After a series of several-day increases caused by the exit from the declining trend channel, the bulls reached the resistance zone, which slowed their rally to the north. Is this the end of their climbing?

- EUR/USD: half of the recent short positions (a stop-loss order at 1.1417; the next downside target at 1.1298)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7180; the initial downside target at 0.7064)

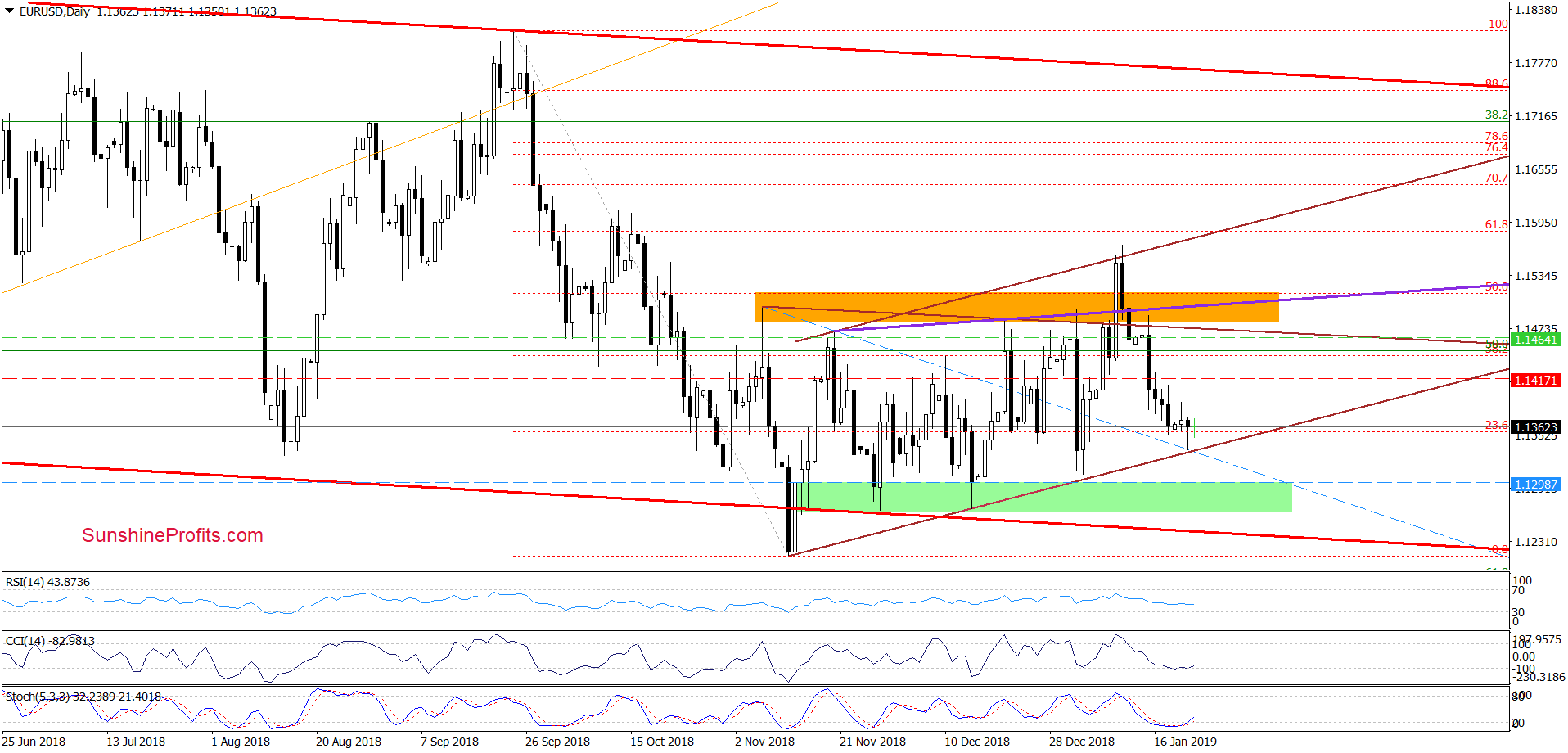

EUR/USD

Yesterday, EUR/USD extended losses and realized the pro-bearish scenario about which we wrote in our Forex Trading Alert posted on January 11, 2019. As you see on the chart, the lower border of the brown rising trend channel stopped the sellers, triggering a small rebound before yesterday’s closure.

Additionally, the CCI and the Stochastic Oscillator generated buy signals earlier today, increasing the probability of reversal from current levels. Nevertheless, before we decide to close the other half of our profitable positions, we’ll wait for any manifestation of bullish strength (e.g. closing today's session above yesterday's peak). We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Half of recent profitable short positions with a stop-loss order at 1.1417 and the next downside target at 1.1298 are justified from the risk/reward perspective.

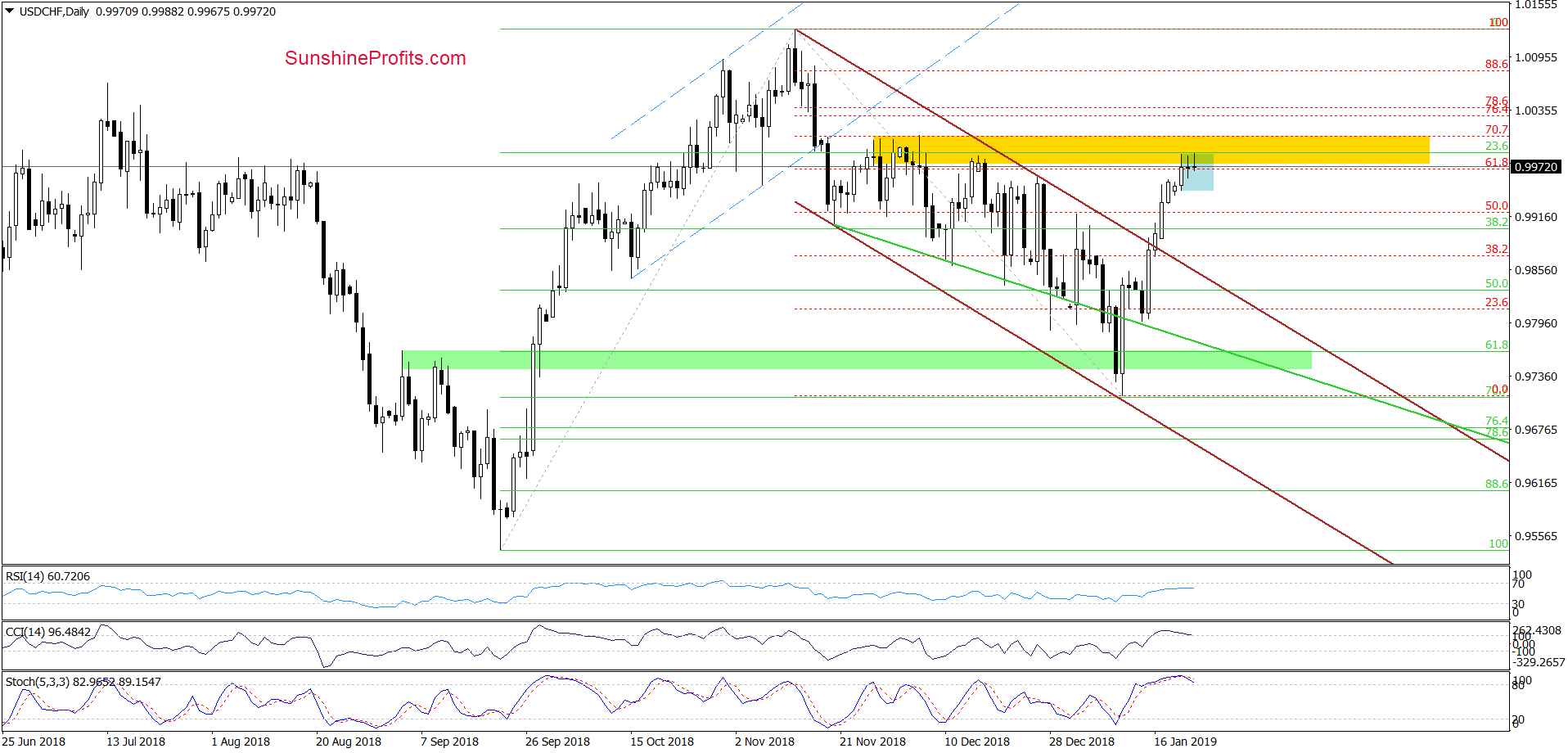

USD/CHF

Quoting our Friday’s alert:

(…) currency bulls not only took USD/CHF to the upper border of the brown declining trend channel, but also managed to break above it, which suggests a test of the 61.8% Fibonacci retracement and the yellow resistance zone in the coming day(s).

From today’s point of view, we see that the situation developed in line with the above assumption and USD/CHF tested our upside targets in recent days. As you see on the chart, the combination of the above-mentioned resistances stopped the buyers, creating a blue consolidation around resistances, which suggests that buyers could have lost their strength after previous increases.

Additionally, the CCI and the Stochastic Oscillator generated sell signals earlier today, increasing the probability of reversal in a very near future. Therefore, if the bulls do not manage to push the pair higher and we’ll see a drop below the lower border of the blue consolidation we’ll consider opening short positions.

What could happen if the bulls fail? In our opinion, USD/CHF will likely decline and test the previously-broken upper border of the brown declining trend channel in the following days. Therefore, we believe that it is worth carefully observing the behavior of this currency pair in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

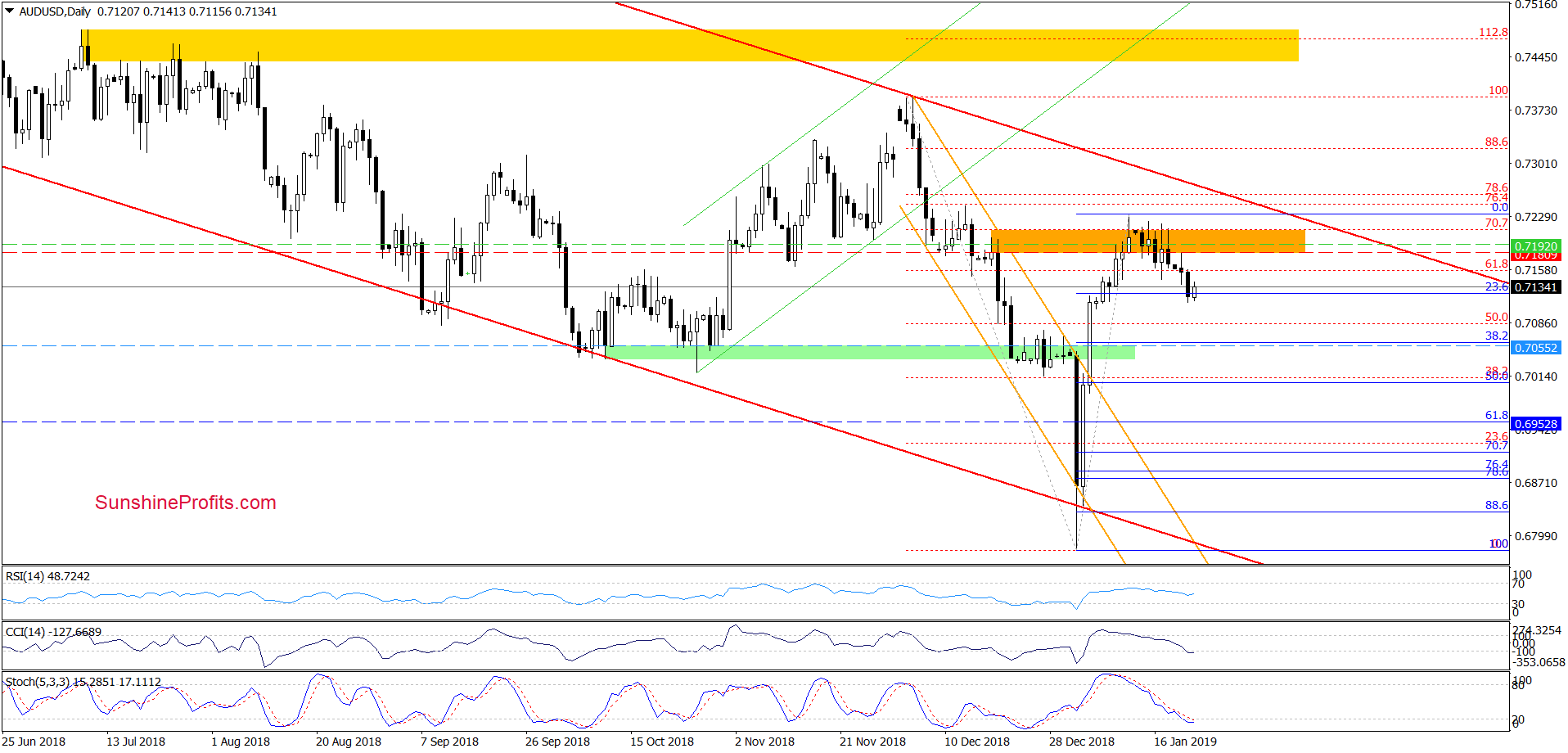

AUD/USD

Looking at the daily chart, we see that currency bears took AUD/USD below the last week’s low during yesterday’s session, making our short positions more profitable. Thanks to yesterday’s price action, the pair slipped and closed the day under the 23.6% Fibonacci retracement, which was a bearish development.

Nevertheless, earlier today, the buyers pushed the exchange rate higher, invalidating yesterday’s breakdown and signaling the willingness to fight for higher levels. Although this is a positive development, we think that it will turn into bullish only if we see a daily closure above the retracement.

Therefore, if currency bulls close the day above the retracement and the indicators (the CCI and the Stochastic Oscillator) generate buy signals, AUD/USD will likely rebound and come back to the orange zone or even climb to the upper border of the red declining trend channel in the following days (if we see such price action, we’ll consider closing our positions and taking profits off the table).

However, we should keep in mind that as long as there no buy signals and the pair is trading between yesterday’s high and low (inside Tuesday’s candle) one more attempt to move lower is still likely. Therefore, if the pair extends losses from current levels, we’ll likely see a test of the 38.2% Fibonacci retracement and the previously-broken green support area in the coming days.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 0.7180 and the initial downside target at 0.7064 are justified from the risk/reward perspective. Why there? Considering today’s price action, we decided to lower our stop-loss order to slightly below our entry level (to protect the trading capital) and increase our initial downside target above the 38.2% Fibonacci retracement. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager