Euro bulls took the rate higher yesterday only to give up most of their gains earlier today. They say that one swallow doesn’t make a summer. Or are we witnessing a downward reversal, its early stages? After being taken out of the market with a profit, what is the right course of action now? We are proud to present our thorough evaluation of other key developments, too.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none (half our short positions were closed by the stop-loss order at a profit while the previous half was closed at an even greater profit on 7th March)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD:long (a stop-loss order at 1.3247; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

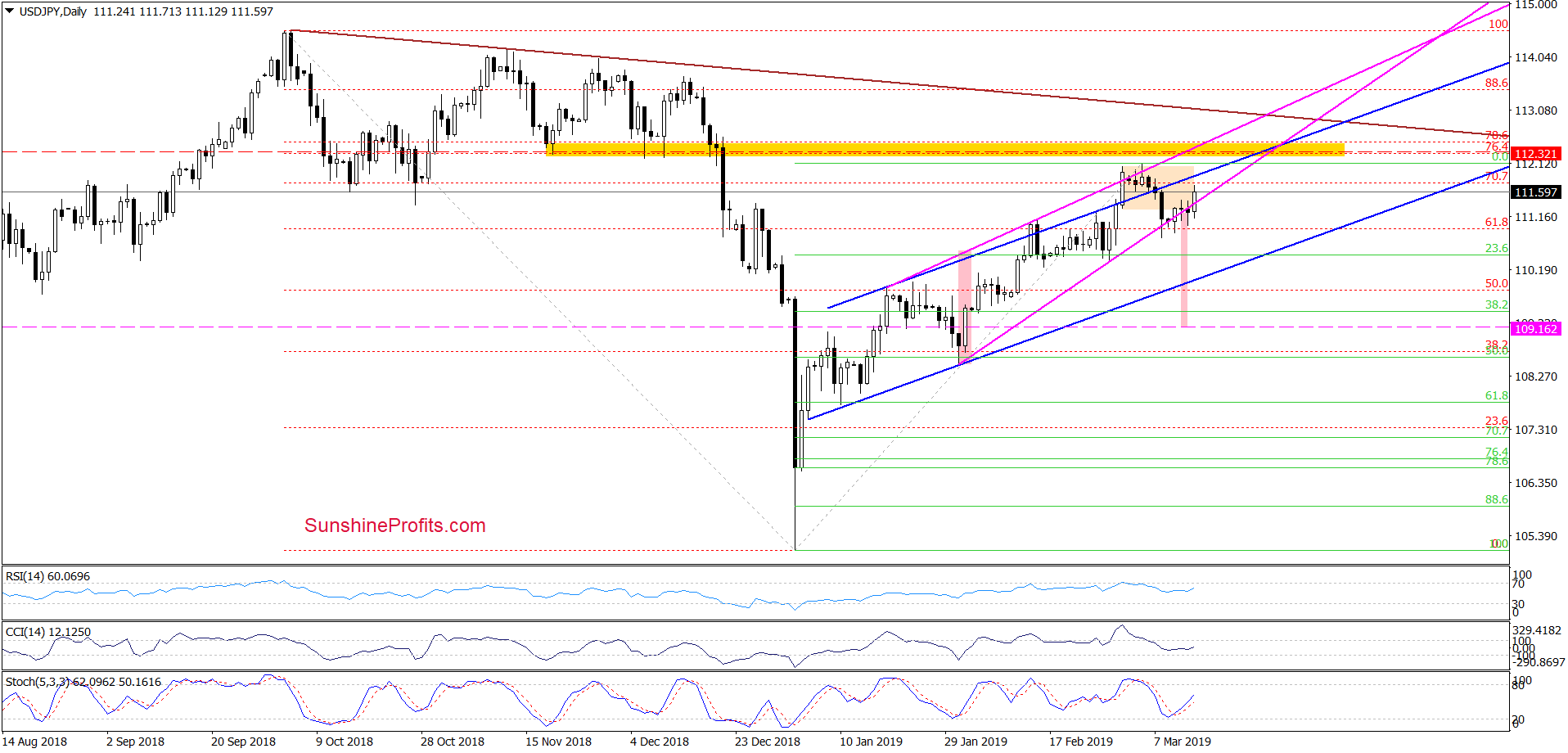

EUR/USD

EUR/USD moved sharply higher yesterday and closed the day above the 38.2% Fibonacci retracement. This activated our stop-loss order and closed the remaining half of our short positions still at a profit. True, the first half was closed at an even greater profit a week ago but one can’t get poorer by cashing any profits, can they?

Earlier today, the pair reversed and invalidated yesterday’s breakout above the 38.2% Fibonacci retracement. This suggests that another attempt to move lower is on the horizon. If we see such price action, the first downside target will be around 1.1275. This is where yesterday’s low and the 38.2% Fibonacci retracement (based on the recent upward move) are.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

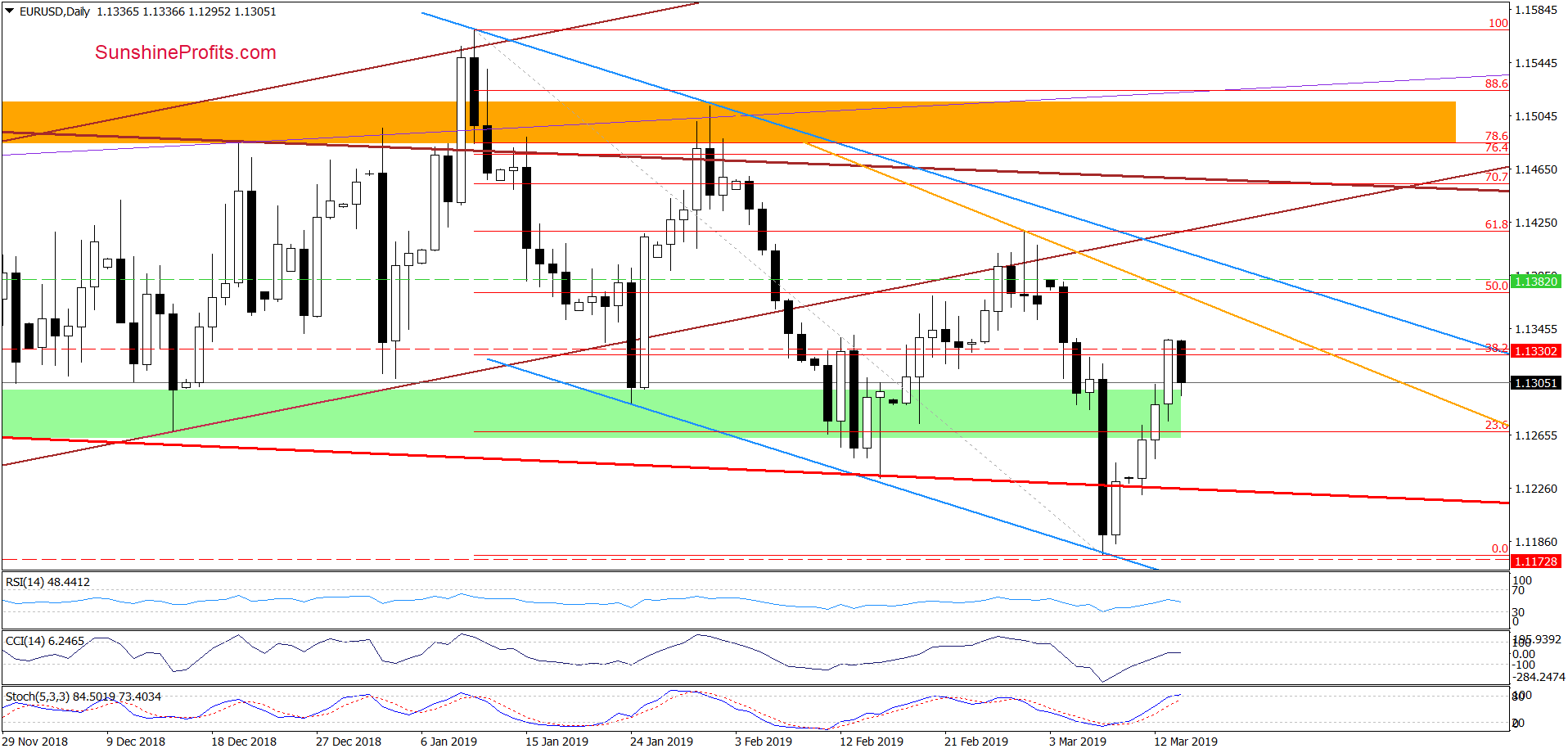

USD/JPY

USD/JPY moved higher earlier today and climbed back above the previously broken lower border of the pink rising wedge, invalidating yesterday’s breakdown. The bulls are fighting hard to keep the price action still inside the pink rising wedge.

Nevertheless, as long as the pair remains below the upper border of the formation, the recent peaks and the yellow resistance zone, another attempt to move lower is still likely and the short position justified by the risk-reward ratio.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 112.32 and the initial downside target at 109.82 are justified from the risk/reward perspective.

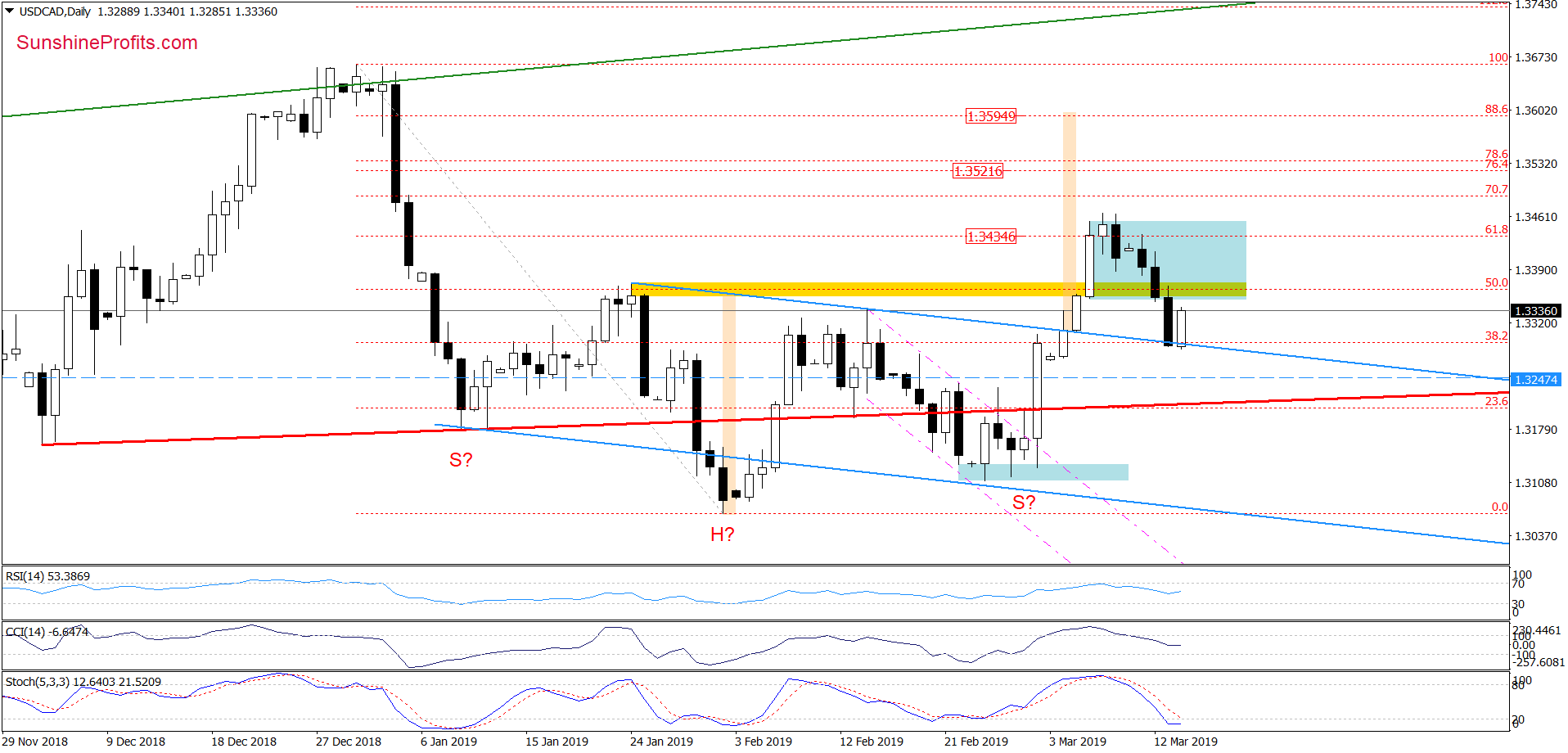

USD/CAD

USD/CAD moved sharply lower yesterday, broke below the yellow support zone and reached the previously broken upper border of the blue declining trend channel. It looked like the yellow support would stop the bears but instead, it was the upper border of the blue declining trend channel that did the job.

Today’s rebound means that the previous decline was most likely just a verification of the earlier breakout above the upper border of the blue declining trend channel. If this is indeed the case, currency bulls will likely not only take the rate to and above the yellow zone, but can also test the recent highs at the upper border of the blue consolidation in the following days.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3247 and the initial upside target at 1.3530 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist