The latest FOMC meeting was accompanied by Janet Yellen’s press conference. Let’s analyze the implications of her remarks for the gold market.

Yellen’s Opening Remarks

Yellen did not say anything new in her opening remarks: the labor market slowed down, but we should not overreact to one monthly reading; inflation remained below the Fed’s target, but it is temporary; the U.S. central bank really anticipates gradual increases in the federal funds rate, but malignant and dark external forces do not allow it to hike.

Is July Really Impossible?

Let’s move to the question and answer session. The key takeaway from it is that Yellen said that July is not impossible:

“We do need to make sure that there is sufficient momentum (in order to raise rates). I don't know what the timetable is going to be to gain that assurance. Every meeting is live. There is no meeting that is off the table. No meeting is out in terms of a possible rate increase. But we really need to look at the data and I can't pre-specify a timetable so I'm not comfortable to say it's in the next meeting or two but it could be. It could be. It's not impossible. It's not impossible that by July for example we would see data that led us to believe that we are on a perfectly fine course, and that data was an aberration and that other concerns would have passed."

It’s bullshit, at least according to investors, who slashed their expectations for interest rate hikes this year. As we reported on Friday, the market odds of a July hike are below 10 percent. July is not an option, not now. Yellen and her colleagues have to try harder in order to convince investors that they are really ready to rock & roll. It will not be an easy task as Mr. Market is losing patience. The Fed’s motto is: “I would like to but I’m afraid”. The U.S. central banks would like to hike, but is afraid of many uncertainties encompassing the market. Well, it is a sad truth: the market is dark and full of terrors. If the Fed fears any possible turmoil, it will never hike. Just think how Volcker’s tightening cycle would have looked like (and how much time it would have taken) if he had behaved like Yellen.

Other Issues

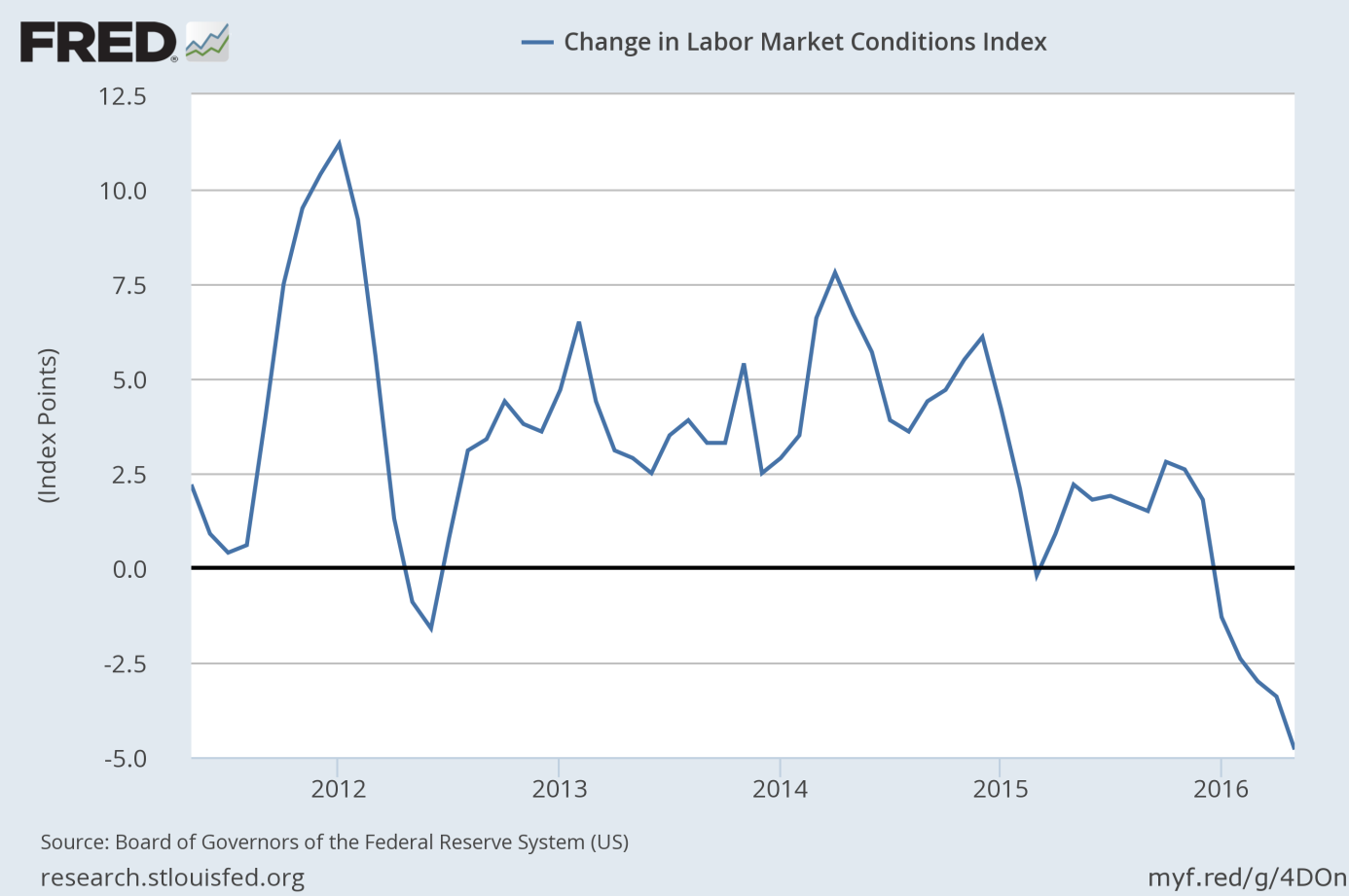

Yellen also believes that wage increases are a sign that labor market slack is diminishing. No, it is a reflection of minimum wages introduced recently by many states. And the labor market is deteriorating, according to the Fed’s own metrics called Labor Market Conditions Index. As one can see in the chart below, the recent weakness started at the end of 2015. The current dynamics of the index suggests that the labor market is not likely to improve any time in the near future.

Chart 1: Change in the Fed’s Labor Market Conditions Index from 2011 to 2016.

Lastly, Yellen argues that the current stance of monetary policy should be viewed as modestly accommodative, because “the so-called neutral rate or rate compatible with the economy operating at full employment is low at the present time”. It’s nonsense again, as the neutral rate is difficult to determine and it is not independent of the Fed’s actions, but this is a matter for a separate discussion.

Conclusion

To sum up, Yellen pointed out that a July rate increase remains possible. However, given the Fed’s cautious approach (and deterioration of the labor market) we do not believe that the U.S. central bank will hike before September, if ever this year. Why do we think so? It’s simple: the outlook will still be too cloudy next month to determine the optimal course of action. There will be just one payroll report before the July meeting, therefore the Fed may not be sufficiently sure about the health of the labor market. Moreover, in case of Brexit we could witness some market turmoil, which would likely not dissipate until the July meeting. This is good news for the gold market – reduced odds of interest hike this year should support the price of gold. Anyway, forget for a while about the Fed – now all eyes are on Europe as the British people ponder exit from the EU. Stay tuned, we will keep you up to date.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview