After yesterday's relative indecision, currencies are on the move today. This is especially true of the euro. Does it look to you like lower values are just ahead, or can the bulls stem the decline? It's not about the euro only though - we've seen pretty interesting action in the Australian dollar yesterday. The question is whether its upswing has changed the outlook, or not. Let's dive into these pressing questions and turn the resulting knowledge into something beneficial to you.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the initial downside target at 1.1197)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a fresh stop-loss order at 0.7078; the downside target at 0.6925)

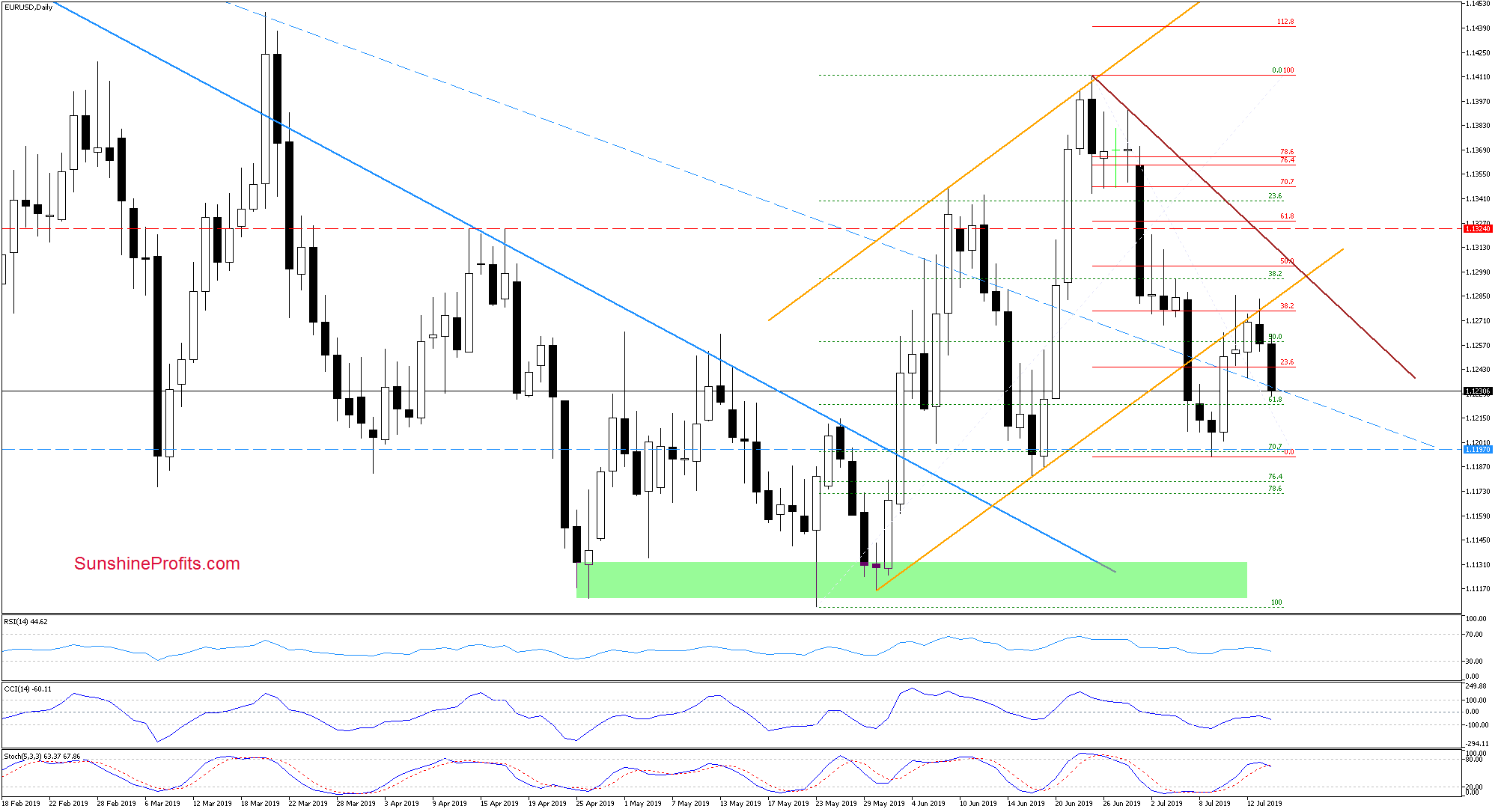

EUR/USD

Earlier today, EUR/USD has moved sharply to the downside, making our short positions more profitable. It has broken below Friday's lows, opening the way further south. The daily indicators continue to support the downswing, and we may see the Stochastic Oscillator issue its sell signal as soon as today's trading is over.

Therefore, our downside target remains up-to-date, and the bears can aim to make a test of the July lows as a minimum.

Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at 1.1324 and the initial downside target at 1.1197 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

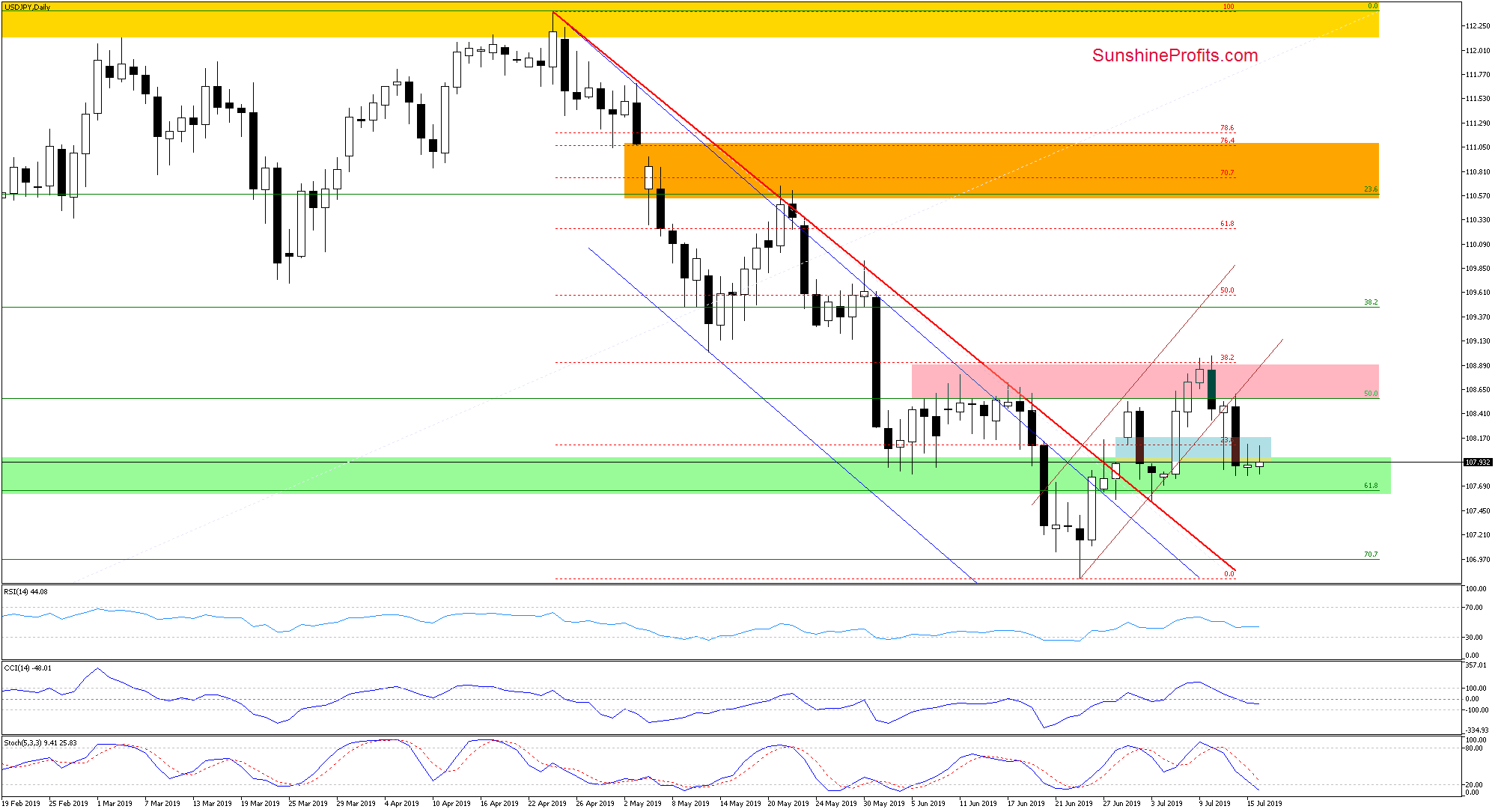

USD/JPY

Overall, the situation hasn't changed much as USD/JPY keeps trading in a very narrow range around the upper border of the green support zone. Looking at the daily indicators though, we see that they are on sell signals. This means that one more downswing and a test of the lower border of the green support zone and the early-July low is probable.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

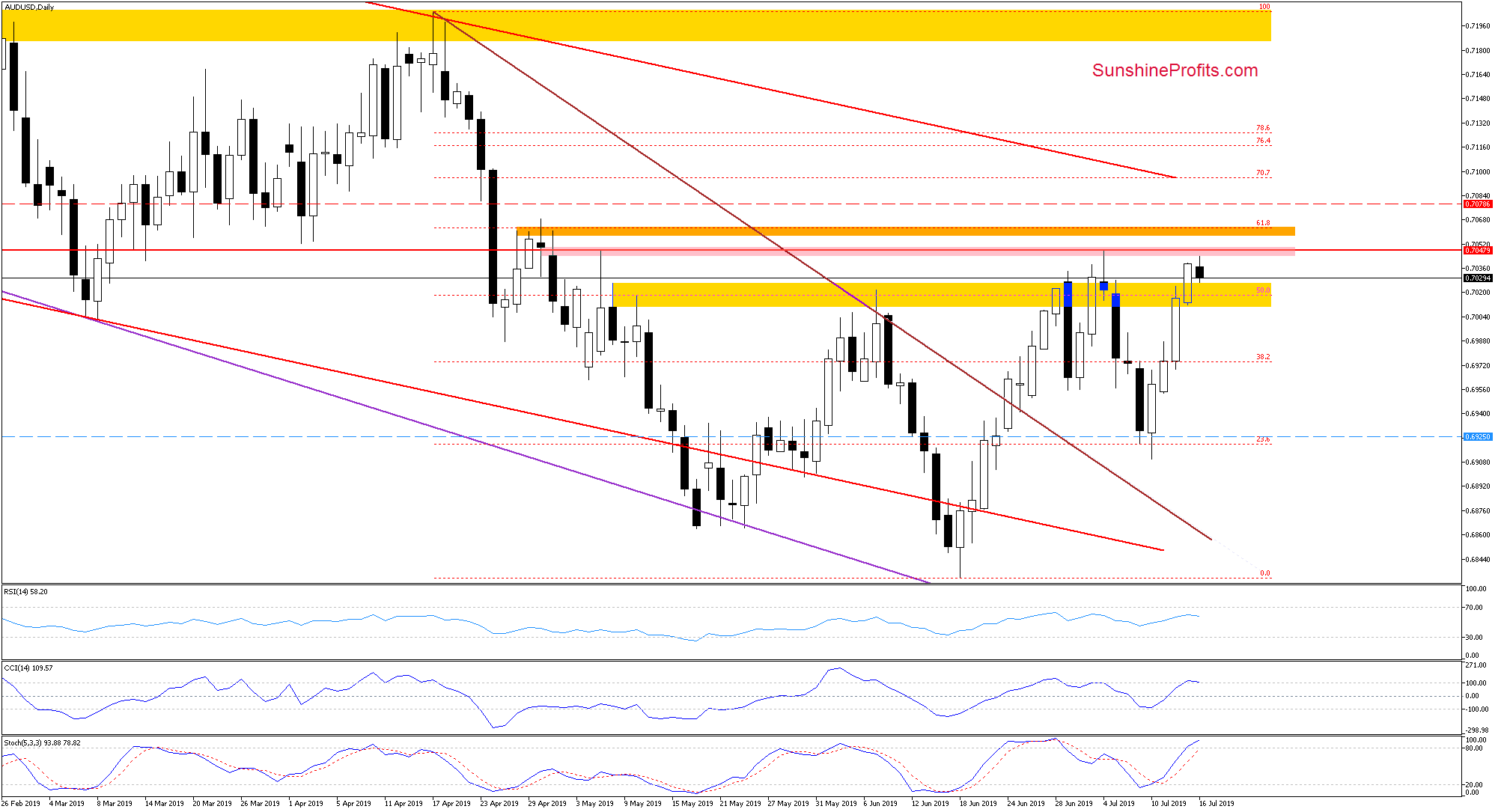

AUD/USD

Yesterday's AUD/USD upswing took the market to the vicinity of our waiting order. This fact coupled with the bearish outlook described below, makes us move the stop-loss higher to preempt a possible stop-run move. While yesterday's move higher may look encouraging, it only took the pair to the resistance area created by the early-May and early-July peaks, and the pink gap.

Such a strong combination of resistances has been strong enough to stop the bulls at the beginning of this month already. It suggests that as long as the gap is open, another downward reversal from here with further declines to boot, remain very likely indeed.

Should the pair move lower from here, we'll see at least a test of the last week's low in the following days. Such a move would be supported by the current positioning of the daily indicators.

Trading position (short-term; our opinion): Short positions with a fresh stop-loss order at 0.7078 (adjusted in light of yesterday's upswing and continuing bearish outlook) and the next downside target at 0.6925 are justified from the risk/reward perspective.

Summing up the Alert, the EUR/USD rebound gave way to today's downswing, and the profitable short position is justified. AUD/USD looks unable to add to yesterday's gains, as its strong combination of nearby resistances has stopped the bulls yesterday. As the same thing happened earlier this month already, the short position remains justified. Taking into account the possibility of a stop run, we're moving the stop-loss a bit higher. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist