In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1165)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the exit target at 0.9849)

- AUD/USD: none

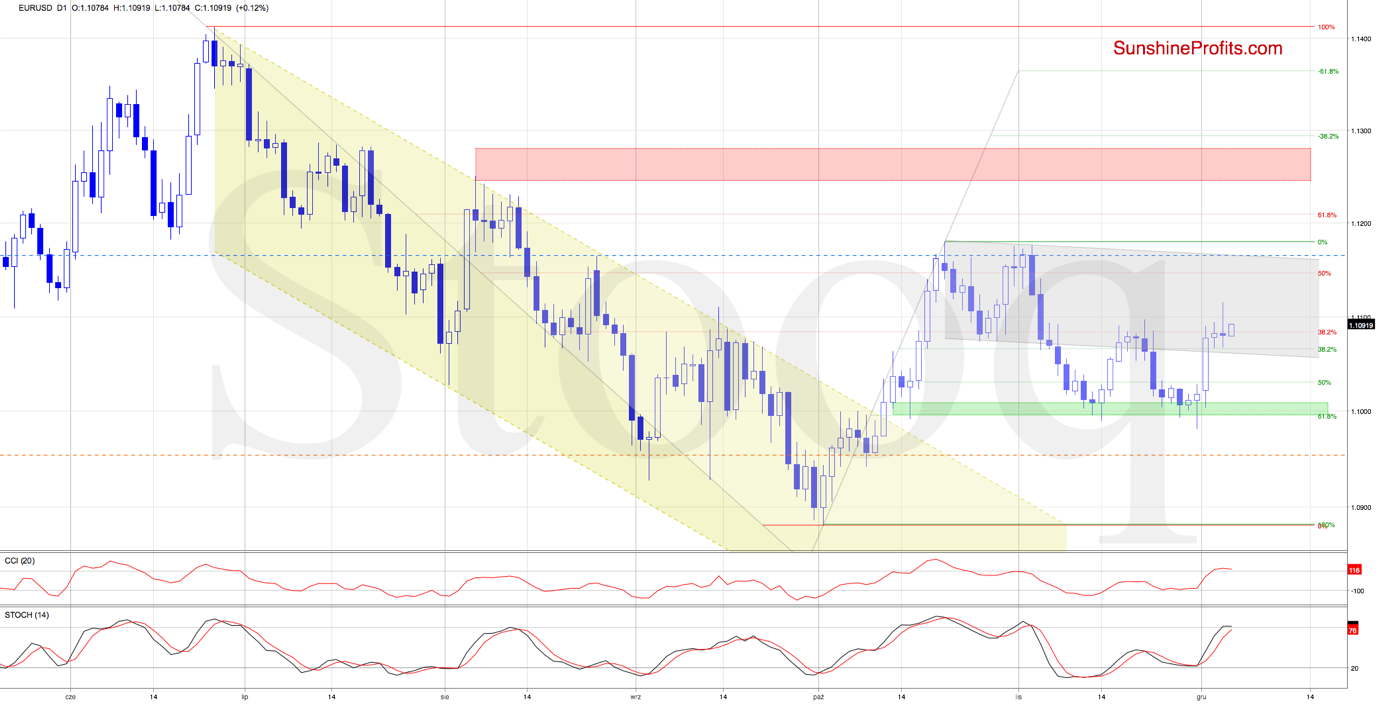

EUR/USD

Yesterday's session brought us quite some back-and-forth trading, and the pair closed almost unchanged. Today though, the bulls are once again in action.

Let's recall our Tuesday's commentary as it is still valid today:

(...) It's our opinion that further rally will be more likely and reliable only if the exchange rate breaks above the late-November peaks.

Should the bulls prove strong enough and overcome that 1.1100 mark, the way to the upper border of the grey trend channel would be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1165 are justified from the risk/reward perspective.

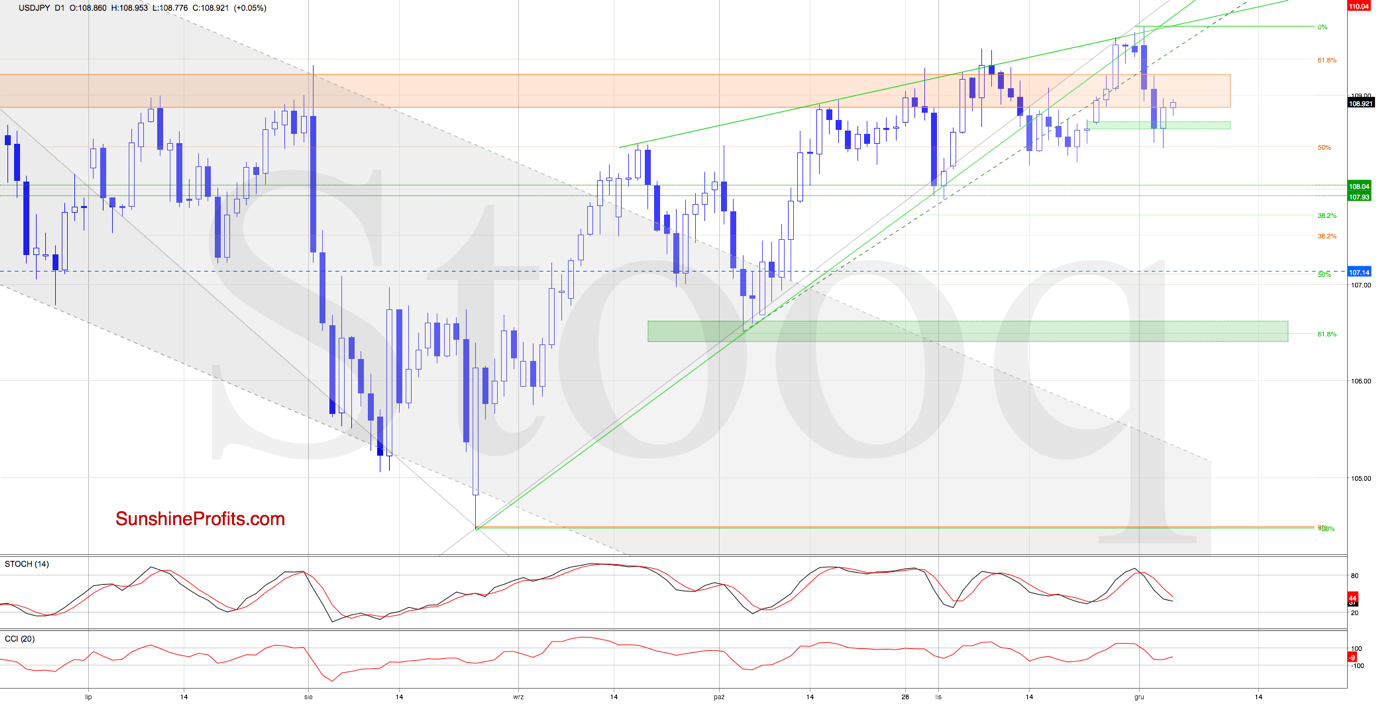

USD/JPY

While USD/JPY moved a bit higher yesterday, the rebound doesn't really compare to the recent declines. Coupled with the sell signals generated by the daily indicators, it suggests further deterioration in the coming days.

A bigger move to the downside will be more likely and reliable only if the pair closes the green gap created on November 25, however.

Should we see such price action, the first downside target for the bears would be around 107.93-108.04. This is where the nearest support area (created by the lows at the turn of Oct and Nov) is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.03 and the initial downside target at 107.14 are justified from the risk/reward perspective.

USD/CHF

After many a days' climb higher, USD/CHF bulls gave up all of their gains in two short sessions. They're making a recovery though, and it's worth asking what are its chances of sticking.

These were our Tuesday's observations regarding USD/CHF:

(...) The pair indeed reversed lower, and invalidated the earlier tiny breakout above both resistances. A sharp move to the downside followed yesterday, and we saw its continuation earlier today too.

Combined with the sell signals generated by the daily indicators, this increases the probability of not only seeing a test of the lower border of the rising green trend channel, but also of a re-test of the green support zone that is based on the late-September, October and early-November lows soon.

The pair went on to slip to our downside targets. The green support area encouraged the bulls to act though, and the exchange rate came back inside the green trend channel. This means invalidation of the earlier breakdown below it.

The sell signals of the daily indicators remain on the cards though, hinting at the high likelihood of another downswing ahead. This is especially so when we factor in the current situation in the USD Index.

Should the pair moves lower from here, we'll likely see a re-test of the green zone or even a move to the Oct 21 low in the very near future.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.0035 and the exit target at 0.9849 are justified from the risk/reward perspective.

Before finishing today's Forex Trading Alert, let's take a closer look at the current situation in the USD Index.

USD Index

In our Forex Trading alert posted on November 19, we wrote the following:

The first thing catching the eye on the above chart, is the invalidation of the tiny breakout above the upper border of the rising yellow trend channel in recent days.

This bearish development triggered further deterioration, and the index slipped recently both to the lower border of the said trend channel and to the previously broken lower border of the declining red trend channel.

While these support lines could encourage the bulls to act, the overall short-term picture and the sell signals generated by the daily indicators suggest that further deterioration is just around the corner.

Should it be the case and the U.S. currency moves lower from here, we'll likely see not only a test of the recent lows, but also a fresh multi-week low and a test of the green support zone based on the mid-April and early May lows. This would be in line with the bullish scenario for EUR/USD and the bearish scenario for USD/JPY and USD/CHF.

The situation developed in tune with the above, and the USD Index not only reached our downside target during yesterday's session, but also broke below it earlier today.

Taking into account this breach of this support and the sell signals of the daily indicators, further deterioration to around 70.77 is likely. This is where the size of the downward move would correspond to the height of the rising yellow trend channel (marked with purple rectangles for your convenience).

If the buyers don't show up here, the way to the next green support zone created by the February and March lows, would be open. Of note, this is where the size of the downward move would correspond to the height of the declining red trend channel (marked with orange rectangles for your convenience).

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist