Bitcoin Trading Alert originally sent to subscribers on September 14, 2015, 11:52 AM.

In short: short speculative positions, target at $153, stop-loss at $273.

Japanese authorities have made another move in the Mt. Gox affair. The former CEO of the exchange, Marker Karpelès, is being charged with embezzlement. The amount in question is $2.6 million – a fraction of all the funds that went missing at Mt. Gox. We read on the Business Insider website:

The former head of the defunct bitcoin exchange Mt Gox, Mark Karpelès, has been charged with embezzlement by Japanese prosecutors, according to reports from the Japanese media.

Karpelès is accused of embezzling 321 million yen ($2.6 million) from the bitcoin exchange, which collapsed in 2014 after revelations of a massive shortfall in customer funds.

He is accused of transferring money from Gox's bank account to other accounts in October 2013, where it was mainly spent on buying licenses for 3D-rendering software, according to Jiji Press. Some of the money was also allegedly used on an "expensive custom-built bed," Jiji added.

Karpelès was arrested in August in connection with the loss of hundreds of millions of pounds' worth of bitcoin when the exchange collapsed.

The new charges are an indication that the Japanese authorities might not have evidence of Karpelès’ fault as far as the rest of the funds are concerned. There are a lot of ideas floating around as to what actually happened with the customers’ money. The actions of the authorities, however, suggest that either Karpelès might not have pilfered the funds or the investigators are having a hard time untangling the knot left in the wake of the Mt. Gox debacle.

Even though the update hit the news and it is a suggestion that there is no clear evidence against Karpelès as far as all the funds at Mt. Gox are concerned, we still have to wait for the investigation to end and to yield an answer to the question where the funds went. More than one year after the problems at Mt. Gox became obvious, the odds of investors of getting their money back are getting ever slimmer.

For now, let’s focus on the charts.

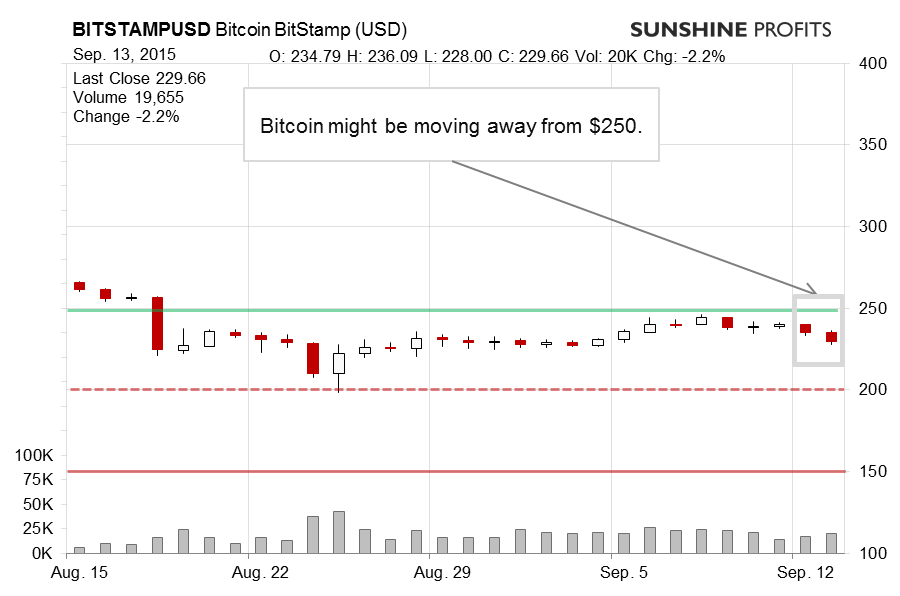

On BitStamp, we saw two days of moderate depreciation on Saturday and Sunday. The volume was up compared with what we had seen on Friday but not necessarily high when you look at the readings we have for September. So, the move down itself is not very significant when you look at the most obvious metrics but it might be more meaningful if one considers that Bitcoin is now appearing to make a move back down from $250. Such a failed move up might suggest more declines in the future. The situation has just become more bearish than it was last Thursday when our previous alert was posted – it was already bearish then so now it slightly more so. Recall what we wrote in the mentioned alert, as it is up to date:

The $250 level is now on to observe as it also coincides with a possible declining trend line (not visible in the chart). A move above $250 confirmed in price or by a period of holding up above this level might change the short-term outlook. This is definitely not the case just yet and the environment is still favorable for short positions, in our opinion.

This has been confirmed, at least so far, by the action in Bitcoin. The currency is now in somewhat of a “no man’s land” between $200 (dashed red line in the chart) and $250 (green line). This means that we might see some sideway trading but the fact that $250 was tested and seems to have failed make a bet on lower prices appealing.

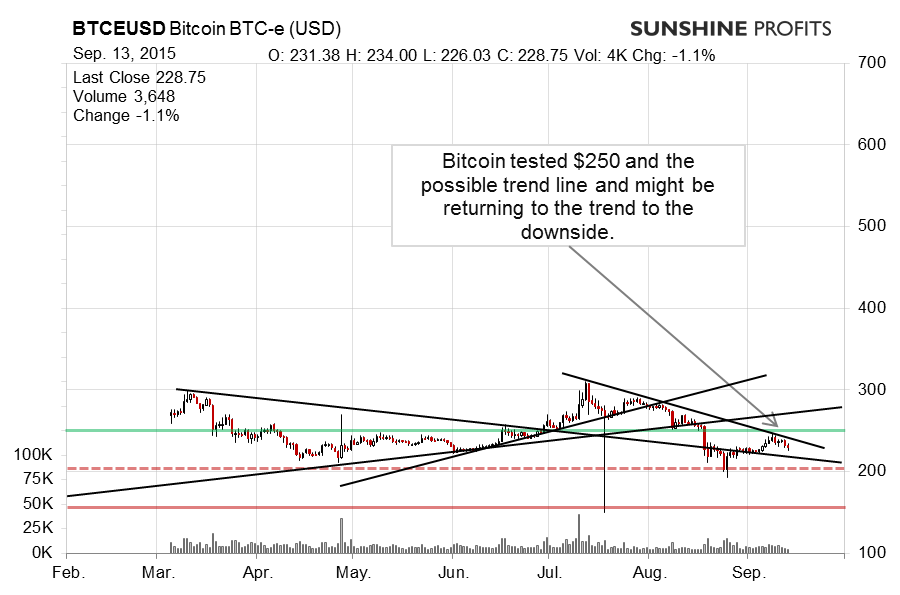

On the long-term BTC-e chart, the move down from a possible declining trend line is visible. In our previous alert, we wrote:

We’re seeing a sort of a rebound to the downside right now. It still isn’t a fully-fledged move yet but it makes the current situation more bearish than it was a couple of years ago. It’s still too early to declare that yet another move down has begun but the environment seems to favor short positions.

The situation just got even more bearish. Bitcoin is below $250, below the possible declining trend line and still relatively far away from $200 (dashed red line in the chart). All of that points to an even more bearish environment than we saw on Thursday. At the moment, it seems that the next stop for Bitcoin might be $200 but even a move to $200 wouldn’t necessarily be too steep for the decline to continue even lower.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $147, stop-loss at $273.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts