for, and can be a major factor in keeping the oil prices down.

In its recent report, the International Energy Agency (IEA) also stated that an oversupply in the market is likely due to OPEC+ possibly deploying its spare capacity to glut the market. The IEA also believes that the demand for oil will take two more years to return to its pre-pandemic levels. This has again strengthened the bearish outlook, although I don’t think this will have a major impact on the market in the short-term.

While the fundamentals of the market are developing, all eyes are on the upcoming FOMC (Federal Open Market Committee) meeting today (Mar. 17), during which the monetary policies outlook will be provided. Any strengthening of the U.S. dollar will have a stronger downward impact on oil prices. I think the Feds will keep the policy unchanged, which will be good news for bullish traders.

So, we are facing some strong downward pressure due to oversupply, sluggish demand and bearish technical factors, which is balanced by the upward pressure of market fundamentals (supply-demand deficit and economic recovery stimulus). Oil seems to be at a precipice and the barrel can roll either way. I would be on the side-lines for this week and closely follow the monetary policy decisions and U.S. supply situation before making any trading decision.

Letters to the Editor

Q:

Hi Nishant,

Thank you for your analysis. Can I please check what is your entry price for this long futures position and is it a 100% position or more?

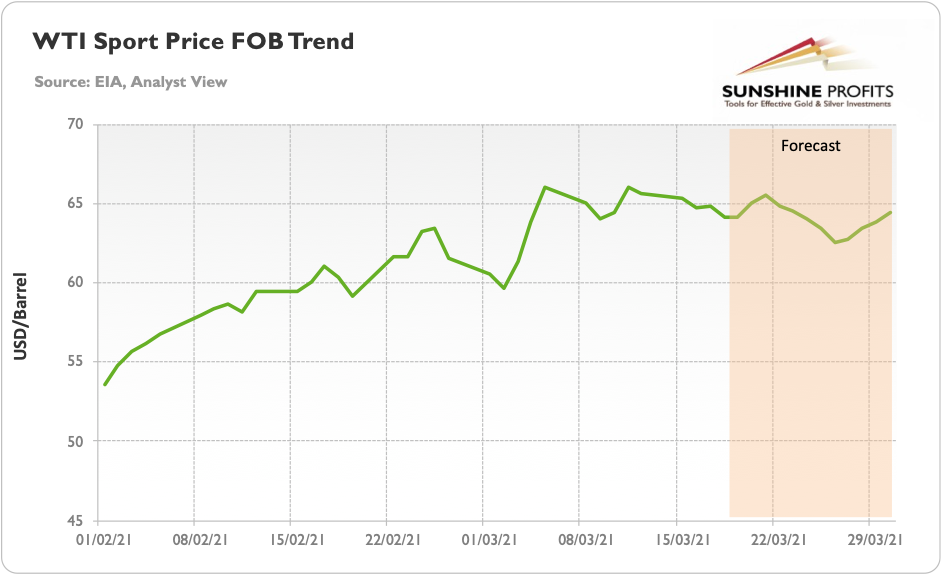

A: Thank you for the question. In my opinion, I would go for a regular 100% position at an entry price range of $64-65, which is where prices are now. I see the fundamentals still pointing towards a 10-15% upward price movement. However, based on technical analysis, and the monetary policies and recent developments in the supply market, it would be best to wait and watch for few days before making any decision.

Q:

Sorry, am I reading this right? Enter oil now, so $65.32 as of this moment. Stop loss of $59.62, so a potential loss of $5,700 for a potential gain of $2,930? Maybe I misunderstood this?

A: I estimated the probability of a price fall to be about one-third compared to the probability of a price increase, and hence, estimated that the price will bounce back after a temporary dip due to volatility. So, the overall risk adjusted returns or expected value of investment would be positive as of Monday. However, recent developments are placing the chances of either movement happening at the same level, it might be prudent to stay on the sidelines for now and closely watch the market developments.

To summarize, the oversupply situation due to Iranian oil flowing to China and from U.S. inventories is going to keep prices down, while upcoming monetary policies can unleash another rally in the crude oil prices. I estimate the price movement can go either way, hence a wait and see approach could be fruitful for this week. For the long-term, production and demand will have some catching up to do, which will keep prices on the higher side.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): No positions are justified from the risk to reward point of view.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist