Traders are back at their desks, and the start of the week has brought us some continuation of Friday's violent moves. More precisely, meek attempts at reversing some of those moves. Below, we'll take a look at these countermoves' chances throughout several key pairs. Such an examination has yielded a fresh short candidate. Let's see what it all means to our trading positions - high time to adjust one of the profitable two.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a fresh stop-loss order at 1.1295; the next downside target at 1.1194)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7072; the initial downside target at 0.6937)

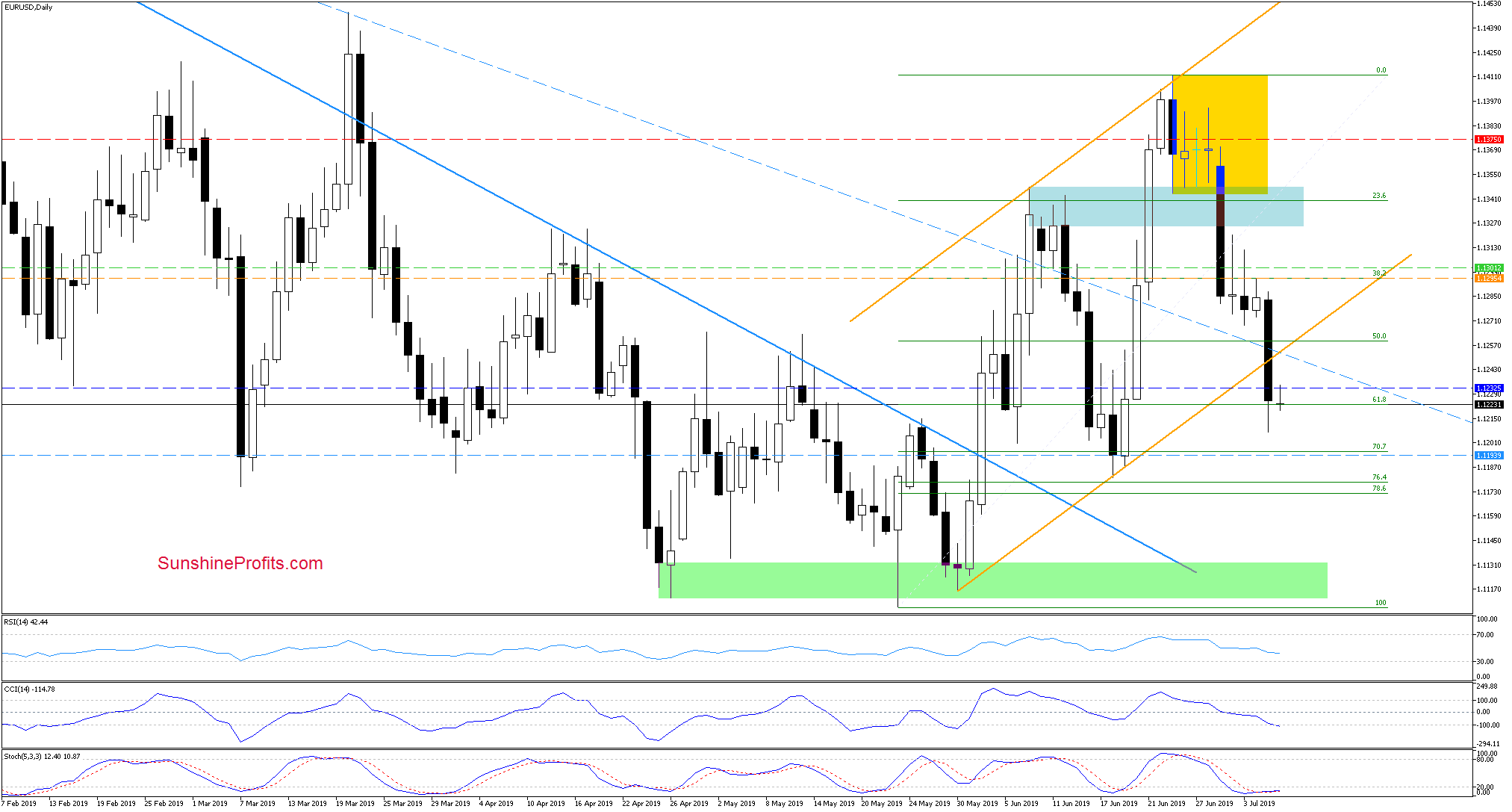

EUR/USD

Spurred by the strong employment data, EUR/USD has moved sharply lower on Friday, breaking down below the lower border of the rising orange trend channel. Additionally, it has also tested the 61.8% Fibonacci retracement (based on the entire May-June upward move).

While this could encourage the bulls to act, all upswings will be nothing more than verifications of the earlier breakdown unless price action reverts back to the orange trend channel. As the daily indicators aren't on any buy signals, a bigger rebound isn't in the cards probably.

Connecting the dots, another downswing is likely just around the corner. If it is indeed the case and the pair goes south from here, a test of the mid-June lows is in short order.

Trading position (short-term; our opinion): Profitable short positions with a fresh stop-loss order at 1.1295 (we decided to move it under our entry level to protect some of the gains) and the next downside target at 1.1194 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

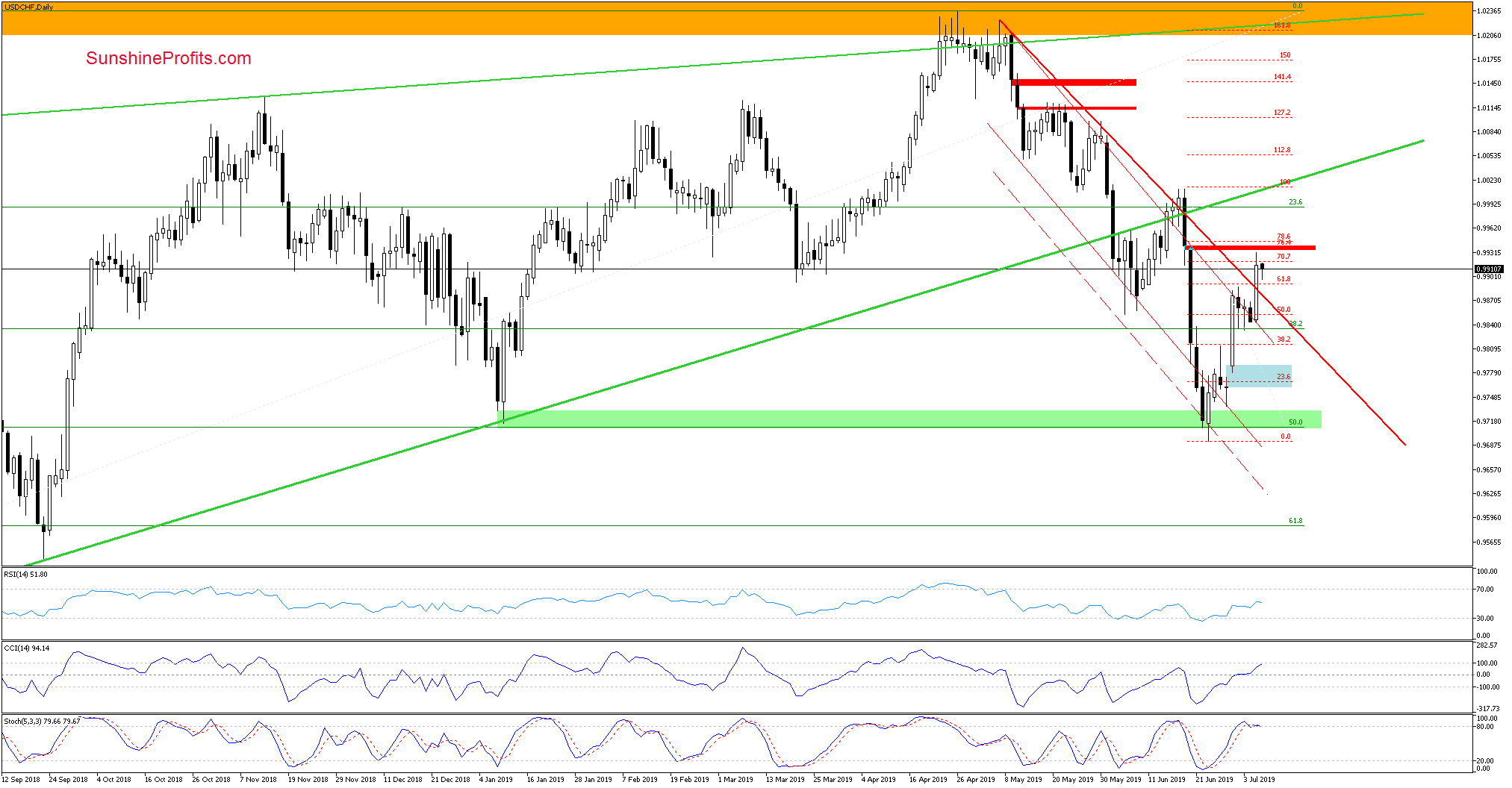

USD/CHF

We wrote these words in our Tuesday's commentary:

(...) the pair has reached the upper border of the declining red trend channel, approaching the 61.8% Fibonacci retracement. As the daily indicators haven't issued any sell signals, it looks likely that the bulls will attempt to reach the next red gap (...) before any correction of this upswing gets a chance to play out.

The bulls have indeed managed to break above the declining red resistance line, and almost reached the red gap. Earlier today however, they appear hesitating.

Should we see their weakness at this resistance, we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

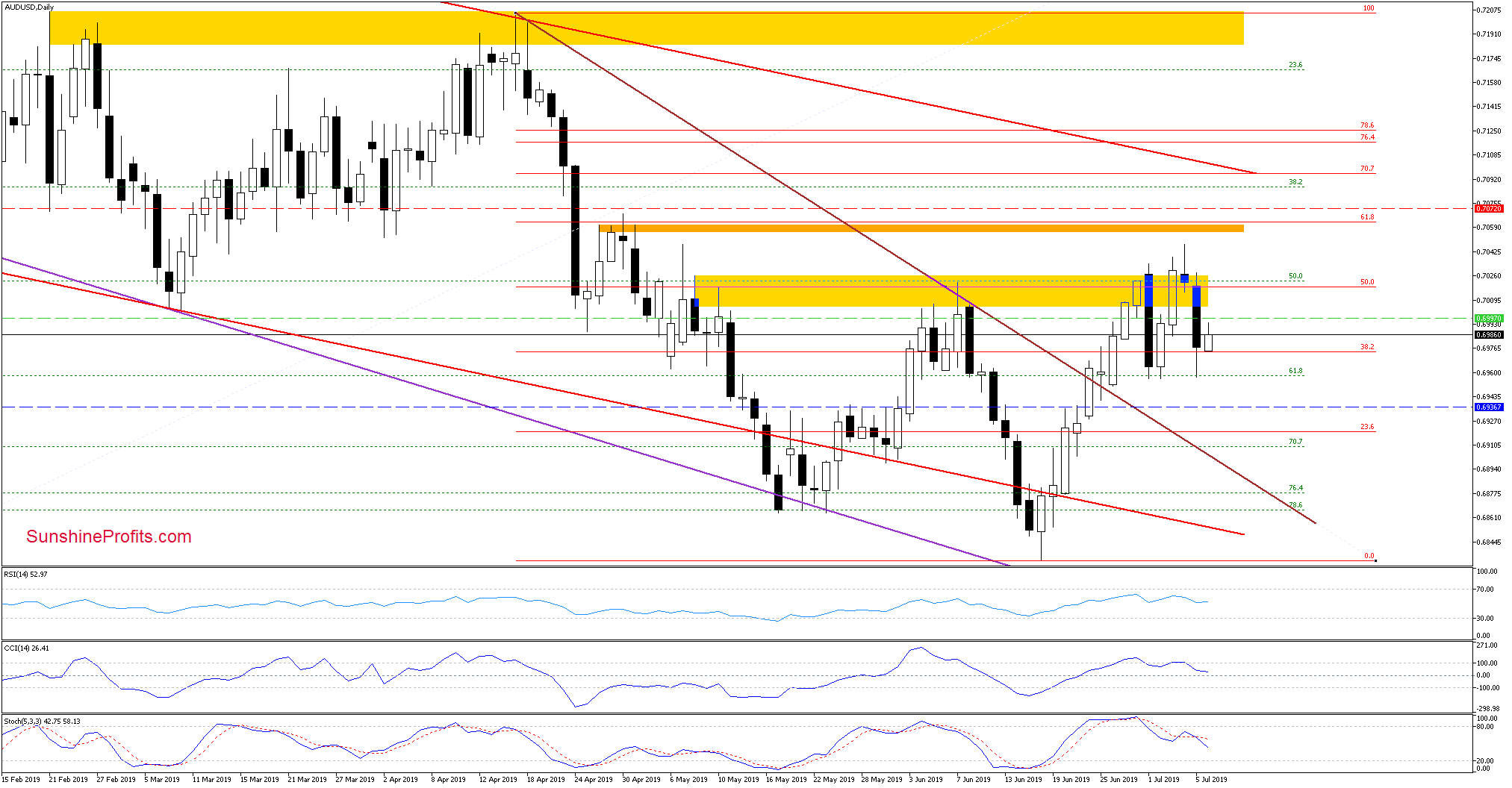

AUD/USD

In the latter half of the previous week, AUD/USD has hit a fresh local high. This improvement proved very temporary, and the pair has moved sharply lower on Friday.

This way, the bears have erased the previous upswing almost in full. This suggests that further deterioration may be just around the corner, which would be supported by the daily indicators' sell signals.

If this is indeed the case and AUD/USD extends losses from here, we'll likely see not only a test of our initial downside target, but possibly even a drop to the previously-broken declining brown resistance-turned-support line (currently at around 0.6904).

Let's examine the weekly perspective for more clues.

As you can see, the pair retested the previously-broken pink dashed resistance line. This is similar to what we saw in mid-April, and suggests that further deterioration is very likely. After all, that would be exactly what we have seen back in April.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.7072 and the initial downside target at 0.6937 (are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the EUR/USD reversal aftermath still continues to favor the bears, and the short position continues being justified. The AUD/USD upswing has fizzled out in the previous week, and both the short- and medium-term outlook favor another downswing. USD/CHF bulls appear to be sputtering and should we see their weakness at the nearest resistance, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist