Bitcoin Trading Alert originally sent to subscribers on March 4, 2014, 10:50 AM.

Cutting right to the chase: in our opinion speculative long positions might still be a good idea.

More facts on Mt. Gox emerge. Ars Technica’s Sean Gallagher reported yesterday that 1,719 lines of PHP code supposedly from Mt. Gox had been leaked. The code can be accessed here. The article goes on:

As MtGox CEO Mark Karpeles and his lawyers officially filed for court-supervised restructuring of the Bitcoin exchange, someone posted a chunk of code to Pastebin that would appear to lend credence to Karpeles’ contention that his company was hacked. The block of PHP code appears to be part of the backend for MtGox’s Bitcoin exchange site, and it includes references to IP addresses registered to Karpeles’ Web hosting and consulting company, Tibanne.

(...)

The 1,719 lines of commented PHP code posted over the weekend include code to access individual customers’ Bitcoin wallets and to process transactions. MtGox’s Bitcoin node IP address is hard-encoded in the server code, as are SSH keys used to connect to MtGox’s transaction processing server. Anyone who had access to the server running this code could have easily redirected transactions or pillaged the Bitcoin wallets of customers.

PHP code is not necessarily our area of expertise but if this is the case, then it might be a start on the road to understand what actually happened with the missing bitcoins and where they went.

In the meanwhile, Japanese Finance Minister Taro Aso admitted that it still wasn’t clear whether crimes had been committed as far as Mt. Gox is concerned, Reuters reported yesterday:

Japanese Finance Minister Taro Aso said on Tuesday that the government is still trying to figure out what has led to the collapse of the Tokyo-based bitcoin exchange Mt. Gox and is not sure whether crime is involved.

"We still have not had a clear grasp of the situation," Aso said in response to a reporter's question after a cabinet meeting. "(We) don't know if it was a crime or just a bankruptcy."

So, it does seem like there’s been no striking news so far this week. How has Bitcoin reacted to such a period of relative calmness? Let’s look at the charts.

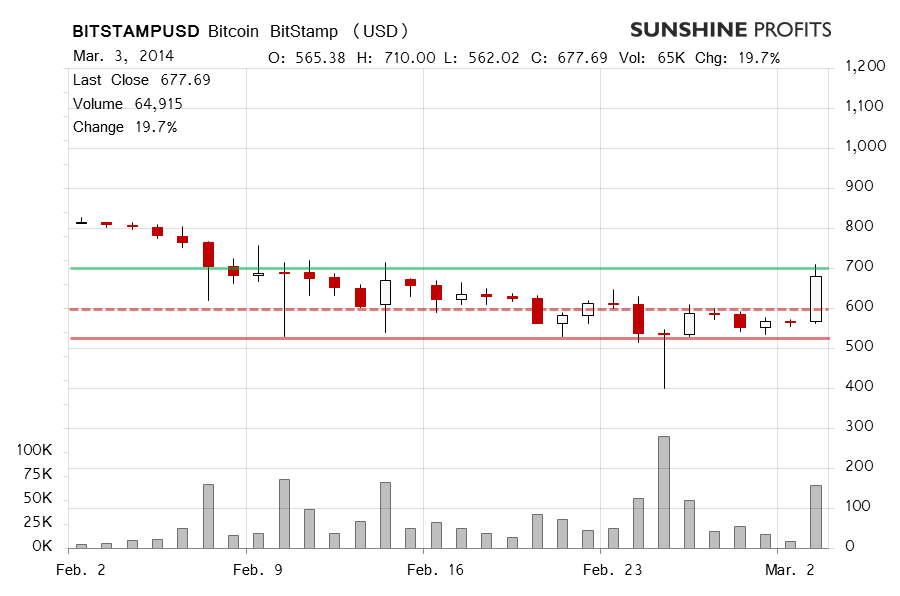

Yesterday, the volume basically exploded on BitStamp after our essay was published. The price was pushed even further up and the day ended with Bitcoin 19.7% higher than on the previous close. This was the most visible upswing since all the trouble with Mt. Gox came to light (beginning of February). Bitcoin not only broke above $600 (dashed red line on the chart) but also vigorously attacked $700 (solid green line) to ultimately close the day slightly below it.

Today, the volume has been markedly lower but the move’s been up (this is written just before 10:00 a.m. EST). 2.7% up is not much compared with what we saw yesterday. Altogether, it seems that the move up might be running out of steam. The short-term outlook is still bullish, but a lot less bullish than yesterday (in our opinion). If we see Bitcoin go lower than where it closed yesterday ($677.69), we would see that as an invalidation of the short-term bullish outlook.

It seems that Bitcoin still has a lot of catching up to do to get back to where it had been trading before Mt. Gox put withdrawals on an indefinite hold. Based on the reaction of the market to one day of no news about Mt. Gox, we would bet on the currency recovering to around $800. It is, however, possible that the first part of the move is coming to a halt and a pause could be seen. Today’s close and tomorrow’s action could be instrumental in determining whether a pause is in fact happening.

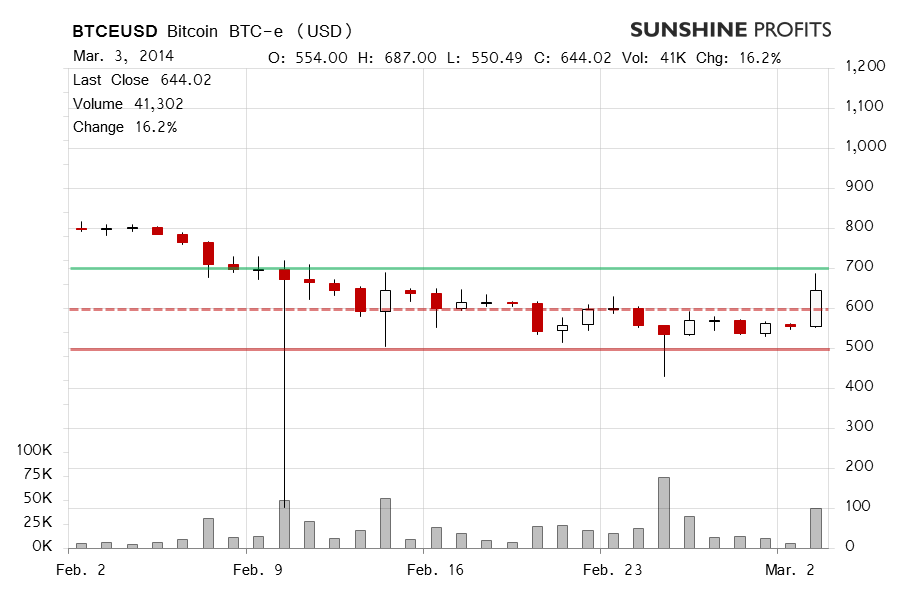

The action on BTC-e yesterday was similar to what we saw on BitStamp, only weaker with Bitcoin going 16.2% up. Bitcoin broke above $600 (dashed red line on the chart) and approached $700 (solid green line) only to recede to $644.02 at the end of the day.

Today, the exchange has been playing catch up with BitStamp and Bitcoin has gone up 7.7% so far. The volume is decidedly weaker than yesterday and the implications are similar as for BitStamp – the short-term outlook is still bullish but weaker than yesterday and a pause in the appreciation is possible.

Based on the developments on BitStamp and BTC-e, we readjust our stop-loss levels to sit at $650 for both exchanges. We also add an additional safeguard – if any of the exchanges closes the day lower than yesterday, we would suggest closing longs (our opinion).

Summing up, we still think having long speculative positions might be a good idea but we’re alert to any changes in the short-term trend.

Trading position (short-term, our opinion): long, stop-loss at $650. Additional condition for closing longs: BitStamp or BTC-e close the day lower than yesterday.

Thank you.

Best,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts