Oil Trading Alert originally sent to subscribers on June 25, 2014, 7:07 AM.

Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Tuesday, crude oil moved higher as stronger than expected U.S. data boosted demand for the commodity. However, light crude reversed as investors sold it for profits for a second session in a row. Because of these circumstances, crude oil declined to its nearest support zone. Will oil bears be strong enough to push the price below it?

Yesterday, data showed that Conference Board consumer confidence index jumped to 85.2 this month from 83.0 in May (it’s worth noting that this was the highest reading since January 2008), while the number of new home sales also rose to a six-year high, increasing 18.6% in May ( the highest level since May 2008 and the largest monthly increase since January 1992). These strong bullish numbers underlined the view that the U.S. economy is improving (after slowdown caused by unusually cold temperatures during the winter months) and boosted demand for the commodity.

Despite this improvement, the current situation in Iraq capped yesterday’s gains as country’s oil production continued to be untouched by ongoing violence in the country. Similarly to what we noticed a day earlier, oil investors sold the commodity for profits which resulted in a drop to the nearest support zone. Will we see a breakdown below it in the coming days? Let’s check the technical picture of crude oil (charts courtesy of http://stockcharts.com).

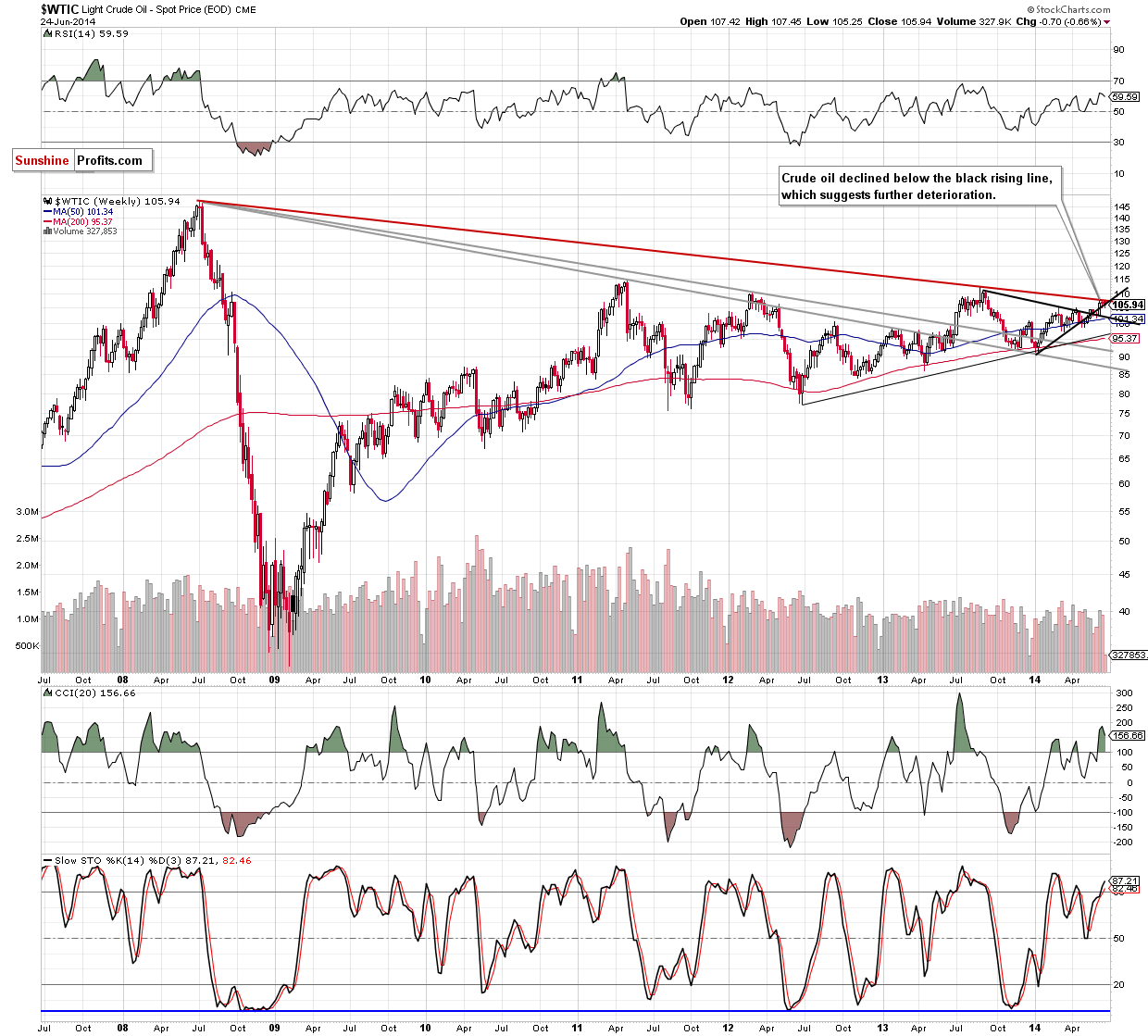

From the weekly perspective the situation hasn’t changed much as crude oil still remains slightly below the black support rising line. Therefore our last commentary is up-to-date:

(…) if light crude moves lower once again and oil bulls do not invalidate the breakdown, we’ll see further deterioration and a drop to around $102, where the declining black medium-term support line is. On the other hand, if the commodity came back above its nearest resistance, will see an upswing to the long-term declining line (currently around $107.50).

Will the daily chart give us any interesting clues about future moves?

Quoting our last Oil Trading Alert:

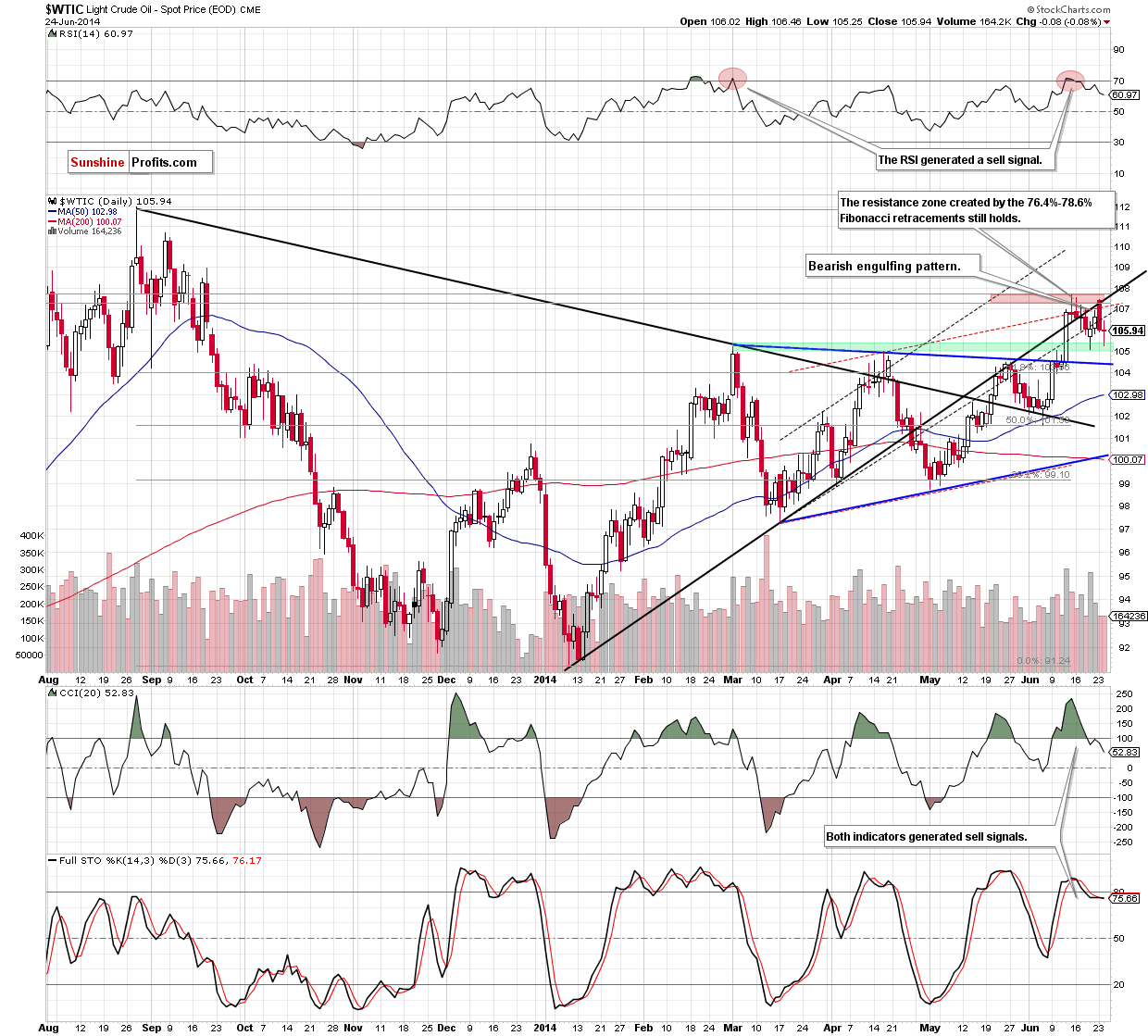

(…) the commodity reversed, dropping below the key support/resistance line and invalidating earlier breakout. This strong bearish signal triggered a sharp decline (…) the recent daily candlesticks created a bearish engulfing pattern, which suggests that further deterioration is more likely than not (especially when we take into account the fact that this formation occurred in the strong resistance area). Therefore, in our opinion, even if crude oil moves higher from here (…), the combination of the above-mentioned bearish factors will stop further improvement and we’ll see a test of the strength of the green support zone. Please keep in mind that sell signals generated by the indicators remain in place and favor oil bears at the moment.

Yesterday, we noticed such price action as crude oil reversed after a small increase and declined to the above-mentioned green support zone. At this point, we should consider two scenarios. On one hand, if it withstands the selling pressure, we’ll see a rebound – similarly to what we saw at the end of the previous week and the upside target will be around $107.30-$107.68, where the strong resistance zone is. On the other hand, if oil bears show their claws once again and manage to push the commodity lower, we’ll see a test of the strength of the previously-broken blue support line (currently around $104.40). As we mentioned yesterday, sell signals generated by the indicators remain in place, supporting the bearish scenario.

Summing up, we still remain bearish as crude oil has been trading below the strong resistance zone and the medium-term black rising line. Although light crude reached the green support zone and we may see a corrective upswing from here, we believe that further deterioration and lower values of crude oil in the coming days are still ahead us.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts