Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

USD’s Weekly Breakout and the Golden Spring

November 5, 2018, 10:49 AM

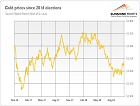

USDX’s Friday’s close was its highest weekly closing prices of 2018. This is an extremely significant confirmation of the bullish outlook for the US currency that followed the verification of the breakout above the inverse head-and-shoulders pattern. The implications are clearly bullish for the US dollar. But are they clearly bearish for gold? The yellow metal ended the week close to its October lows and the SLV ETF closed at the highest level since late August. Is the outlook for the precious metals market really bearish?

-

Uncertainty Following Last Week's Rebound

November 5, 2018, 7:42 AM -

Will the US Mid-Term Elections Boost Gold?

November 2, 2018, 9:39 AM -

Trump Is Not Thrilled. But What about Gold?

November 1, 2018, 3:30 AM

Trump is going to influence the US monetary policy or even to destroy the Fed’s independence. This is what many analysts say after the recent President’s comments. But are they right? We invite you to read our careful examination of Trump’s remarks about the Fed’s policy and find out what does it imply for the independence of the US central bank and the gold market.

-

Iron Lady of Europe Quits. Will Gold Replace Her?

October 30, 2018, 7:40 AM -

Inverse H&S Patterns and Something Even More Extreme

October 29, 2018, 11:09 AM

And so it happened. Gold stocks closed the week below the neck of their inverse head-and-shoulders pattern, while the USD Index closed it above its own inverse H&S. The implications thereof are strongly bearish for gold, silver, and mining stocks and we can say the same about gold’s shooting star candlestick that formed on Friday... And that’s not even close to being everything that happened and changed in the last few trading days. There are myriads of factors that are in place right now and if one wants to trade and invest in the precious metals market successfully, they should definitely not be ignored.

-

Friday's Late-day Bounce - Chance for Bulls?

October 29, 2018, 7:40 AM

Stocks continued their downtrend on Friday, as investors reacted to Thursday's big cap tech stocks' quarterly earnings releases. The releases were quite good, but the weak future guidance mattered the most. The S&P 500 index fell below its Wednesday's local low. However, it was gaining at the end of the day. Was it a short-term bottom?

-

In Search of a Bearish Trigger

October 26, 2018, 3:22 PM

A large asset manager has decided to offer Bitcoin trading to its institutional investors. Bitcoin shot up around the announcement but reversed course and erased most of the move up. The currency has stayed subdued since. This could mean that the market is getting boring. It could also mean that investors and traders are taking a breather before a more decisive move.

-

AUD/USD, Fresh Low and the Profit

October 26, 2018, 10:01 AM -

Gold Stocks and the Sell Signal from the Inverse H&S Pattern

October 26, 2018, 9:00 AM

Wait, what?! Isn’t the inverse head-and-shoulders a bullish pattern that was supposed to take gold miners much higher? Indeed, it is. But it didn’t take gold miners much higher and all that the completion of the above-mentioned pattern generated was a corrective upswing that didn’t even take gold stocks back above their December 2016 lows. And we warned that this is the likely outcome as the more important, long-term factors continued to favor lower mining stocks values. Why is there a sell signal based on the inverse H&S pattern? Because the breakout above its neck level was just invalidated and this invalidation by itself is a strong sell sign.

-

Dow Extends Losses. And Gold?

October 25, 2018, 8:20 AM -

Is Fear of the Stock Market Crash Justified?

October 25, 2018, 7:30 AM -

Clearest Reversal in Gold

October 24, 2018, 8:13 AM

Gold rallied yesterday, right before its turning point, and reversed its course before the end of the session. Precisely, even before the US session started. Miners reversed as well, after failing to move back above the late-2016 bottom. With the critical situation in the USD Index, and gold miners’ short-term underperformance (so far this week gold is up by $8.10, while the HUI Index is down by 0.2), it appears that things will get very hot for the precious metals market shortly.

-

Rome vs Brussels. Will That Battle Benefit Gold?

October 23, 2018, 8:20 AM -

Crude Oil – Rewarded Bears

October 23, 2018, 7:35 AM

The first session of the week encouraged oil bears to another attack on the nearest support zone. Despite the initial success and a fresh October low, the buyers withstood their opponents’ pressure once again, blocked the way to lower levels and pushed the price of the commodity right under the barrier of $70. Do oil bulls have any solid technical arguments on their side to fight for higher prices of black gold?

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts