Oil Trading Alert originally sent to subscribers on June 20, 2016, 9:15 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil reversed and rebounded sharply as the combination of weaker greenback and fading Brexit fears supported the price. As a result, light crude gained 5% and invalidated earlier breakdown under the short-term support line. Is it enough to encourage oil bulls to act in the coming week?

On Friday, the release of mixed U.S. economic reports pushed the USD Index lower, making the commodity more attractive for buyers holding other currencies. Additionally, worries over a potential U.K. exit from the European Union eased as British officials suspended Brexit campaigning also on Friday (after tragic death of a Parliament member Jo Cox). As a result, light crude gained 5% and invalidated earlier breakdown under the short-term support line. Is it enough to encourage oil bulls to act in the coming week? Let’s check the charts below and find out what can w infer from the about future moves (charts courtesy of http://stockcharts.com).

Quoting our Friday’s alert:

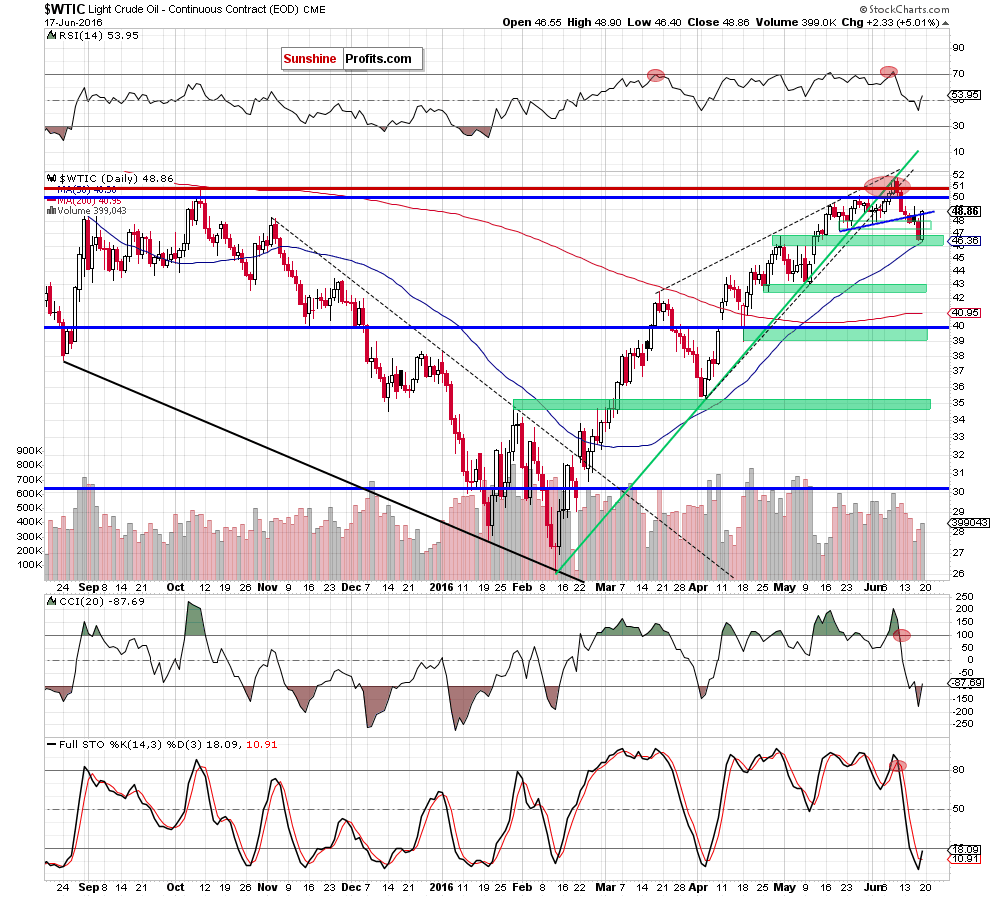

(…) light crude reached the next support zone (created by the Apr and early May highs and the 50-day moving average), which suggests that we may see a rebound from here in the coming day(s). If this is the case, crude oil may increase even to around $48.63, where the previously-broken blue line (which serves as the nearest resistance at the moment) currently is. Finishing today’s alert it’s worth noting that the size of volume that accompanied yesterday’s decline was smaller than earlier this week, which increases the probability of reversal.

Looking at the daily chart, we see that the situation developed in line with the above scenario and crude oil rebounded on Friday. With this move, the commodity not only climbed to our upside target, but oil bulls managed to push black gold above the previously-broken blue resistance line. As a result, light crude invalidated earlier breakdown under the Jun lows and the above-mentioned line, which is a positive signal that suggests further improvement in the coming day(s).

How high could the commodity go in near future? In our opinion, if crude oil moves higher from here, the initial upside target would be the barrier of $50. If it is broken, we may see a test of the recent highs later this week. Additionally, it’s worth noting that the CCI and Stochastic Oscillator generated buy signals, which supports this pro-growth scenario.

Are there any other technical factors that could encourage oil bulls to ac? Let’s examine the oil-to-silver ratio and find out.

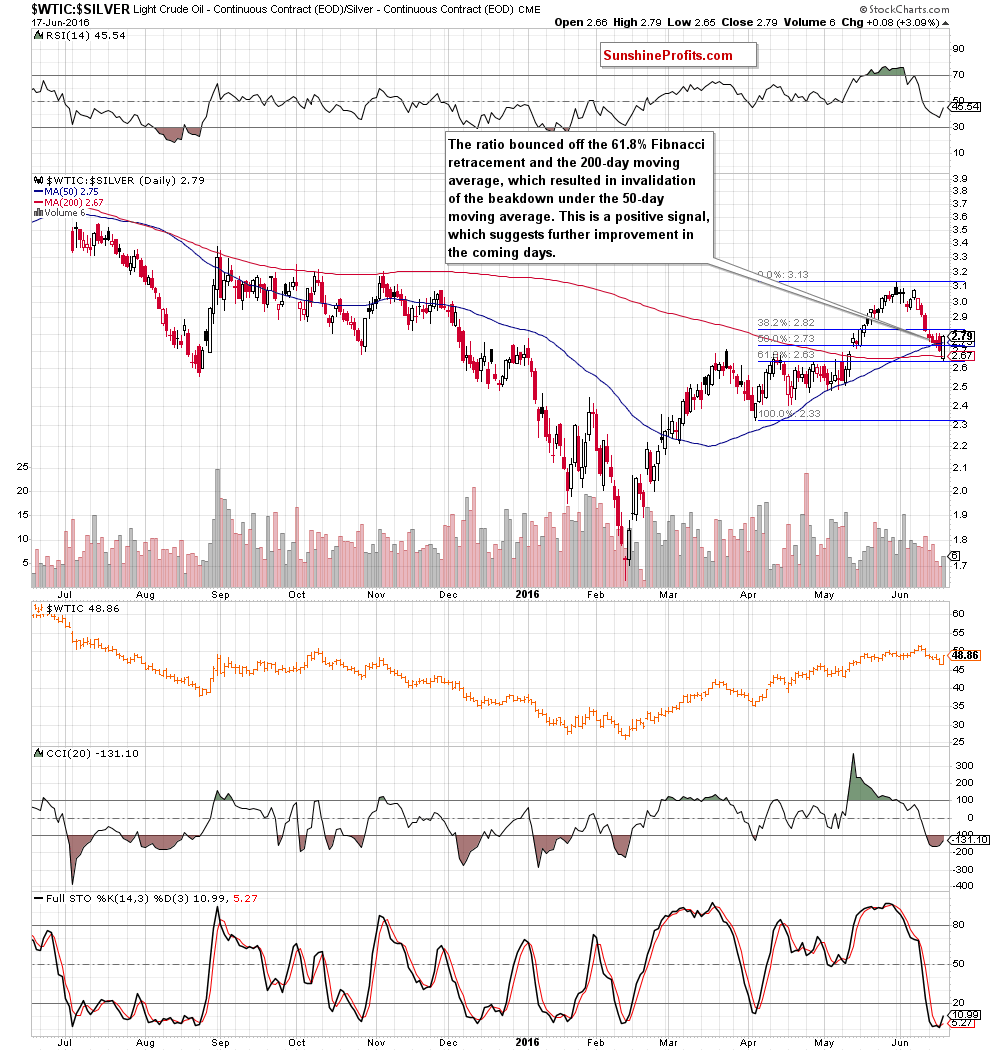

On the above chart, we see that the ratio slipped to the 61.8% Fibonacci retracement, which triggered a sharp rebound on Friday. Thanks to this move, the ratio invalidated earlier small breakdown under the 200-day and 50-day moving averages, which is a bullish signal that suggests further improvement – especially when we factor in buy signal generated by the Stochastic Oscillator (so far quite weak, but still).

What does it mean for crude oil? As you see on the chart, there is a strong positive correlation between the ratio and the commodity, which suggests that further improvement in the ratio will correspond to higher prices of light crude in the coming days (please note that such price action will be more likely if the Stochastic Oscillator climbs above the level of 20 and the CCI generates a buy signal).

Summing up, crude oil reversed and rebounded sharply, which resulted in invalidation of earlier breakdown under the Jun lows and the short-term resistance line, which is a positive signal that suggests further improvement – especially when we factor in buy signals generated by the indicators and the current situation in the oil-to-silver ratio (please click here if you would like to know more about silver as an investment).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts