It looks like another lazy day in the currencies today. On the surface, that is. Many currency pairs are building on their previous movements and are dropping us valuable hints along the way. These make us adjust our trading decisions to reflect on the most recent developments and odds of the next moves. Today, it’s one of those days. It’s never a shame to cash in nice profits (or to protect existing ones) that the market is offering us, is it?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1347 - we moved it lower to protect our open profits; the next downside target at 1.1240)

- GBP/USD: none

- USD/JPY: none (in other words, we decided to close our short positions and take profits off the table – more info about this currency pair you will find in our Thursday’s Alert)

- USD/CAD: long (a stop-loss order at 1.3228; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

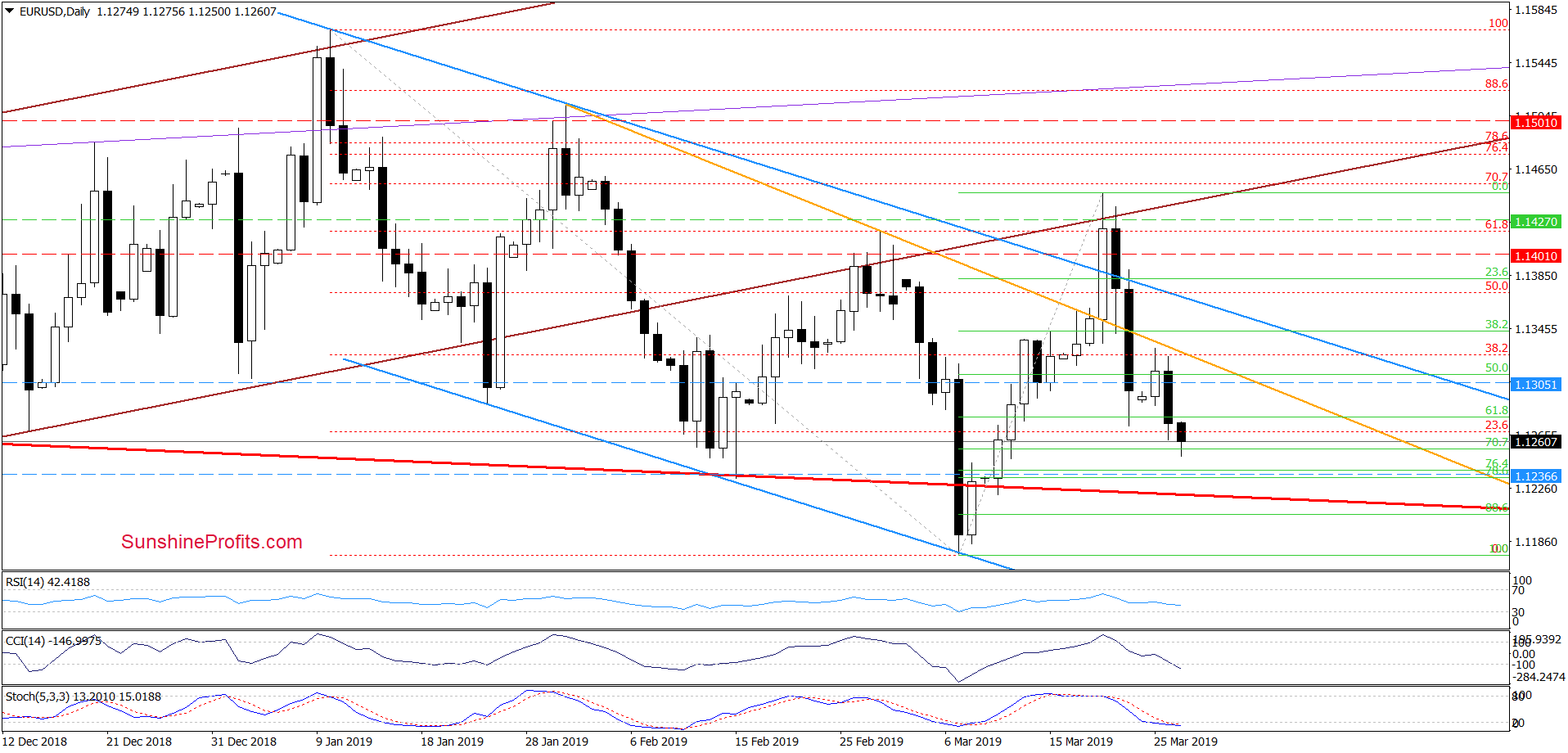

EUR/USD

Yesterday, we have noted that the downswing is on track to more than erase Monday’s modest correction higher. Indeed, the pair continued to slide and has further extended losses earlier today. It increases the probability that we’ll see a realization of the bearish scenario about which we wrote on Friday:

(…) If the situation develops in tune with this assumption, EUR/USD will extend losses and test the next Fibonacci retracement or even the lower border of the long-term red declining trend channel (currently at around 1.1232) in the coming week.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1347 (we moved it lower to protect our open profits) and the next downside target at 1.1240 are justified from the risk/reward perspective.

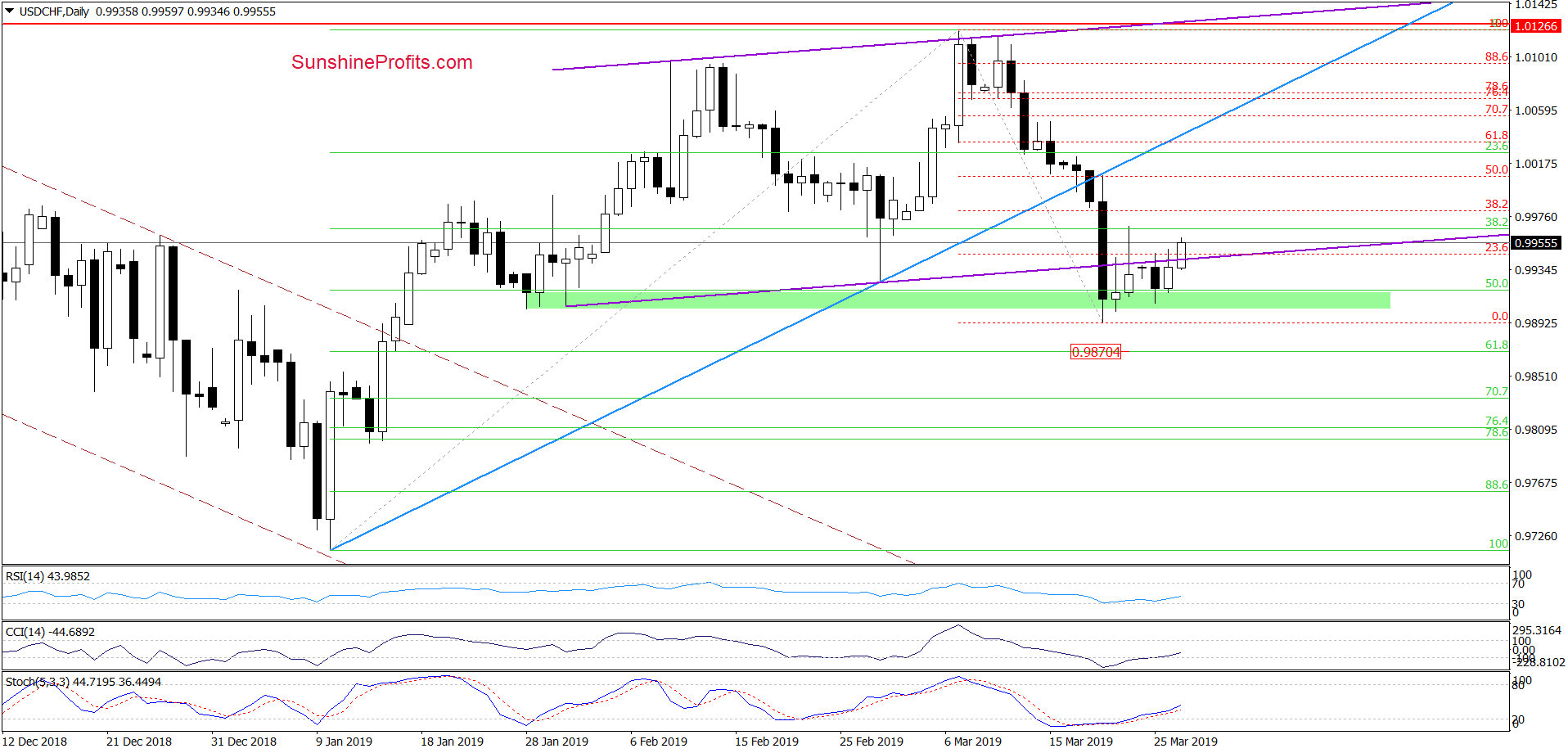

USD/CHF

In quite a few recent sessions, the price action (as viewed by the closing prices) remained confined by the green support zone and the lower border of the rising purple trend channel. Attempts to take the pair any lower have fizzled out.

Examining the attempts to go north, we’ve just seen the fourth unsuccessful attempt in a row to invalidate the breakdown below the lower border of the rising purple trend channel. However, the daily indicators (we’re looking at you, CCI and Stochastics) are flashing their buy signals as earlier today, the bulls took the exchange rate higher. This increases the probability that today they will eventually succeed and the above-mentioned daily indicators will keep flashing their buy signals on a closing basis, too.

If this is indeed the case and USD/CHF closes today’s session above the purple line, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective but if USD/CHF closes today’s session above the purple line, we’ll consider opening long positions.

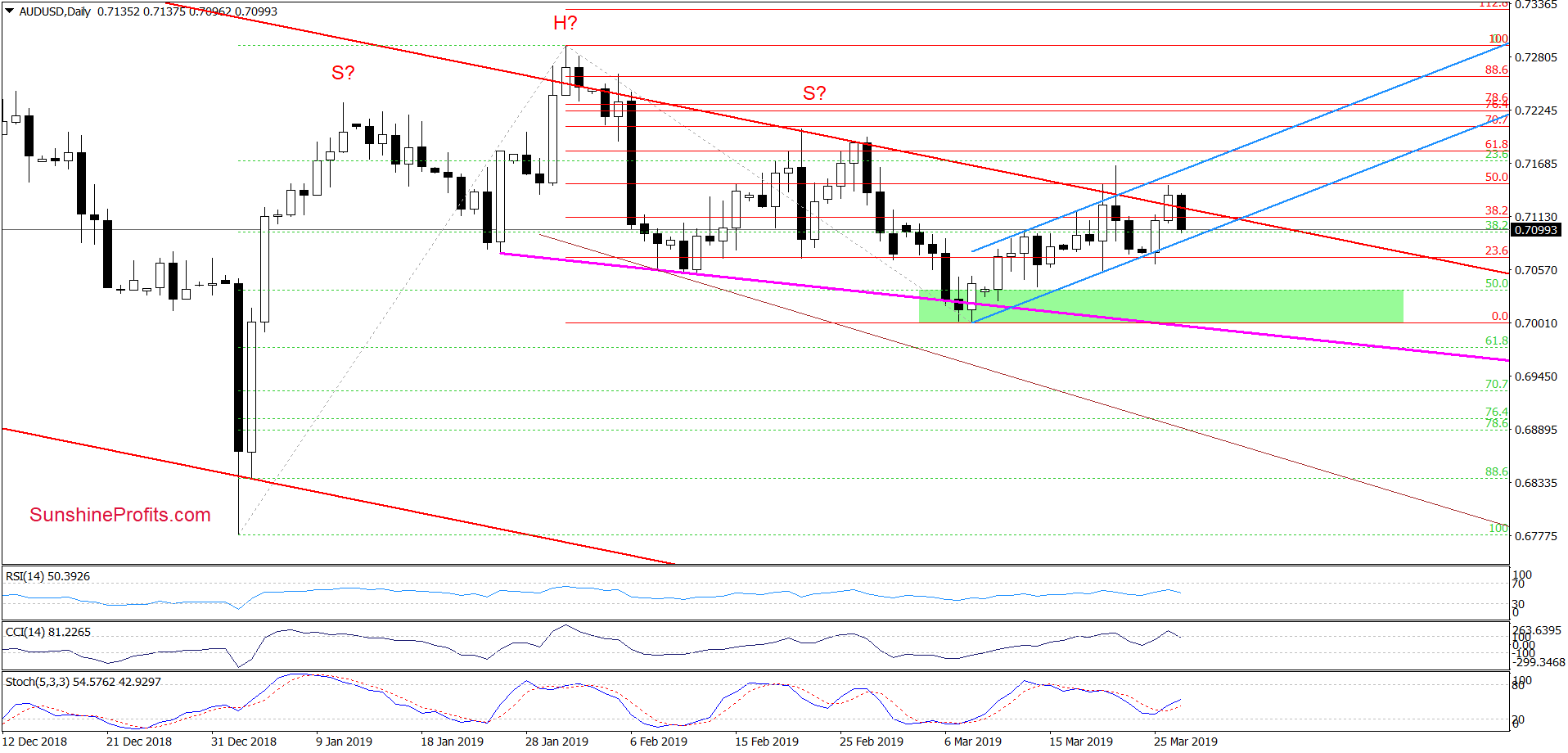

AUD/USD

Looking at the daily chart, we see that AUD/USD broke above the upper border of the declining red trend channel yesterday. The bullish turn of events didn’t last long and today’s price action (the pair currently trades at around 0.7105) looks like another invalidation of the breakout. This is similar to what we have seen in the previous week.

Additionally, the CCI issued its sell signal yet again, supporting the sellers. The Stochastics Oscillator looks like it needs a bit more time and a corresponding downside price action to join in with its own sell signal though. Should the pair drop below the lower border of the very short-term rising blue trend channel, the way to the green support zone will be open and we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective but if AUD/USD drops below the lower border of the very short-term rising blue trend channel, we’ll consider opening short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist