Although the U.S. dollar slipped a bit against the Swiss franc after yesterday’s candlestick open, the combination of the last week low and the short-term support line stopped the sellers, triggering a quite sharp rebound. Is this the beginning of the fight for bigger rebound?

- EUR/USD: short (a stop-loss order at 1.1525; the initial downside target at 1.1250)

- GBP/USD: short (a stop-loss order at 1.2844; the initial downside target at 1.2490)

- USD/JPY: none

- USD/CAD:none

- USD/CHF:none

- AUD/USD:none

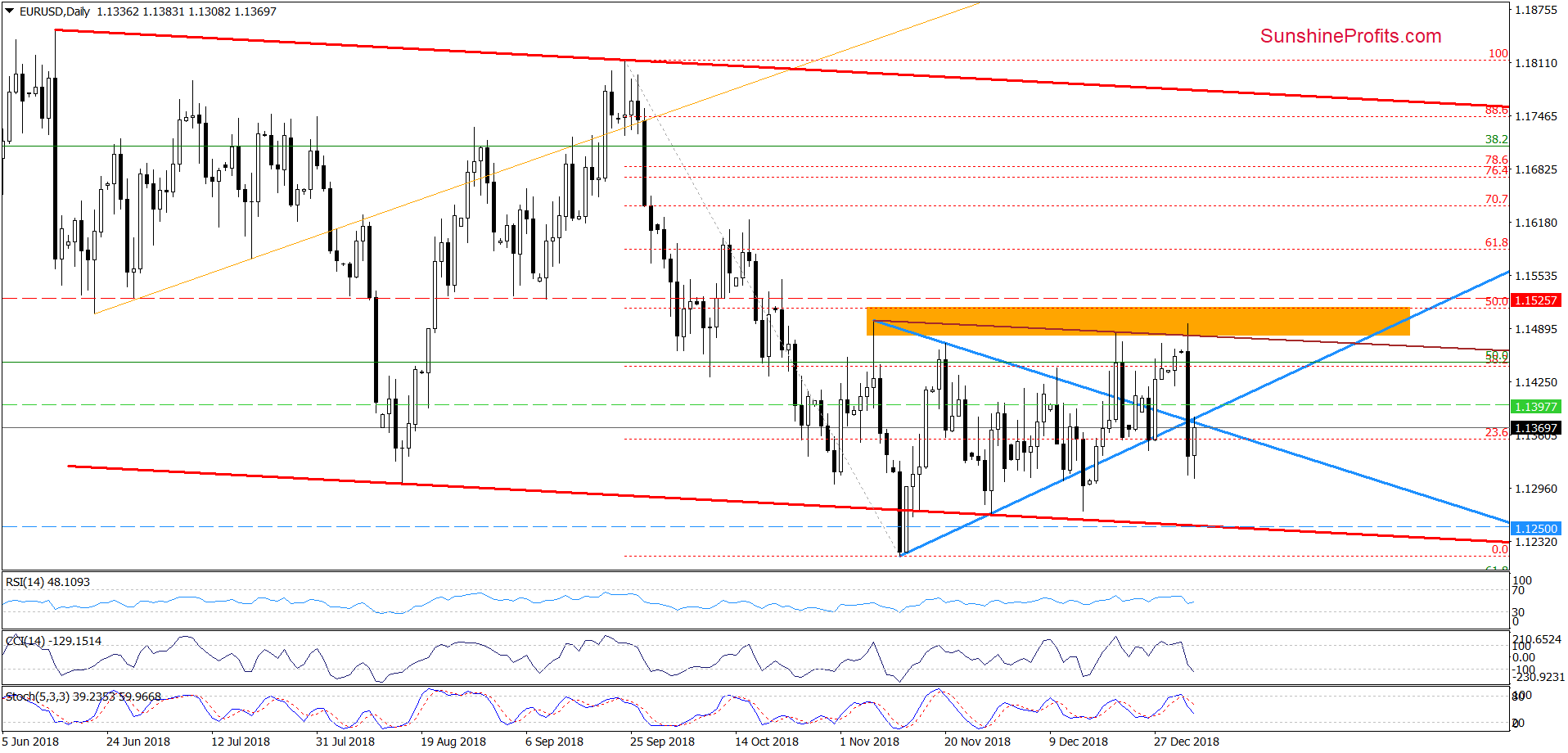

EUR/USD

The highlight of yesterday’s session was a sharp drop, which took EURUSD under upper and lower border of the blue triangle. In this way, the exchange rate invalidated the earlier breakout above the upper arm of the formation, which is a bearish development.

Earlier today, currency bulls pushed the pair higher and EUR/USD came back to these lines, but in our opinion, as long as there is no daily closure above them all upswings will be nothing more than verifications of yesterday’s breakdown.

Therefore, we believe that our yesterday’s commentary on this currency pair is up-to-date also today:

(…) the exchange rate invalidated not only the earlier breakout above the previous peak and the orange zone, but also the brown declining resistance line based on the previous highs.

Additionally, the CCI and the Stochastic Oscillator generated sell signals, suggesting further deterioration in the following days. This scenario will be even more likely and reliable if EUR/USD drops under both arms of the blue triangle.

If we see such price action, the way to the lower border of the red declining trend channel will be open (around 1.1250 at the moment of writing this alert). (…)

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1525 and the initial downside target at 1.1250 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

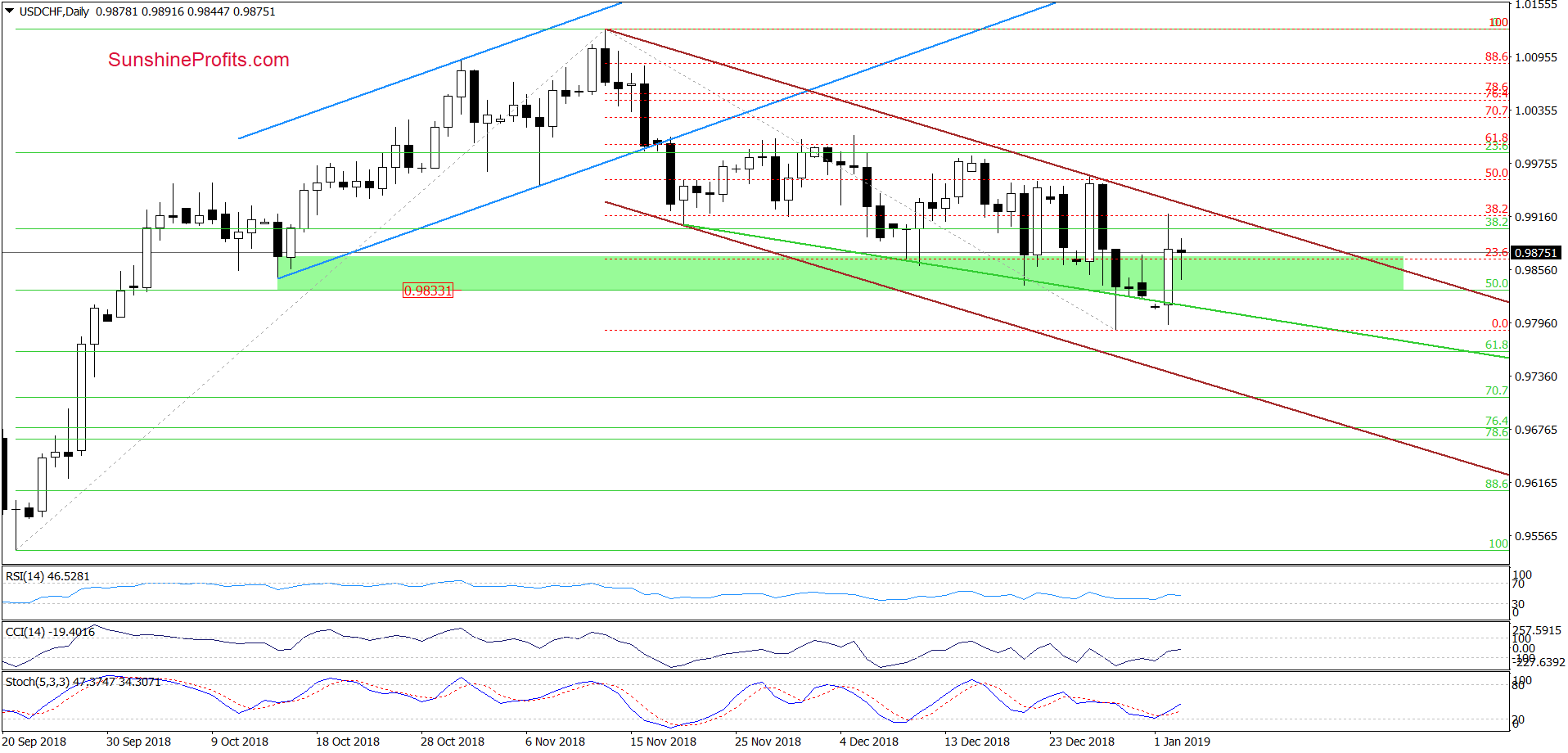

USD/CHF

Looking at the daily chart, we see that the upper border of the brown declining trend channel stopped the buyers in the middle of the previous week, which resulted in a decline below the green support zone and an intraday drop under the green declining support line based on the November and December lows.

Despite this deterioration, currency bulls triggered a rebound, which caused an invalidation of the tiny breakdown under this line. Unfortunately, lack of strength to continue the rebound caused another downswing and a re-test of the above-mentioned green line and the last week’s low during yesterday’s session.

This time the buyers showed greater determination and USD/CHF climbed above the green support zone, invalidating the earlier breakdown. Taking this positive event into account and combining it with the buy signals generated by the indicators, we think that further improvement is just around the corner.

Nevertheless, in our opinion, a bigger move to the upside will be more likely if the exchange rate breaks above the upper border of the brown declining trend channel (currently at around 0.9930). If we see such price action, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No short positions are justified from the risk/reward perspective.

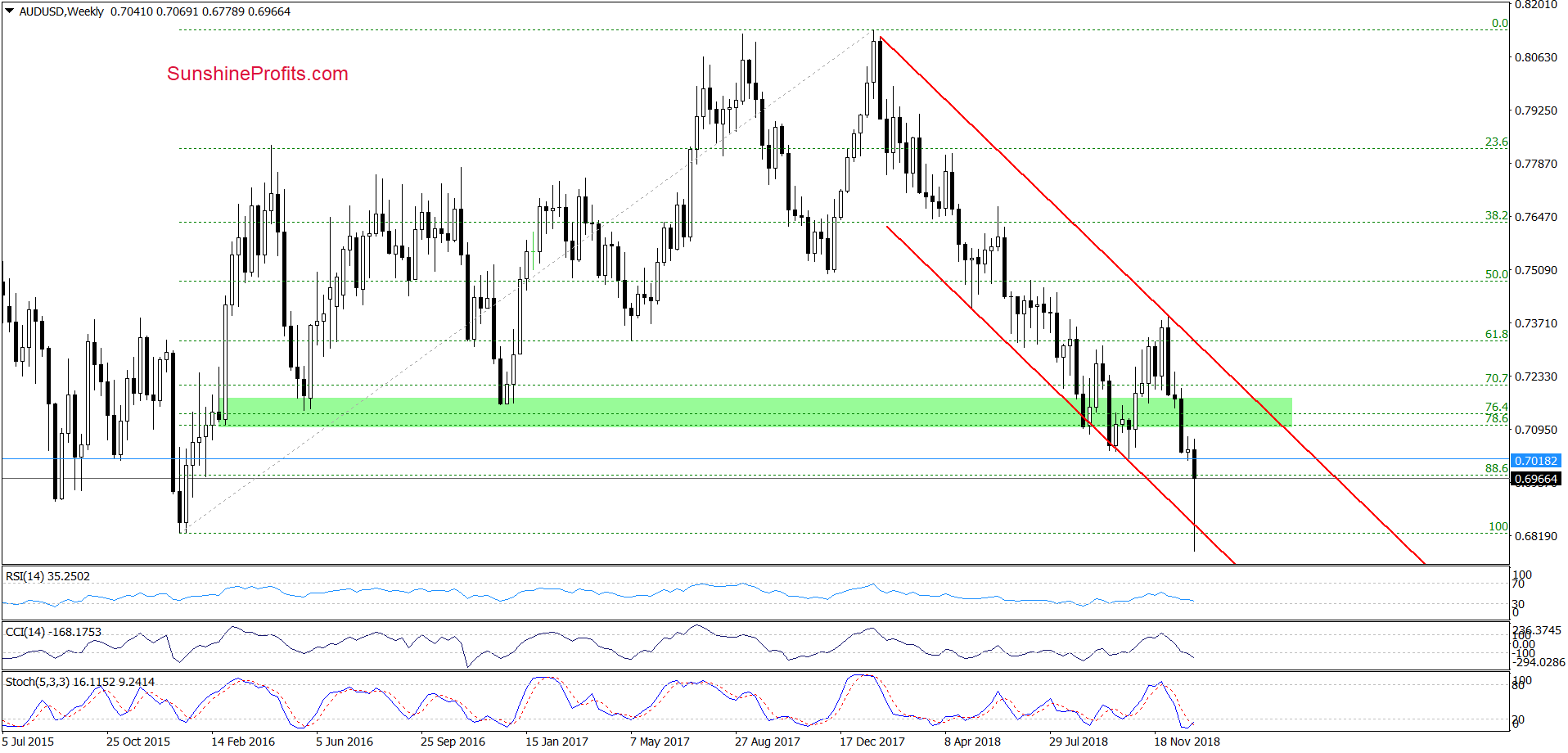

AUD/USD

On the medium-term chart, we see that AUD/USD moved sharply lower earlier this week, breaking slightly below the lower border of the red declining trend channel.

How did this price action affect the very short-term chart? Let’s check.

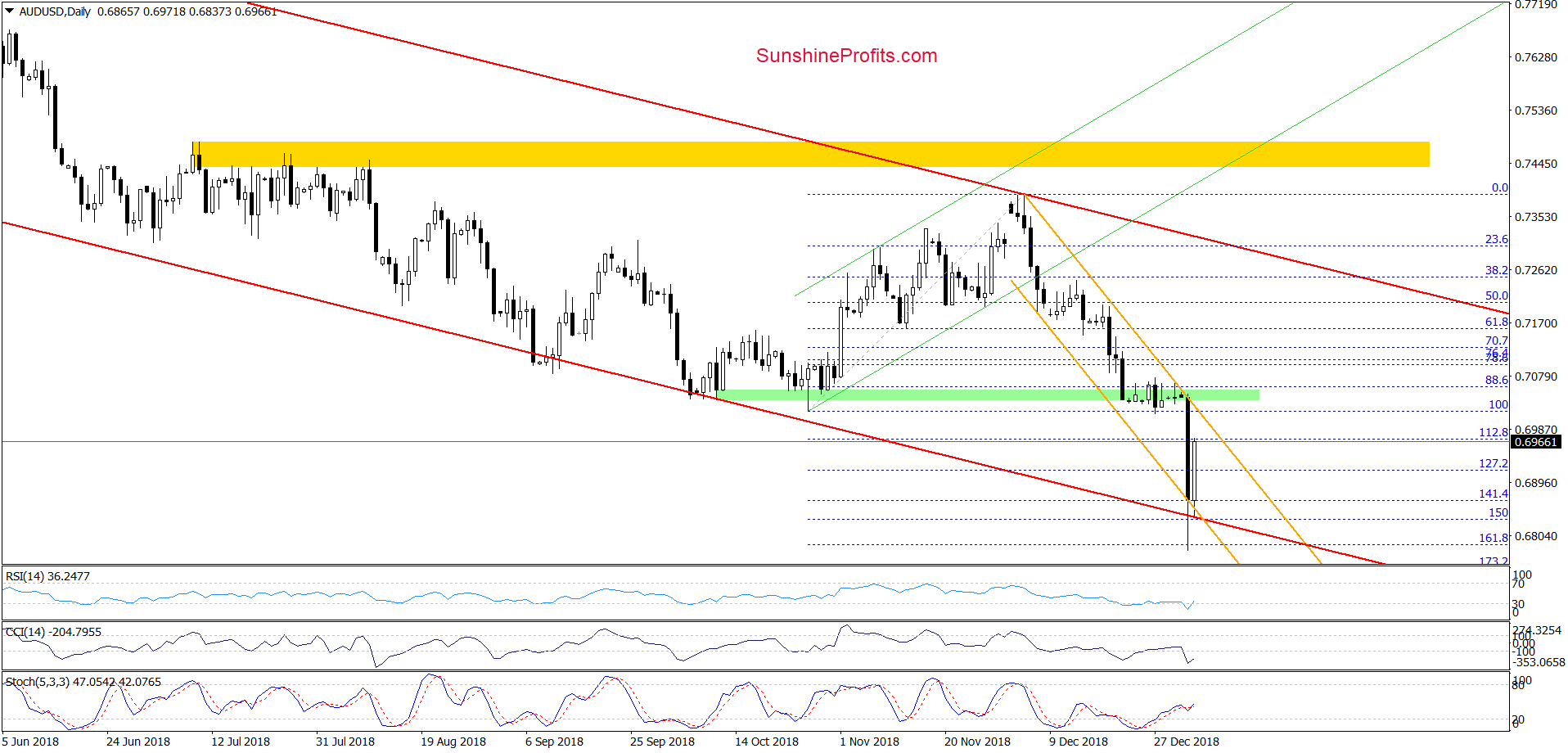

From this perspective, we see that although the green support zone stopped the sellers for a few days, yesterday’s session brought a breakdown and a very sharp move to the downside.

Thanks to their action, the pair declined not only to the above-mentioned lower border of the red declining trend channel, but also tested the 161.8% Fibonacci extension and the lower border of the short-term orange declining trend channel.

As you see, the combination of these supports encouraged the bulls to act and AUD/USD closed Wednesday’s session above them, invalidation the earlier tiny breakdowns. This positive development triggered further improvement earlier today, which suggests that we’ll likely see a test of the previous lows and the green zone in the very near future.

If the bulls show strength and push AUD/USD above it (invalidating the earlier breakdown) and close one of the following sessions above the upper border of the orange declining trend channel, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts