Up and down and turn around – in these several words we could sum up the recent price action that we are observing in the case of USD/JPY. What formation holds both the bulls and the bears in a narrow range for many days?

- EUR/USD: short (a stop-loss order at 1.1593; the initial downside target at 1.1337)

- GBP/USD: short (a stop-loss order at 1.2968; the initial downside target at 1.2630)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7288; the initial downside target at 0.7055)

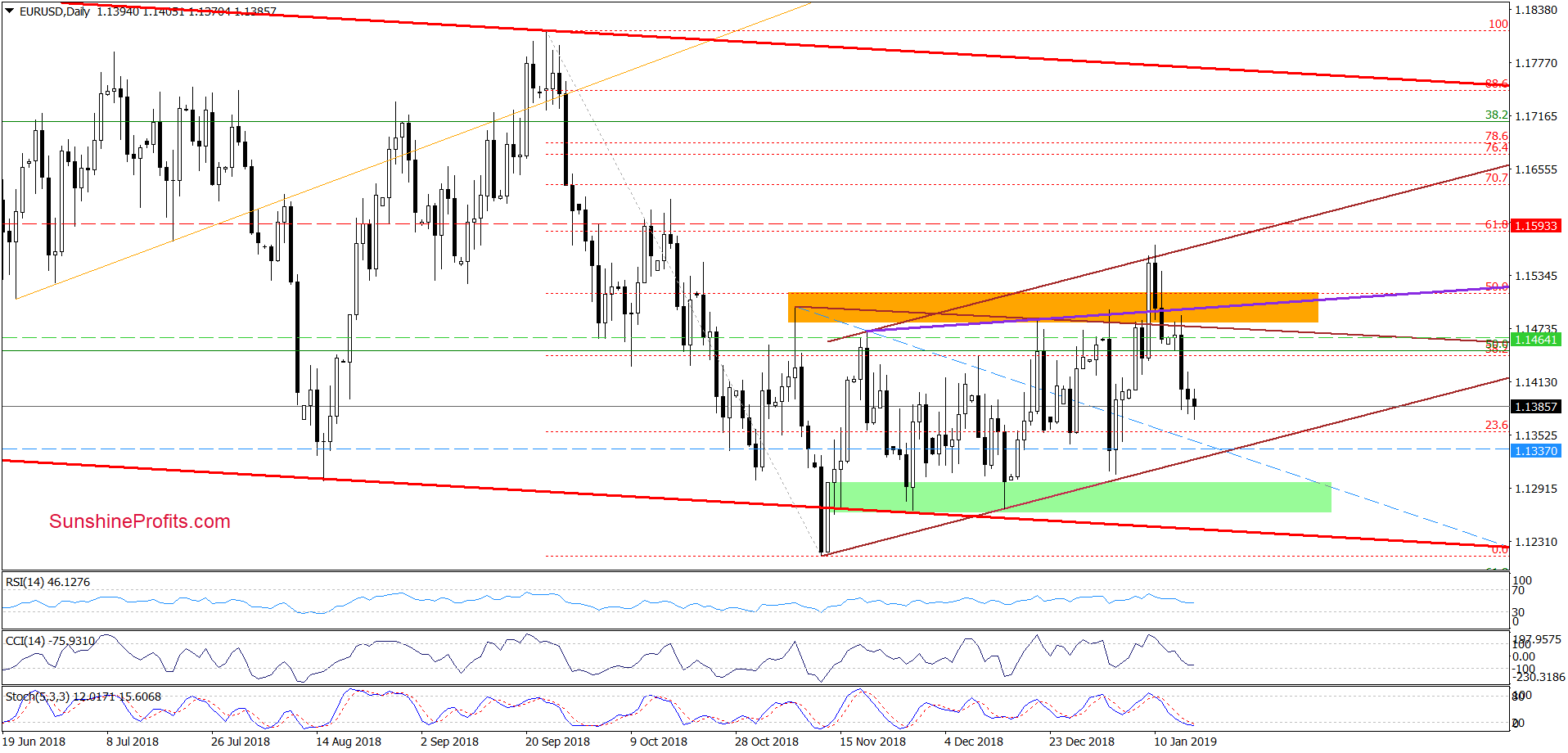

EUR/USD

Earlier today, EUR/USD moved lower once again, which in combination with the lack of the buy signals generated by the daily indicators increases the probability that we’ll see a realization of our Friday’s scenario in the very near future:

(…) currency bears could take the pair to around 1.1335 or even the lower border of the brown triangle in the following days (currently at 1.1316).

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1593 and the initial downside target at 1.1337 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

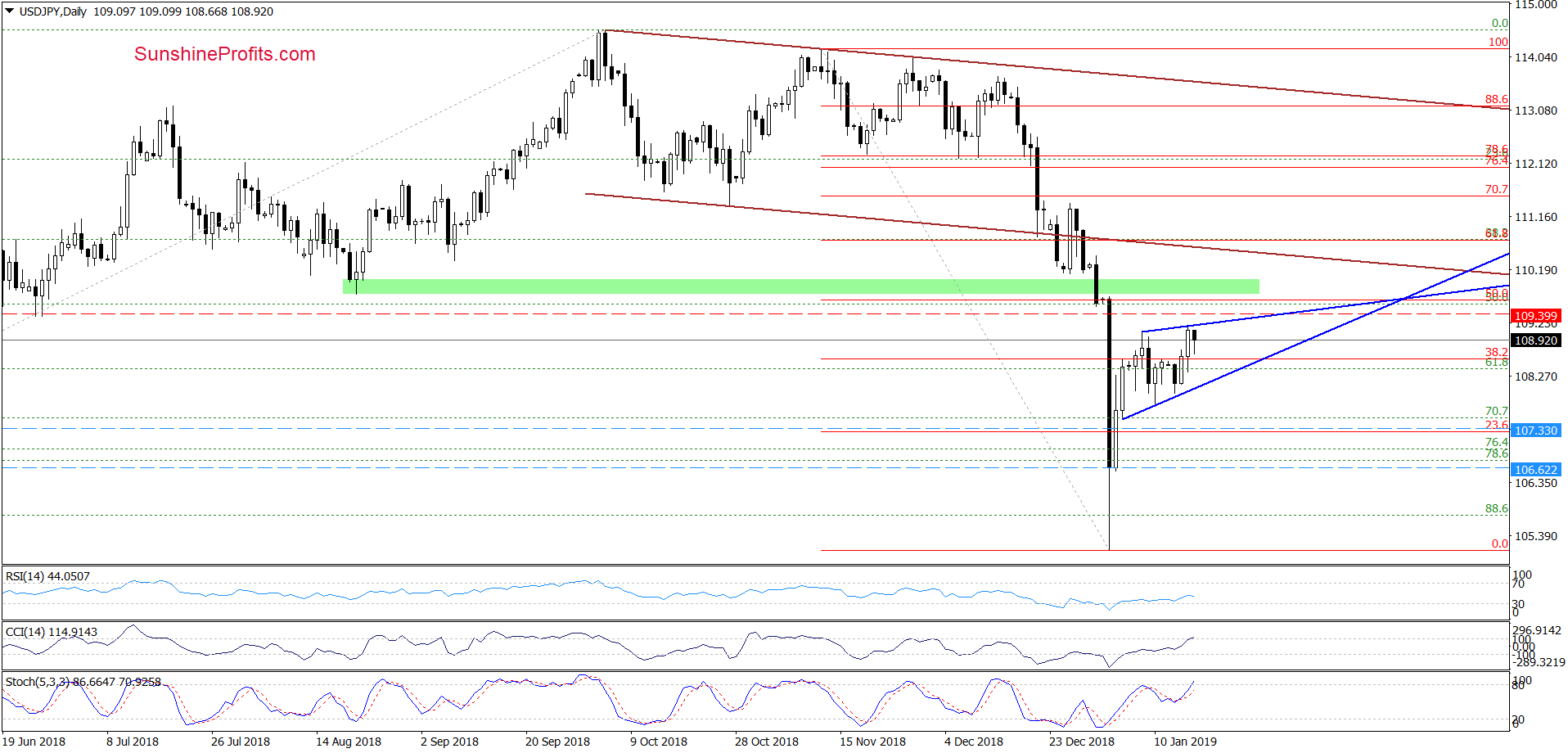

USD/JPY

On the above chart, we see that although USD/JPY slipped under the 38.2% Fibonacci retracement (based on the recent sharp decline), currency bears didn’t manage to trigger a bigger move to the downside.

Instead, the buyers took the exchange rate above the retracement once again, which resulted in a test of the upper border of the blue triangle and approached USD/JPY to the previously-broken late June lows (marked with the red horizontal dashed line).

Although this combination encouraged the sellers to act earlier today, the buy signals generated by the daily indicators remain in the cards, suggesting another attempt to move higher (to the above-mentioned red line or even the previously-broken green zone) in the very near future.

Nevertheless, in our opinion, as long as the exchange rate is trading inside the above-mentioned triangle a bigger move to the upside or downside is not likely to be seen and short-lived moves in both directions can’t be ruled out. Therefore, waiting at the sidelines for more reliable signals is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

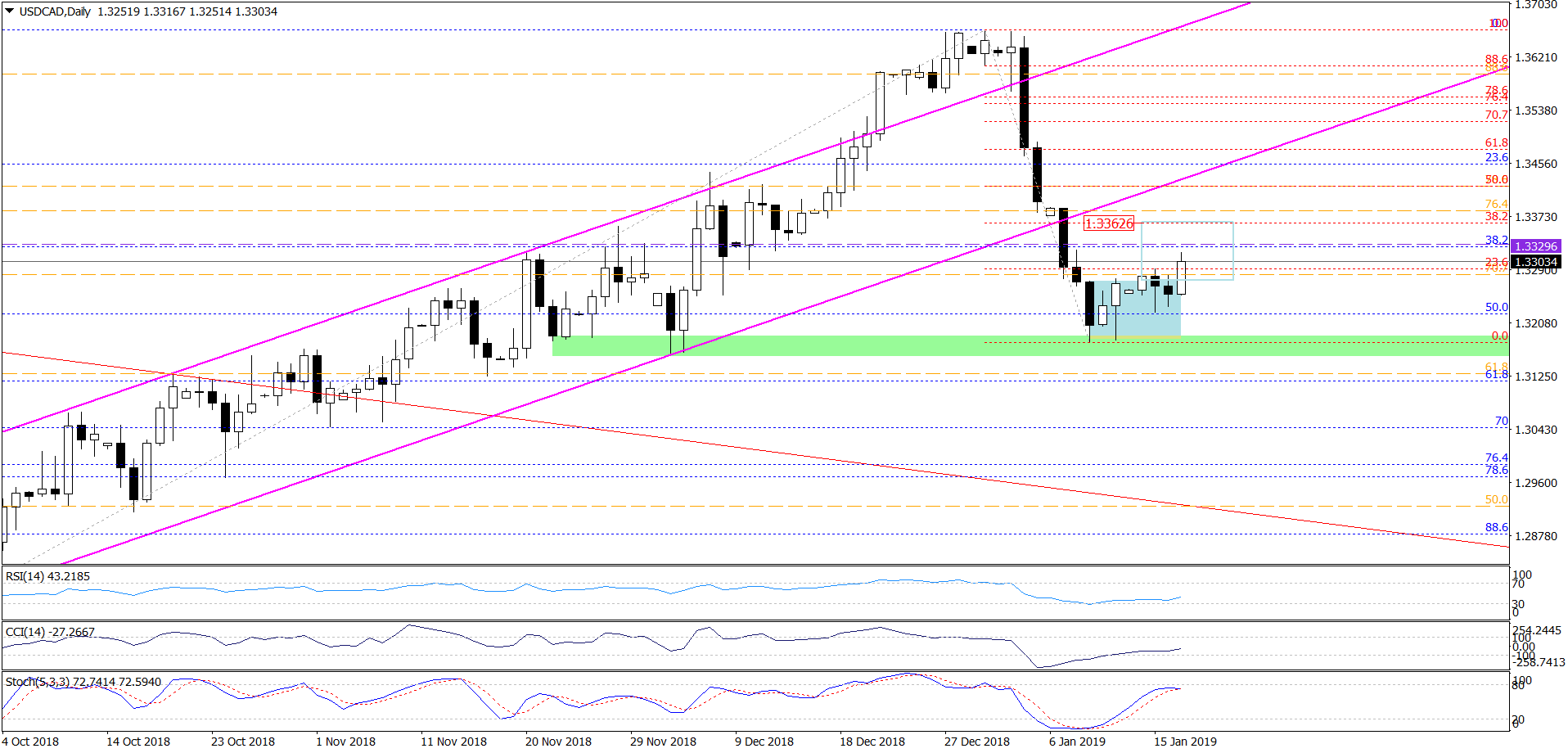

USD/CAD

Looking at the daily chart, we see that although USD/CAD slipped under the previously-broken upper border of the blue consolidation, invalidating the earlier breakout, currency bulls apparently didn’t abandon their pro-growth plans because they pushed the pair above this resistance once again earlier today.

Nevertheless, this signal will be more likely and reliable if the exchange rate closes today’s session above the consolidation.

What could happen if the bulls win later today? In our opinion, the likelihood of an upward move to around 1.3362 (where the size of the correction will be equal to the height of the blue consolidation (around the 38.2% Fibonacci retracement based on the entire recent decline)) will increase.

However, if they fail once again and USD/CAD returns into consolidation, the way to the green support zone (or even a fresh low) will be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager