The growing U.S.-China chasm is working its way through the currency markets, and the sizable moves call for nimble positions management. Be it the existing ones, or newly emerging ones. Let's dive into all the adjustments just made.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 107.45; the next downside target at 105.60)

- USD/CAD: short (a stop-loss order at 1.3307; the initial downside target at 1.3122)

- USD/CHF: short (a fresh stop-loss order at 0.9837; the next downside target at 0.9701) - in other words, we decided to close 50% of our short positions and take profits off the table as the pair is trading below our recent downside target

- AUD/USD: none

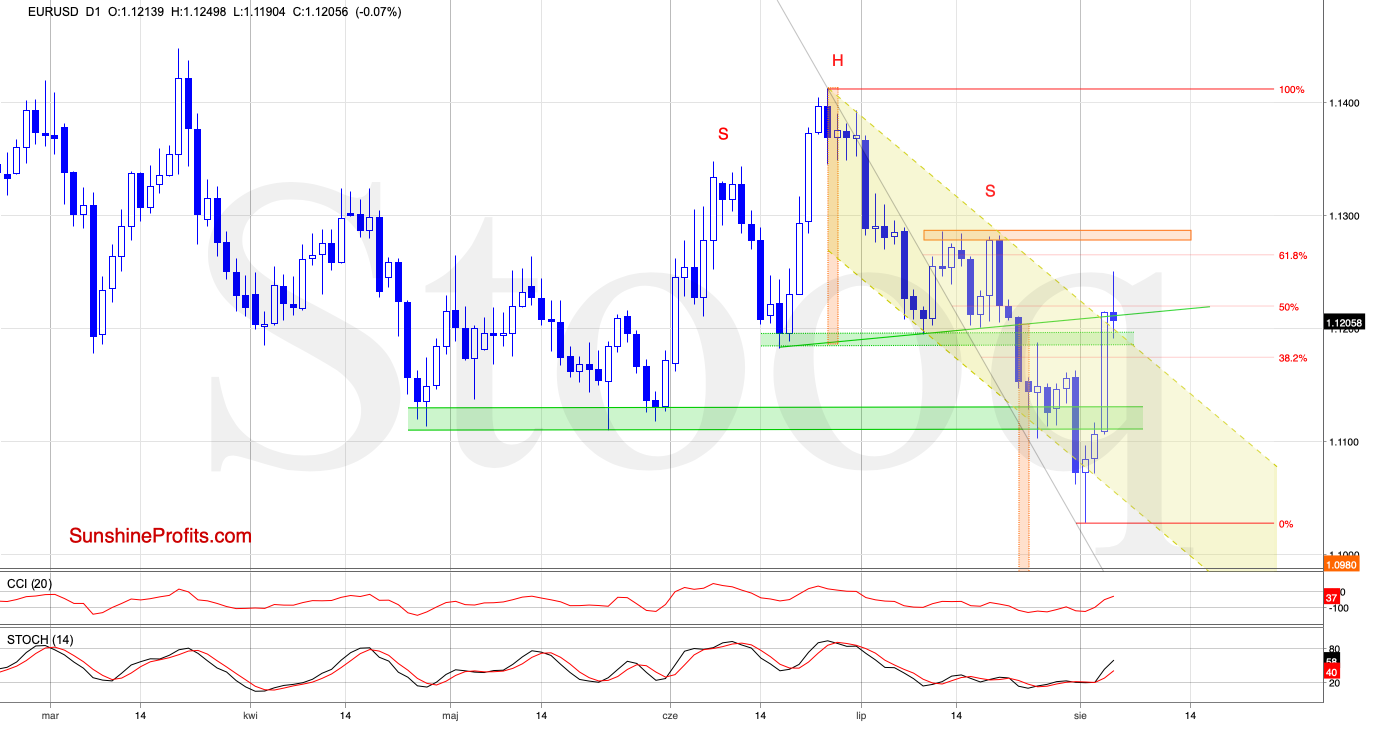

EUR/USD

EUR/USD moved sharply higher during yesterday's session, breaking above last week's peaks and closing the day above the previously-broken neckline of the head and shoulders formation. It also managed to overcome the upper border of the declining yellow trend channel. These are all bullish signs.

Earlier today, the pair moved even higher, suggesting that we'll likely see a test of the orange resistance zone in the coming days. A possible earlier verification of yesterday's breakout would not change that outlook.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

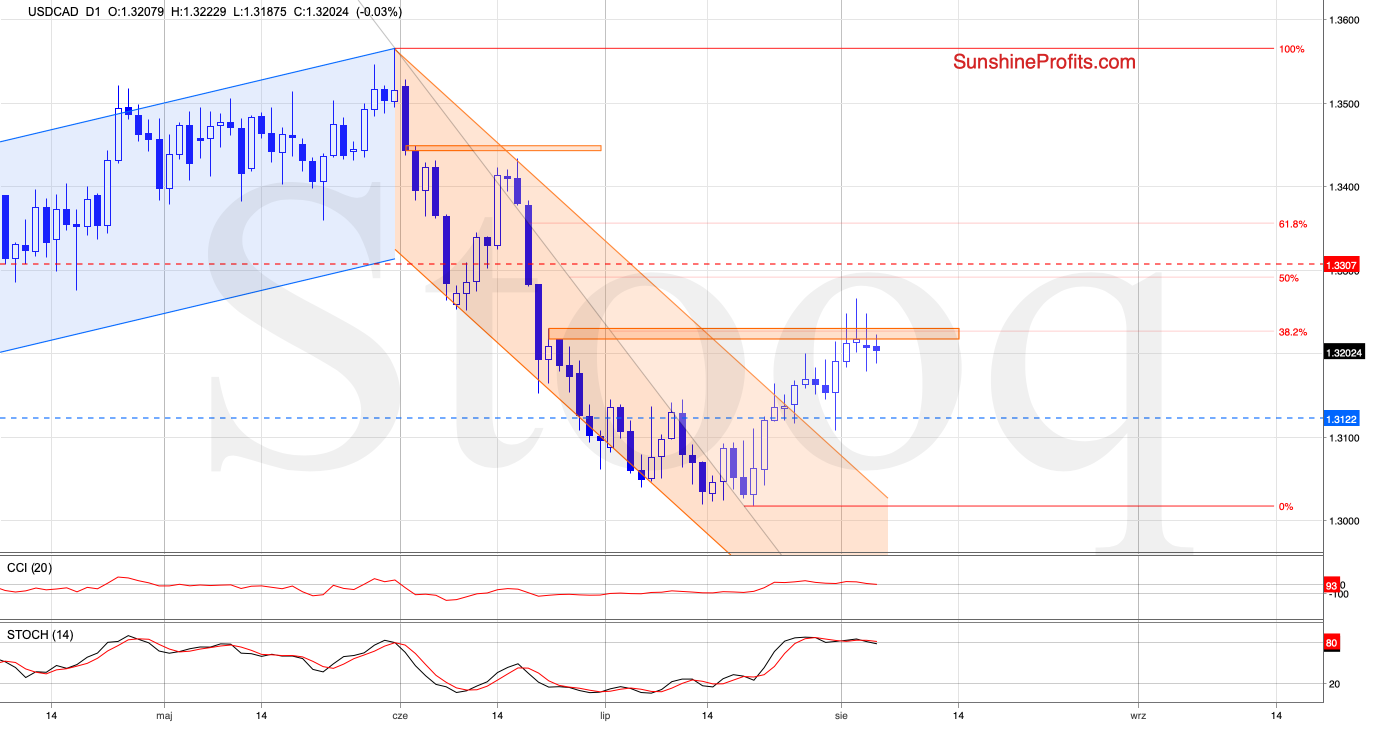

USD/CAD

USD/CAD bulls have tried several times recently to push the pair above the orange resistance zone and the 38.2% Fibonacci retracement, yet they haven't been successful.

Their weakness coupled with bearish positioning of the daily indicators suggests that the room for gains is limited. In turn, a move to the downside in the very near future is very likely.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3307 and the initial downside target at 1.3122 are justified from the risk/reward perspective.

AUD/USD

AUD/USD has been extending losses in recent days, breaking below the lower border of the red declining trend channel. Not only that - it also slipped to the support area created by the early 2019 low and the lower border of the short-term declining grey trend channel.

Additionally, the CCI and the Stochastic Oscillator moved to their oversold areas, increasing the probability of a rebound in the very near future. Should the pair move higher, we'll see it testing the previously-broken lower border of the declining red trend channel as a minimum in the very near future.

If the bulls prove themselves strong enough to invalidate the last week's breakdown, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

Before summarizing today's Alert, please note that USD/CHF moved sharply lower during yesterday's session and finished the day below our next downside target of 0.9755. Earlier today, the pair rebounded slightly and reapproached our target. Taking this fact into account and combining it with the green support (discussed in yesterday's Alert), closing 50% of our short positions and taking profits off the table (as a reminder we opened short positions when the exchange rate was trading at around 0.9903) is justified from the risk/reward perspective.

At the same time, we decided to adjust the remaining half of the short positions with a fresh stop-loss order at 0.9837 and the next downside target at 0.9701.

Summing up the Alert, the euro upswing has overcome several important resistances, and no position is justified from the risk-reward perspective. USD/JPY downswing of recent days is undergoing an upside correction today, and the profitable short position remains justified. USD/CHF has reached our downside target, leading us to take some profits off the table while letting the rest grow. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist