Based on our latest gold Market Overview report.

We all heard about various “bailouts” or the financial wizardry that the American government used after the 2008 crisis. In a two pronged play the government spent public money while at the same time it introduced the “quantitative easing” program, which resulted in huge money printing and increases to the “narrowly defined money supply.” As mentioned in the last reports, even though it was inflationary it was not very, very inflationary-- at least not yet.

Lots and lots of new money was created, huge mountains of the stuff. The biggest question is what happened to this money and how did this affect the stocks and bonds? So besides the quantitative aspect there is also the qualitative aspect – what has happened to the money? Where did it go? How would the Fed’s activity to step back affect the markets?

Central banks create money—that’s their job. The interesting side of this process is how they hand that money out. Even though the fundamental story behind those operations is very simple – print the money – the actual mechanism is often a bit technical and complicated. When the central bank creates the money it does not just hand the money out. It hands the money out via specific channels and takes detailed collateral for those gifts.

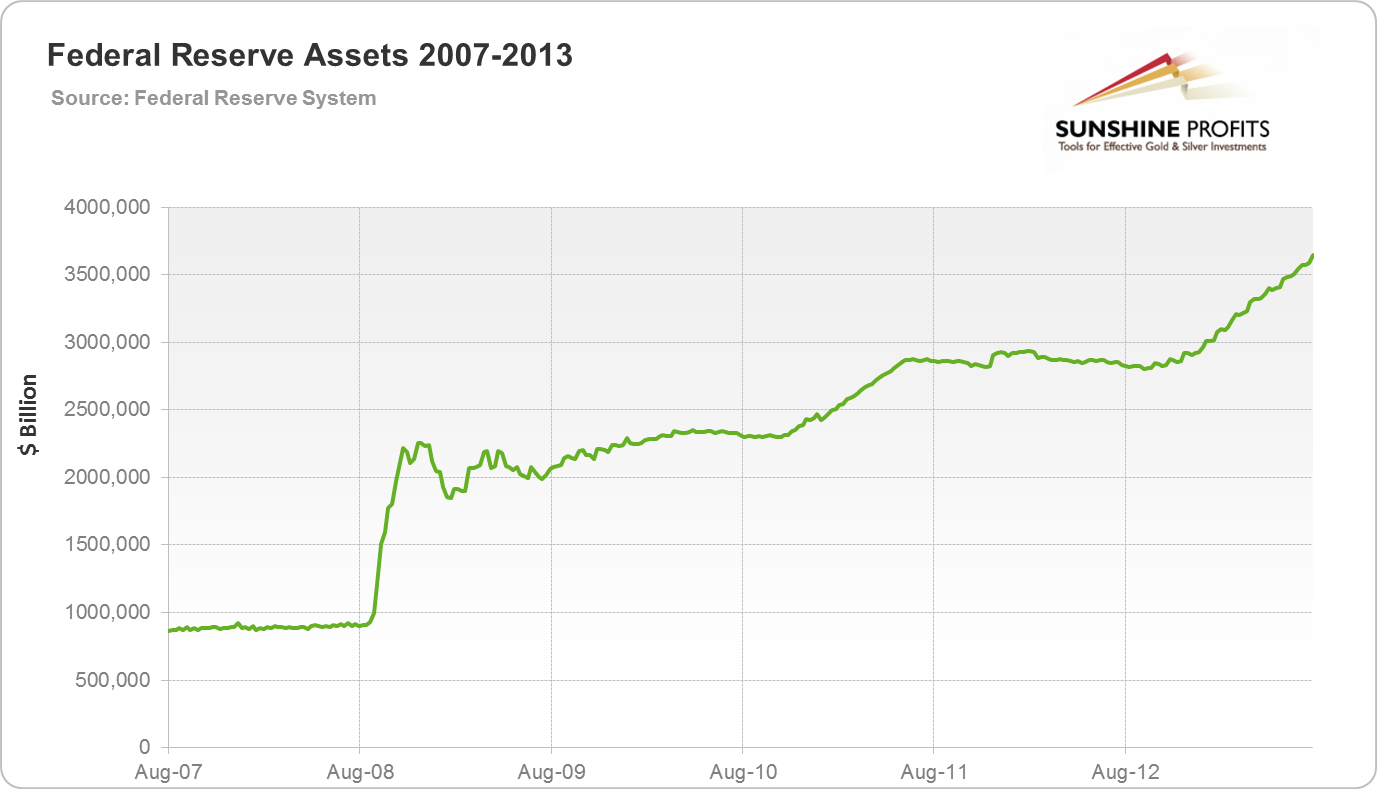

Recent times were revolutionary for central banks around the world. The American central bank is no different, and is actually the leading example for a revolutionary shift. After the Lehman collapse the central banks started to ominously expand their balance sheets, i.e. they started to buy much more securities than in the past. Here is what happened with the Federal Reserve balance sheet since August 2007 till August 2013, with the value of assets held by the Fed:

The value of assets before September 2008 was well below 900 billion dollars. The graph shows that the figure has more than tripled in a very short time. Most of the operations before 2008 were conducted on US Treasuries and the Federal Reserve was very passive in its policy. The “Lehman hit” that took place in 2008 changed everything. The Federal Reserve started to take lots of assets on its balance sheet during a modern crisis of unprecedented proportions which hit both the financial and stock markets. Lots of money was being printed in order to bid up the prices of worthless papers. The end result was the end of the liquidity shortage and the saving from unavoidable drowning of many dollar-denominated assets, including agency debt such as the Student Loan Marketing Association (Sallie Mae), Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac).

Did this influence the stock market? There is no question about that, only the strength of influence can be debated.

We've just heard that a new Boss is coming to the Fed. Janet Yellen will soon replace Ben Bernanke, but do not expect changes in Fed’s approach. The same goes for our outlook for gold in the long run – it remains bullish.

The above is a small excerpt from our latest Market Overview report. The full version includes much more in-depth analysis of this and other fundamental factors that are likely to affect the gold market in the near future. You can sign up for these reports here.

Thank you.

Matt Machaj, PhD

Sunshine Profits‘ Market Overview Editor