Bitcoin Trading Alert originally sent to subscribers on June 9, 2015, 11:12 AM.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

Another day, another Bitcoin startup, it might seem to anyone who’s following Bitcoin news on the Internet. We’ve just learned of yet another one, called BlockCypher. In an article on NewsBTC, we read:

Blockchain-based web API company BlockCypher recently released a Microtransaction API making it possible to transmit payments as little as 2,000 satoshis (or roughly 0.5 cents). The offering also enables On-blockchain microtransactions marking a significant departure from the usual off-blockchain transactions.

“In addition to our normal Transactions API, we offer a unique, on-chain microtransaction endpoint that makes it easy to propagate smaller, nearly-instantly guaranteed, more frequent transactions that are still publicly auditable and trusted through their existence on the blockchain.”

(...)

Co-founder of Internet giant Yahoo, Jerry Yang said,

“Micropayments have incredible potential for many industries worldwide. We’re excited that BlockCypher has figured out how to make it cost effective and fast to do microtransactions ON the block chain, fully demonstrating that it’s possible to transfer small amounts using Bitcoin.”

It’s definitely too early to tell whether this will take off or not. It certainly seems that there might be a need for small payments on the Internet, as small transfers are currently the most expensive ones and quite visibly so. Can you imagine sending $1 overseas? The fee would almost certainly surpass the amount of the transfer. Now, BlockCypher might help challenge this status.

The company has come up with a special kind of adaptive fee and potentially quicker confirmations, but the key consideration here will be whether the transactions are safe, cheap and easy enough for customers to enjoy this service.

For now, let’s focus on the charts.

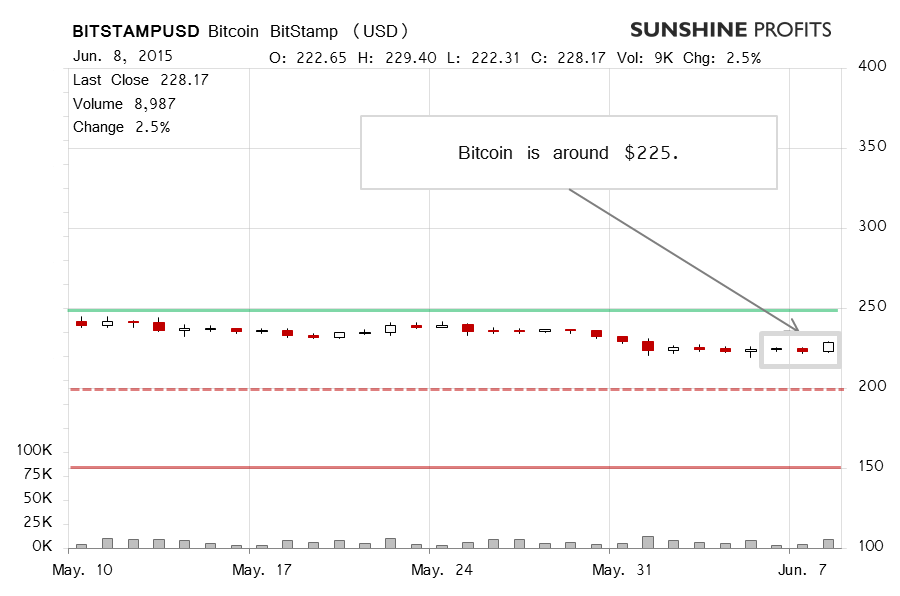

On BitStamp, we see that Bitcoin moved higher yesterday, the volume was up but overall the appreciation didn’t really come in particularly strong. If you recall, yesterday we wrote:

(…) Does this mean that the move down is over? In our opinion, not necessarily.

First of all, the depreciation in the last couple of weeks was not strong enough to push Bitcoin into oversold territory. Secondly, the move today has not been able to recoup most of the recent losses. The action might look strong at the first sight but it doesn’t really look this strong in comparison with the slide we saw between May 30 and June 1, 2015. Thirdly, no market moves in a straight line so a breather might now be in order. This doesn’t mean that the depreciation is over.

Today, there’s been some more appreciation (this written around 10:30 a.m. ET), but the above comments actually remain very much up to date. The volume today hasn’t really been stronger than yesterday and the move has been weaker in terms of price. Is Bitcoin running out of steam? It might. Our best bet at the moment is that the currency might still go up some or stay where it is before potentially declining even further.

On the long-term BTC-e chart we see Bitcoin right at a possible rising trend line. This is a pretty important point. If Bitcoin manages to go above this line and stay there for some time, we might actually see a slight improvement in the short-term outlook but this would be far from certain. On the other hand, a move to the downside, bringing Bitcoin visibly away from the line might be suggestion that the currency is up for declines. So far, we haven’t really seen either of those but Bitcoin is still lingering around the line which makes the situation unchanged from yesterday and bearish.

It still seems that the room for appreciation is limited as Bitcoin is not that far from $250 (green line) while the room for depreciation might be more significant with a psychological point just above $150 (solid red line). Bitcoin doesn’t have to go there right away, as there’s still the $200 level (dashed red line) along the way. On the other hand, if the currency declines, it the $30 now separating it from $200 might not be enough to stop the decline.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts