In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the exit target at 1.3300)

- USD/CHF: none

- AUD/USD: none

EUR/USD

Yesterday, we wrote:

(...) In recent sessions, EUR/USD broke down below the 50% Fibonacci retracement. This has opened the way to the green support zone based on the mid-October lows and the 61.8% Fibonacci retracement.

As both the CCI and the Stochastic Oscillator dropped to their oversold areas, it suggests that reversal may be just around the corner.

The pair had indeed moved lower in line with expectations, testing the green support zone. It went on to rebound, however.

Let's examine the daily indicators. While they're in their oversold areas, the Stochastic Oscillator is on the verge of flashing its buy signal.

Connecting the dots, there is a high probability of a reversal being just around the corner.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

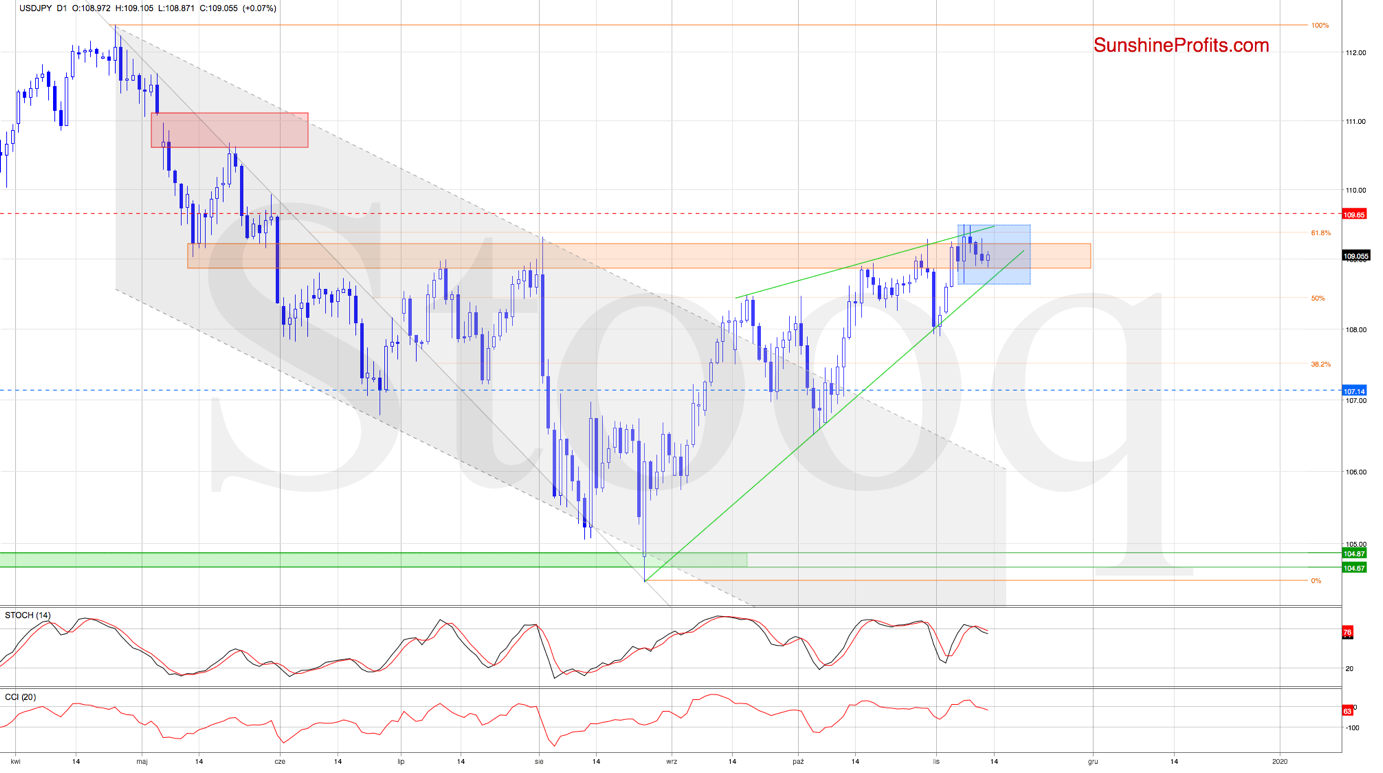

USD/JPY

USD/JPY recently attempted breakout above both the upper border of the rising green wedge, and the upper border of the orange resistance zone. It has been invalidated, though. The fact is that invalidation of a breakout is a bearish development.

Additionally, both the CCI and the Stochastic Oscillator have generated their sell signals, which increases the probability of upcoming deterioration.

The exchange rate is however still trading inside the blue consolidation and the rising green wedge. A bigger move to the downside will be more likely and reliable only if the bears push USD/JPY below the lower borders of both formations.

Should we see such price action, the way to the early-Nov lows will be open.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the initial downside target at 107.14 are justified from the risk/reward perspective.

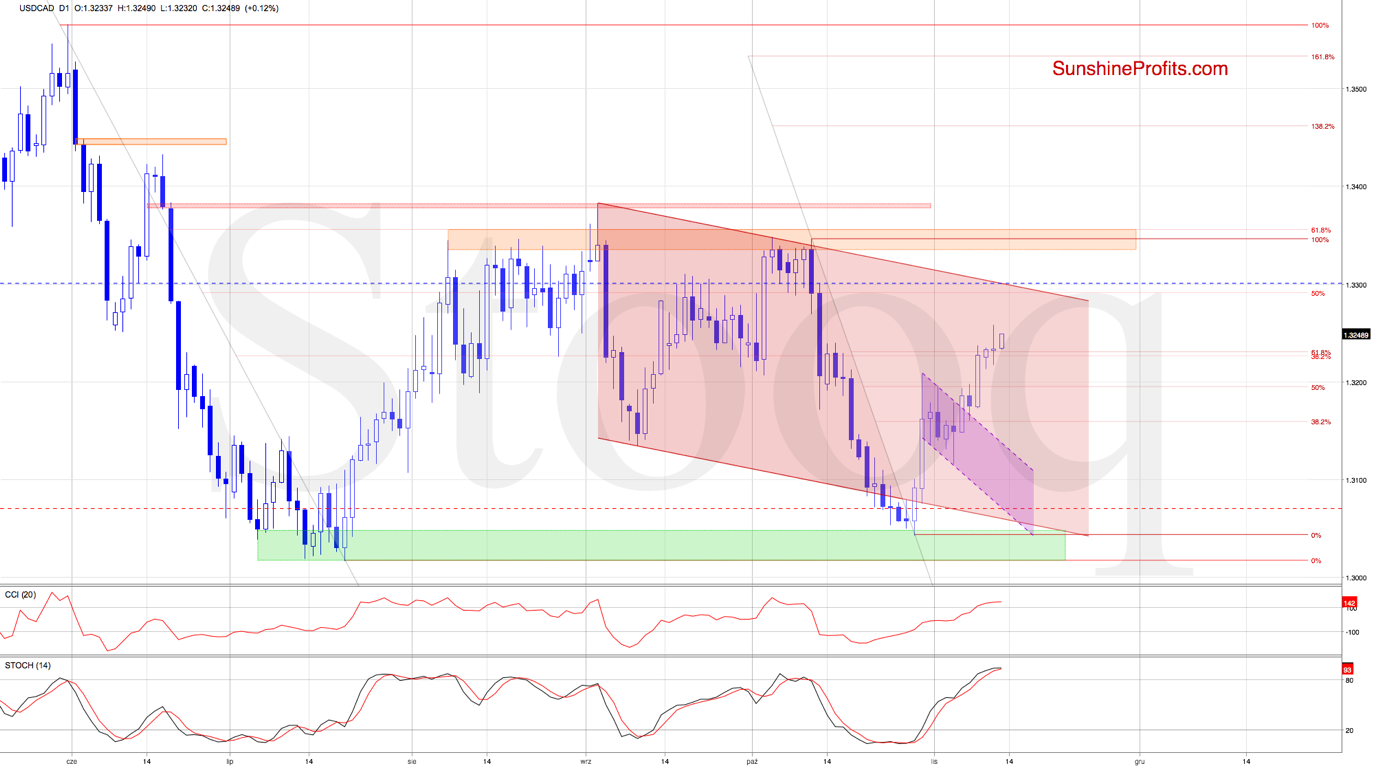

USD/CAD

We've discussed the loonie on Friday, just when the pair spiked higher. What has happened with our profitable open position since then? Have the bulls been able to add to their gains even more?

These were our Friday's observations:

(...) Yesterday brought us verification of the breakout above the declining purple trend channel, suggesting that higher values of USD/CAD are just around the corner.

Should we see the pair rise from here, the first target for the bulls will be the last week's peak and then the 61.8% Fibonacci retracement (at around 1.3232).

The situation indeed developed in tune with the above, and USD/CAD overcame not only the late-Oct high, but also the 61.8% Fibonacci retracement, making our long positions even more profitable.

Despite the pair pulling back yesterday, the bulls managed to keep the price action above the previously broken retracements . This suggests that yesterday's drop could be nothing more than verification of the earlier breakout.

Should it be the case, the way to the 50% Fibonacci retracement (based on the entire May-July decline) or even the upper border of the declining red trend channel may be open.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3070 and the exit target at 1.3300 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist