In the January Market Overview we wrote that a strong greenback and low commodity prices would be negative for many emerging markets, but also for commodity-exporting countries, like Canada and Australia. We actually wrote that Canada was probably sliding into recession. Today, we are looking at Australia, which also suffers a severe economic downturn. How can this fact affect the U.S. economy and the gold market?

The story of Australia’s boom is similar to Canada’s experience. It is rich in natural resources, especially iron ore, coal and some agricultural products. The weak greenback and rising demand for commodities, especially from booming China, caused the prices of commodities to soar. Australia’s commodities export boom led to a significant bull-market in stocks and housing. Indeed, just like in Canada, the housing bubble had grown larger than the U.S. real-estate bubble until it burst and caused the Great Recession.

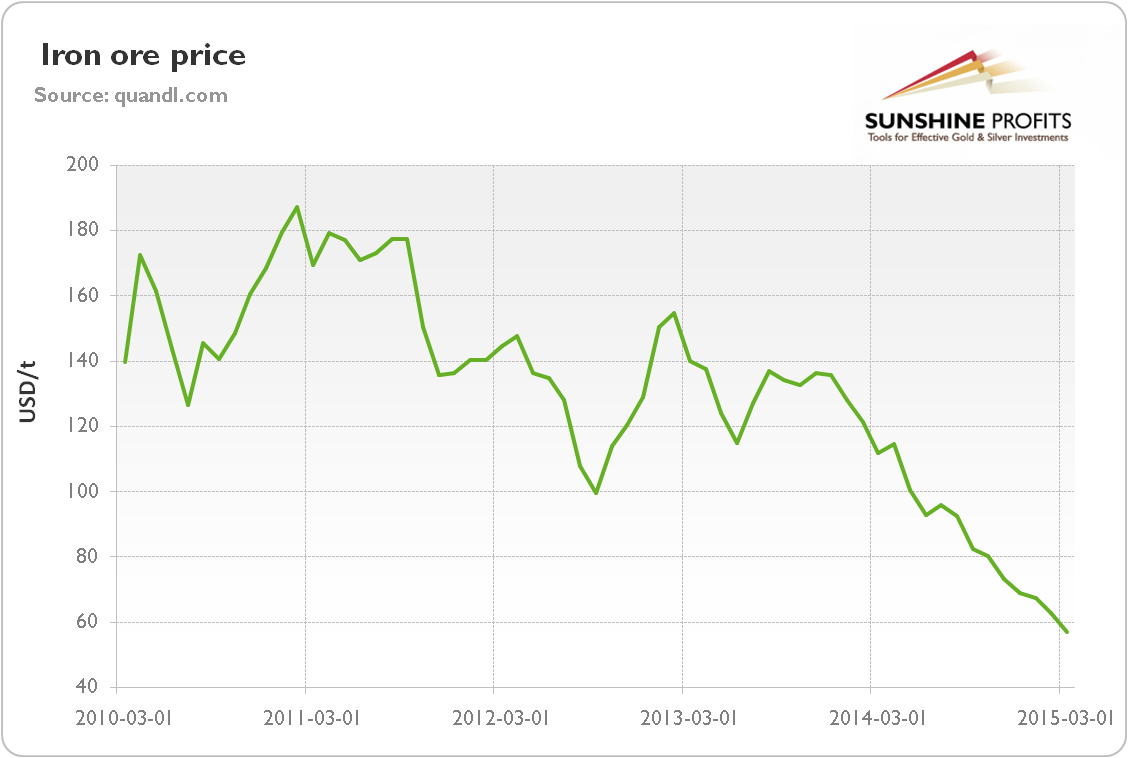

Now, the boom is over. It is true that Australia is not as dependent on oil production as Canada (oil and gas constitute less than 10 percent of exports), however its economy is heavily based on iron ore, which accounts for about 20 percent of total exports. And, as you can see in the chart below, the iron ore prices have already collapsed.

Figure 1: Iron ore price (USD/t) from 2010 to 2015.

They have fallen 30 percent since the beginning of this year to a decade low, forcing some producers (such as Atlas Iron Ltd, Australia’s fourth-largest iron ore supplier) to suspend their operations, and leading some Aussie boom-towns to bust. The plunging iron ore prices, layoffs in the mining industry and sinking real estate prices in the boom-towns may trigger the burst of the stock and housing market bubbles.

The situation is so serious, that the Reserve Bank of Australia cut its benchmark interest rate to a record low of 2.25 percent, the first decrease in 18 months. However, the easy monetary policy will not help, because the problem is weaker Chinese economic growth and subdued demand for Australian commodities. Miners, politicians and economists assumed wrongly that China would grow forever and willingly consume every ounce of commodities that Australian miners could dig from the ground. In consequence, China is Australia's biggest trading partner (this is another difference between Australia and Canada) and the Australian bubble was based on a China-driven commodities exports boom. Actually, Australia is now the most China-dependent economy in the world. The Reserve Bank of Australia seems to be aware that Australia’s problem is to a large extent external, since it held interest rates unchanged during the April meeting, due to concerns over further fueling the property market bubble (but it may further cut interest rates in the future).

How may Australia’s problems affect the U.S. economy and the gold market? The trade ties between Australia and the U.S. are not very deep, however, the economic distress may further strengthen the U.S. dollar (because of possible further monetary easing by the Reserve Bank of Australia and flight to U.S. Treasuries). It would be negative for gold; however, the financial crisis in Australia may lead to a rise in global uncertainty and stronger demand for gold as a safe-haven. Moreover, the downturn in the mining industry may lower gold extraction in Australia. The lower the supply, the higher the price; however, the impact of supply factors on gold prices is not large and comes with a significant lag.

The key takeaway is that Australia is sliding into recession. The central bank may further ease its monetary stance; however, this would not help, because the problem lies abroad, in the slowing China’s economy. Australia’s example shows that the economic slowdown is spreading across the world. The global slowdown should be positive for the gold prices; however the possible further appreciation of the greenback may exert some downward pressure.

P.S. As we believed, President Vladimir Putin offered Greek Prime Minister Alexis Tsipras moral support and long-term cooperation but no financial aid on Wednesday, according to Reuters. Moral support, it’s touching!

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview