In our opinion, the following forex trading positions are justified - summary:

- EUR/USD:none

- GBP/USD: long (a stop-loss order at 1.2802; the initial upside target at 1.3312)

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Like a phoenix from the ashes, the euro has risen recently - and quite sharply so. Does it portend more strength ahead, or what exactly can we expect ahead? The answer features our game plan for the scenario ahead...

Let's recall our Friday's analysis:

(...) EUR/USD moved sharply higher earlier today, breaking out above the declining black resistance line that is based on its previous peaks. This move also brought us invalidation of the earlier breakdown below the lower border of the blue consolidation, while the Stochastic Oscillator generated its buy signal.

Taking the above developments into account, it seems probable that we'll see further improvement and a test of the lower arm of the black triangle, of the upper border of the declining grey trend channel or even of the recent peaks at the upper border of the blue consolidation.

The situation developed in tune with the above, and EUR/USD reached both resistances on Friday and earlier today. The move also took the pair to both the red resistance zone and the 61.8% Fibonacci retracement, suggesting that we could see a downward reversal in the very near future.

But what about the daily indicators? The Stochastic Oscillator has generated its buy signal, and there is still some upside potential in it. The best course of action would be to observe the exchange rate and in case we would see reliable signs of the bulls' weakness, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

GBP/USD

As the pair has been declining to the proximity of the green support zone, we noted in our analysis:

(...) let's keep in mind that the pair approached the green support zone created by the upper border of the purple consolidation and the previous peaks.

The situation has developed in tune with the above, and GBP/USD bounced off these supports. The resulting upswing means invalidation of the earlier breakdown below the blue consolidation. This is certainly a positive event for the bulls.

Additionally, the Stochastic Oscillator has just flashed its buy signal, and the CCI turned up. These signal tailwinds for the buyers.

Taking all the above into account, there's a high likelihood of further improvement just around the corner, and opening long positions is thus justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.2802 and the initial upside target at 1.3312 are justified from the risk/reward perspective.

USD/JPY

At the above USD/JPY chart, the first thing that catches the eye, is the breakdown below the lower border of the blue consolidation. The move lower is supported by the CCI and Stochastic Oscillator's sell signals - these increase the likelihood of further deterioration in the coming days.

Let's recall our latest observations as they're still up-to-date:

(...) the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by the early December lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.40 and the initial downside target at 108.04 are justified from the risk/reward perspective.

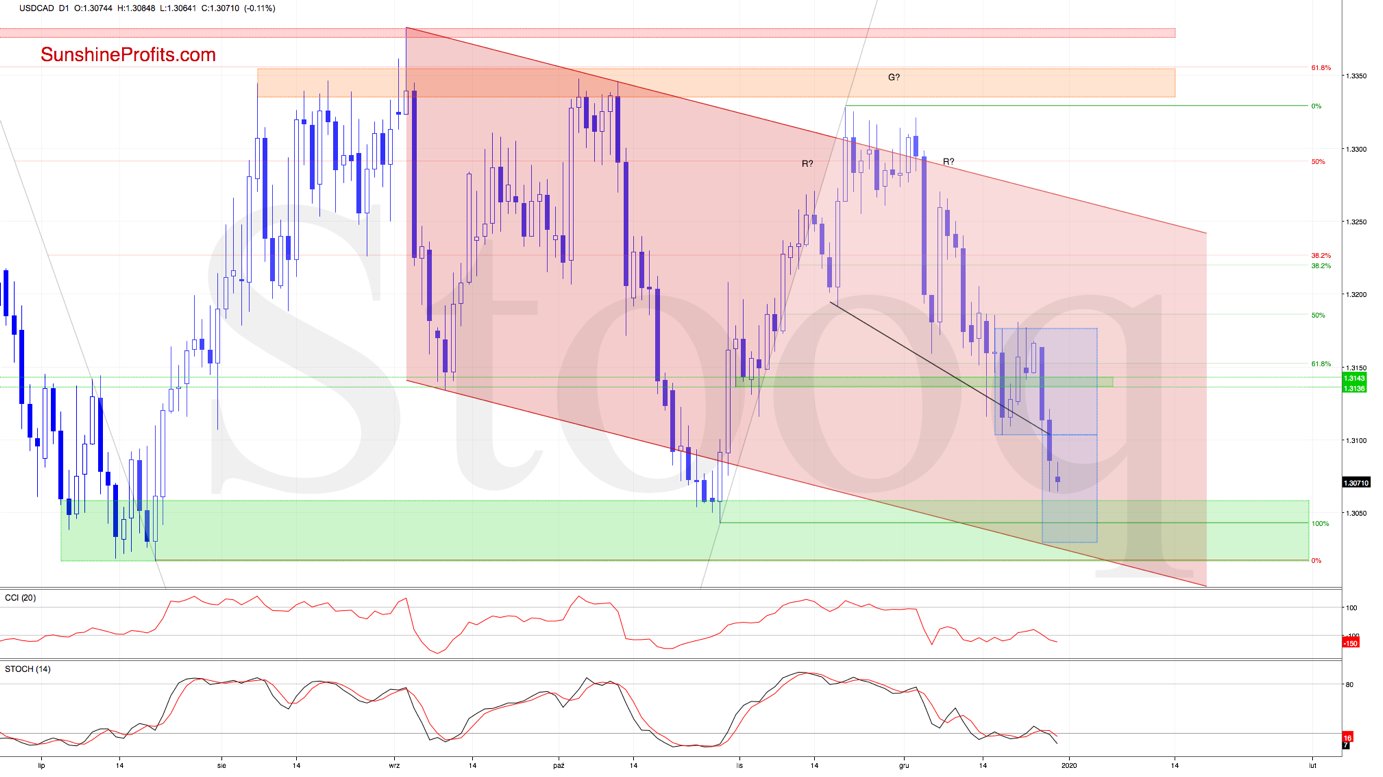

USD/CAD

USD/CAD moved sharply lower in recent days, approaching the lower border of the blue consolidation. Although the bulls tried to go north, they failed, and another downswing followed. It took USD/CAD not only below the lower border of the formation, but also below the black support line based on the previous lows. These form the neck line of a potential head and shoulders formation.

This way, the bears have opened the way to even lower values of the exchange rate, increasing the probability of a test of the green support zone. Additionally, the sellers opened today with a bearish gap, increasing the probability of testing not only the late-October low, but also of the test of the lower border of the declining red trend channel.

But what about the daily indicators? Their current positions suggests that the room for further decline may be limited, and a reversal later this week can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/CHF

USD/CHF broke below the green support zone and the 61.8% Fibonacci retracement once again on Friday, which triggered further deterioration and a breakdown below the recent lows. Additionally, the Stochastic Oscillator issued its sell signal again, suggesting that a test of the next green zone and August lows can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

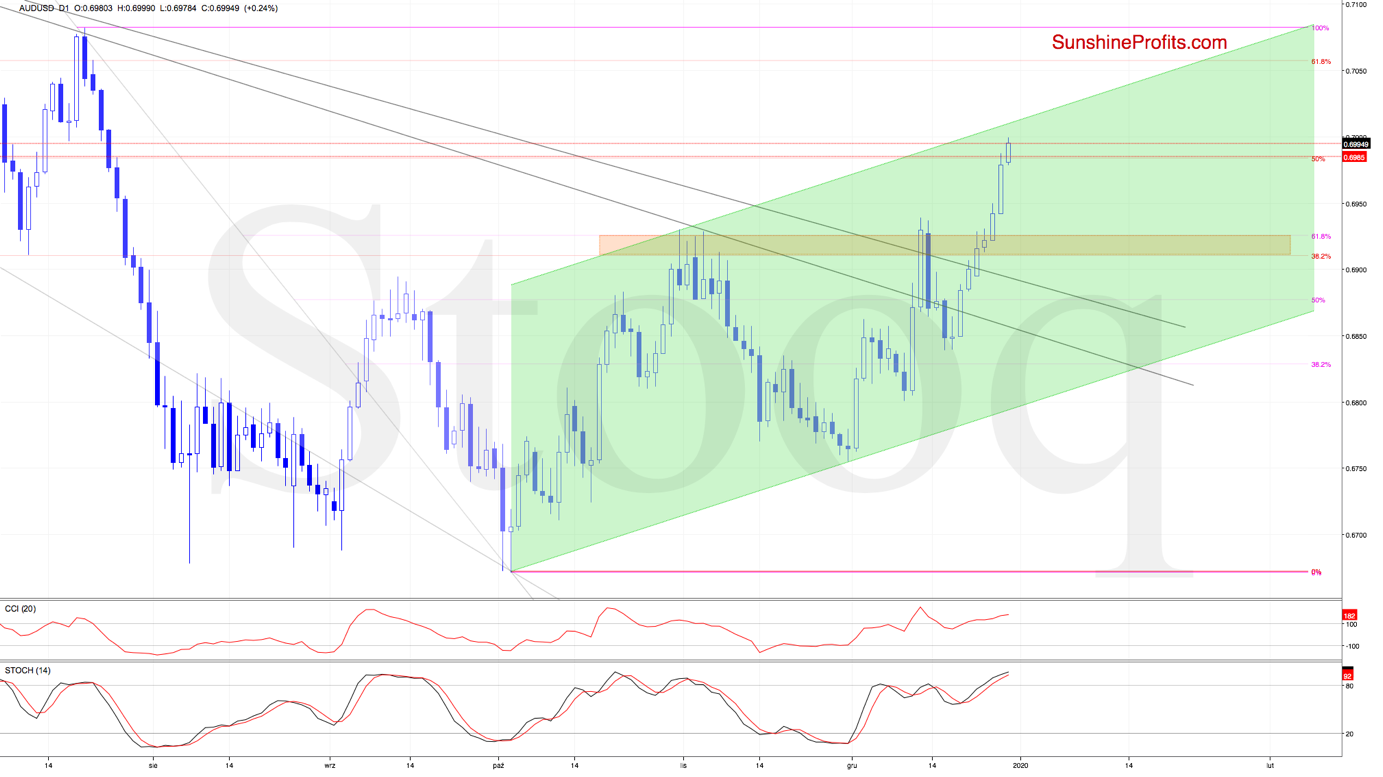

AUD/USD

The immediately noticeable development on the AUD/USD chart is the successful breakout above the orange resistance zone, the previous peaks and the 61.8% Fibonacci retracement. This improvement brought the pair back above the two declining resistance lines, opening the way for further gains and to the resistance zone created by the 76.4% and 78.6% Fibonacci retracements.

Earlier today, the pair reached this area, and as the daily indicators haven't flashed any sell signals, it increases the likelihood of further improvement and a test of the upper border of the rising green trend channel in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist