Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

On the Verge of the Next Major Decline

August 6, 2018, 9:17 AM

On Thursday, the HUI index just broke below the December 2016 lows (in terms of daily closing prices), but it reversed on Friday and closed the week back above this important support. Invalidations are often more important than breakdowns, so did Friday’s action just tell us that we’re going to see a major reversal?

-

Breaking Higher? Stocks at a Crossroads

August 6, 2018, 7:53 AM -

Gold Market in H1 2018

August 3, 2018, 9:44 AM

Trade wars. Inflation comeback. Historic meeting between US and North Korea leaders. Surge in the U.S. bond yields. Central banks’ monetary tightening. A lot happened in the first half of the current year! Was it a good time for gold? We invite you to read our today’s article about the gold market in H1 2018 and find out what to expect next.

-

Was the Latest FOMC Meeting Really a Non-Event?

August 2, 2018, 8:31 AM -

ECB Ends QE in 2018. What Does It Imply for Gold?

July 31, 2018, 5:12 AM -

Gold Stocks’ Breakdown, Platinum’s Invalidation, Gold’s CoT and Seasonality

July 30, 2018, 10:32 AM

And so it happened. After a breakdown that might have appeared accidental as it was triggered mostly by one company’s decline, we saw a weekly close below the key 61.8% Fibonacci retracement level in the HUI Index. There was no analogous breakdown to new lows in gold and silver, but what happened in these markets on a relative basis was even more significant.

-

Conflicting Views on Crude Oil

July 27, 2018, 9:33 AM

Recent days were good for oil bulls. Thanks to their action, the price of the commodity came back to around $70 and one of the daily indicators even generated a buy signal. Did the outlook turn to bullish? In our opinion, it didn’t. Furthermore, it seems that a fresh July low is still ahead of us. Why? The answer is quite simple - an analogy to the past.

-

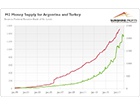

Are Crises in Argentina and Turkey Harbinger of the Global Crash?

July 27, 2018, 6:09 AM

Argentina’s peso and Turkish lira are in free-fall. Is it a tip of the iceberg of a broader systemic crisis across the emerging markets? We invite you to read our today’s article about the economic crises in Argentina and Turkey and find out whether they are a harbinger of a full-blown global debt crisis triggered by the Fed and what do they imply for the gold market.

-

Is There Any Gold in Auburn?

July 26, 2018, 8:04 AM -

Supposedly Bullish Gold’s CoT Signal

July 25, 2018, 10:07 AM

At first sight, yesterday’s session was quite boring – gold ended the session practically unchanged while silver and mining stocks were only a little higher. The USD Index was practically unchanged. But just because nothing happened in the market in terms of the daily closing prices, it doesn’t mean that we don’t have anything interesting to discuss. We do. There is a boomerang topic that just came back once again – the Commitment of Traders report for gold seems to be favoring higher gold prices as the current readings were seen at previous local bottoms. Are we going to see a CoT-driven rally shortly?

-

Why Trade Wars Don’t Matter to the Gold Market

July 24, 2018, 7:35 AM -

Gold’s Weekend Reversal – Really So Bullish?

July 23, 2018, 8:58 AM -

Powell Sinks Gold, Again

July 20, 2018, 6:22 AM -

S&P 500 Just 2% Below Record High, but There's More Uncertainty

July 19, 2018, 7:06 AM -

Will the Fed’s Tightening Trigger Another Crisis?

July 18, 2018, 8:46 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts