Bitcoin Trading Alert originally sent to subscribers on March 7, 2016, 10:55 AM.

In short: short speculative positions, target at $153, stop-loss at $515.

Bitcoin is still relatively hard for customers to use and it might be the Blockchain solutions that will become more relevant in the future, we read in an article on the Fortune website:

Remember the hype over bitcoin? The crypto-currency that so tantalized techies and excited investors is today in a sorry state: Its core supporters are at war with each other and ordinary consumers still don’t care about this supposedly revolutionary form of money.

But that’s only half of the story. The other half is about the remarkable rise of blockchain, the core technology underlying bitcoin that is enjoying unprecedented adoption by banks and big business.

(...)

“(…) mining is a really elegant software solution that equally distributes who is going to validate the next set of bitcoin transactions,” Garzik [former Bitcoin developer] says. “A private chain replaces the entire trust-less aspect with a more private closed network of participants.”

In practice, this will involve the banks rejecting a global federation of miners in favor of a handful of trusted verification partners within their own network—a process already underway. For instance, a group of 15 banks might agree that the ledger becomes official once computers from seven group members agree to record a set of transactions.

We wouldn’t necessarily call it quits on Bitcoin. The currency still has the potential to become a viable money transfer option, an area which doesn’t seem to be affected that much by private ledgers. The point here is not to be too bearish on the currency but rather see the current situation for what it is. Bitcoin is definitely still having trouble with convincing customers. This is mainly because it is relatively hard to set up a wallet, transfer funds to it, get to know the apps and figure out how the network actually works. The recent block size problems and the general perception of Bitcoin not being particularly stable certainly don’t help.

The second part of the quote might actually show how ledger-based solutions might actually look. So, for the confirmation of transactions or ownership, financial institutions might actually set up their own networks, akin to bank or exchange associations the members of which would participate in the transaction confirmation process. This seems a far cry from the idea of a currency free from the influence of the banks. On the other hand, such a framework might not offer rapid international payments. So, there might still be room for a global network.

For now, let’s focus on the charts.

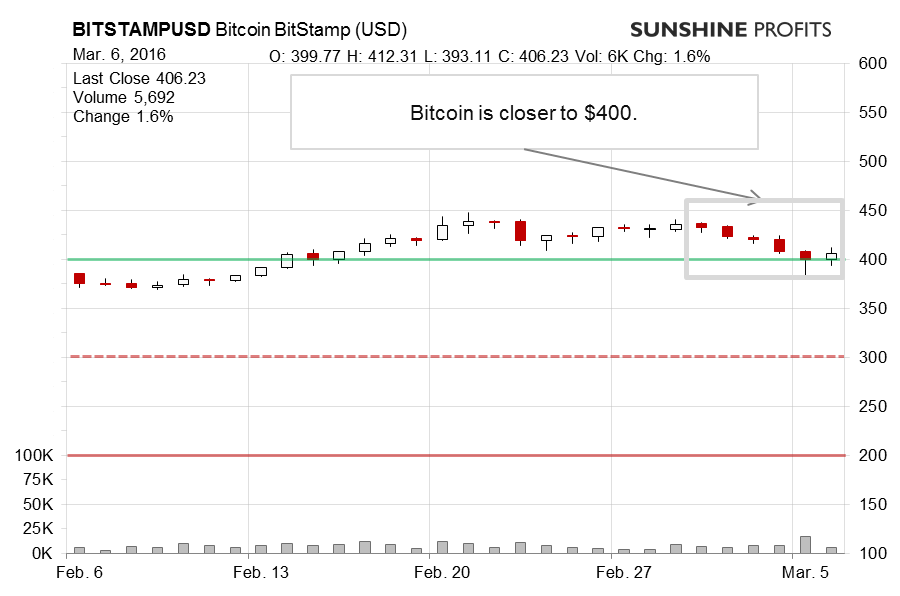

On BitStamp, we saw Bitcoin go down from Wednesday to Saturday. This has been followed by some appreciation. Which of these two periods provides us with more meaningful hints?

In our opinion, the depreciation is more important. For starters, it was on higher volume than the recent upswings. The size of the daily returns for the moves down was also more significant than during the up days. Recall our recent comments:

Bitcoin remains flat above $400 and the fact that the currency has held this level is the main condition that might be cited as bullish. On the other hand, the currency hasn’t moved up recently, it almost went to overbought territory on Feb. 21 (RSI at 69.45) and now we’re seeing a pullback from the possible overbought level. Almost all such pullbacks in the past didn’t end before the oversold territory was reached (the major exception being the November 2015 top).

(...)

The previous possible breakout above a declining long-term resistance line is now weakened as the recent price action permits a redraw the declining resistance line and there is now no breakout above it. What bullish implications we had last time, have been diluted since and the situation is still very much bearish.

We are now even further from the possible declining trend line. On top of that, the RSI is still relatively far from oversold levels. It seems that we might still see a continuation of the decline.

On the long-term BTC-e chart, we now clearly see a pullback to the $400 level (green line in the chart). Recall our previous alert:

For the time being, it seems that we still have important resistance lines $450-470, so the situation doesn’t really seem bullish. (…) Combining this with the bearish indications still results in a bearish indication, particularly given the recent rally. It seems that Bitcoin might be ready for more declines (in our opinion).

Even if we were to see the recent months as a head-and-shoulders formation (which itself might be debatable), it would seem that we are now after the second shoulder. This would itself be a bearish indication for the next couple of weeks.

Right now it seems that Bitcoin has a lot of downside potential ($350 being the first possible pause for a potential decline) while at the same time not displaying much upside potential. If we see a slip below $400, the decline might accelerate.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts