After a recent bullish run, both the euro and the British pound are consolidating. The same can be said about the Australian dollar. Meanwhile, the Japanese yen is meeting with buying interest - some would say finally. But where does it leave our open positions - what kind of a decision is appropriate today?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0963; the initial upside target at 1.1112)

- GBP/USD: long (a stop-loss order at 1.2139; the initial downside target at 1.2467)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 0.9951; the initial downside target at 0.9768)

- AUD/USD: long (a stop-loss order at 0.6751; the initial upside target at 0.6916)

The short-term situation hasn't changed much, as the pair keeps on trading inside the blue consolidation. Short-lived moves in both directions shouldn't surprise us but as the morning star formation remains at play, it supports the move higher - just as the daily indicators do.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0963 and the initial upside target at 1.1112are justified from the risk/reward perspective.

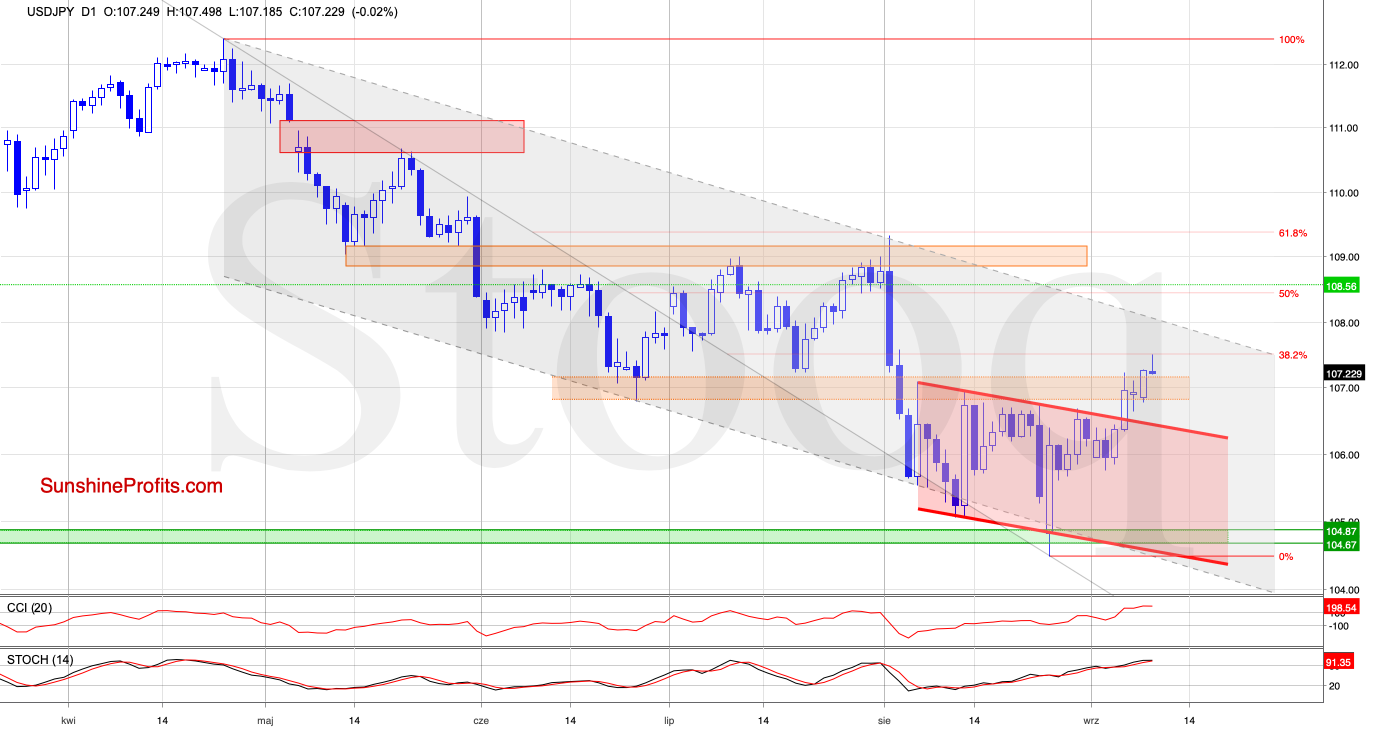

USD/JPY

We've written these words in our Friday's commentary:

(...) USD/JPY has broken above the upper border of the declining red trend channel. It has also tested the orange resistance zone. This is certainly a bullish development.

The daily indicators' buy signals remain on the cards, suggesting a test of the 38.2% Fibonacci retracement in the very near future. On the other hand though, the indicators' high reading also suggests that a reversal (or at least a pullback) may be just around the corner.

The situation developed in line with the above scenario and USD/JPY climbed to the 38.2% Fibonacci retracement. This resistance has also stopped the bulls earlier today, triggering a pullback.

Let's take a look at the daily indicators. As they are in their overbought areas, a reversal may be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

AUD/USD extended gains and broke above the 38.2% Fibonacci retracement, making our long positions more profitable. Yesterday, the bulls approached the next retracement, which encouraged the sellers to act earlier today.

Nevertheless, as long as there are no sell signals, another attempt to move higher is likely and a test of the orange resistance zone created by two important Fibonacci retracements (the 61.8% one and the 38.2% one based on the entire 2019 decline) can't be ruled out in the very near future.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.6751 and the initial upside target at 0.6916are justified from the risk/reward perspective.

Summing up the Alert, the euro and British pound bulls keep up the fight and both long positions remain justified. USD/CHF appears rolling over to the downside, and the short position also remains justified. AUD/USD has taken a breather today but the daily indicators still favor continuation of the move higher. The profitable long position remains justified from the risk-reward point of view. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist