Yesterday was a particularly volatile and interesting day on the precious metals market. The sector moved slightly higher, then it soared, stayed high for several minutes and crashed. Stocks did more or less the same and the USD Index did the opposite. The likely reason? Comments from Ben Bernanke who said the Fed could decide to scale back the pace of bond purchases at one of the "next few meetings" if the economic recovery looked set to maintain forward momentum.

So, what happened was markets discounted the information about the possible tapering of the stimulus. Will the Fed really decrease the Quantitative Easing? Actually, it could. The Fed has actually been quite good in making people believe that you can really get away with creating money out of thin air. We will provide a bigger discussion of the above, but first, we want to focus on what happened yesterday - technically speaking.

The USD Index reversed at the cyclical turning point and this technical indicator is no longer a threat to the rally in USD. We were supposed to see at least a consolidation based on it - and we did. Overall, we stick with what we wrote in last week's Premium Update: "If anything, we could see stocks move back to this level [2007 highs], which could further verify the breakout and allow them to gather strength in advance of the next rally."

We were asked what the increased volatility means, if anything. We think that it's a signal that the end of the decline is getting closer, but not necessarily just a day or two away. We have previously written that gold is now in a reverse parabola - probably in the final stage thereof. The implication is that the volatility will increase and that it's difficult to estimate just how low gold will go temporarily - which was also the reason why we adjusted our trading plan.

We've promised to get back to the discussion of the Fed actions, so here we are. Can Fed influence banks to make them start lending out? If not officially, then unofficially. If the Fed was able to save some banks just a few years ago, then why wouldn't it be able to make them expand their credit operations? On the other hand - can Fed prevent banks from expanding their credit operations? Why not? We're not saying that it had to happen in this way, but it's possible if you consider that Bernanke doesn't say what he means but he says things based on what he thinks it will make markets do. Think about the following:

- A lot of money is being created through low interest rates, which eventually leads to an asset bubble and subsequent crash (triggered by the subprime mortgage crisis)

- The Fed knows that excessive money creation was the problem in the first place, but also knows that the only way of getting out of the crisis in the short- and medium-term is printing even more money. The problem is that this will ultimately lead to massive inflation and depreciation of the dollar and perhaps cause big problems with those who hold a lot of USD-denominated debt.

- ... That is unless the Fed can manage expectations very well. It can.

- Depreciation of the dollar? Not if other currencies depreciate as well. There have been numerous meetings of central bankers, so it shouldn't be too hard for Bernanke to persuade others to inflate their problems away. "So, guys, you either inflate too, or we're gonna hurt your exports to the US via a cheap dollar policy. Any questions?". Ultimately the currency exchange rate is just a ratio between the values of currencies - if others are losing value faster than USD, then USD will rally. At the first sight it will look like what the Fed is doing, is not harmful to the currency or is not causing inflation whatsoever.

- We see rising prices of commodities, food, and virtually anything else - especially precious metals, but as long as we're focusing on the official inflation measures, things will not look that bad as these measures have been adjusted over the years to show lower values. People will still see rising commodity and precious metals prices.

- Knowing that all markets correct eventually, the Fed officially ignores soaring gold prices - "it's just another bubble". After prices finally correct and consolidate, the Fed thinks that maybe it would be a good idea to "help" gold move a little lower which would trigger further selling (Goldman sell / short recommendation?).

- Emphasize gold's decline and the speculative nature of the previous price moves, suggesting that buyers were just a bunch of people who didn't understand the economy and how inflation works. You don't see this directly, but you do see it indirectly, through comments from other analysts.

- Create economic theories to support this view. It's not like any other time - this time creating a lot of money doesn't cause inflation, because ... . Just look at the dollar, inflation numbers and even commodity / gold prices - what's the problem? There is no inflation. Check this article entitled "Gold Rallied for Years on 'Misunderstanding'". Could the Fed simply tell their friends in banks "now just wait a bit with the credit action, we want to convince people that QE is ok".

- Start talking about ending or limiting the money printing - this will send commodities and metals lower, along with stocks, but push the dollar higher. Consequently, this can be done only after a strong rally in stocks, when the stock market should correct anyway. Isn't that exactly what we've seen just now? This sends an even stronger message to the people - there is no real inflation now and we could see deflation if the Fed stopped the easing programs - if things get worse, we can expect to see voices for additional easing.

- The Fed knows that people confuse short-term implications with long-term implications and that what they do is really complex, so that only a few people will realize what's going on. Most won't - it will be easier to convince people about something that can be "proved" immediately.

So - open-ended QE and no inflation, declining gold prices and rallying dollar. What's wrong with this picture?

Bank's reserves will ultimately translate into higher credit action and a lot more money in the economy. Why would people not be borrowing or banks lending? With lower commodity prices and soaring stocks everything seems to be "fine" at the first sight, so it seems it's just a matter of time when the credit action goes back to normal (or excessive) and the inflation really starts kicking in. It's also just a matter of time when investors realize that and get back into precious metals. The bull market will continue, just like it did over 30 years ago - back then we also had a big correction after which the bull market resumed with vengeance.

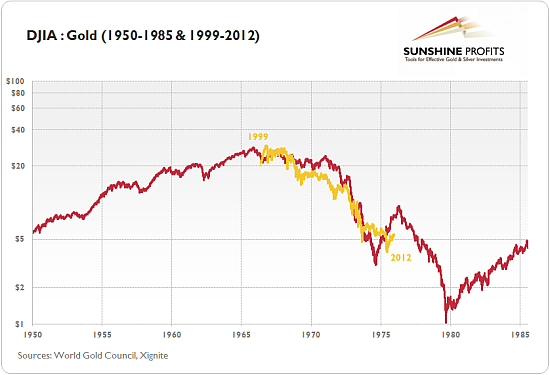

Actually, this is the chart that we posted over a year ago:

Comparing the current decline in the ratio and the one seen over 30 years ago we can see that it was actually about time to see stocks outperform gold for some time. Therefore, the analysis of this single ratio can tell us whether the bull market in gold is really over or if it's just a big correction - it's a big correction.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA