The U.S. dollar is on the move and many currency pairs are feeling the heat. Keeping a watchful eye on the hints dropped along the way is a surefire way to gain. The pairs of our interest have been building upon their recent moves to our satisfaction and if not exactly very strongly, we’ve found an elegant and beneficial way to deal with the situation anyway. Just take a look and be inspired by the actionable details below.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none (in other words, we decided to close our short positions and take sizable profits off the table)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none (in other words, we decided to close our long positions and take sizable profits off the table)

- USD/CHF: none

- AUD/USD: none

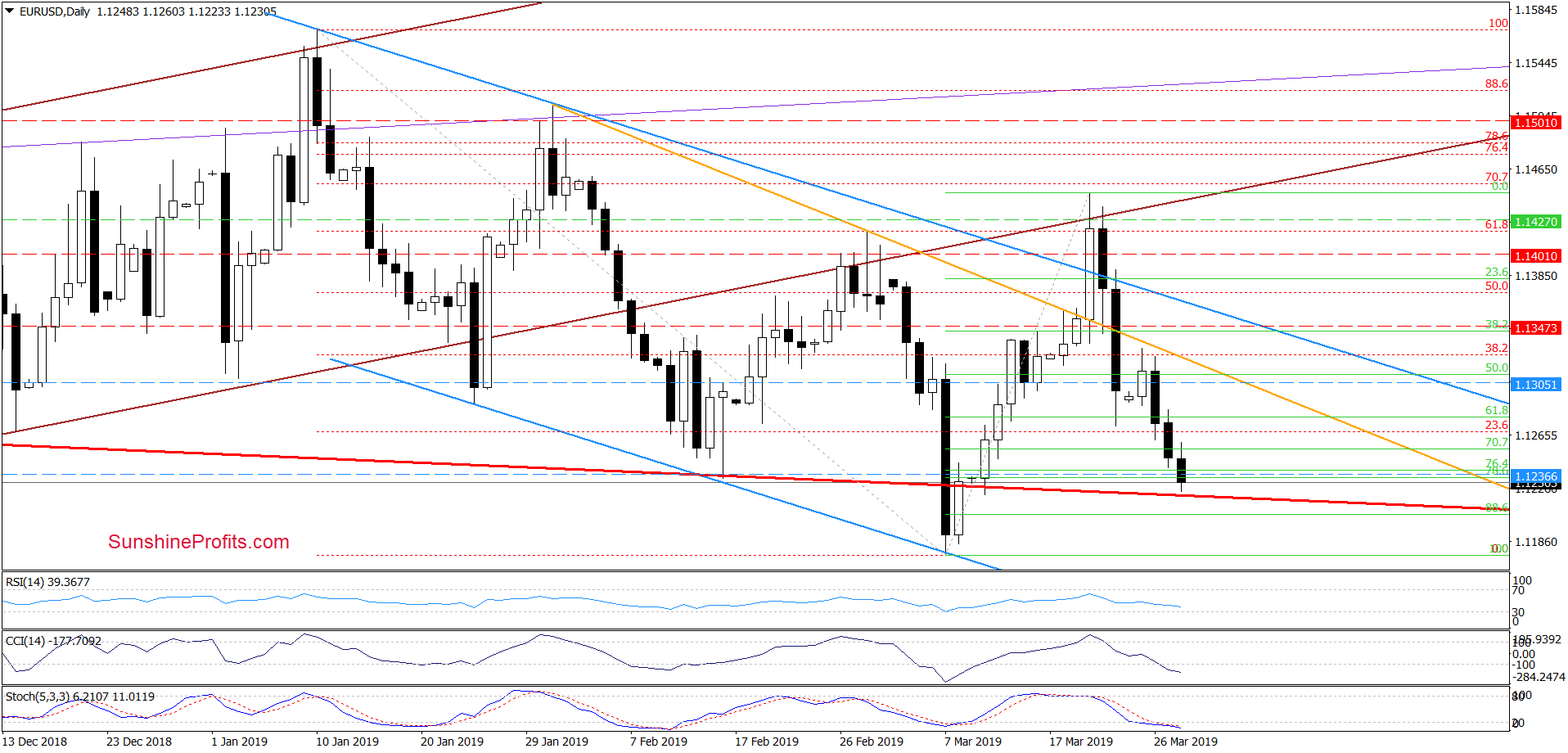

EUR/USD

We wrote the following in our Friday’s Alert:

(…) “If the situation develops in tune with this assumption, EUR/USD will extend losses and test the next Fibonacci retracement or even the lower border of the long-term red declining trend channel (currently at around 1.1232) in the coming week.”

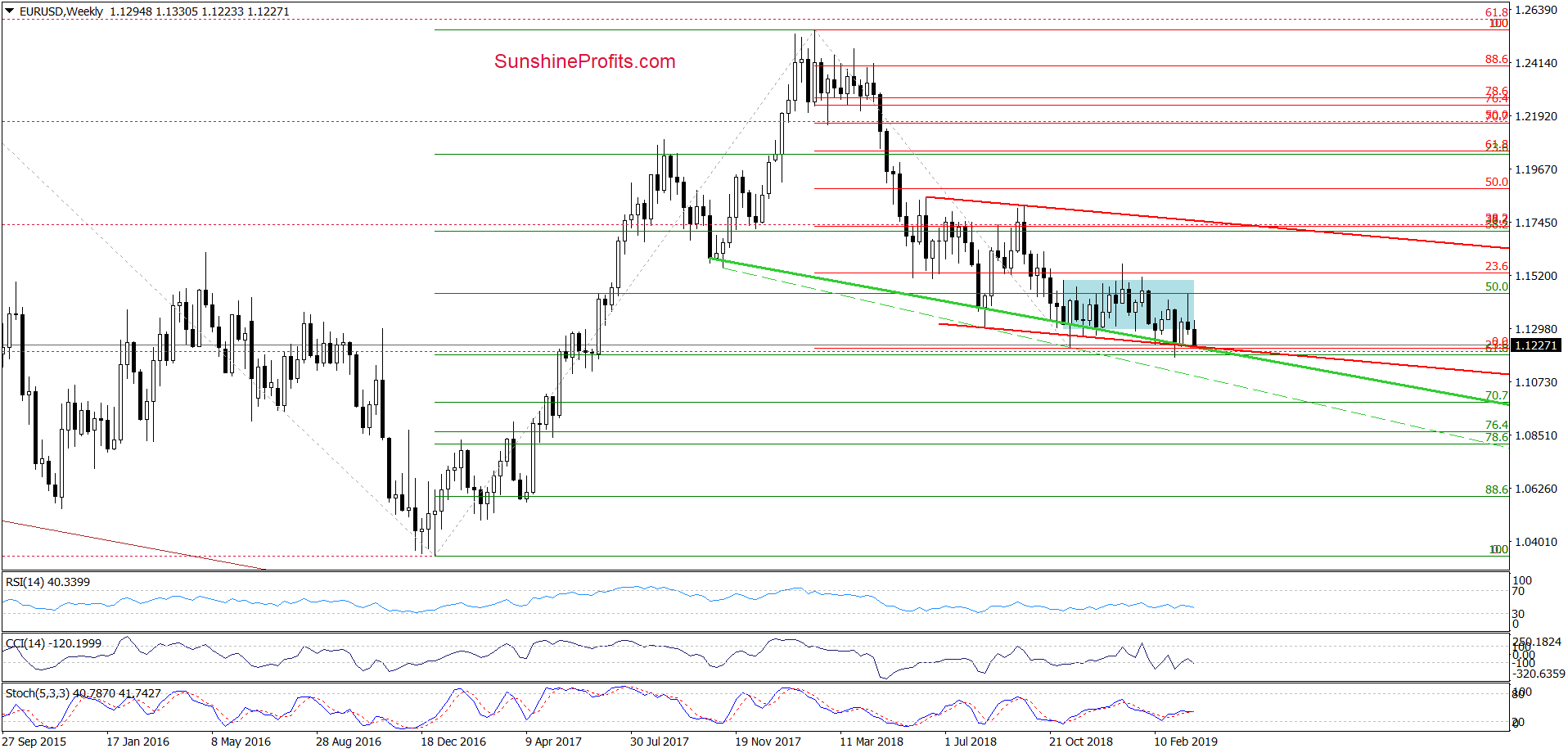

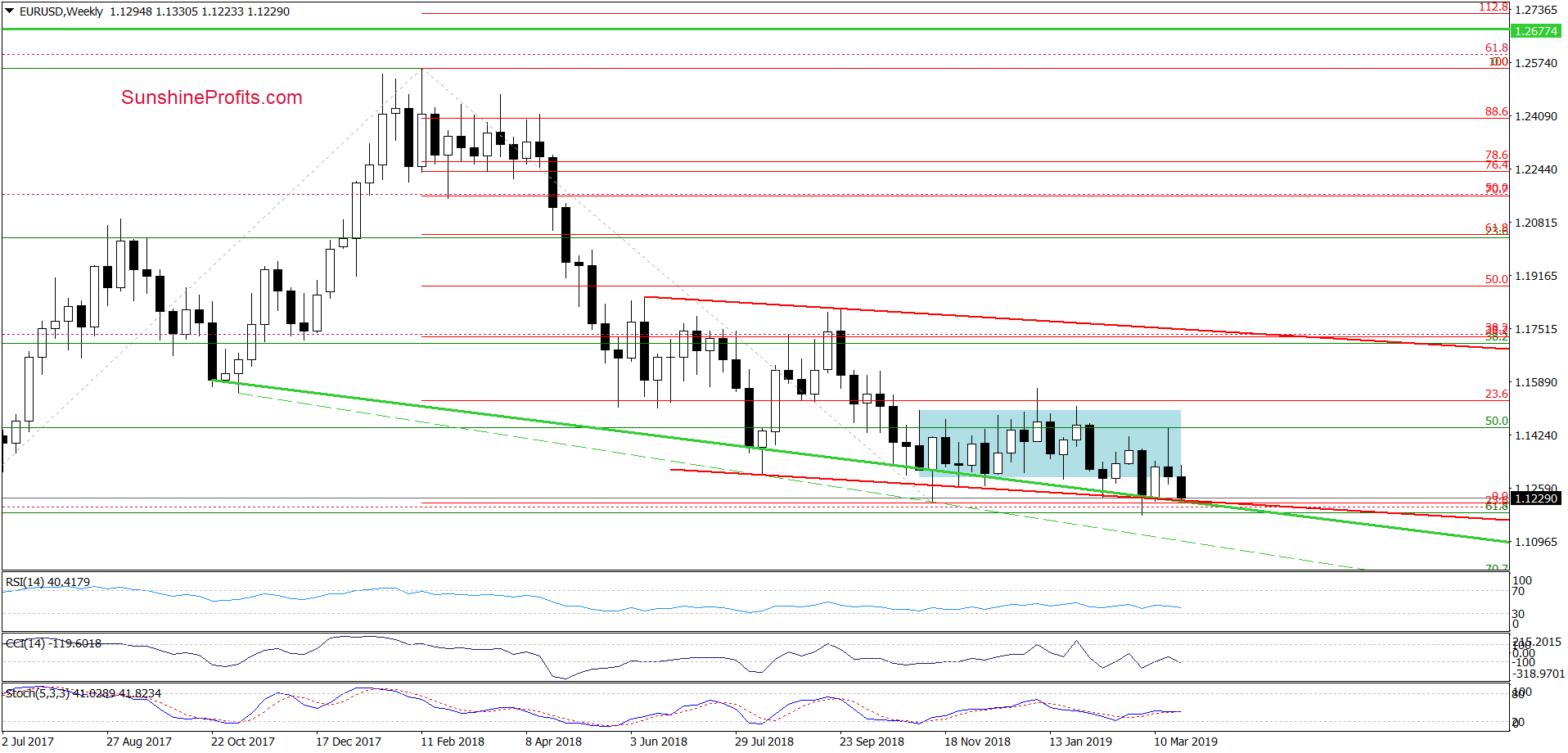

EUR/USD indeed extended losses earlier today, as we had expected. The price action slipped below our next downside target earlier today. The pair had also dropped below the support area created by the 76.4% and 78.6% Fibonacci retracements and approached the lower border of the long-term red declining trend channel and the long-term green support line seen on the charts below.

On both the EUR/USD weekly charts (they differ only in their choice of the starting point), we see that this support has been strong enough to stop the sellers quite a few times in the past, which increases the likelihood of another upswing in the coming day(s).

Taking all the above into account, we think that closing short positions and taking profits off the table (as a reminder, we have opened them when EUR/USD was trading at around 1.1270) is the sensible choice now and justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

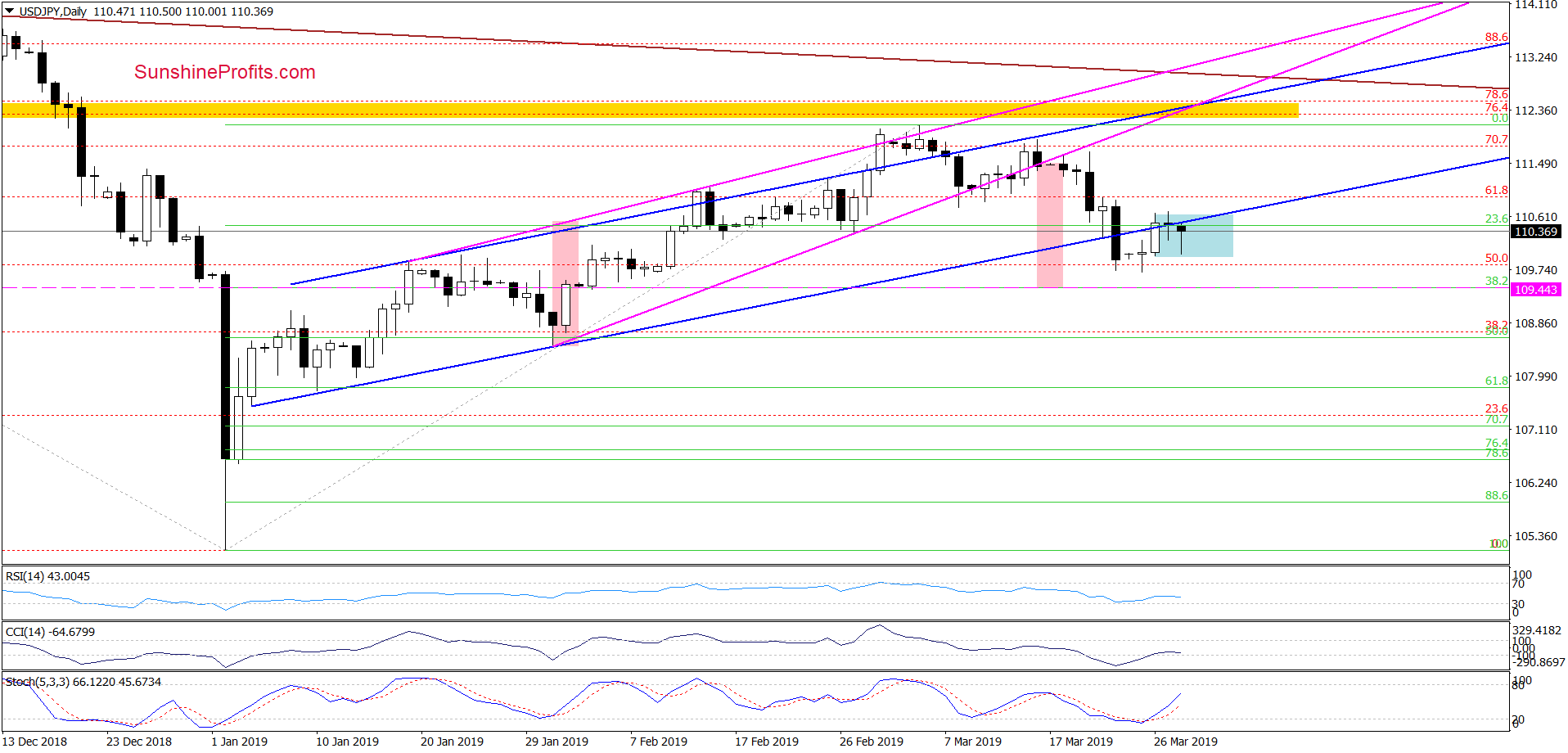

USD/JPY

USD/JPY closed Tuesday’s session above the previously-broken lower border of the blue rising trend channel, invalidating the earlier breakdown below it. This positive event in combination with the buy signals generated by the daily indicators gave us the reason to close our short positions and take profits off the table during yesterday’s session.

Earlier today, the sellers have pushed the exchange rate lower once again and USD/JPY came back below the blue channel only to bounce back since. We should keep in mind that the pair remains still inside the blue consolidation, which suggests that as long as there is no breakout above the upper border or a breakdown below the lower border of the formation, another bigger and lasting move is not likely to be seen.

Therefore, waiting on the sidelines for another profitable opportunity emerging seems to be the best course of action at the moment. Your capital is too precious to squander through acting on inconclusive hints.

Nevertheless, if we see more reliable bullish or bearish factors, we’ll consider opening a new position. As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/CAD

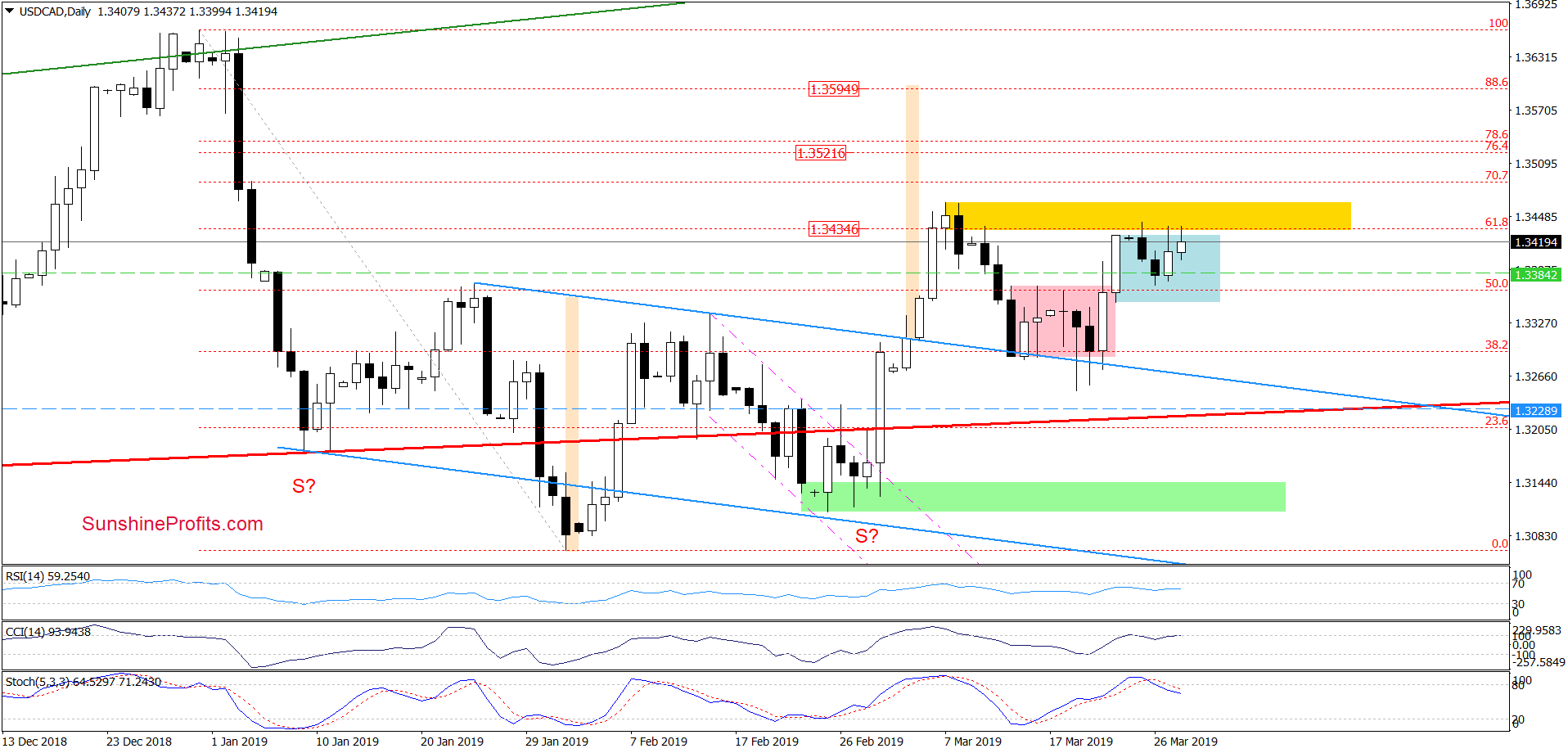

The 61.8% Fibonacci retracement stopped the buyers at the start of this week. On Monday and Tuesday, we’ve witnessed a pullback. Starting Wednesday however, the bulls became more active and pushed the pair higher to erase previous losses. And they keep on trying today, too.

However, the yellow resistance zone (created by the above-mentioned Fibonacci retracement and the early-March peaks) continues to keep further increases in check. Today’s attempt to go north has mostly failed so far and the pair has come back into the blue consolidation.

Additionally, the sell signals generated by the CCI and the Stochastic Oscillator remain on the cards, increasing the likelihood of another reversal potentially just around the corner. And such a reversal may very well be bigger than the one experienced at the start of the week.

Therefore, taking into account bulls’ weakness in recent days and the position of the indicators, we decided to close our long positions and to sensibly take profits off the table (as a reminder, we have opened them when USD/CAD was trading at around 1.3385). This trade was given ample time to develop and the market has showed us that it’s probably not ready to continue the upswing right now, so we’re not arguing but closing the position accordingly and with a modest profit: it’s still a profit and we’re in here for the long run.

Nevertheless, should we see a successful breakout above the yellow resistance zone or a breakdown below the lower border of the consolidation, we’ll consider opening the next position. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On an administrative note, our data center informed us that there might be some connectivity issues lasting two hours tomorrow morning (8 AM - 10 AM EST, which is 1 PM - 3 PM CET), so you may experience some delays while accessing our website. We will strive to provide you with our analysis before that time, but since it depends on the market, we cannot promise that we will manage to do so as intended. In other words, we will be posting our Alerts normally tomorrow, but our website might be slow to load or our e-mail notification might reach you with a 1-2 hour delay tomorrow. We apologize for any possible inconvenience caused.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist