Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- WTI Crude Oil [CLU22] Short around the $103.16-105.18 resistance area (yellow band) with stop just above $108.28 and targets at 99.66, 96.22 & 90.65.

WTI crude oil prices switched to the bearish side on July 14 by making a new lower low while dropping below the $90 mark.

Before entering short on the lower side of a market that has been ranging for the past two weeks, I would expect a return higher to the upper side of the range before entering a short-sell order.

This area could possibly be located on a higher volume node, so I would enter around the past closest monthly Volume Point of Control (VPoC) in May and would place my stop above the June’s VPoC (also within the May’s low volume area where rejection had happened then (considering the market has memory).

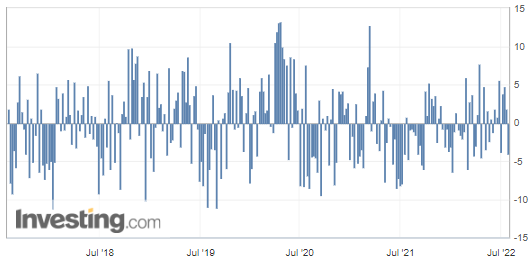

U.S. API Weekly Crude Oil Stock

Fundamentally, yesterday’s drop in Crude Oil Inventories released by the American Petroleum Institute (API) may trigger a short-term bounce back to the re-integration of the upper range side. However since on the daily timeframe we are now in a rather overall bearish trend, we could expect bears to take over around the next resistance.

On the other hand, the continuation of the release of the U.S. Strategic Petroleum Reserve could support this new bearish trend as well as return oil supplies from Libya.

Therefore, this is exactly where I would prepare to enter.

By doing so, I would mitigate my risk on the upside with a stop on the current (July) month’s high – an optimal location as this area (if reached) would thus invalidate the bearish trend and consequently would reinitiate the trend on the bullish side.

Regarding targets, I would set a series of three levels to allow me to stay on that trade longer.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

WTI Crude Oil (CLU22) Futures (September contract, 4H chart)

That’s all, folks, for today. Happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist