Bitcoin Trading Alert originally sent to subscribers on October 29, 2015, 12:31 PM.

In short: no speculative positions.

MasterCard and Visa, the two most known credit card companies, are not necessarily hostile toward Bitcoin-based solutions, contrary to the popular opinion. In an article on the Forbes website, we read:

Fresh off the heels of selling his first company, SecondMarket Solutions, to Nasdaq last week, financial whiz Barry Silbert is officially launching his next startup, Digital Currency Group, and announcing that it has raised an undisclosed sum from a number of investors, including MasterCard, Bain Capital Ventures and New York Life. They are the latest in a string of traditional financial institutions including Nasdaq, Citi, Visa, American Express, Goldman Sachs and others to invest in a digital currency company.

The company also revealed that it plans to launch a Bitcoin-focused conference, called BTC2016, next year in New York in May.

“The mission [of DCG] is to accelerate the development of a better financial system and we do that by building and investing in bitcoin and blockchain companies and leveraging our insights, our network and our access capital,” says Silbert. He established DCG as a company instead of a fund to give it flexibility to start, invest in and buy companies, and to give it permanent capital.

It is well worth noting that the company drew names such as MasterCard, Bain and CME. It shows that Bitcoin startups are no longer something foreign to mainstream companies, at least not in terms of being reluctant to invest in them. This might show a changing attitude – Bitcoin and, more specifically, its underlying technology is no longer a “geeky” quirk in the payments scene but rather a technology rapidly entering the scene. It’s still probably years away but Bitcoin might become the blueprint for extensions to the payment system. Once Bitcoin or Bitcoin-based systems take off in the regulated space, we might see payments transformed like credit cards transformed it.

For now, let’s focus on the charts.

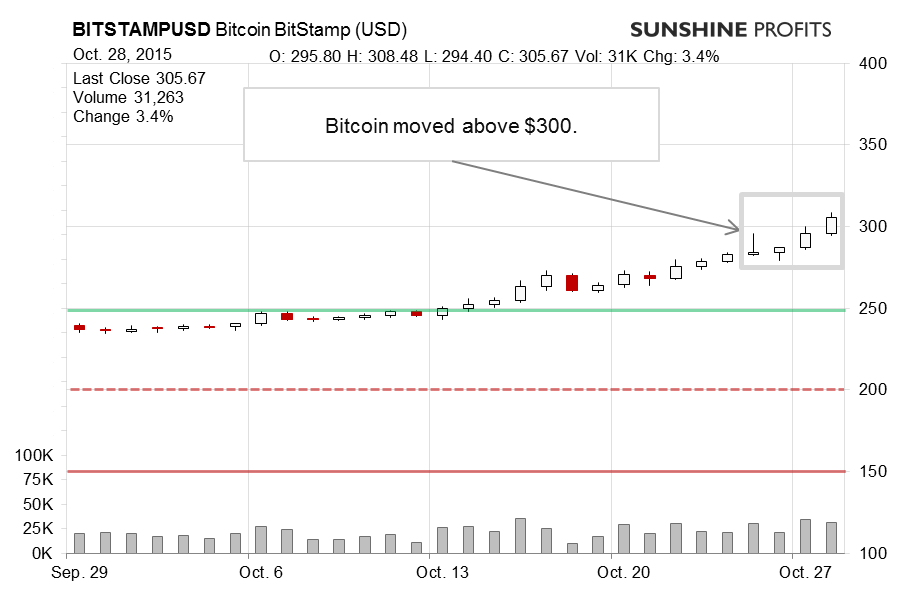

On BitStamp, we saw a move above $300 yesterday, which might suggest a bullish outlook for Bitcoin for the next couple of weeks. But does it? Firstly, let’s recall our recent comments:

(…) The only thing that has changed since our alert was published is that Bitcoin moved above a possible long-term declining trend line. In such a situation, the risk/reward seems less favorable than a couple of days ago since a further move up might be in the cards. So, do we go long? Our opinion is that the following move up might not be long-lived, it might even be over now, and it would be followed by depreciation. At the moment, we would prefer to see more bearish hints, perhaps in the form of a move back below a possible long-term trend line.

The move above $300 possibly plays out like the last part of a rally. The volume is down from what we saw in the last two days (at least so far). Additionally, Bitcoin is well into overbought territory. We still might see a violent upshot but it also seems that the situation might reverse in the next couple of days. Combine an unconfirmed move above $300 with an overbought situation, the strength of the rally and you arrive at a relatively bearish conclusion. Actually, the last time we saw Bitcoin so overbought was… back in 2013. Once we see a move down, we might be in for a ride down to $250 where a possible long-term declining trend line lies.

On the long-term BTC-e chart has similar implications. Recall our recent comments:

Another factor that might keep the rally in check is the proximity of the $300 level, and then the July top not far higher. The key takeaway here is that we might actually see even more strength in the next couple of days, but a move up could be stopped – if not at $300, then possibly at $310-315 and a move down could follow. If we see more hints at such a move, we might re-enter the short position. Stay tuned.

Right now, Bitcoin is closer to the second target or even slightly above it. The proximity of the July high is yet another factor that might keep the rally in check, in addition to the factors mentioned before. In the current environment, even though it might be tempting to jump in on the long side of the market, it seems that there are more bearish indications. As such, we might re-enter short positions once we see a bearish confirmation.

Summing up, we don’t support any speculative positions now.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts