When managing any trade, one must be nimble and consider the most recent action. The question is: does it make us reevaluate the open trade or should we keep our position unchanged? Please join us in carefully assessing the situation and the action(s) to take.

- EUR/USD:half of short positions (a stop-loss order at 1.1338; the next downside target at 1.1240). In other word, half of our profitable short positions were closed with a profit

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041)

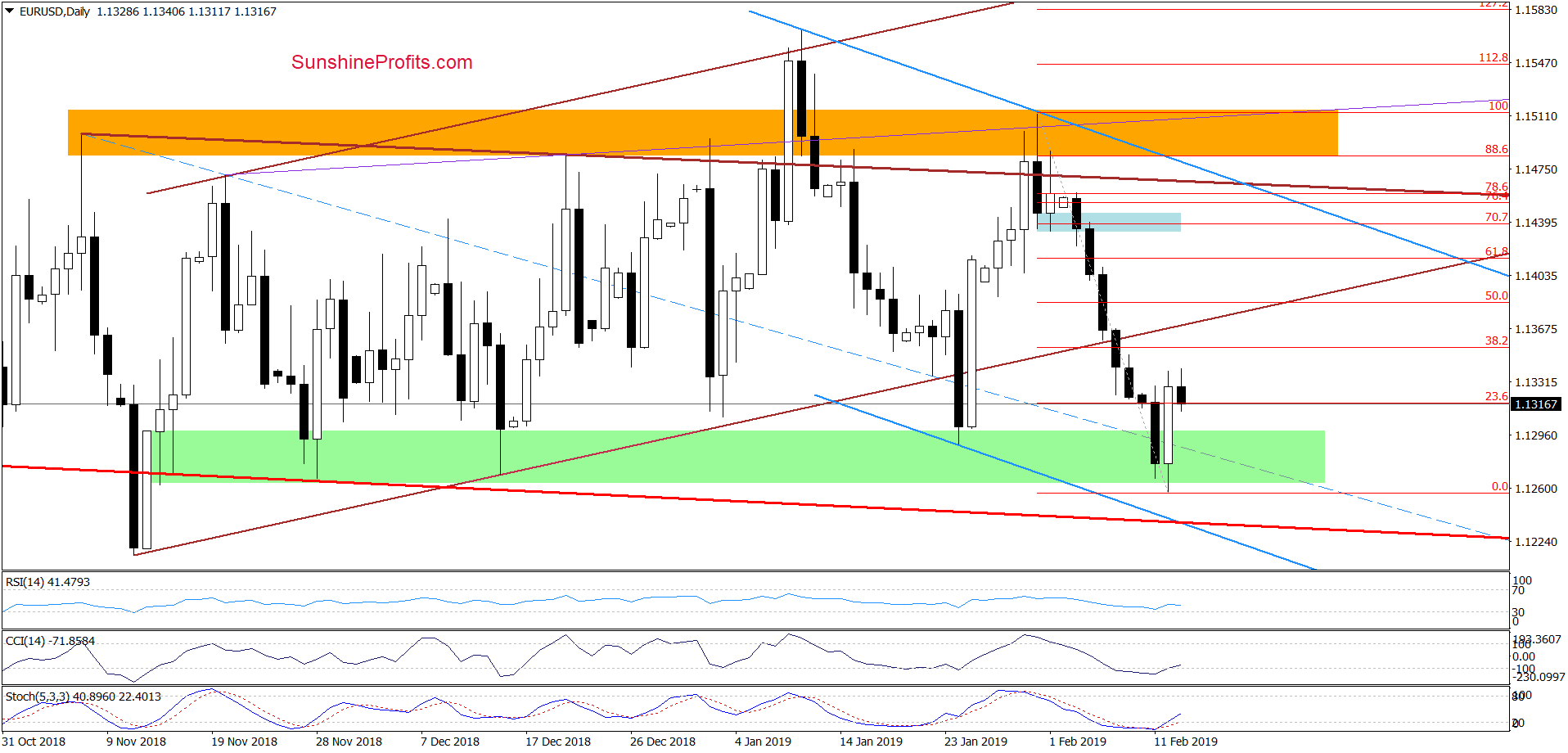

EUR/USD

Yesterday, EUR/USD moved sharply higher and reached our stop-loss order. This closed the short positions with a profit. In a situation like this, it’s prudent to see first the staying power of the upside momentum before putting the capital to work again. Capital is simply too precious to remain always invested in the markets – it’s best to choose only the strongest moments to go in.

We have one right now as currency bulls didn’t even manage to reach the 38.2% Fibonacci retracement. Earlier today, there was another unsuccessful attempt at it, which encouraged the sellers to take the pair down to trade at around 1.1310 currently.

The euro turned south, which in combination with the above-mentioned unsuccessful attempts to go higher suggests further deterioration in the coming days. The daily indicators are arrayed in such a way that even the possibility of any short-term resilience coming true would leave them positioned nicely for a subsequent price move down in earnest. If the bearish scenario is indeed the case and the pair declines from here, we’ll likely see (at least) a test of the lower border of the red declining trend channel.

Taking all the above into account, we think that re-opening short positions is justified from the risk/reward perspective. You will find all needed details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1375 and the initial downside target at 1.1242 are justified from the risk/reward perspective.

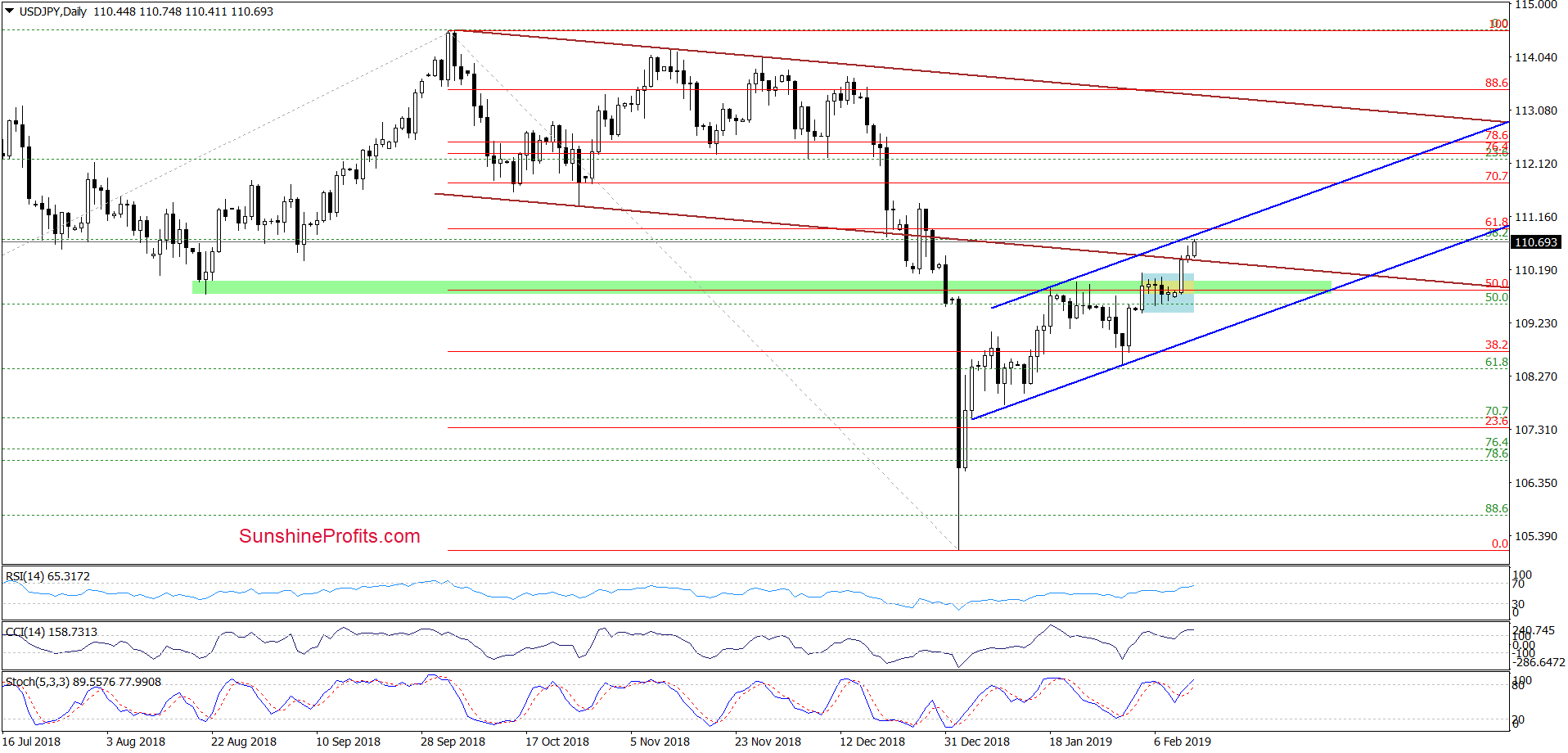

USD/JPY

The first thing that catches the eye on the daily chart is the invalidation of the earlier breakdown below the lower border of the brown declining trend channel. This bullish development triggered further improvement earlier today, which suggests a test of the 61.8% Fibonacci retracement based on the entire October-February downward move.

The 61.8% Fibonacci retracement is reinforced by the upper border of the blue rising trend channel. These both could stop further improvement in the coming days.

Let’s take a look at the daily indicators – both CCI and Stochastics look to have some juice left in that could take them (and the exchange rate) higher still. As long as there are no sell signals generated, higher values of USD/JPY and a test of the late-December peaks can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

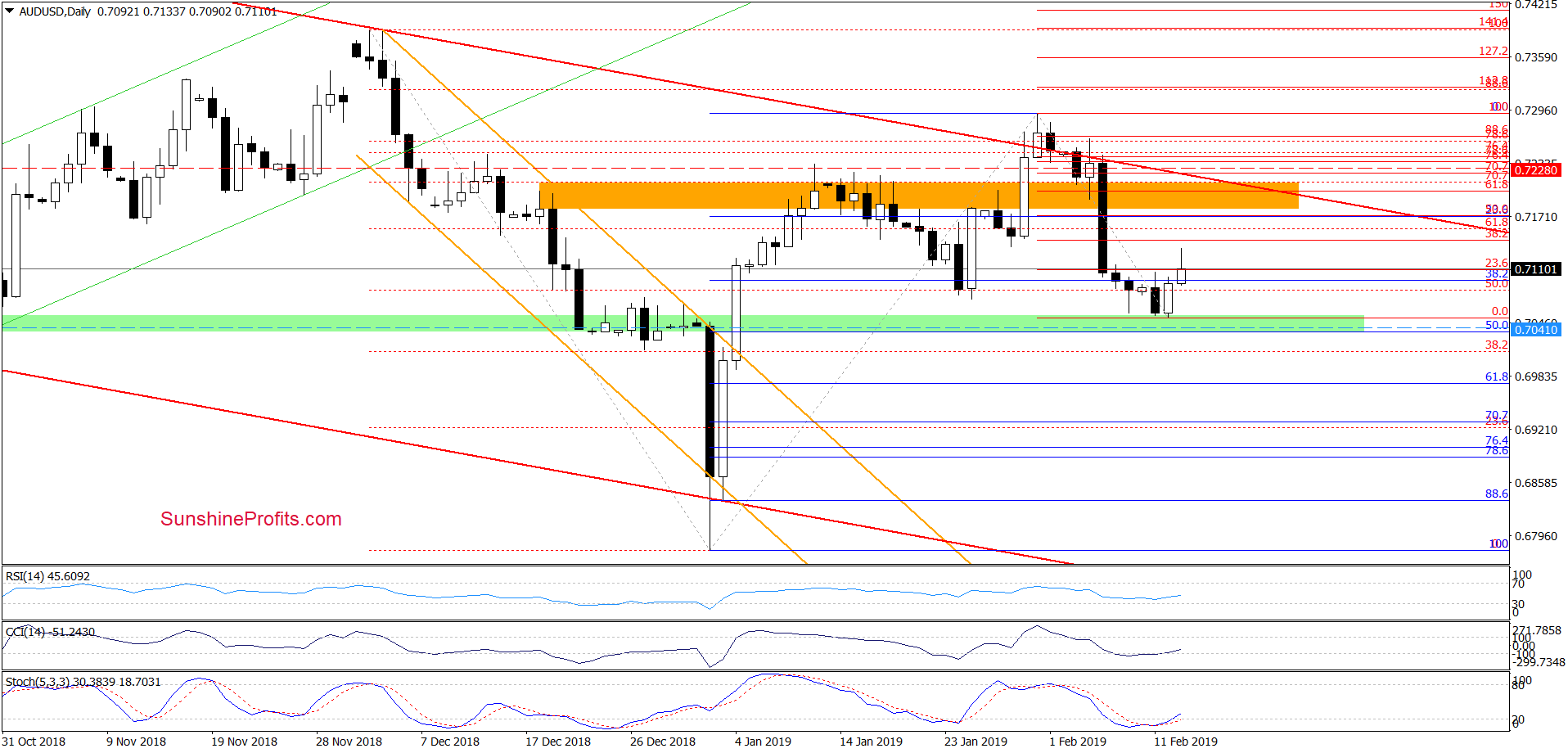

AUD/USD

The weekly situation hasn’t changed since our last commentary:

(…) On the weekly chart, we see an invalidation of the tiny breakout above the upper border of the red declining trend channel at the beginning of the previous week. This triggered a sharp move to the downside.

(…) Additionally, the Stochastic Oscillator flashed the sell signal, increasing the probability of further deterioration in the coming week. It is worth noting that last time we saw a similar reading of the indicator was at the beginning of December, which translated into a decline to fresh multi-month lows at the end of the month.

At the moment of writing these words, the pair trades at around 0.7120 which is well below the upper border of the declining red trend channel. The medium-term bearish outlook is therefore justified.

Let’s focus now on the daily perspective.

We see that the green support zone encouraged the buyers to act in recent days. As a result, AUD/USD moved higher, but the bulls didn’t even manage to reach the 38.2% Fibonacci retracement. This weakness is similar to what we saw in the case of EUR/USD.

It suggests that another attempt to move lower may be around the corner and a re-test of the green support zone (or even a drop to/below our next downside target) should not surprise us in the following day(s). Any possible short-term resilience coming true would still leave the daily indicators lined up nicely for a subsequent price move down in earnest.

Trading position (short-term; our opinion): Half of profitable short positions (with a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist