The currency markets have woken up to a stormy Monday, with the euro recovering sharply. The Japanese yen and the Swiss franc have also made quite a move. And good news is that we were there. All the above lead us to these important open position adjustments.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a fresh stop-loss order at 1.1203; the exit downside target at 1.0980)

- GBP/USD: none

- USD/JPY: short (a fresh stop-loss order at 107.45; the next downside target at 105.60)

- USD/CAD: none

- USD/CHF: short (a fresh stop-loss order at 0.9914; the next downside target at 0.9755)

- AUD/USD: none

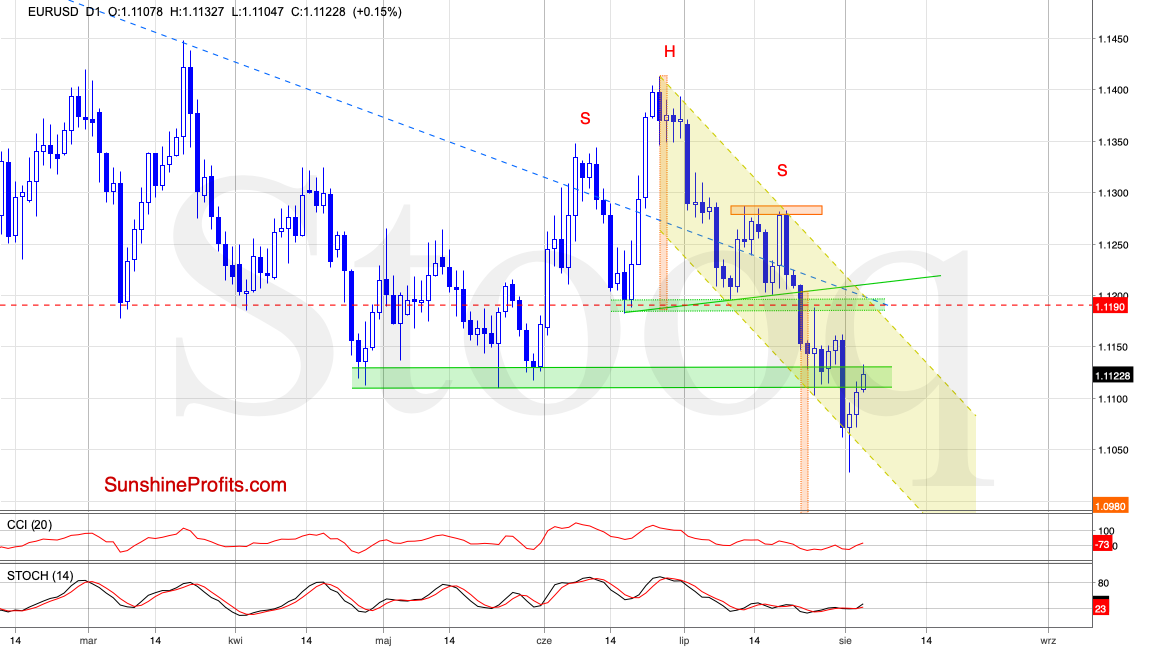

EUR/USD

EUR/USD has extended gains earlier today, overcoming the previously-broken green zone as it trades at around 1.1170 currently. It appears set to challenge the upper green zone (marked by the mid-June lows), which continues to serve as the nearest resistance.

Today's show of the bulls' strength is the reason behind tightening our stop-loss order. All details below.

Trading position (short-term; our opinion): short positions with a fresh stop-loss order at 1.1203 (we decided to move it higher above the next resistance area in the case of a potential test of the last week's peaks) and the exit downside target at 1.0980 are justified from the risk/reward perspective.

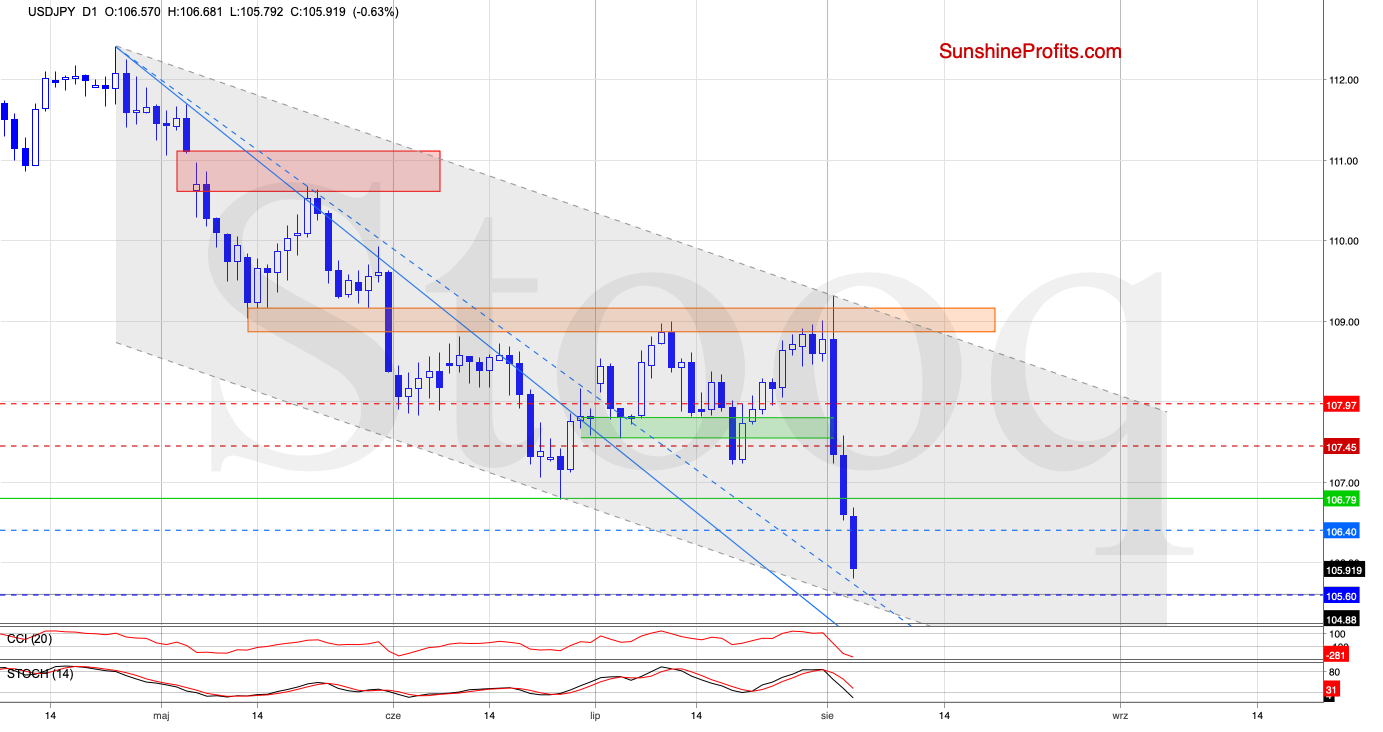

USD/JPY

On Friday, USD/JPY extended losses and closed the day below the June low. As it marks also the weekly close, it's one more reason why the way to lower levels remains open. Earlier today, the sellers pushed the exchange rate lower still, making our short positions even more profitable.

How low could the pair go?

The next downside target for the bears will be the lower border of the grey declining trend channel (currently at around 105.60). It's our opinion that if the pair reaches this support, the buyers could become more active. Therefore, if USD/JPY declines to our next downside target, we will close 50% of our short positions and take profits off the table (as a reminder, we opened them when USD/JPY was trading around 109).

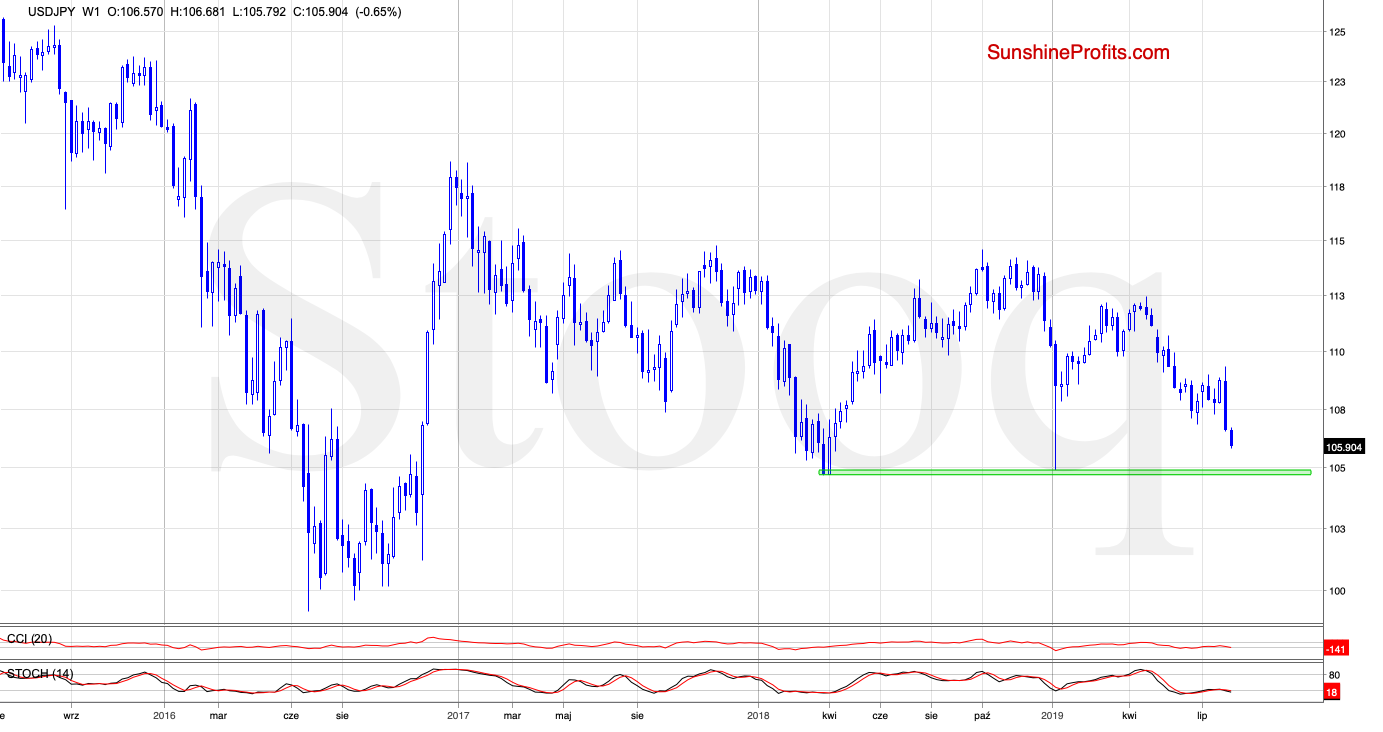

However, taking into account the sell signals generated by the indicators (they still have more room to decline), further deterioration is still likely ahead of us. Should it be the case, USD/JPY could even test the support area (marked on the weekly chart below) created by the late-March 2018, the early-April 2018 and early-June 2019 lows.

Trading position (short-term; our opinion): already profitable short positions with a fresh stop-loss order at 107.45 (we decided to lower it to protect another part of our gains) and the next downside target at 105.60 (at this level, we will close 50% of our short positions and take profits off the table) are justified from the risk/reward perspective. However, if the pair moves below the lower border of the grey declining trend channel, the next downside target for remaining 50% of short positions will be at 104.90 (slightly above the February 2019 low).

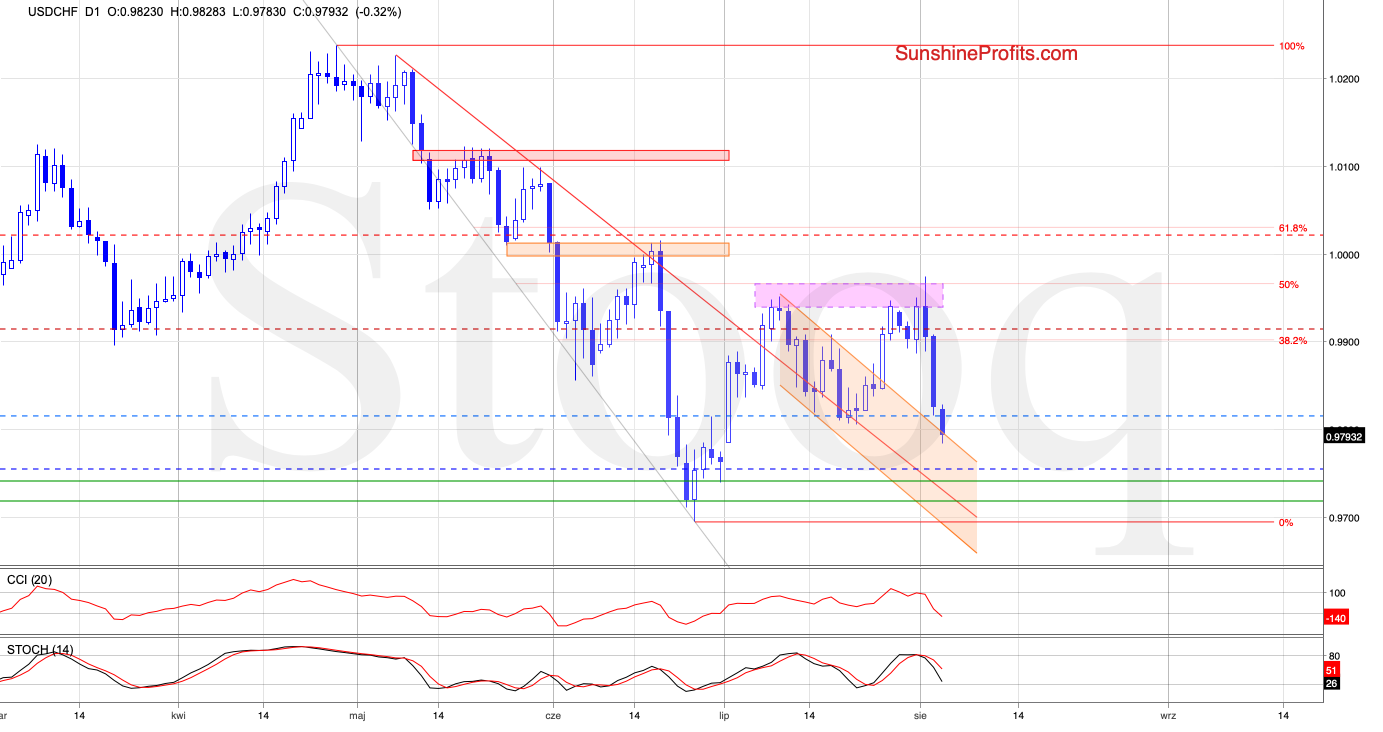

USD/CHF

On Friday, USD/CHF moved sharply lower, approaching the support area based on the July lows. This also marks the pair reaching our downside target. Despite the proximity to this zone, the sellers pushed the exchange rate lower earlier today, making our short positions even more profitable.

Thanks to today's downswing, the pair also slipped below the previously-broken upper border of the orange declining trend channel, giving the bears another reason to act. The sell signals remain on the cards, suggesting further deterioration is still ahead of us.

How low could the pair go? The next target for the sellers will be the support area created by the June lows (marked with two green lines on the above chart).

Trading position (short-term; our opinion): already profitable short positions with a fresh stop-loss order at 0.9914 (we lowered it below our entry level to protect our capital) and the next downside target at 0.9755 are justified from the risk/reward perspective.

Summing up the Alert, the euro upswing has overcome its first important resistance, leading us to tighten the stop-loss. USD/JPY downswing continues unabated, and warrants being on the lookout of cashing out part of our enormous earlier gains should it reach our downside target. USD/CHF has also declined powerfully on Friday and earlier today - the short position remains justified, again calling for adjusting the trade parameters. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist