Monday's session was difficult for the bulls, because shortly after the start of the new week their rivals took control on the trading floor, generating a strong downward move. Where can the buyers find support?

- EUR/USD: short (a stop-loss order at 1.1525; the initial downside target at 1.1250)

- GBP/USD: short (a stop-loss order at 1.2870; the initial downside target at 1.2490)

- USD/JPY: none

- USD/CAD:none

- USD/CHF:none

- AUD/USD:none

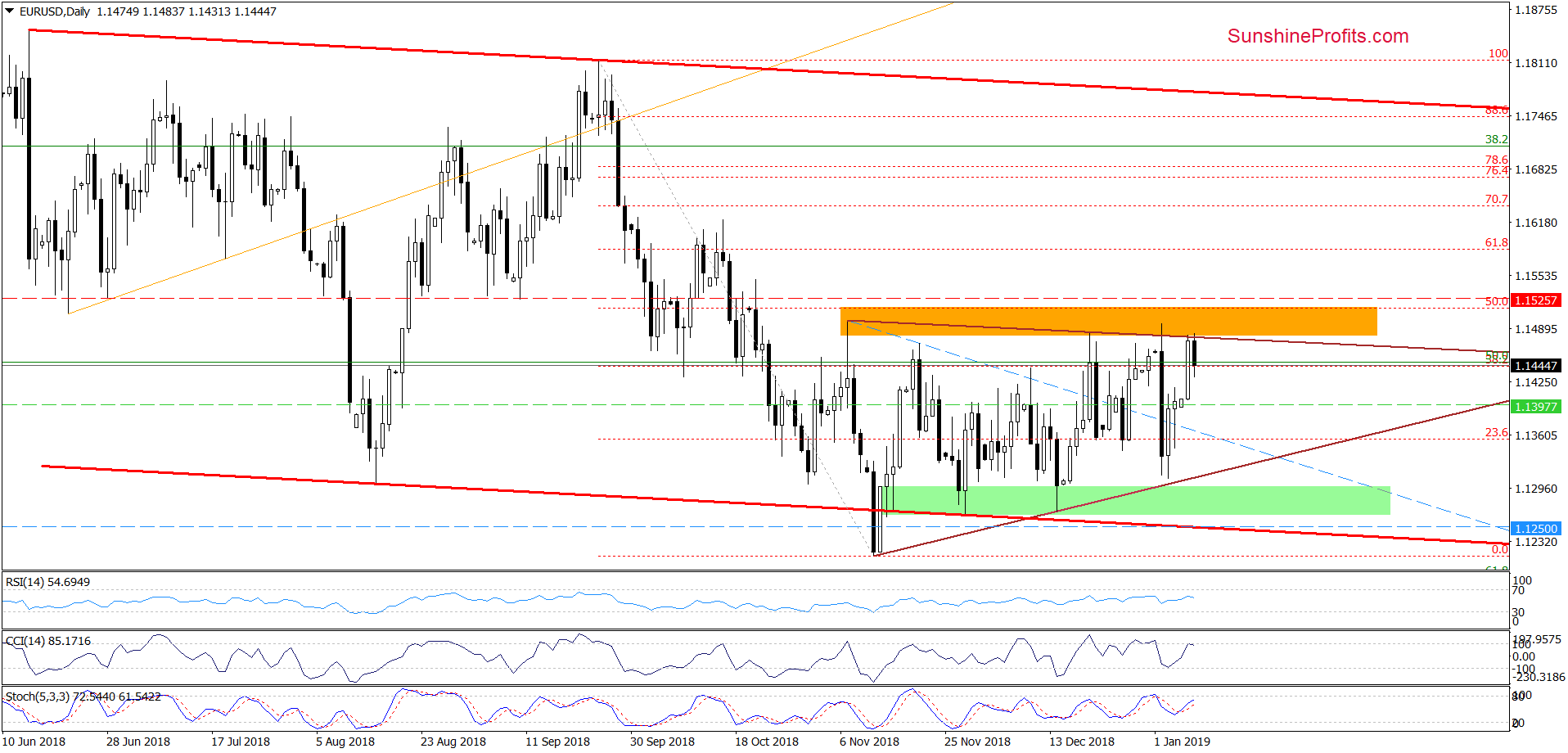

EUR/USD

From today’s point of view, we see that although EUR/USD extended gains during yesterday’s session, the combination of the orange resistance zone and the brown declining resistance line based on the previous highs stopped the buyers once again, triggering a pullback earlier today.

Taking this fact into account, we believe that what we wrote yesterday is up-to-date:

(…) in our opinion as long as there is no breakout above them all upswings could be nothing more than a verification of the earlier breakdown. If this is the case, the pair will reverse in the very near future and the first downside target for the sellers will be the brown rising support line based on the November and mid-December lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1525 and the initial downside target at 1.1250 are justified from the risk/reward perspective.

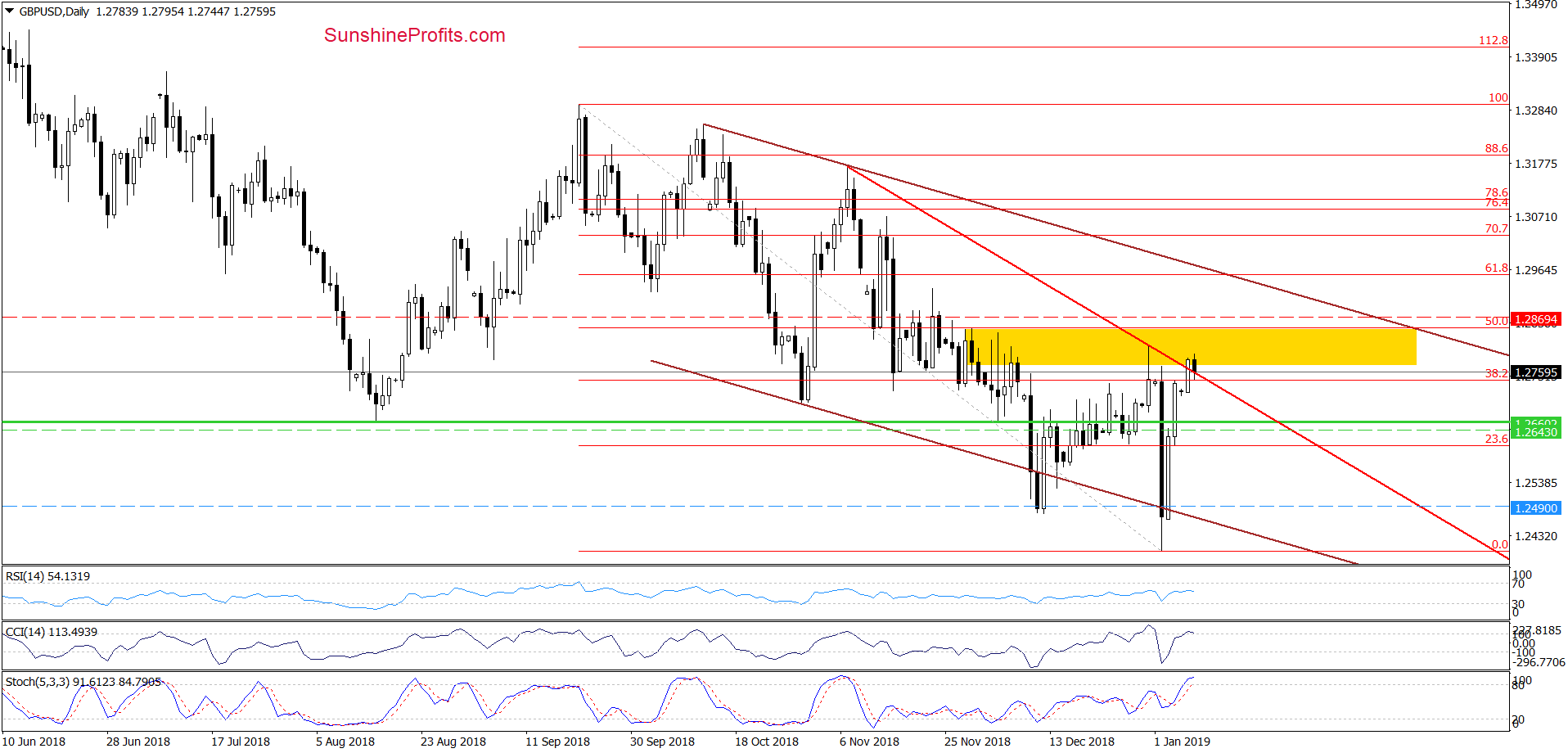

GBP/USD

Looking at the daily chart, we see that GBP/USD moved higher once again yesterday, which resulted in a climb above the red declining resistance line. Although this is a positive development, we should keep in mind that the exchange rate increased to the yellow resistance area once again.

As you see on the chart, it was strong enough to stop the buyers many times in the past (not only at the turn of November and December, but also at the end of last month), which increases the probability that we’ll see a similar price action in the very near future – especially when we factor in the proximity to the 50% Fibonacci retracement and the current position of the daily indicators (the CCI and the Stochastic Oscillator moved to their overbought areas, suggesting generating sales signals in the near future).

If the situation develops in tune with this assumption, GBP/USD will reverse and decline from current levels in the coming day(s). The pro-bearish scenario will be even more likely and reliable if the pair invalidates yesterday’s breakout above the red declining resistance line.

What could happen if we see such price action? In our opinion, the sellers will re-test the recent lows or even the lower border of the brown declining trend channel. Therefore, to avoid unwanted closure of the position, we decided to move our stop-loss order a bit higher. All needed details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.2870 and the initial downside target at 1.2490 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

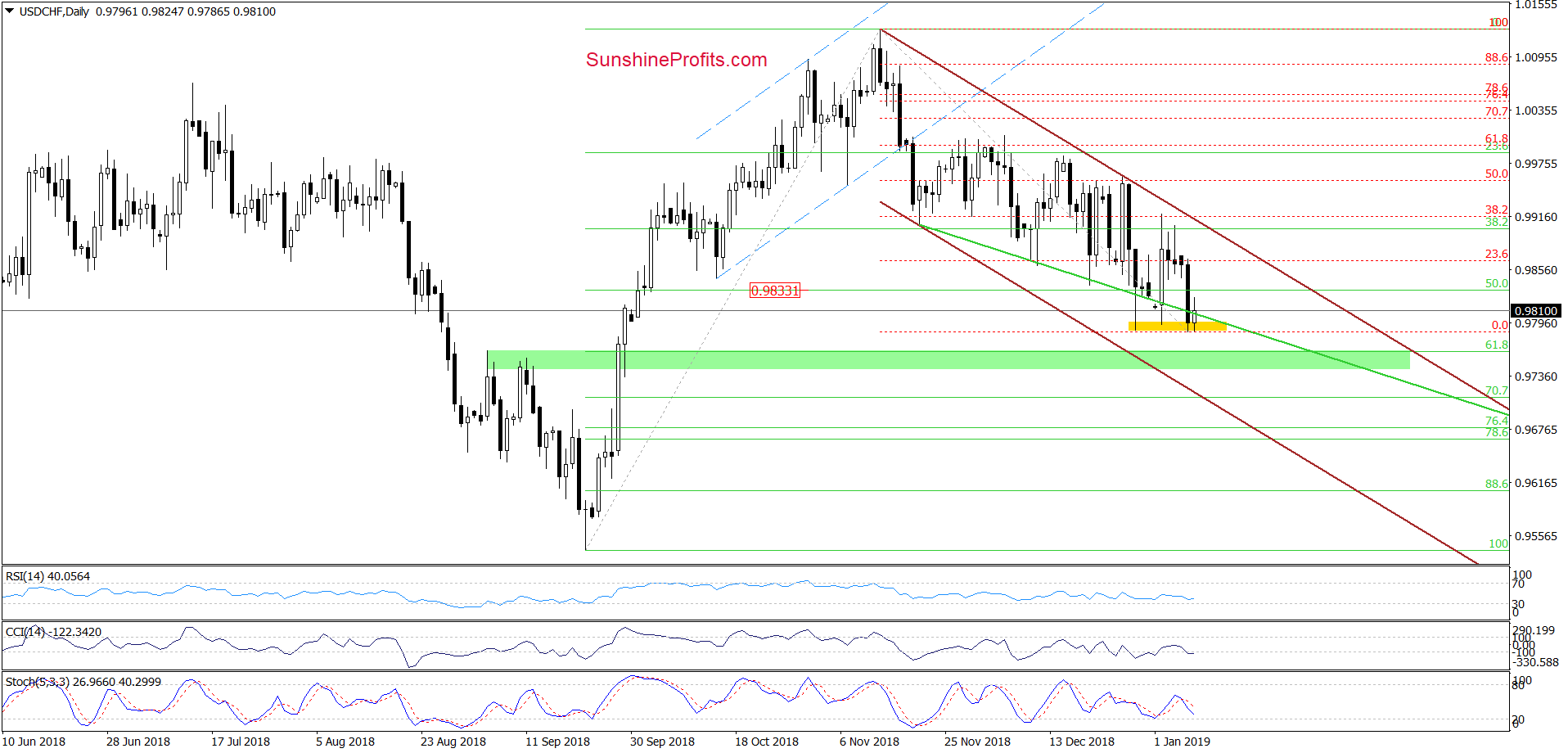

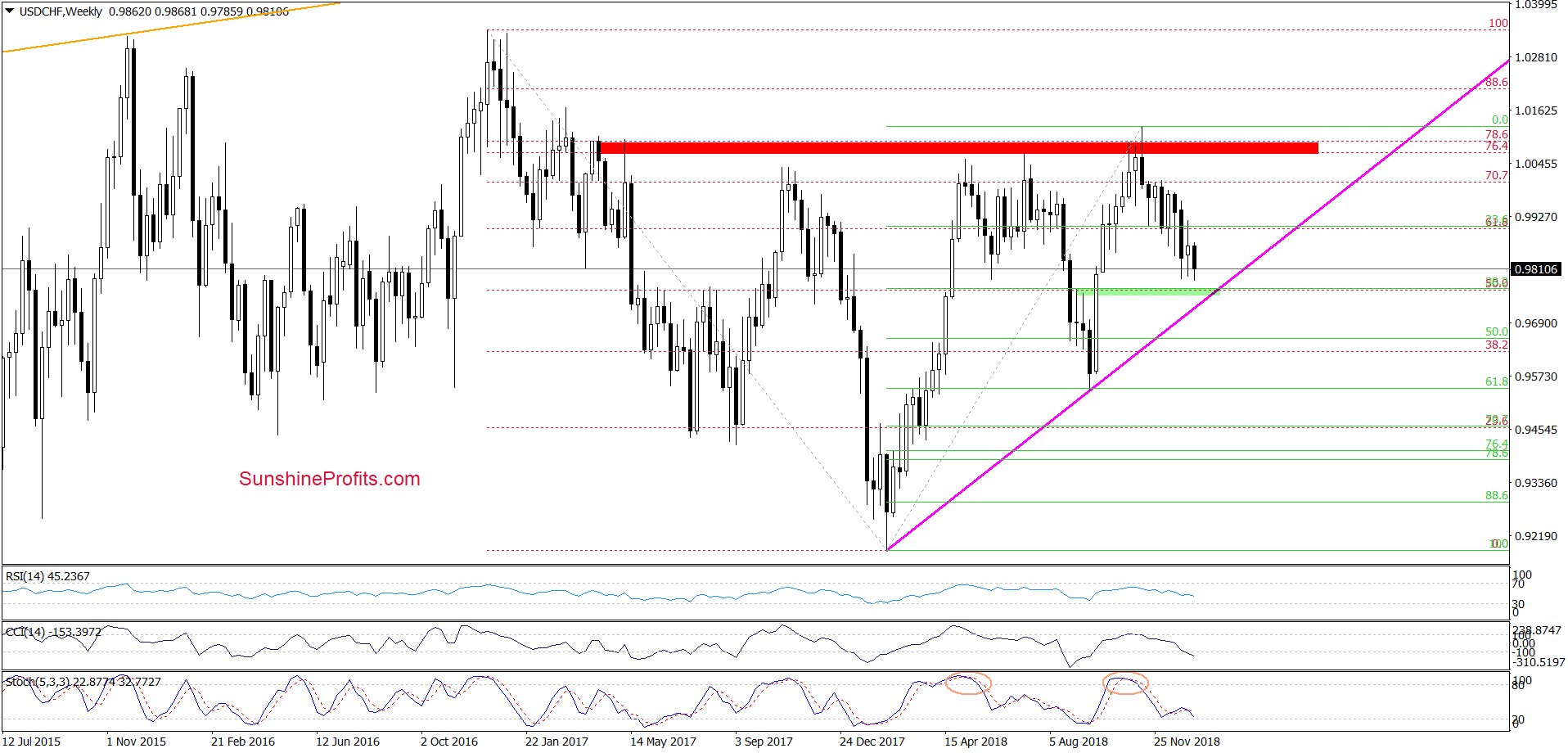

USD/CHF

From the short-term perspective, we see that the sellers pushed the exchange rate lower during yesterday’s session, which resulted in a test of the late-December low. Although the buyers managed to slow down the pressure of their rivals in this rejoin, the bears finished the day below the green support line based on the late-November and December lows.

This is a bearish development, which could translate into further deterioration and at least a test of the green support zone (created by the early-September 2018 peaks and the 61.8% Fibonacci retracement based on the September-November increases) if the buyers do not manage to invalidate yesterday’s breakdown later in the day.

At this point it is worth noting that this area is also reinforced by two other supports seen more clearly from the medium-term perspective – the 38.2% Fibonacci retracement (based on the entire 2018 upward move) and the pink rising support line based on the February 2018 and September 2018 lows.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts