While the euro is taking its time, other currency pairs aren't waiting. And it's there, where our eyes are focused in the search for the next tradable and profitable opportunity. And as it turns out, we don't have to reach out too far to find something interesting...

In our opinion, the following forex trading positions are justified - summary:

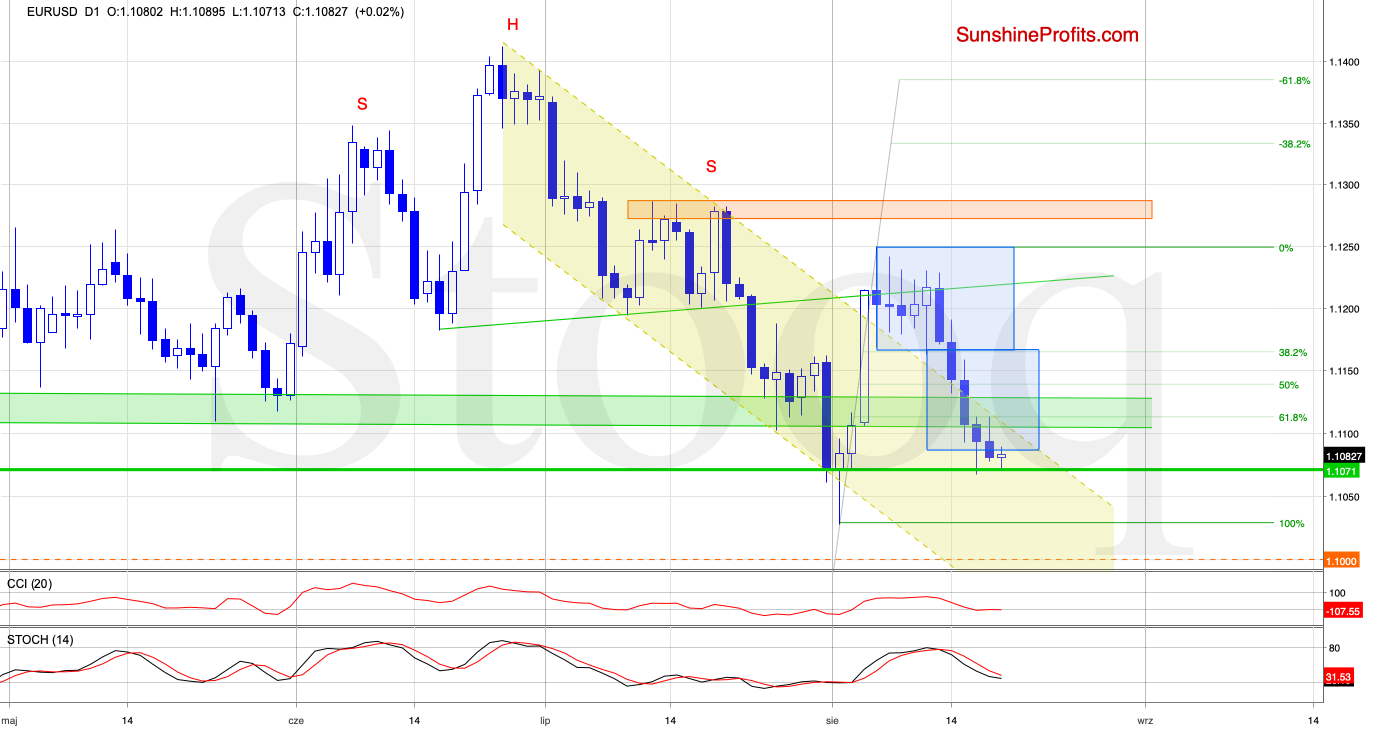

EUR/USD

EUR/USD again moved lower yesterday and also scored losses earlier today, resulting in a retest of the green horizontal support line. Although the pair rebounded slightly in the following hours, the sell signals continue to support the sellers, and our yesterday's observations are up-to-date also today:

(...) the pair also slipped to the area where the size of the downward move corresponded to the height of the blue consolidation, which together encouraged the bulls to act.

Friday's rebound led the bulls to test the previously-broken green area, but this could be nothing more than a verification of the earlier breakdown. This is especially likely when we factor in the continuing sell signals of the daily indicators.

As long as the pair is trading below this green zone, another attempt to move lower can't be ruled out. Should we see such price action, the sellers could test the early-August intraday low or even the psychologically important 1.1000 this week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

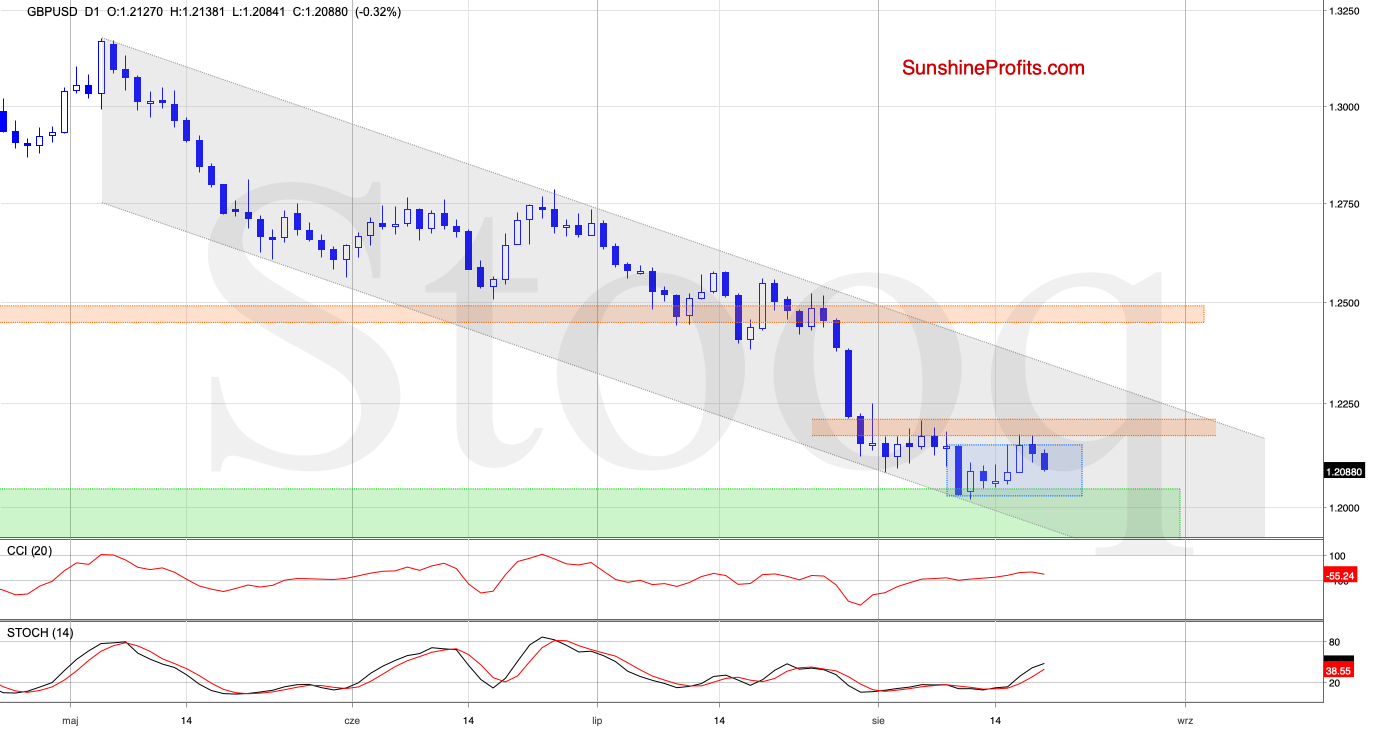

GBP/USD

Although GBP/USD rose on Friday, the bulls didn't manage to break above the orange resistance zone created by the previous peaks. The buyers tried once more yesterday, yet failed again - and the pair pulled back.

This show of weakness triggered further deterioration earlier today, which suggests that we could see a retest of the green support zone and the lower border of the blue consolidation in the coming day(s).

As long as there is no breakout above the upper border of the formation and the orange resistance zone, or a breakdown below the above-mentioned supports, a bigger move in either direction is not likely to be seen. Short-lived moves in both directions should not surprise us.

Nevertheless, should we see a breakout/breakdown, we'll consider opening appropriate positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

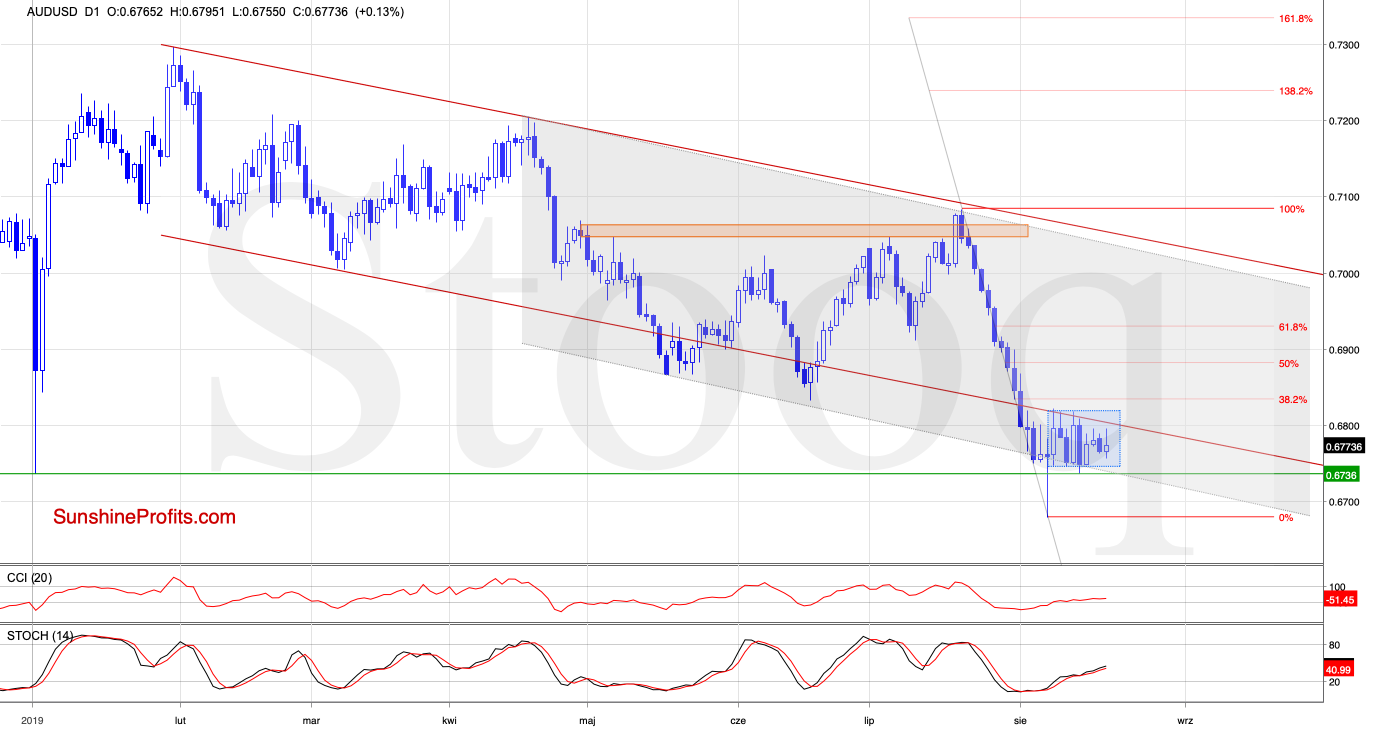

AUD/USD

The daily chart shows that AUD/USD continues to trade inside the blue consolidation between the lower border of the declining grey trend channel and the previously-broken lower border of the declining red trend channel.

Let's recall our Friday's commentary - it is up-to-date also today:

(...) the pair is still trading inside the declining grey trend channel and above the early-2019 low. The daily indicators have also just flashed their buy signals, hinting at a possible reversal around the corner.

But as long as there's no breakout above the lower border of the declining red trend channel, a bigger move to the upside is questionable. Therefore, opening long positions isn't justified from the risk/reward perspective.

What could happen if the bulls fail in the above-mentioned support area? Then, further deterioration and even a test of the green support zone seen (created by the late 2008 and early 2009 lows) would lie ahead.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the euro upswing hasn't traveled far, and the common currency is trading near its lows again. There have been no signs of the USD/JPY and USD/CHF bulls' strength and a break above their respective resistances that would justify possible long positions. But it's the GBP/USD we are watching for breakout or breakdown in order to make an appropriate decision either way. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist