Oil Trading Alert originally sent to subscribers on October 20, 2014, 9:19 AM.

Trading position (short-term; our opinion): No positions.

On Friday, crude oil climbed above $84 supported by upbeat U.S. data. Despite this increase, light crude gave up gains and finally lost 0.19% as concerns over bigger-than-expected increase in crude oil inventories continued to weight. Will we see a rebound in this environment?

On Friday, the Census Bureau showed that U.S. building permits rose 1.5% in September, disappointing expectations for an increase of 2.8, but U.S. housing starts rose 6.3% in the previous month, beating expectations for a 4.8% gain. Additionally, later in the day, the Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to a seven-year high of 86.4 for October and eclipsed mixed housing data, which supported the price and resulted in an increase to $84.45.

As we mentioned earlier, despite this increase, crude oil reversed and came back below $83. Will we see further deterioration? (charts courtesy of http://stockcharts.com).

Quoting our last Oil Trading Alert:

(…) we should keep in mind that the commodity is still trading under the previously-broken lower border of the declining trend channel and two other long-term resistance lines, which could trigger a pullback from here in the coming day (or days).

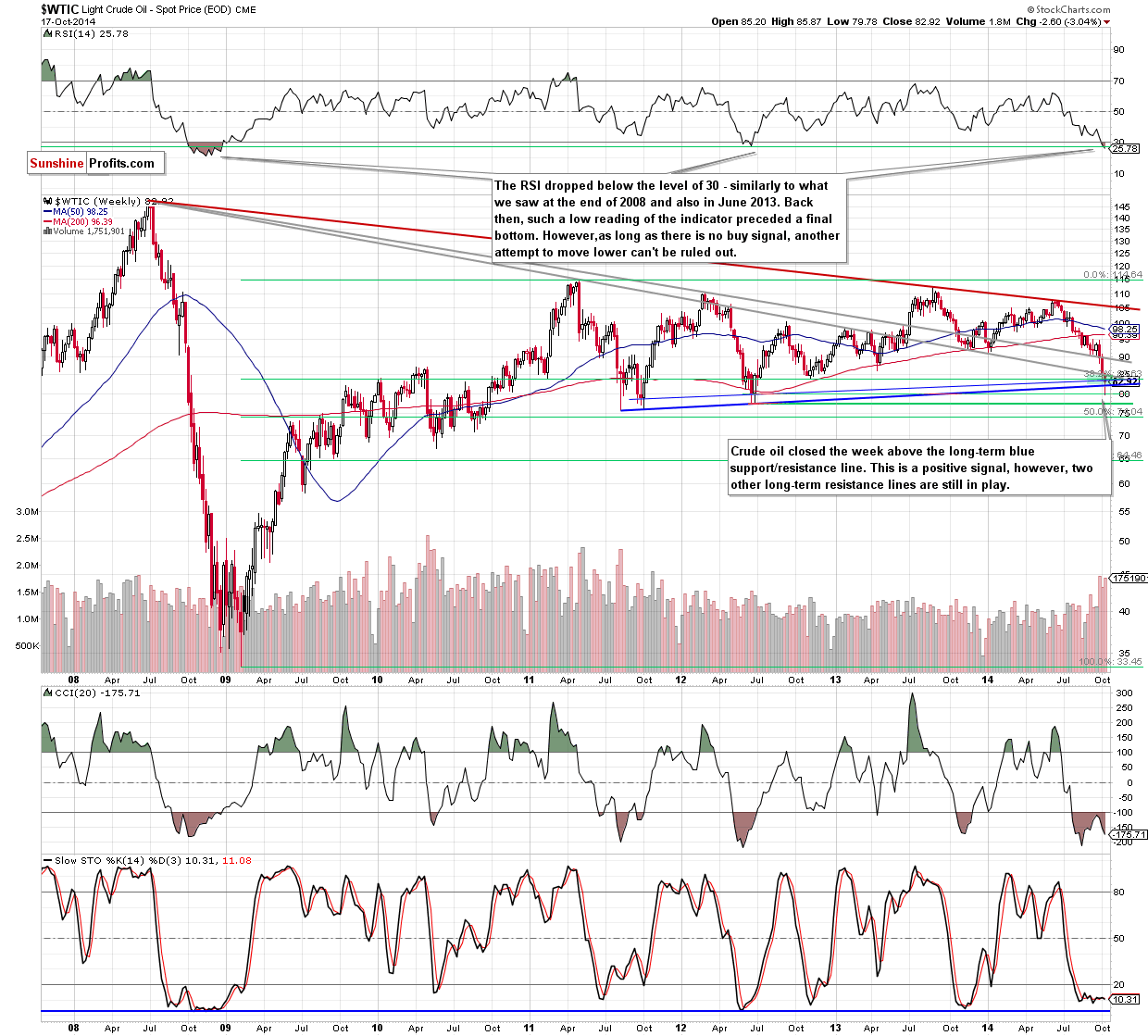

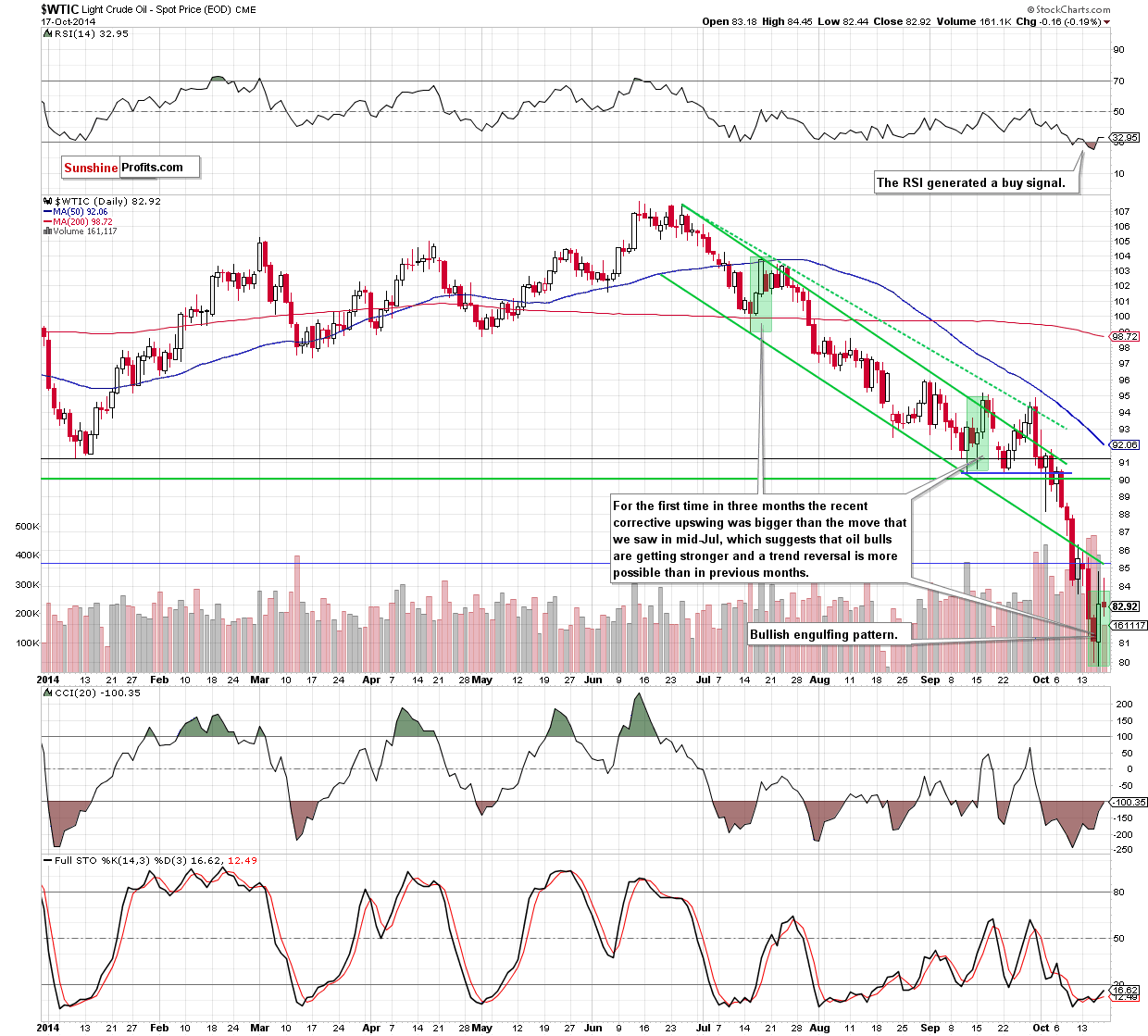

Looking at the daily chart, we see that oil bears triggered a pullback as we expected. As a result, crude oil slipped below $83, but despite this small drop, light crude still remains above the long-term blue support/resistance line. As you see at the medium-term chart, the commodity closed the week above this important support line, which is another positive signal (next to the bullish engulfing pattern and buy signal generated by the Stochastic Oscillator seen on the daily chart). Nevertheless, please keep in mind that crude oil is still trading below two other long-term resistance lines and lower border of the declining trend channel, which together keep further rally in check. Taking this fact into account, it seems that as long as there is no comeback above the short-term resistance line, a sizable upward move is not likely to be seen and another pullback can’t be ruled out.

Summing up, although crude oil closed the previous week above the support level of $80 and the long-term blue support/resistance line (which means that an invalidation of the breakdown below these lines and its potential positive impact on the price is still in effect), it is still trading under the solid resistance area, which keeps gains in check. Therefore, we think that staying on the sidelines and waiting for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts