Forex Trading Alert originally sent to subscribers on October 6, 2016, 9:17 AM.

Earlier today, the U.S. Department of Labor reported that the number of initial jobless claims in the week ending October 1 dropped by 5,000, beating analysts’ forecasts. As a result, the British pound extended losses against the greenback and hit a fresh multi-year lows. How low will the exchange go in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3549 and initial downside target at 1.2231)

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3346; initial downside target at 1.2876)

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7791; initial downside target at 0.7516)

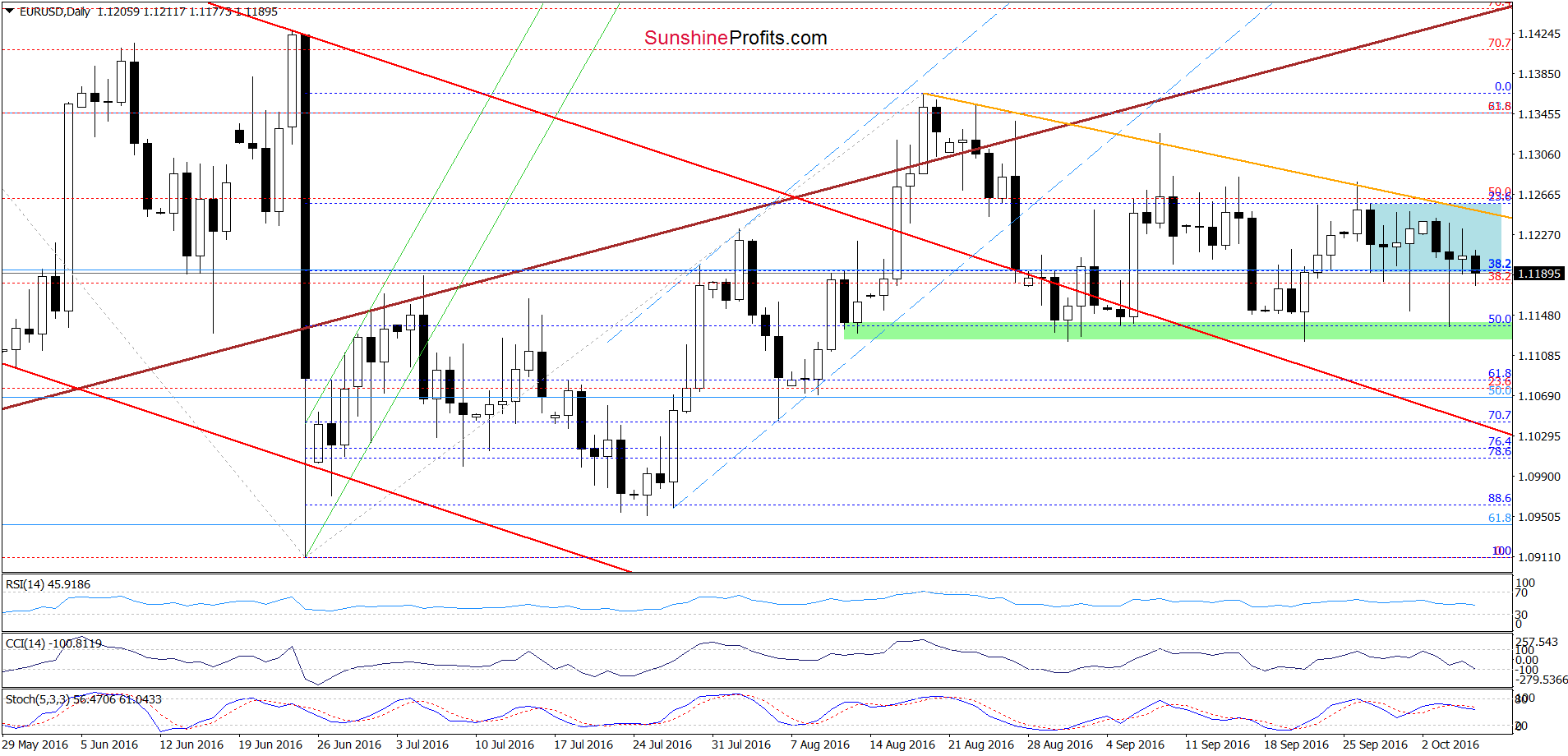

EUR/USD

The situation in the medium term hasn’t changed much as EUR/USD remains in a consolidation between the Sep high and low. Today, we’ll focus on the very short-term changes.

Yesterday, we wrote the following:

(…) the green support zone stopped currency bears once again, triggering a comeback to the consolidation. Although this is a positive signal, we saw similar price action several days ago, which in combination with a sell signal generated by the Stochastic Oscillator suggests that another attempt to move lower is just around the corner.

From today’s point of view, we see that the situation developed in line with the above scenario and the exchange moved lower earlier today. With this downswing, the pair re-tested the lower border of the consolidation, which doesn’t bode well for EUR/USD – especially when we factor in sell signals generated by the indicators. Taking all the above into account, we think that the pair will extend losses and test the green support zone once again in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

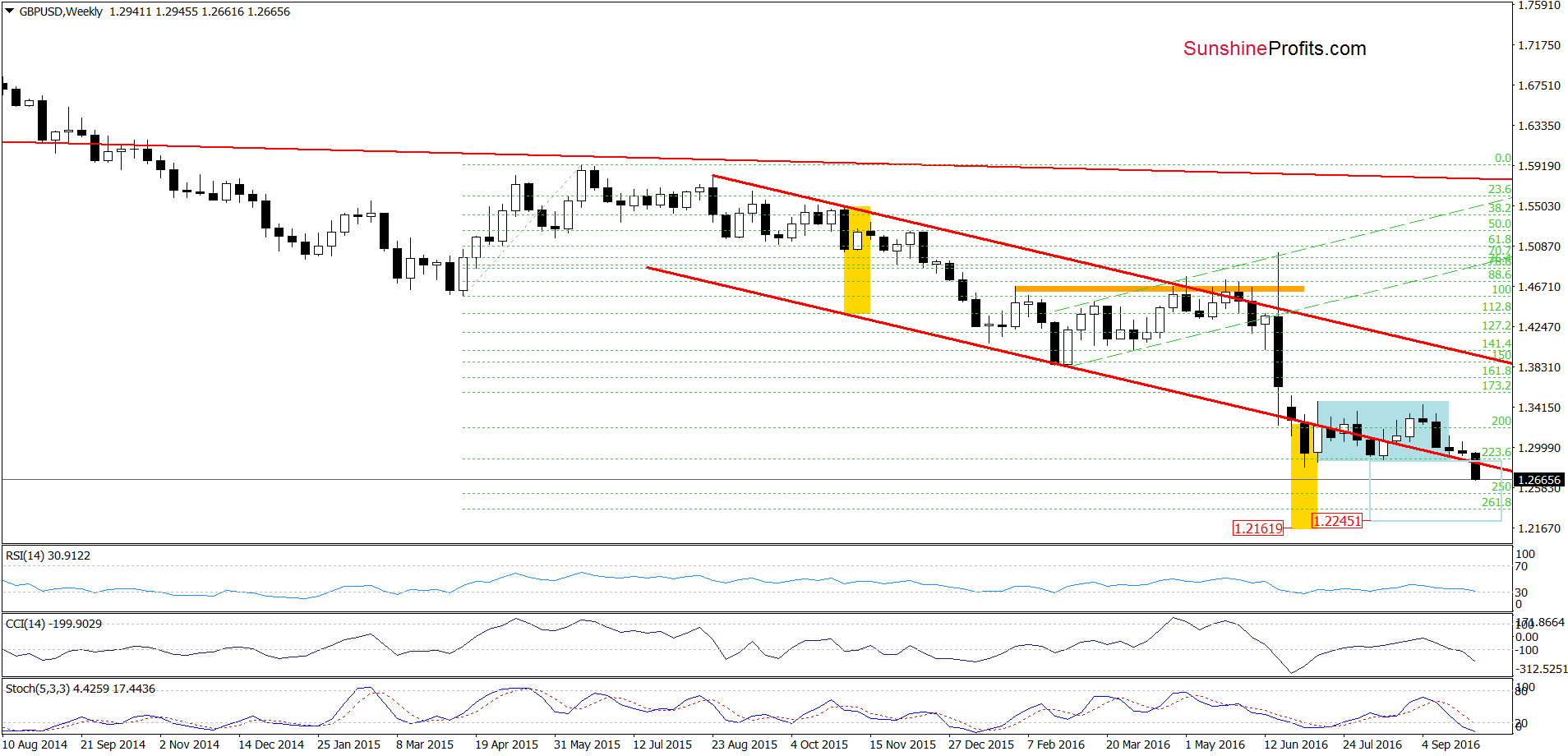

GBP/USD

Looking at the weekly chart, we see that GBP/USD extended declines below the lower border of the red declining trend channel and the lower line of the blue consolidation (making our short positions more profitable), which means that our last commentary on this currency pair is up-to-date:

(…) If the pair extends losses, the initial downside target would be around 1.2231, where the size of the downward move will correspond to the height of the consolidation. If this level is broken, we may see a decline even to around 1.2163, where the size of a drop corresponds to the height of the red trend channel.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3549 and initial downside target at 1.2231) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

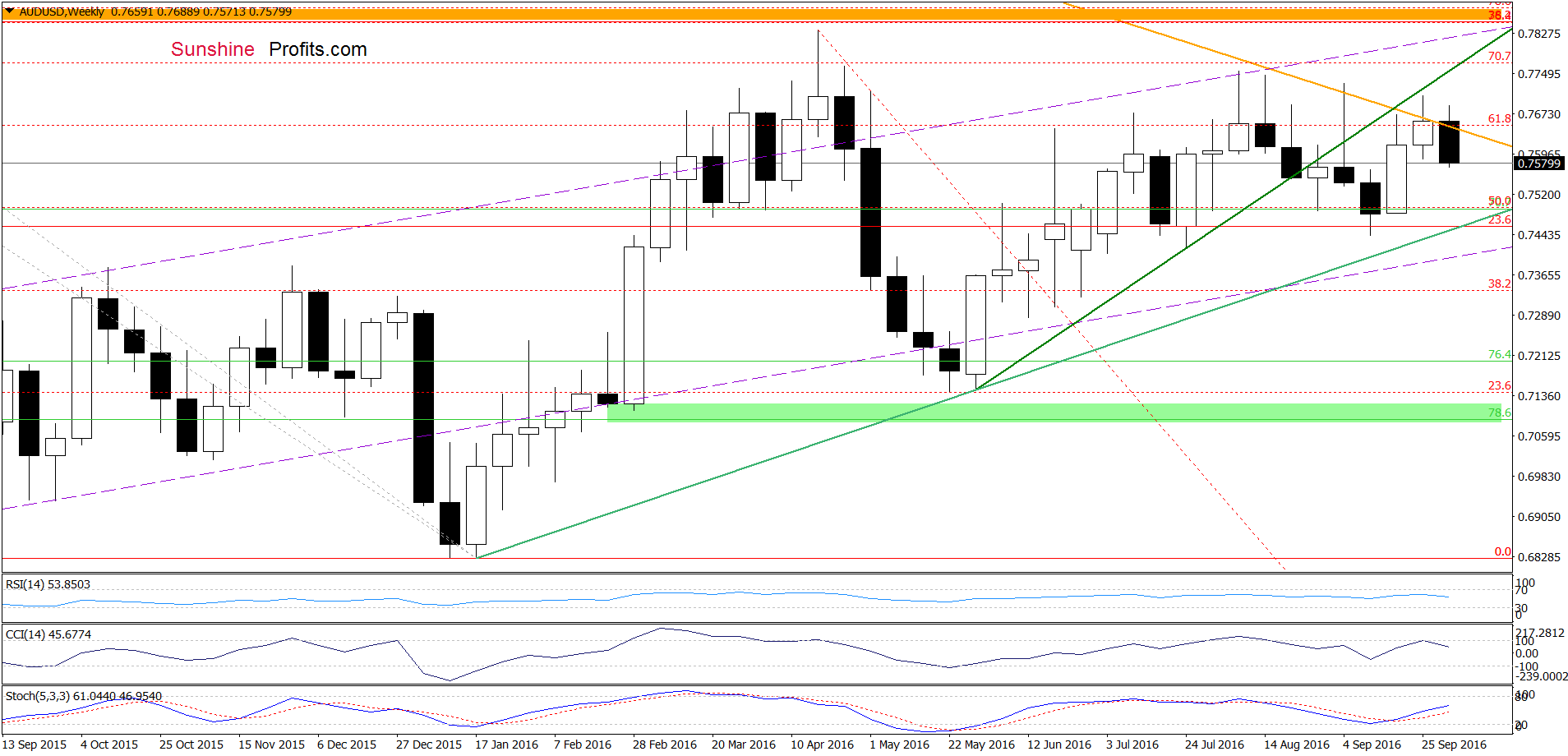

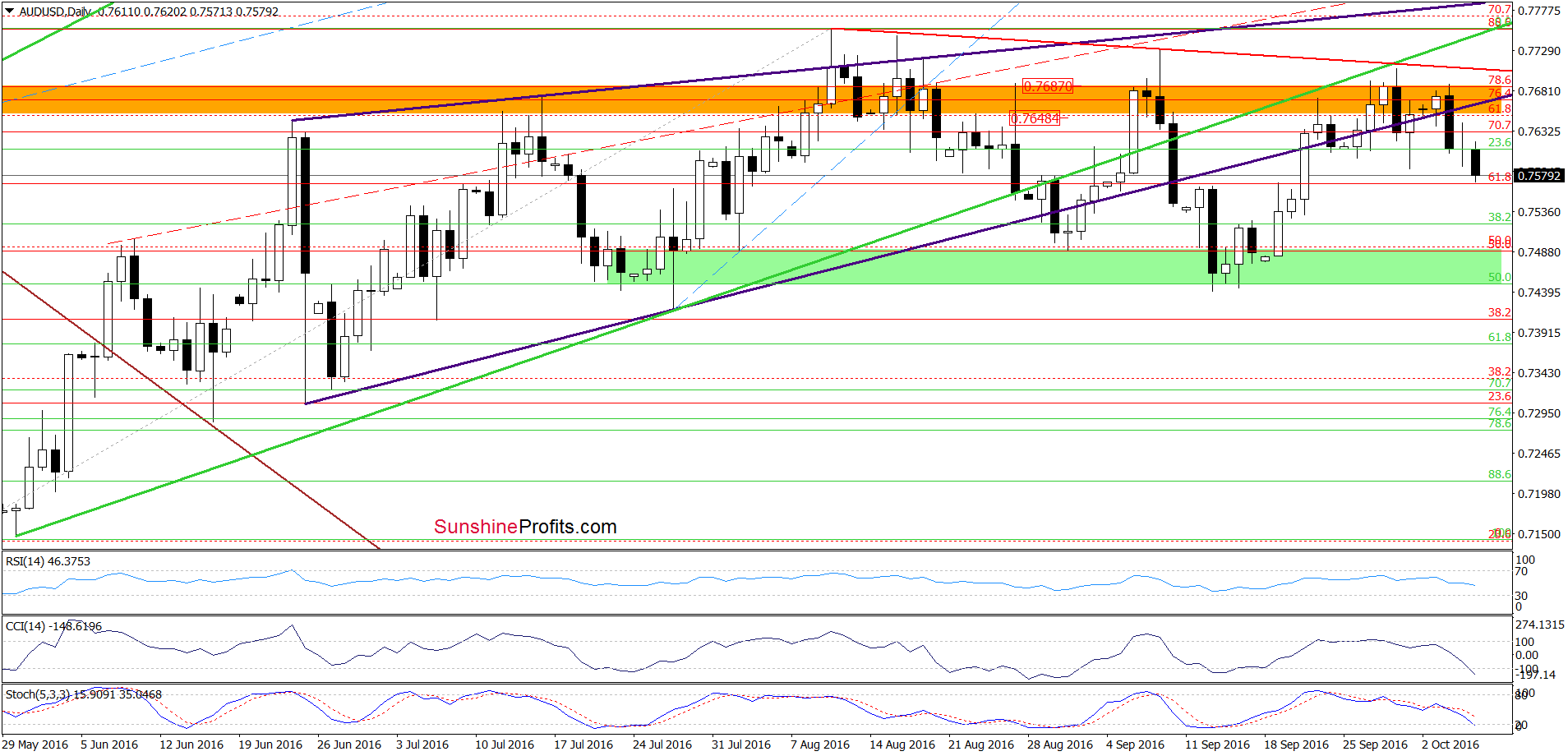

AUD/USD

On the above charts, we see that although AUD/USD paused yesterday, currency bears didn’ give up, which resulted in further deterioration earlier today. Taking this fact into account, we believe that our Tuesday’s commentary on this currency pair remains valid:

(…) the medium-term green rising line, the long-term declining orange resistance line (both marked on the weekly chart) and the orange resistance zone (seen on the daily chart) coninue to keep gains in check. Additionally, sell signals generated by the indicators are still in play, which suggests that another attempt to move lower is just around the corner.

If the pair extends losses from current levels, we think that the initial downside target would be around 0.7516, where the 70.7% Fibonacci retracement (based on the Sep upward move) is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.7791 and initial downside target at 0.7516) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts