Visit our archives for more gold articles.

Since my previous essay the short-term situation in gold has improved. Gold prices have risen in the short-term as the Reserve Bank's recent liquidity tightening measures have made other investment options like stock and bonds less attractive, experts have said. The shiny metal rallied and hit its highest level in more than three months driven by consistent demand from stockists amid investment buying and speculative off-take. In this way, buyers pushed the price above the psychological barrier of Rs 80,000 per ounce.

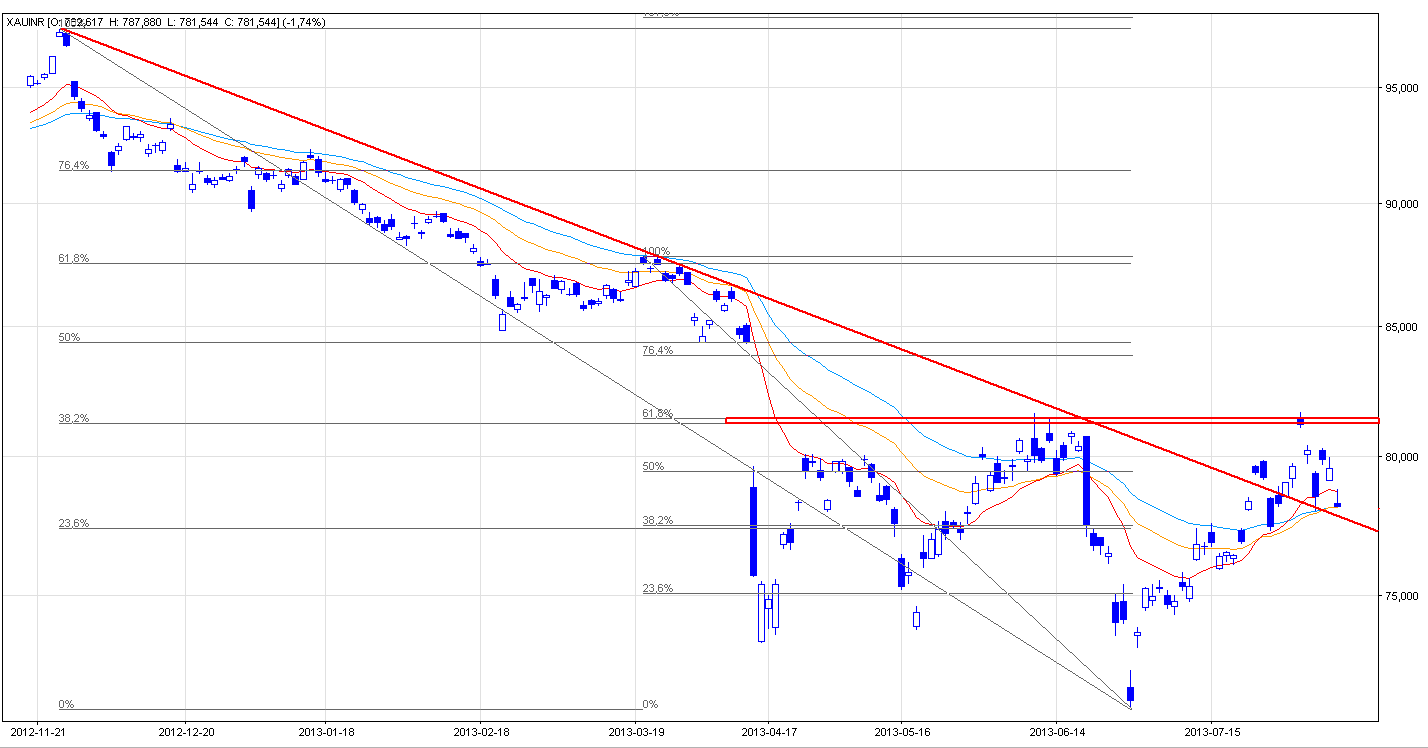

Despite this growth, the higher prices didn't last long. The yellow metal gave up the gains and dropped sharply in the following days. Where did this corrective move take gold's prices? Where are the nearest support zones and resistance levels? Let's take a closer look at the charts and find out what the current outlook for gold is.

On the above chart we see that the price of gold rose once again in the last days of July. Last Wednesday, after a higher open, the price edged up and reached over Rs 81,670 per ounce. It was gold's highest level since April 12. In this way, buyers pushed the price above the psychological barrier of Rs 80,000 per ounce. Additionally, the strong resistance zone based on the 38.2% and 61.8% Fibonacci retracements levels was broken.

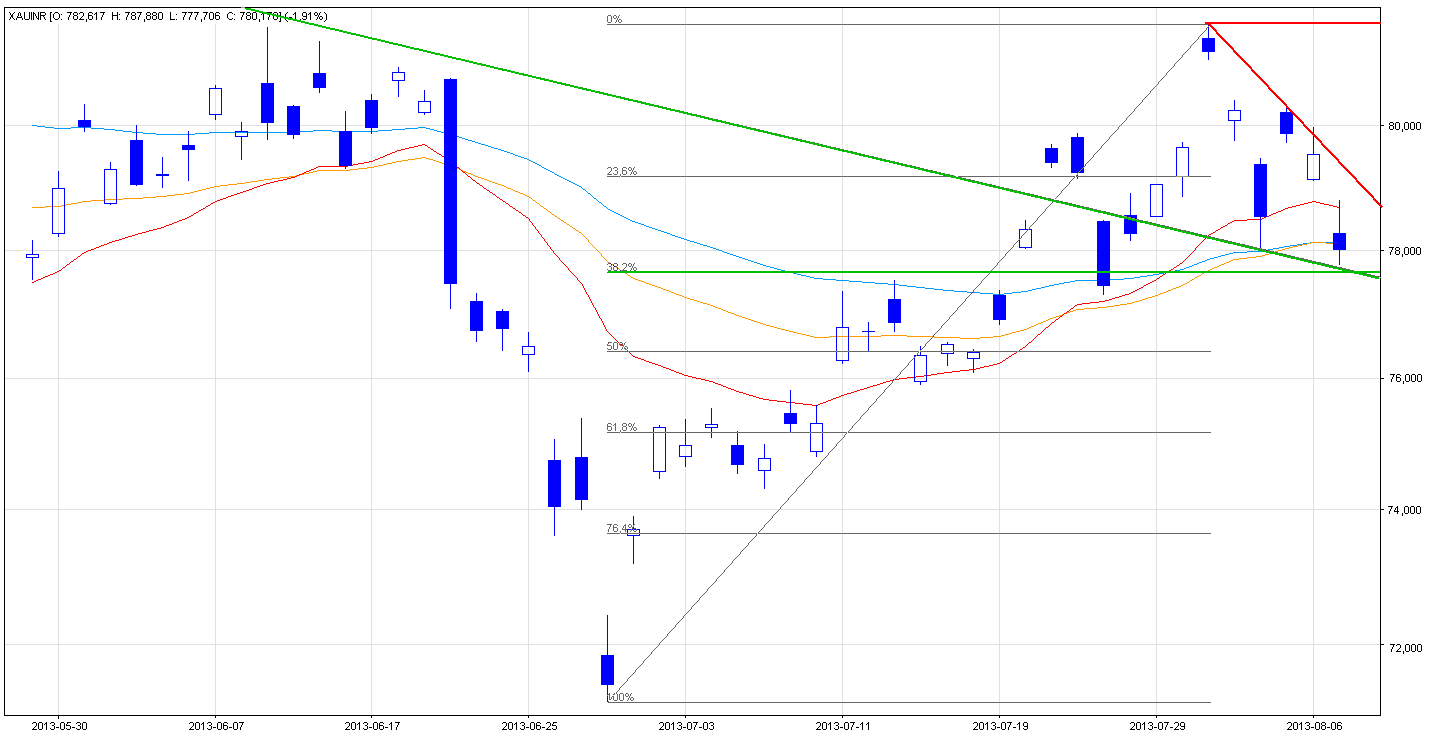

In spite of this growth, gold gave up the gains and dropped sharply in the following days. The above-mentioned breakout was invalidated very quickly and the corrective move took prices below the 15-day moving average and reached the previously-broken declining downtrend line and two moving averages: the 30-day and the 45-day one.

This strong support zone helped gold bulls to take control and triggered a pullback. However, it didn't last long. Although buyers tried to push the price higher on Monday, the strong psychological barrier of Rs 80,000 slowed further growth and the whole session closed below it. Despite yesterday's attempts, buyers failed and didn't manage to get back above this level.

This led to a lower open on Tuesday and a strong sell-off, which took prices below all three moving averages, which serve as resistance now. We can see it on the chart below more clearly.

As you see on the above chart, although gold priced in rupees dropped, the recent decline stopped at the previously-broken declining downtrend line which serves as support at the moment. In this area there is also the 32.8% Fibonacci retracement level which, together with the above-mentioned line, forms a strong support zone.

At this point it's worth to mention that the current corrective move is much bigger than the previous one, which is a bearish factor.

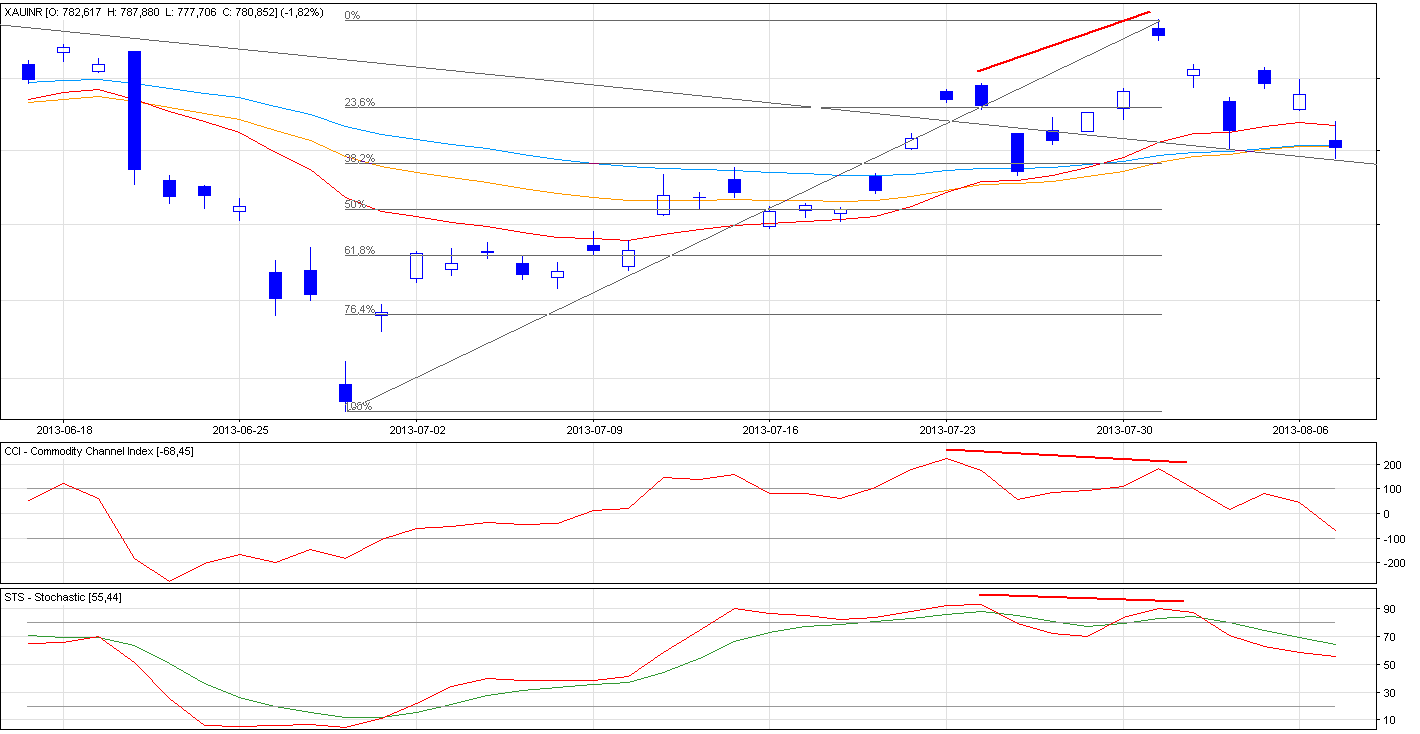

Once we know the current situation from the daily chart, let's take a closer look at the position of indicators.

As you see, both the Commodity Channel Index and Stochastic Oscillator were overbought at the end of July. Additionally, there were negative divergences on the indicators which resulted in sell signals. For me this is a bearish factor which may encourage sellers to go short and possibly trigger a deeper correction.

What's next? Let's summarize.

Last week, the yellow metal hit its highest level in more than three months and reached the psychological barrier of Rs 80,000 per ounce. Although the price broke above the resistance zone based on the Fibonacci retracement levels and the June 11 top, the breakout was quickly invalidated. Additional factors which prescribe caution are the positions of indicators and the fact that the current corrective move is much bigger than the previous one.

In these circumstances, if buyers manage to push the prices higher, we might see a bullish scenario: a pullback at least to the psychological barrier of Rs 80,000. However, if they fail, gold bears will likely trigger another corrective move. In this case, the first support is around the July 25 bottom and the next one is the 50% Fibonacci retracement level.

If you'd like to stay up-to-date with our latest free commentaries regarding gold, silver and related markets, please sign up today.

Thank you.

Nadia Simmons

Back