Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Key Recession Indicators and Gold

March 29, 2019, 6:52 AM

Do you want to protect your capital against recession? Great, just like us and millions of other people. The key questions is, thus, how to predict that the danger is coming. We invite you to read our today’s article and find out what are key recession indicators – and their relationship with the price of gold.

-

With the USD Rising, Has The Harvest Time Come Now?

March 28, 2019, 11:39 AM

The U.S. dollar is on the move and many currency pairs are feeling the heat. Keeping a watchful eye on the hints dropped along the way is a surefire way to gain. The pairs of our interest have been building upon their recent moves to our satisfaction and if not exactly very strongly, we’ve found an elegant and beneficial way to deal with the situation anyway. Just take a look and be inspired by the actionable details below – just like our subscribers are every trading day.

-

Yield Curve Inverted Even More. Is It Finally Time for Buying Gold?

March 28, 2019, 9:22 AM -

S&P 500: More Sideways Trading Action

March 28, 2019, 7:49 AM -

Dangerous Strength in the Gold Stocks

March 27, 2019, 8:51 AM

We previously wrote about the situation being similar to 2012 with regard to overall price movement in gold and in particular with regard to the 61.8% Fibonacci retracement that has been just reached. The yellow metal declined by a few dollars yesterday, just like it did after topping out in November 2012. Higher prices were never seen since that time, which means that there was no single day giving a better opportunity to sell gold. But… Gold miners just moved higher yesterday, even though gold declined, which is a classic buy sign.

-

Yield Curve Has Inverted. Will Gold Rally Now?

March 26, 2019, 9:34 AM -

Is Gold’s Apparent Resilience a Show of Its True Strength?

March 25, 2019, 9:55 AM

Some things change, and some things don’t. On the precious metals market and the related ones, we currently have both. There are trends that were unaffected by last week’s developments, but there are certain markets that made powerful moves and flashed important signals. And in order to correctly determine the next direction for gold, silver, and mining stocks, we will examine thoroughly.

-

Friday's Sell-Off - New Downtrend or Just Correction?

March 25, 2019, 7:43 AM -

Risk Aversion Rules the Day: Which Currency Pairs Stand to Benefit?

March 22, 2019, 11:31 AM

After the Fed’s surprise move, the dust is getting settled. We are seeing serious reprising across many currency pairs. Sharp movements practically anywhere you look today. Where to start? With the euro, the yen or the Canadian dollar? It’s hard to choose the winner among all the moves in our favor. Let’s shine more light into every pair covered so that you are as prepared for what lies ahead as we are. Our subscribers already are.

-

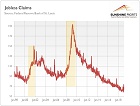

Two Most Important Recession Indicators and Gold

March 22, 2019, 5:11 AM

With everyone talking about recession, investors desperately need some clues to assess the state of the economy. This is what our today’s article provide you with. We invite you to read it and find out what are the two most important recession indicators – and what is the link between them and the gold prices.

-

Does Fed Know Something Gold Investors Do Not Know?

March 21, 2019, 9:17 AM -

Stocks Going Sideways After Fed's Statement Release

March 21, 2019, 7:31 AM

Stocks were mixed on Wednesday following the Fed's Rate Decision release. We saw an increased volatility after the announcement, but overall there wasn't much of a change. The S&P 500 index was the highest since the early October on Tuesday. But will the rally continue despite short-term technical overbought conditions?

-

A Message to the Gold Bulls: Relying on the CoT Gives You A False Sense of Security

March 20, 2019, 9:23 AM

Gold stocks have repeated their decline once again yesterday while gold and silver soldier on. When will the miners take gold and silver down with them? Underperformance is a critical sign of weakness, there’s no denying that. Would today’s Fed policy pronouncements provide the spark? These are valid questions that we answer for our subscribers on an everyday basis. For you, dear visitor, we have explored everyone’s favorite subject: the CoT report. You won’t get a chance to get bored while waiting for the pieces of today’s puzzle to fall where they belong. While an evergreen, today from an angle you probably haven’t heard before anywhere else. Get wiser and benefit!

-

Calm and Boredom Before The Storm Tomorrow? Not in the Least!

March 19, 2019, 10:43 AM

Currency market participants look cautious before tomorrow’s big day of the Fed pronouncements. Looks reasonable but even guarded moves can give telling signs. Of where the action is now and where it’s likely to go next, to paraphrase one famous Canadian ice hockey player. Remember, one doesn’t have to shout in order to be heard. Also, we still keep an eye on the candidate for opening new positions. Emerging throughout the currencies arena, here are the clues to share.

-

Will the Fed Cut its Interest Rate Forecast, Pushing Gold Higher?

March 19, 2019, 7:25 AM

Some important pieces of the US economic reports, including the latest nonfarm payrolls, have disappointed recently. May indicators (including the leading ones) have hit a soft patch it seems. Will that push the Fed to downgrade its dot-plot or fine-tune the monetary policy mix anyhow? Can gold jump in reaction to the Wednesday’s FOMC policy meeting?

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts